|

市场调查报告书

商品编码

1630253

西班牙包装产业:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Packaging Industry in Spain - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

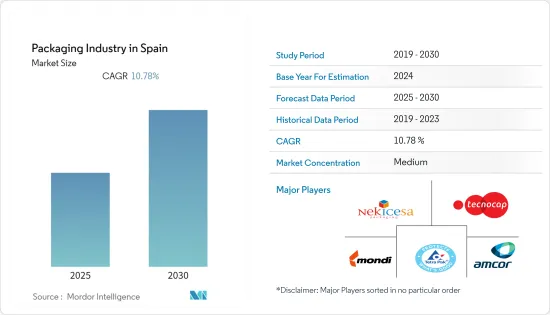

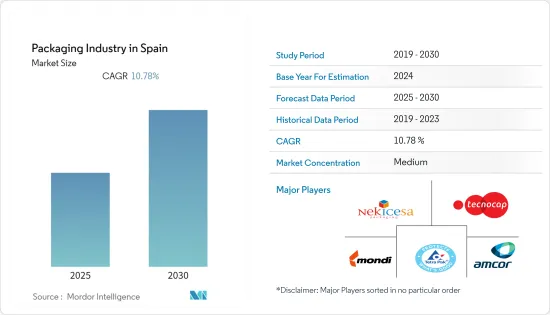

西班牙包装产业市场预计在预测期内复合年增长率为10.78%。

主要亮点

- 良好的展示、强烈的视觉印像以及对紧凑、方便的包装日益增长的需求是支持该国包装行业扩张的一些因素。

- 例如,鱼贝类生产商 Globalimar 凭藉 Cryovac VST Traskin(一种密封空气真空包装)取得了成功。包装采用温和的吸力,不会使托盘支撑变形,平衡成本和质量,保证产品保质期,并由于顶部薄膜的强阻氧功能而减少零售收缩。

- 此外,疾病发生率的增加和营养意识的提高使西班牙公民更加註重健康,并鼓励他们吃更新鲜的食物。

- 西班牙生鲜食品包装领域的顶级公司包括 Mondi、DS Smith、Sonoko Products Company、Smurfit Kappa 和 International Paper。全球领先的蒙迪集团为生鲜食品提供瓦楞包装,确保产品从农场到商店的新鲜度,同时提高运输效率、延长保质期并促销。鑑于肉类消费量处于历史高位,家禽及肉类产业预计将拥有广阔的市场。

- 截至 2021 年的五年里,推动工业需求的最大因素是 COVID-19 大流行的爆发,这对市场产生了积极影响。

西班牙包装市场趋势

纸质包装预计将占据较大份额

- 纸基材料使我们能够有效率且经济地运输、储存和包装各种产品。许多最终用户行业采用不同类型的纸包装,包括运输袋、纸板、纸袋和瓦楞纸板。

- 据欧洲漫画製造商协会称,据报道,欧洲各国政府和商人在 COVID-19 大流行期间已经意识到包装的价值。尤其是折迭式纸盒,对于帮助品牌所有者在关键时刻向家庭和社区分发关键产品至关重要。例如,AR Packaging 于 2021 年 1 月收购了 FirstanHoldings Ltd,包括其子公司 FirstanLimited,透过增加本地折迭纸盒生产,增加了向英国食品和医疗保健客户提案。这项策略选择导致集团:

- 事实证明,回收包装材料具有挑战性,尤其是塑胶。这可能会鼓励使用纸张等易于回收的材料,从而导致更多当地居民使用纸质包装。

- 全球对品牌耐用品和快速消费品 (FMCG) 的需求导致包装纸板的使用量增加。在食品和饮料领域,纸板最广泛用于包装加工产品,如麵包、零嘴零食、已调理食品(RTE)、肉品、水果、耐用食品以及食品和饮料。

- 公司正在创新新的包装解决方案,以满足客户的不同需求。 2021 年 2 月,Mondi 推出了名为 BCoolBox 的创新纸板包装解决方案。 BCoolBox 具有隔热功能,无需冷却车即可将食物冷藏在摄氏 7 度以下长达 24 小时。盒子完全由回收材料製成,100% 可回收。这使得线上零售商能够扩大其送货的地理范围。

食品和饮料行业对包装行业的成长做出了巨大贡献

- 西班牙特别注重加工食品的品质、可追溯性和安全性,并拥有以国内市场为中心的现代食品加工业。在整个预测中,该地区的市场预计将走强。

- 由于上门限制放宽后,酒类消费量预计将稳定成长,市场可能会更关注店外消费而不是店内消费。外部部署酒精消费有利于软包装纸市场的成长。用于单剂量消费的袋装饮料是在所研究的市场中越来越受欢迎的一些值得注意的例子。

