|

市场调查报告书

商品编码

1630344

聚丙烯包装薄膜:市场占有率分析、产业趋势、成长预测(2025-2030)Polypropylene Packaging Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

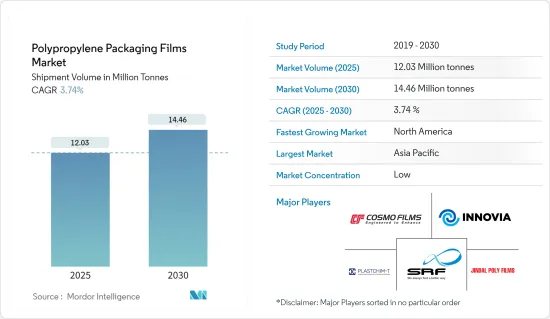

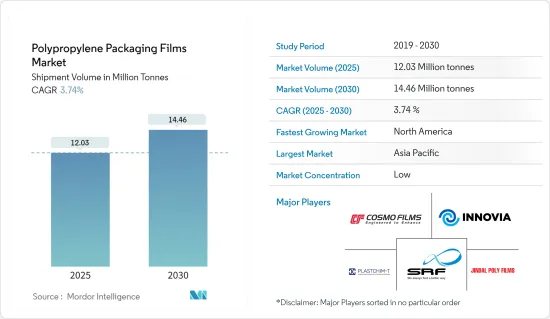

基于以出货量为准的聚丙烯包装薄膜市场规模预计将从2025年的1,203万吨成长到2030年的1,446万吨,预测期间(2025-2030年)复合年增长率为3.74%。

软质塑胶包装是聚丙烯包装薄膜市场的重要成长领域之一。包装薄膜结合了塑胶的最佳品质,并使用更少的材料提供广泛的保护性能,提高了食品和其他非食品相关产品的附加价值和适销性。

包装产业不断适应不断变化的消费者需求。可支配收入的增加和中阶的崛起等关键因素正在推动消费品、食品和饮料以及工业产品等各个领域对聚丙烯包装薄膜的需求。

此外,随着对永续性的日益重视,传统的硬质包装解决方案正在被创新且环保的软质塑胶包装所取代。这种转变,加上对用户友好型包装和增强产品保护的日益增长的需求,将推动对聚丙烯包装薄膜的需求。

聚丙烯是软包装领域的推动力,因为它具有比聚乙烯更高的熔点,并且可用于许多应用。此外,全球从可重复使用包装到一次性包装的转变预计将加强对聚丙烯薄膜的需求。

对延长产品保质期的薄膜的需求不断增长,推动了聚丙烯包装薄膜市场的成长。此外,环保替代包装材料的出现正在扩大聚丙烯薄膜的应用范围,进一步推动市场扩张。

2024 年 4 月,Amcor 和 Kimberly Clark 合作在秘鲁推出由 30% 回收材料製成的 Eco Protect 尿布新包装。这种低过敏性的一次性尿布包装由植物来源纤维製成,并含有回收材料,促进永续性。 Amcor主导了Kimberly Clark 的这种创新包装的设计和製造,突显了其对循环经济的承诺。

然而,由于大流行的影响,市场正遭受供应链和製造设施的重大干扰。此外,能源危机导致的原材料成本上涨对市场成长构成潜在威胁。

聚丙烯包装薄膜市场趋势

BOPP薄膜实现显着成长

- BOPP薄膜透过机械和手动拉伸製程进行交叉拉伸。该薄膜采用共挤结构,可以是透明的、不透明的或金属化的。 BOPP 薄膜的多功能性和优点使其成为包装行业中金属罐和纸盒的潜在替代品。 BOPP 薄膜是蜡纸和铝箔的绝佳替代品,具有高拉伸强度、低伸长率、优异的气体阻隔性能、更高的挺度和更低的雾度。

- 在消费者对实用解决方案和便利交通的需求的推动下,BOPP 薄膜的需求正在快速成长。鑑于食品包装的严格要求,BOPP 薄膜的需求预计将增加。

- BOPP 单层纤维网或层压材料通常用于个人护理和家庭护理行业,用于包装肥皂和牙刷等产品。此外,该薄膜还具有优异的耐化学性、平坦的表面积和紫外线防护能力。由于它可回收且无毒,它越来越受欢迎和需求。此外,它还具有很强的防水蒸气、油和油脂屏障作用。

