|

市场调查报告书

商品编码

1630258

云端整合软体:市场占有率分析、产业趋势与成长预测(2025-2030)Cloud Integration Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

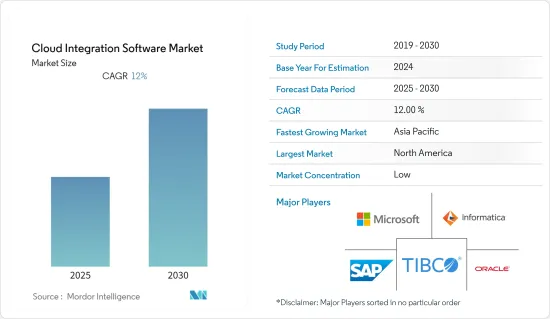

云端整合软体市场预计在预测期内复合年增长率为 12%。

主要亮点

- IPAAS(整合平台即服务)是整合云端和本地应用程式的新兴趋势。例如,Cloud Hub 是世界上第一个全球 IPAAS(整合平台即服务),提供完全託管、全球可用且安全的云端平台,无需维护硬体即可整合应用程式。

- 云端整合软体市场的成长要素包括对云端基础的企业应用程式的需求不断增长以及对云端处理服务的需求不断增长。各产业的云端资料整合也将推动市场成长。全球工业IT基础设施的进步也导致云端资料整合的增加。

- 有多种因素阻碍市场成长。阻碍市场成长的因素包括资料安全、多个资料来源的整合、全球资料外洩的威胁、金融不稳定以及外汇和经济困难等宏观经济状况。

- 许多企业广泛采用云端整合解决方案,透过经济高效且灵活的解决方案实现IT基础设施现代化。

- 由于政府的封锁限制,COVID-19 大流行迫使许多主要产业转向远距工作环境。这种情况增加了对云端基础设施服务的需求。

云端整合软体市场趋势

BFSI预计将大幅成长

- 预计 BFSI 产业在预测期内将出现显着成长。许多银行和金融服务机构都使用资料整合软体。例如,许多银行和财富管理公司依靠 TIBCO Scribe 的资料整合软体平台为销售和服务团队提供有关其客户和潜在客户的即时 360 度视图。

- 云端整合技术用于整合核心银行服务中的各种资料和应用程序,并用于改造Google Wallet、Apple Wallet和PayPal等IT和经营模式。银行体系的现代化和转型创造了实现盈利和回报最大化的新方法。

- BFSI 产业在国家的金融福祉和进步中发挥着重要作用。云端整合帮助 BFSI 部门解决了安全储存、互通性和机密性等各种问题,带来了降低成本等许多好处。借助云端集成,BFSI 部门可以避免与建设IT基础设施相关的巨额资本支出。

- 去年 8 月,大申银行宣布在 Red Hat OpenShift 上部署 IBM Cloud Pak for Integration,以实现云端整合架构的现代化。此次合作将透过加速数位转型和新的创新客户服务来帮助扩大银行的生态系统。

亚太地区预计将出现显着成长

- 预计亚太地区在预测期内将显着成长。亚太地区的高成长率归因于基于云端基础的应用程式的兴起、 IT基础设施支出的增加以及对流程自动化的需求不断增加。

- 根据《麻省理工学院技术评论洞察》的数据,去年,新加坡拥有世界上最好的数位基础设施,指数得分为 8.48。亚太国家中,澳洲、纽西兰、日本和韩国得分较高,显示其云端服务生态系统去年表现良好。

- BYOD(自带设备)趋势的兴起、企业对 iPaaS 意识的增强以及对降低拥有成本的兴趣日益浓厚,是推动该地区市场成长的因素。

- 在预测期内,企业对资料预防和资料安全的日益关注以及亚太国家/地区政府支持的增加可能会继续推动 iPaaS 市场的发展。

- 去年 12 月,中国电子商务巨头阿里巴巴旗下的阿里云宣布与 Avalanche 区块链整合,以加强其节点即服务倡议。

云端整合软体产业概况

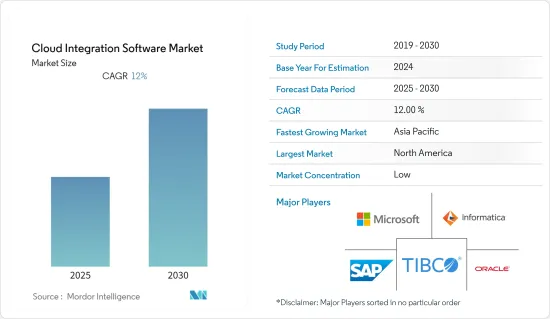

云端整合软体市场是一个分散且竞争激烈的市场,没有市场主导者。市场上发生了很多併购,进一步促进了市场的成长。该市场的主要参与者包括微软公司、甲骨文公司、Informatica公司、SAP SE和SnapLogic公司。

2023 年 1 月,对话式商务平台 Attentive 在 Salesforce AppExchange 上宣布推出适用于 Salesforce Commerce Cloud 的 Attentive SMS。这项新的整合补充了 Attentive 与 Salesforce Marketing Cloud 和 Salesforce Service Cloud 的现有整合。 2022 年 9 月,Avocatoo 宣布与 Salesforce Marketing Cloud 集成,让负责人透过 Salesforce 的行销自动化平台 Journey Builder 向消费者发送简讯。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链/供应链分析

- 产业吸引力——波特五力

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场动态

- 市场驱动因素

- 云端运算服务需求增加

- 工业IT基础设施的进步

- 市场限制因素

- 资料安全问题

第六章 市场细分

- 依部署类型

- PaaS

- IaaS

- SaaS

- 按最终用户产业

- BFSI

- IT

- 零售

- 教育

- 卫生保健

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Microsoft Corporation

- Oracle Corporation

- TIBCO Software Inc.