- 经济环境的改善和人们可支配收入的增加是预测期内推动包装产业扩张的两个主要因素。例如,2021年西班牙的食品零售额达到274亿美元。

- 包装行业的主要公司正在增加在该地区的业务,对包装用品的需求预计将全面增加。

- 例如,2022 年 5 月,卡夫亨氏与 Pulpex 合作开发了一种纸质、可再生和可回收的瓶子,完全由永续来源的木浆製成。 CPG 巨头亨氏表示,它是第一个评估 Pulpex 酱料永续纸瓶包装潜力的酱料品牌。几乎所有食品和饮料 CPG 都使用包装来减少对环境的影响。

西班牙包装产业概况

西班牙包装产业较为分散,主要参与者如下: Nekicesa Packaging SL、Tecnocap SpA. 和 Mondi Group、Tetra Pak International SA.、Amcor PLC 在该市场上运营。

- 2022 年 4 月 - Amcor 宣布投资扩大其位于爱尔兰斯莱戈的医疗包装工厂的医疗包装热成型新产能。扩张加强了 Amkor 在不断发展的无菌包装行业的领导地位,并提供了一个新的地点,为欧洲和北美的客户提供全面的医疗保健解决方案。

- 2022 年 5 月 - Buenvato 是世界上第一款采用 94% 回收材料製成的纸板瓶龙舌兰酒,将于 2022 年 7 月在欧洲(主要是瑞典市场)首次亮相。 Tequila Buen Batou 的使命是透过投资永续製造、运输和企业社会责任计画来彻底改变饮料产业。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 市场定义

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场促进与市场约束因素介绍

- 市场驱动因素

- 引领市场的创新与优质包装

- 对小型便利包装的需求不断增长

- 市场限制因素

- 关于包装材料的严格规则和规定

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按包装材料分

- 塑胶

- 纸

- 玻璃

- 金属

- 封装层数分类

- 更

- 双层

- 三层

- 按最终用户产业

- 饮食

- 医疗保健和製药

- 美容/个人护理

- 工业

- 其他最终用户产业

第六章 竞争状况

- 公司简介

- Nekicesa Packaging SL

- Tecnocap SpA

- Mondi PLC

- Tetra Pak International SA

- Amcor PLC

- Sealed Air Corporation

- COVINIL SA

- Wipak Group

- Plastipak Holdings Inc.

第七章 投资分析

第八章 市场机会及未来趋势

简介目录

Product Code: 66436

The Packaging Industry in Spain Market is expected to register a CAGR of 10.78% during the forecast period.

Key Highlights

- Excellent presentation, a powerful visual impression, and the growing demand for compact and convenient packages are some elements that will support the expansion of the packaging sector in the country.

- As an illustration, the fish and shellfish producer Globalimar has succeeded with Sealed Air's vacuum packing, the Cryovac VST tray skin. The package utilizes a gentle suction that doesn't distort the tray support, striking a balance between cost and quality, ensuring the product's shelf life and a reduction in retail shrinkage due to the strong oxygen barrier capabilities of the top film.

- Additionally, due to the increased frequency of diseases and growing nutrition awareness, the Spanish population is becoming more health concerned, encouraging them to eat more fresh foods.

- Among Spain's top companies that offer fresh food packaging are Mondi, DS Smith, Sonoco Products Company, Smurfit Kappa, and International Paper. As a global leader, Mondi Group offers corrugated packaging for fresh produce that keeps the product fresh from the farm to the shop while enhancing transport effectiveness, extending the shelf life, and promoting sales. Due to the nation's historically high consumption of fresh meat, the poultry and meat products industry is expected to have a sizeable market.

- The biggest driver of industrial demand throughout the five years leading up to 2021 had been the start of the COVID-19 pandemic has positively impacted the market.

Spain Packaging Market Trends

Paper Based Packaging is Expected Hold a Significant Share

- A range of goods can be efficiently and affordably transported, preserved, and packaged using paper-based materials. Many end-user sectors employ different types of paper packaging, including shipping sacks, paperboard, paper bags, and containerboard.