- 由于其密封能力和阻氧作用,BOPP 薄膜越来越受到製药和化妆品行业的青睐。从2023年北美占全球化妆品市场29%的份额就可以看出这一趋势。

- 值得注意的是,BOPP 薄膜比其他塑胶薄膜的环境足迹更小。由于其熔点较低,加工过程中消费量的能量较少。 BOPP 薄膜很容易与聚乙烯层压,并且作为更广泛的聚烯化学家族的一部分,可以广泛回收。

- 聚丙烯包装薄膜市场的主要企业正在增加 BOPP 薄膜的产量。例如,凸版于2024年3月宣布将在印度推出创新环保阻隔膜GL-SP。该产品是与印度凸版特种薄膜 (TSF) 合作开发的,基于双轴延伸聚丙烯(BOPP)。

亚太地区占最大市场占有率

- 塑胶材料的便捷获取是亚太地区聚丙烯包装薄膜成长的主要推动力。该地区塑胶包装的使用呈成长趋势。根据印度品牌公平基金会 2024 年 7 月的报告,印度商工部强调,印度西部占塑胶消费量的 47%,其次是北部(23%)和南部(21%)。推动这项消费的主要产业包括汽车、包装和电器产品。中国是塑胶包装的重要市场,但面临可能阻碍其成长的监管禁令的挑战。

- 对包装食品和已调理食品的需求不断增加以及电子商务的快速扩张正在推动对聚丙烯包装薄膜的需求。食品和饮料、製药和个人护理等行业越来越多地转向软包装解决方案。聚丙烯薄膜的吸引力在于其出色的阻隔性、耐用性和视觉吸引力,使其成为各种包装应用的理想选择。

- 新兴的中产阶级和有组织零售的兴起是软包装产业成长的重要催化剂。全球特定包装要求的出口激增进一步推动了包装产业的发展。塑胶软包装在亚太地区包装领域占据主导地位,甚至在传统硬包装用户中也发生了转变。聚丙烯包装薄膜扩张的一个显着推动力是消费者对方便包装和合理层压数量的产品的偏好。

- 对食品加工业的投资增加以及尽量减少农业废物的努力增加了对包装食品和蔬菜的需求,从而增加了对聚丙烯包装薄膜的需求。

- 根据加拿大农业和食品部的报告,到2026年,包括泡麵在内的中国包装食品销售额预计将达到约166.6亿美元。资料显示,该国加工和包装食品市场持续呈上升趋势。预计这一趋势将持续下去,并对聚丙烯包装薄膜的需求产生积极影响。

聚丙烯包装薄膜产业概况

聚丙烯包装薄膜市场竞争激烈,国内外都有许多参与企业在运作。市场是细分的。聚丙烯包装薄膜市场的主要企业,包括 Jindal Poly Films Ltd、CCL Industries (Innovia Films)、Cosmo Films Ltd、SRF Limited 和 Plastchim-T,准备应对潜在的干扰并确保长期可持续增长。于开发新产品和采用敏捷的经营模式。宣布市场的一些关键发展。

2024 年 5 月,Plastchim-T 收购了 Manucor SpA,并获得了大量 BOPP 产量和软包装专业知识。此次收购将使产能增加至每年20万吨,并加强欧洲运输和分销网络。

2024 年 3 月:塑胶製造商 Inteplast Group 位于南卡罗来纳州格雷考特、德克萨斯州洛丽塔和田纳西州莫里斯敦的三个 BOPP 薄膜工厂获得 ISCC PLUS 认证。凭藉此认证,Inteplast 成为北美首批获得 ISCC PLUS 认证的 BOPP 薄膜製造商之一。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 对具有成本效益的包装形式的需求不断增长

- 环境法规为软包装要求铺路

- 包装食品市场的成长

- 市场限制因素

- 原物料价格波动

第六章 COVID-19 对市场的影响

第七章 市场区隔

- 按类型

- BOPP

- CPP

- 按用途

- 食物

- 饮料

- 製药/医疗

- 工业的

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 亚洲

- 中国

- 印度

- 日本

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

- 北美洲

第八章 竞争格局

- 公司简介

- Plastchim-T

- Jindal Poly Films Ltd

- CCL Industries(Innovia Films)

- SRF Limited

- Cosmo Films Ltd

- Amcor PLC

- UFlex Limited

- Taghleef Industries LLC

- Berry Global Inc.

