|

市场调查报告书

商品编码

1630343

北美风力发电:市场占有率分析、产业趋势与成长预测(2025-2030)North America Wind Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

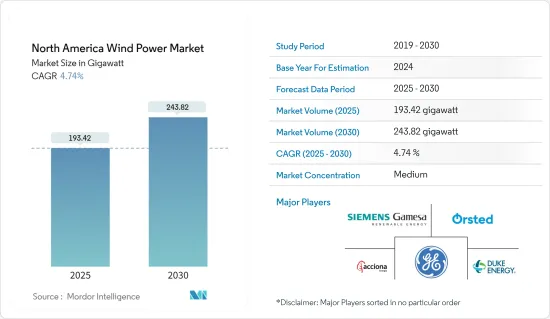

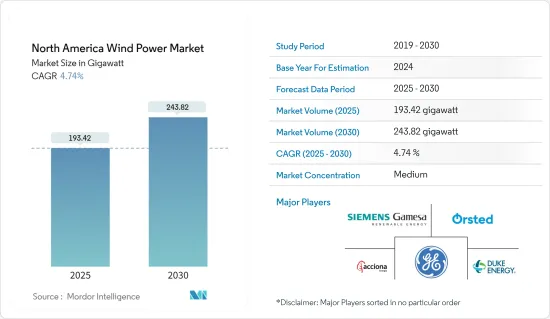

北美风电市场规模预计到2025年为193.42吉瓦,预计2030年将达到243.82吉瓦,预测期间(2025-2030年)复合年增长率为4.74%。

主要亮点

- 长期来看,市场成长的关键因素包括政府政策利多、风发电工程投资增加、风力发电成本下降,导致风力发电部署增加。

- 另一方面,越来越多地采用天然气电力和太阳能等替代能源能源可能会阻碍该地区的市场成长。

- 儘管近期面临挑战,北美风电产业的陆上和离岸风力发电预计仍将强劲成长。产业专家预测,技术进步,特别是浮体式海上风电平台的进步,将释放太平洋沿岸和大西洋深水区的巨大潜力。

- 美国拥有该地区最高的装置容量,在陆上风力发电和即将推出的离岸风力发电计划持续增长的支持下,预计在预测期内仍将是最大的市场。

北美风电市场趋势

主导市场的土地领域

- 陆域风电是指安装在陆地上的风力发电机利用自然气流所产生的电力。它是北美发展最快的可再生能源技术之一。风力发电机对于未来的无碳能源产业也很重要,因为它们不会排放空气或水污染物。

- 在过去五年中,陆上风电技术不断发展,以最大限度地提高每兆瓦装置容量的发电量,以覆盖北美更多风速较低的地区。

- 例如,2023年,北美陆上风电装置总量将总合172.29GW。美国有 147.979GW,加拿大有 16.989GW。这比2022年装置容量164.215GW成长了4.92%。美国和加拿大较低的发电成本和增加的投资预计将鼓励进一步安装陆上风力发电机。

- 此外,美国2023年6月新增风电装置650千万瓦,投资108亿美元。年内安装的所有计划均为陆上项目;没有启动海上计划。此类措施可增加北美陆上风电的总装置容量。

- 随着对经济实惠、清洁和多样化电源的需求不断增长,美国各地政府和公用事业公司正在考虑将风力发电作为可行的解决方案。此外,凭藉该地区独特的风能资源,有充分的机会最大限度地发挥风力发电开发的经济和环境效益。

- 2024年,北美陆域风力发电产业呈现復苏与扩张。根据美国能源局(DOE) 的一份新报告,通货膨胀控制法案 (IRA) 显着改善了近期风力发电部署预测。根据美国清洁电力协会(ACP)预测,到2024年第一季,美国陆上风电装置容量将达到约2,530万千瓦,与前一年同期比较增加超过50兆瓦。

- 未来四年,北美预计将新增6,000万千瓦陆上风电装置容量,其中92%将出现在美国,其余8%将出现在加拿大。这种扩张可能源自于有利的措施、投资和技术进步。美国将引领新的陆上风电发电工程,并为可再生能源努力做出重大贡献。这种成长支持向清洁能源的过渡和减少碳排放。

- 考虑到上述几点和最近的发展,预计陆上产业将在预测期内主导北美风电市场。

美国主导市场

- 美国风电产业透过「美国优先」倡议获得了政府的大力支持,该倡议旨在提高国内能源生产。由于该国拥有广阔的沿海地区可供租赁,离岸风力发电领域被认为是重点发展领域。

- 2023年总设备容量为148,020兆瓦,比2022年的141,674兆瓦成长4.9%,占北美风总设备容量的90%以上,排名第二。

- 此外,美国公用事业规模发电总量的约 10%(即 4,250 亿度)来自 41 个州的风电发电工程。这段期间风电产量领先的五个州是德克萨斯州、爱荷华州、奥克拉荷马州州、堪萨斯州和伊利诺州,这五个州合计约占全国风电总产量的59%。