- According to the European Cartoon Makers Association, European governments and shops reportedly realized the value of packaging during the COVID-19 pandemic. Particularly folding cartons have been crucial in helping brand owners distribute important goods to families and communities at essential times. For instance, AR Packaging increased its offering to UK food and healthcare customers by adding local folding carton production in January 2021 with the acquisition of FirstanHoldings Ltd, including its subsidiary FirstanLimited. This strategic choice has resulted in the Group being.

- It hasn't proven easy to recycle packaging materials, particularly when it comes to plastic. This may encourage the use of readily recyclable materials like paper, which could result in more people in the area using paper packaging.

- Worldwide demand for branded consumer durables and fast-moving consumer goods (FMCG) is driving an increase in the use of corrugated boards for packaging. In the food and beverage sector, boards are most widely used to package processed goods, such as bread, snacks, ready-to-eat (RTE) meals, meat products, fruits, durable foods, and beverages.

- The companies are innovating new packaging solutions to meet the different needs of customers. In February 2021, Mondi launched an innovative Corrugated packaging solution called BCoolBox, featuring thermo-insulation that keeps food chilled below 7° Celsius for up to 24 hours without a cooling truck. This box is entirely made from recycled material and 100% recyclable. It allows online retailers to expand their geographical reach for deliveries.

Food and Beverage Industry to Contribute Significantly for the Growth of Packaging Industry

- The quality, traceability, and safety of processed food products are particularly prioritized in Spain, where a modern food processing industry with a domestic market-centric focus exists. Throughout the forecast, this is anticipated to strengthen the market in the area.

- With an expected steady increase in alcohol consumption after the lockdown restrictions are eased out, the market is expected to see more focus on off-premise consumption compared to on-premise consumption. The off-premise consumption of alcohol is favorable for the growth of the flexible paper packaging market. Beverages packaged in pouches for single-serve consumption are a few notable examples that have become increasingly popular in the market studied.

- The improving economic environment and the increase in people's disposable income are two major factors propelling the packaging industry's expansion during the projection period. For instance, retail food sales in Spain reached USD 27.4 billion in 2021.

- The region is seeing some major firms in the packaging sector grow their presence, which is predicted to increase demand for packaging supplies across the board.

- For instance, in May 2022, KraftHeinz collaborated with Pulpex to develop a paper-based, renewable, and recyclable bottle made entirely of sustainably sourced wood pulp. According to the CPG giant, Heinz is the first sauce brand to evaluate the possibilities of Pulpex'ssustainable paper bottle packaging for its sauces. Packaging has been used by nearly every food and beverage CPG to lessen its environmental impact.

Spain Packaging Industry Overview

The packaging Industry in Spain is moderately fragmented, with players such as Nekicesa Packaging SL, Tecnocap SpA., and Mondi Group, Tetra Pak International SA., Amcor PLC. operating in the market. The packaging market comprises several global and regional players vying for attention in a contested market.

- April 2022 -Amcor announced an investment to expand its new thermoforming capabilities for medical packaging in its Sligo, Ireland, healthcare packaging facility. The expansion will strengthen Amcor's leadership in the growing industry for sterile packaging, providing customers in Europe and North America with another site with inclusive healthcare solutions.

- May 2022 - Buen Vato, the world's first tequila in a cardboard bottle manufactured from 94% recycled material, will debut in Europe in July 2022, focusing on the Swedish market. Tequila Buen Vatois on a mission to revolutionize the beverage business by investing in sustainable manufacturing, transportation, and CSR initiatives.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Innovative and Premium Packaging to Drive the Market

- 4.3.2 Rising Demand for Small and Convenient Packaging

- 4.4 Market Restraints

- 4.4.1 Stringent Rules and Regulations Regarding Packaging Materials

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Packaging Material

- 5.1.1 Plastic

- 5.1.2 Paper

- 5.1.3 Glass

- 5.1.4 Metal

- 5.2 By Layers of Packaging

- 5.2.1 Primary Layer

- 5.2.2 Secondary Layer

- 5.2.3 Tertiary Layer

- 5.3 By End-user Industry

- 5.3.1 Food and Beverage

- 5.3.2 Healthcare and Pharmaceutical

- 5.3.3 Beauty and Personal Care

- 5.3.4 Industrial

- 5.3.5 Other End-user Industry

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Nekicesa Packaging SL

- 6.1.2 Tecnocap S.p.A

- 6.1.3 Mondi PLC

- 6.1.4 Tetra Pak International S.A

- 6.1.5 Amcor PLC

- 6.1.6 Sealed Air Corporation

- 6.1.7 COVINIL S.A.

- 6.1.8 Wipak Group

- 6.1.9 Plastipak Holdings Inc.

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219