- Polyplex Corporation Limited

- ProAmpac LLC

- Inteplast Group

- Toray Plastics(America)Inc.

- Profol GmbH

- Napco National

- Oben Holding Group

第九章投资分析

第10章 未来趋势

The Polypropylene Packaging Films Market size in terms of shipment volume is expected to grow from 12.03 million tonnes in 2025 to 14.46 million tonnes by 2030, at a CAGR of 3.74% during the forecast period (2025-2030).

Flexible plastic packaging is one of the significant growing segments of the polypropylene packaging film market. Packaging films, which combine the best qualities of plastics to give a wide range of protective characteristics while using little material, are an added value and marketability for foodstuffs and other products not related to food.

The packaging industry continually adapts to meet the changing demands of consumers. Key drivers, such as rising disposable incomes and a burgeoning middle-class population, fuel the demand for polypropylene packaging films across various sectors, including consumer goods, food and beverages, and industrial products.

Moreover, with an increasing emphasis on sustainability, traditional rigid packaging solutions are being replaced by innovative, eco-friendly, flexible plastic packaging. This shift, combined with a growing appetite for user-friendly packaging and enhanced product protection, is set to elevate the demand for polypropylene packaging films.

Polypropylene has gained traction in the flexible packaging domain, primarily due to its higher melting point than PE, making it versatile for numerous applications. Additionally, the global shift from reusable to disposable packaging is anticipated to bolster the demand for polypropylene films.

The rising demand for films that extend product shelf life is propelling the growth of the polypropylene packaging film market. Also, the easy availability of eco-friendly packaging alternatives is broadening the applications of polypropylene films, further fueling market expansion.

In April 2024, Amcor and Kimberly Clark teamed up to launch a new packaging for their Eco Protect diapers in Peru, featuring 30% recycled materials. This hypoallergenic diaper packaging is made from plant-based fibers and includes recycled materials, promoting sustainability. Amcor took the lead in designing and producing this innovative packaging for Kimberly Clark, underscoring the commitment to a circular economy.

However, the market grapples with significant disruptions in its supply chain and manufacturing facilities, a fallout from the pandemic. Additionally, soaring raw material costs due to the energy crisis pose a potential threat to market growth.

Polypropylene Packaging Films Market Trends

BOPP Films to Witness Major Growth

- BOPP films undergo mechanical and manual stretching through a cross-direction process. These films, featuring coextruded structures, can be transparent, opaque, or metalized. The versatility and benefits of BOPP films position them as potential replacements for metal cans and cartons in the packaging industry. BOPP films are excellent alternatives to waxed paper and aluminum foil, offering higher tensile strength, lower elongation, superior gas barriers, increased stiffness, and reduced haze.

- Driven by consumer demand for practical solutions and convenient transport, BOPP films are witnessing a surge in demand. Given the stringent requirements in food packaging, BOPP films are poised for increased demand, mainly because they help preserve food's nutritional properties until consumption.

- Commonly used in the personal and household care industry, BOPP monolayer webs and laminates wrap items like soap and toothbrushes. Beyond this, the film boasts exceptional chemical resistance, a flat surface area, and UV protection. Its recyclability and non-toxic emissions have fueled its rising popularity and demand. Moreover, it offers robust barriers against water vapor, oil, and grease.

- Due to their sealing capabilities and role as an oxygen barrier, BOPP films are increasingly favored in the pharmaceutical and cosmetic industries. This trend is underscored by North America's 29% share of the global cosmetic market in 2023.

- Notably, BOPP films present a smaller environmental footprint than other plastic films. Their low melting point translates to reduced energy consumption during transformation. BOPP films easily laminate with polyethylene and maintain wide recyclability as part of the broader polyolefin chemical group.

- Key players in the polypropylene packaging films market are ramping up BOPP film production. For example, in March 2024, Toppan announced the upcoming launch of "GL-SP", an innovative eco-friendly barrier film, in India. Developed in collaboration with India's TOPPAN Speciality Films (TSF), this product is based on biaxially oriented polypropylene (BOPP).

Asia-Pacific Holds the Largest Market Share

- Convenient access to plastic materials in Asia-Pacific significantly fuels the growth of polypropylene packaging films. The region sees a rising trend in plastic packaging usage. According to a July 2024 report by the India Brand Equity Foundation, the Ministry of Commerce and Industry highlights that Western India accounts for 47% of plastic consumption, followed by Northern India at 23% and Southern India at 21%. The key industries driving this consumption include automotive, packaging, and electronic appliances. While China stands out as a pivotal market for plastic packaging, it faces challenges from legislative bans that could hinder its growth.