- 2023年,维斯塔斯向美国交付约210万千瓦风力发电设备。此外,维斯塔斯订单了新墨西哥州SunZia风电计划1,089MW的合同,使其成为维斯塔斯全球最大的陆上计划。维斯塔斯还为其美国供应链投入了 19 亿美元,并与 1,200 多家供应商合作。这凸显了美国在风力涡轮机和设备方面对维斯塔斯等国际公司的依赖,儘管国内风电产能不断扩大。

- 2024年,Natixis企业与投资银行向Invenergy提供了9亿美元的绿色信用证。此次融资旨在支持美洲各地发电工程的发展。 Invenergy的可再生能源计划规模超过30GW,风电企业也备受关注。此外,Natixis CIB还提供了12.7亿美元,支持堪萨斯州和德克萨斯州677兆瓦的风能和太阳能发电设施。这项投资凸显了我们致力于加强风力发电基础设施的决心。

- 根据美国风力发电协会(AWEA)的数据,风电市场的风电装置容量显着成长。美国超过四分之一的风力发电能力位于德克萨斯州。

- 而且,根据能源部 (DOE) 的数据,离岸风电每年有潜力超过 2,000 吉瓦。此外,美国风力发电协会的相关人员表示,大约 700 亿美元的离岸风力发电计划正在进行中,预计将于 2030 年完工。

- 鑑于上述几点和最近的发展,预计美国将在预测期内主导北美风电市场。

北美风电产业概况

北美风电市场较为分散。该市场的主要企业包括 Acciona Energia SA、Orsted AS、杜克能源公司、通用电气公司和西门子歌美飒可再生能源公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2029年装置容量及预测(单位:GW)

- 北美可再生能源结构,2023 年

- 2019-2023 年安装的风力发电机数量

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 政府支持措施和奖励

- 风力发电成本下降

- 抑制因素

- 越来越多采用天然气和太阳能发电等替代能源

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 按位置

- 陆上

- 离岸

- 按地区

- 美国

- 加拿大

- 北美其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- 风电场营运商

- Acciona Energia SA

- Orsted AS

- Duke Energy Corporation

- NextEra Energy Inc.

- Trident Winds Inc.

- E.ON SE

- EDF SA

- EnBW Energie Baden-Wurttemberg AG

- 设备供应商

- Envision Energy

- General Electric Company

- Siemens Gamesa Renewable Energy

- Vestas Wind Systems AS

- 风电场营运商

- 其他主要国家名单

- 市场排名分析

第七章 市场机会及未来趋势

- 采用浮体式海上风电平台

简介目录

Product Code: 69531

The North America Wind Power Market size is estimated at 193.42 gigawatt in 2025, and is expected to reach 243.82 gigawatt by 2030, at a CAGR of 4.74% during the forecast period (2025-2030).

Key Highlights

- Over the long term, major factors attributing to the growth of the market include favorable government policies, the increasing investment in wind power projects, and the reduced cost of wind energy, which led to increased adoption of wind energy.

- On the other hand, the increasing adoption of alternate energy sources, such as gas-based power and solar power, is likely to hinder the market growth in the region.

- Nevertheless, despite potential short-term challenges, the North American wind energy power industry is projected to grow substantially, with both onshore and offshore wind installations. Industry experts anticipate that technological advances, particularly in floating offshore wind platforms, will unlock a vast potential along the Pacific coast and deeper Atlantic waters.

- The United States had the highest installed capacity in the region, and it is expected to be the largest market during the forecast period, bolstered by constant growth in onshore wind power additions and upcoming offshore wind power projects.

North America Wind Power Market Trends

Onshore Segment to Dominate the Market

- Onshore wind energy refers to the electricity produced by wind turbines situated on land, harnessing the natural flow of air. It is one of the fastest-growing renewable energy technologies in North America. It is also important for a future carbon-free energy industry because wind turbines do not release air or water pollutants.

- Over the last five years, onshore wind energy power generation technology has evolved to maximize electricity produced per megawatt capacity installed to cover more North American sites with lower wind speeds.

- For instance, in 2023, onshore wind energy installations in North America totaled 172.29 GW. The United States accounted for 147.979 GW, while Canada had 16.989 GW. This represented a 4.92% increase from 2022, when installations were at 164.215 GW. The decreasing cost of power generation and increased investments in the United States and Canada are expected to drive further onshore wind turbine installations.

- Moreover, in June 2023, the United States increased its wind power capacity by 6.5 GW, investing USD 10.8 billion. All projects installed during this year were onshore, as no offshore projects were initiated. This kind of initiative can boost North America's total onshore wind energy installations.

- With the increasing need for an affordable, clean, and diverse electricity supply, the government and utilities nationwide consider wind power a viable solution. Moreover, with the region's unparalleled wind resources, ample opportunities exist to maximize wind energy development's economic and environmental benefits.