- Informatica Corporation

- SAP SE

- Mule Soft Inc.

- Dell Boomi

- SnapLogic Inc.

- Software AG

- IBM Corporation

- Accenture Inc.

第八章投资分析

第九章 市场机会及未来趋势

The Cloud Integration Software Market is expected to register a CAGR of 12% during the forecast period.

Key Highlights

- Integrations platform as a service (IPAAS) is now the emerging trend for integrating cloud and premises applications. For instance, Cloud Hub is the world's first global IPASS (Integrations platform as a service), providing a fully managed, globally available, and secure cloud platform for integrating applications with no hardware to maintain.

- The factors responsible for the growth of the cloud integration software market include increasing demand for cloud-based enterprise applications and rising demand for cloud computing services. Cloud Data Integration in different industry verticals will also drive the market's growth. Advancements in industrial IT infrastructure across the globe have also led to an increase in Cloud Data Integration.

- There are various reasons which may hinder the growth of the market. Some factors that inhibit market growth are data security, integration of multiple data sources, the threat of data breaches worldwide, financial uncertainty, and macroeconomic situations such as currency exchange rates and economic difficulties.

- Many organizations have extensively adopted cloud integration solutions to modernize IT infrastructure through cost-effective and flexible solutions.

- The COVID-19 pandemic has compelled many major industries to switch to remote working environments due to the lockdown restrictions imposed by the government. The situation has increased the demand for cloud infrastructure services.

Cloud Integration Software Market Trends

BFSI Expected to Have Significant Growth

- The BFSI sector is expected to have significant growth for the forecast period. Many banking and financial services are using data integration software. For instance, many banking and wealth management firms rely on TIBCO Scribe's data integration software platforms to provide sales and service teams with a real-time, 360-degree view of their customers and prospects.

- Cloud integration technology is used in the core banking service to integrate various data and applications using the IT and business model transformation like google wallet, apple wallet, Pay pal & others. Modernizing and transforming the banking system creates a new way to maximize profitability and returns.

- The BFSI industry plays a significant role in nations' financial well-being and progress. Cloud integration is helping the BFSI sector by addressing various concerns, such as secure storage, interoperability, and confidentiality, and it provides many advantages, such as cost savings. With the help of cloud integration, the BFSI sector can avoid the enormous capital expenditure involved in establishing IT infrastructure.

- In August last year, Dashen Bank announced that it had implemented IBM Cloud Pak for Integration on Red Hat OpenShift, to modernize its cloud integration architecture. The collaboration would help the bank expand its ecosystem by accelerating digital transformation and new innovative customer offerings.

Asia-Pacific Expected to Have Significant Growth

- Asia-Pacific is expected to have significant growth over the forecast period. The high growth rate in the Asia-Pacific region is due to rising cloud-based applications, increased IT infrastructure spending, and growing demand for the automation of processes.

- According to MIT Technology Review Insights, last year, Singapore had the best digital infrastructure globally, with an index score of 8.48. Australia, New Zealand, Japan, and South Korea were the following Asia-Pacific countries that scored high, indicating a favorable ecosystem for cloud services in the last year.

- The growing BYOD (Bring your device) trend, rising awareness about iPaaS among enterprises, and an increasing focus on reducing ownership costs are the factors responsible for the market growth in this region.

- The companies' growing focus on data prevention and data security, along with increased government support in various Asian-Pacific countries responsible for driving the iPaaS market, will continue to do so during the forecast period.

- In December last year, Alibaba Cloud, a subset of Chinese e-commerce giant Alibaba, announced an integration with Avalanche blockchain to power the company's Node-as-a-Service initiatives.

Cloud Integration Software Industry Overview

The cloud integration software market is fragmented and is a highly competitive market with no dominant player present in the market. Many mergers and acquisitions are taking place in the market, further leading to the market's growth. Some major players in the market are Microsoft Corporation, Oracle Corporation, Informatica Corporation, SAP SE, and SnapLogic Inc.

In January 2023, Attentive, the conversational commerce platform, announced it had launched Attentive SMS for Salesforce Commerce Cloud on Salesforce AppExchange, empowering brands to personalize every SMS message and drive higher conversions with their e-commerce data. This new integration complements Attentive's existing integrations with Salesforce Marketing Cloud and Salesforce Service Cloud. In September 2022, Avochato announced the launch of Salesforce Marketing Cloud Integration to give marketers the ability to text consumers through Salesforce's Journey Builder marketing automation platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand For Cloud Computing Services

- 5.1.2 Advancements In Industrial IT Infrastructure

- 5.2 Market Restraints

- 5.2.1 Data Security Concerns

6 MARKET SEGMENTATION

- 6.1 By Deployment Mode

- 6.1.1 PaaS

- 6.1.2 IaaS

- 6.1.3 SaaS

- 6.2 By End-user Industry

- 6.2.1 BFSI

- 6.2.2 IT

- 6.2.3 Retail

- 6.2.4 Education

- 6.2.5 Healthcare

- 6.2.6 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 Oracle Corporation

- 7.1.3 TIBCO Software Inc.

- 7.1.4 Informatica Corporation

- 7.1.5 SAP SE

- 7.1.6 Mule Soft Inc.

- 7.1.7 Dell Boomi

- 7.1.8 SnapLogic Inc.

- 7.1.9 Software AG

- 7.1.10 IBM Corporation

- 7.1.11 Accenture Inc.