- Rising demand for packaged and ready-to-eat foods, coupled with the rapid expansion of e-commerce, propels the demand for polypropylene packaging films. Industries such as food and beverages, pharmaceuticals, and personal care increasingly lean toward flexible packaging solutions. The appeal of polypropylene films lies in their superior barrier qualities, durability, and visual allure, making them ideal for various packaging applications.

- The burgeoning middle class and the rise of organized retailing are significant catalysts for the growth of the flexible packaging industry. The export surge, which comes with specific global packaging requirements, has further invigorated the packaging industry. Dominating the Asia-Pacific packaging landscape, plastic flexible packaging is witnessing a shift even among traditional rigid packaging users. A notable driver for the expansion of polypropylene packaging films is the consumer preference for convenient packaging and products offered in reasonable laminate quantities.

- With growing investments in the food processing industry and initiatives to minimize agricultural crop waste, the demand for packaged food and vegetables is set to rise, subsequently boosting the need for polypropylene packaging films.

- As reported by Agriculture and Agri-Food Canada, sales of packaged foods in China, including instant noodles, are projected to reach around USD 16.66 billion by 2026. The data shows a consistent upward trend in the country's processed and packaged food market. This trend is expected to continue, positively impacting the demand for polypropylene packaging films in the coming years.

Polypropylene Packaging Films Industry Overview

The polypropylene packaging films market is competitive because of the presence of many players running their businesses within national and international boundaries. The market is fragmented. The major companies in the polypropylene packaging films market, such as Jindal Poly Films Ltd, CCL Industries (Innovia Films), Cosmo Films Ltd, SRF Limited, and Plastchim-T, are focusing on developing new products and adopting agile business models to address potential disruptions and ensure sustained long-term growth. Some of the key developments in the market are:

May 2024: Plastchim-T acquired Manucor SpA, gaining significant BOPP volume and expertise in flexible packaging. This acquisition boosts the production capacity to 200,000 tons annually and strengthens Europe's transportation and delivery network.

March 2024: Inteplast Group, a plastics manufacturer, secured ISCC PLUS verification for its three BOPP film facilities located in Gray Court, South Carolina; Lolita, Texas; and Morristown, Tennessee. This certification positions Inteplast as one of the first North American BOPP film producers to achieve ISCC PLUS recognition.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand of Cost-effective Packaging Formats

- 5.1.2 Environmental Regulation Paving Way for Flexible Packaging Requirements

- 5.1.3 Growth in Packaged Food Markets

- 5.2 Market Restraints

- 5.2.1 Fluctuation in Raw Material Prices

6 IMPACT OF COVID-19 ON THE MARKET

7 MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 BOPP

- 7.1.2 CPP

- 7.2 By Application

- 7.2.1 Food

- 7.2.2 Beverage

- 7.2.3 Pharmaceutical and Healthcare

- 7.2.4 Industrial

- 7.2.5 Other Applications

- 7.3 By Geography

- 7.3.1 North America

- 7.3.1.1 United States

- 7.3.1.2 Canada

- 7.3.2 Europe

- 7.3.2.1 United Kingdom

- 7.3.2.2 Germany

- 7.3.2.3 France

- 7.3.3 Asia

- 7.3.3.1 China

- 7.3.3.2 India

- 7.3.3.3 Japan

- 7.3.4 Australia and New Zealand

- 7.3.5 Latin America

- 7.3.6 Middle East and Africa

- 7.3.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Plastchim-T

- 8.1.2 Jindal Poly Films Ltd

- 8.1.3 CCL Industries ( Innovia Films)

- 8.1.4 SRF Limited

- 8.1.5 Cosmo Films Ltd

- 8.1.6 Amcor PLC

- 8.1.7 UFlex Limited

- 8.1.8 Taghleef Industries LLC

- 8.1.9 Berry Global Inc.

- 8.1.10 Polyplex Corporation Limited

- 8.1.11 ProAmpac LLC

- 8.1.12 Inteplast Group

- 8.1.13 Toray Plastics (America) Inc.

- 8.1.14 Profol GmbH

- 8.1.15 Napco National

- 8.1.16 Oben Holding Group