- In 2024, the onshore wind energy industry in North America is demonstrating recovery and expansion. The latest reports from the US Department of Energy (DOE) suggest that the Inflation Reduction Act (IRA) has markedly improved projections for wind energy deployment in the near term. According to the American Clean Power Association (ACP), the land-based wind energy pipeline in the United States reached approximately 25.3 GW by the end of Q1 2024, marking an increase of over 5 GW compared to the previous year.

- In the next four years, North America is expected to add 60 GW of onshore wind capacity, with 92% of this growth occurring in the United States and the remaining 8% in Canada. This expansion may be driven by favorable policies, investments, and technological advancements. The United States will lead in new onshore wind projects, contributing significantly to renewable energy efforts. This growth supports the transition to cleaner energy and reduced carbon emissions.

- Owing to the above points and the recent developments, the onshore segment is expected to dominate the North American wind power market during the forecast period.

United States to Dominate the Market

- The US wind power industry is receiving immense support from the government due to the America First policy, which aims to boost domestic energy production. The offshore wind power sector is considered a major area of development, as the country has a large coastal area available for leasing.

- In 2023, the country had the second-largest total installed wind energy turbine capacity, with 148,020 MW, marking a 4.9% increase from the 141,674 MW installed in 2022, which accounted for over 90% of North America's total wind energy capacity.

- Additionally, approximately 10% of the total electricity generated at the utility-scale in the United States, equating to 425 billion kWh, was derived from wind energy projects across 41 states. The leading five states in terms of wind electricity generation during this period were Texas, Iowa, Oklahoma, Kansas, and Illinois, which together accounted for around 59% of the total wind electricity output in the country.

- In 2023, Vestas provided approximately 2.1 GW of wind capacity to the United States, representing the company's highest delivery volume in any nation during that year. Furthermore, Vestas obtained a substantial order of 1,089 MW for the SunZia Wind project located in New Mexico, which stands as the largest single onshore project worldwide for Vestas. The company also committed USD 1.9 billion to the US supply chain, collaborating with over 1,200 suppliers. This underscores the dependence of the United States on international firms such as Vestas for wind power turbines and equipment, even as domestic wind power generation capacity continues to expand.

- In 2024, Natixis Corporate & Investment Banking offered a Green Letter of Credit valued at USD 900 million to Invenergy. This loan is aimed at backing the growth of extensive wind energy projects throughout the Americas. Invenergy's collection of renewable energy projects spans more than 30 GW, featuring notable wind energy ventures. Furthermore, Natixis CIB has extended USD 1.27 billion in support for 677 MW of wind and solar facilities in Kansas and Texas. This investment underscores the dedication to enhancing wind energy infrastructure.

- According to the American Wind Energy Association (AWEA), the wind power market witnessed significant growth in the total installed wind power capacity, and the ongoing and dramatic onshore wind boom in Texas primarily drove this increase in capacity. More than a quarter of the total wind capacity of the United States is in Texas.

- Also, according to the Department of Energy (DOE), offshore wind has the potential to generate more than 2,000 GW of capacity per year. Adding to this, the American Wind Energy Association's officials have stated that around USD 70 billion of offshore wind power projects are in the pipeline and are expected to be completed by 2030.

- Owing to the above points and the recent developments, the United States is expected to dominate the North American wind power market during the forecast period.

North America Wind Power Industry Overview

The North American wind energy market is semi-fragmented. Some of the key players in the market include Acciona Energia SA, Orsted AS, Duke Energy Corporation, General Electric Company, and Siemens Gamesa Renewable Energy SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumption

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast in GW, until 2029

- 4.3 North America Renewable Energy Mix, 2023

- 4.4 Number of Wind Turbines Installed, 2019-2023

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Supportive Government Policies and Incentives

- 4.7.1.2 Declining Wind Energy Cost

- 4.7.2 Restraints

- 4.7.2.1 Increasing Adoption of Alternate Energy Sources, Such as Gas-based Power and Solar Power

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes Products and Services

- 4.9.5 Intensity of Competitive Rivalry

- 4.10 Invrestment Analysis

5 MARKET SEGMENTATION

- 5.1 By Location

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 By Geography

- 5.2.1 United States

- 5.2.2 Canada

- 5.2.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Wind Farm Operators

- 6.3.1.1 Acciona Energia SA

- 6.3.1.2 Orsted AS

- 6.3.1.3 Duke Energy Corporation

- 6.3.1.4 NextEra Energy Inc.

- 6.3.1.5 Trident Winds Inc.

- 6.3.1.6 E.ON SE

- 6.3.1.7 EDF SA

- 6.3.1.8 EnBW Energie Baden-Wurttemberg AG

- 6.3.2 Equipment Suppliers

- 6.3.2.1 Envision Energy

- 6.3.2.2 General Electric Company

- 6.3.2.3 Siemens Gamesa Renewable Energy

- 6.3.2.4 Vestas Wind Systems AS

- 6.3.1 Wind Farm Operators

- 6.4 List of Other Prominent Countries

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Adoption of Floating Offshore Wind Platforms

02-2729-4219

+886-2-2729-4219