|

市场调查报告书

商品编码

1630355

广播天线:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Broadcast Antenna - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

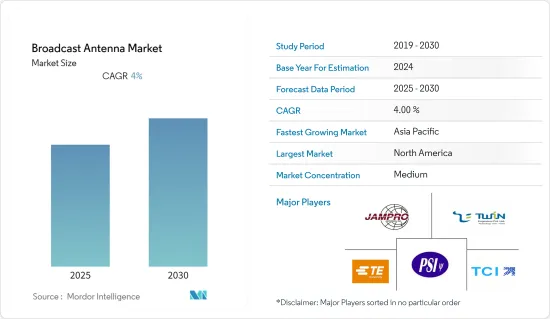

广播天线市场预计在预测期内复合年增长率为 4%。

主要亮点

- 直播(卫星电视)已成为电视内容传播的重要形式。广泛且可控的覆盖范围,再加上更高的频宽,使得可以播放更多的频道,这就是卫星电视如此有吸引力的原因。

- 另外,在最后一个生锈的旧屋顶安装电视天线被运送到回收中心不到十年后,由于智能电视等电视创新,最好的电视天线选择又回到了您的家中,这也是一个了不起的事件。今天的天线更小、更精简、功能更强大。许多室内和室外天线都具有内建放大器,可增强远距离讯号,非常适合在农村地区使用。

- 许多家庭现在选择串流媒体平台(用于 OTT 内容)和天线(用于接收主要网路广播以及本地新闻和资讯)的组合。这消除了对昂贵卫星服务的需求,为大多数家庭每年节省 2,000 美元。例如,「Sukses 室内 HDTV 数位电视天线」是一款功能强大的可拆卸 HDTV 放大器讯号增强器,可接收最远 120 英里以外的讯号。滤波技术可以消除行动电话和FM讯号的干扰。此外,它还支援 1080p HDTV 和 4K 技术的程式设计。

- 与付费电视服务相比,广播电视天线具有多种优势,包括成本更低、未压缩的高清讯号、可靠的服务以及丰富的本地频道。这些是预计在预测期内推动全球广播天线市场向前发展的关键因素。此外,高清、2K 和 4K 等影像品质的提高以及 4K 体育赛事正在推动广播天线的兴起。

- 此外,在 COVID-19 大流行期间,广播电视和天线的渗透率略有上升。超过 30% 的美国宽频家庭拥有电视天线。预计拥有率和使用率都将继续呈上升趋势,尤其是在大流行期间。

广播天线市场趋势

TV类型市场占有率最高

- 与付费电视服务相比,广播电视天线具有广泛的优势,包括成本更低、未压缩的高清讯号、不间断的服务以及广泛的本地频道。这些是预计在预测期内推动全球广播天线市场成长的关键因素。此外,影像品质的提高(例如高清、2K、4K 和 4K 格式的体育赛事)正在推动广播天线的成长。

- 然而,与其他付费频道相比,可使用电视天线观看的频道数量有限且相对较少,预计这将在一定程度上阻碍市场成长。

- 在过去的十年中,各国已从使用旧的类比电视标准的广播转向新的数位电视 (DTV)。但一般来说,使用相同的广播频率,因此相同的天线可以用于较旧的类比电视,并且仍然可以接收较新的 DTV 广播。

- 目前,电视天线製造商正致力于推出同时支援 UHF 和 VHF 功能以及高画质内容的电视天线,尤其是室内天线。预计这一趋势很快就会受到关注。

- 更重要的是,在看到最后一个生锈的旧屋顶安装电视天线被运送到回收中心不到十年后,随着电视技术的创新,最好的电视天线选择又回到了家庭,包括智慧电视等等。今天的天线更小、更精简、功能更强大。许多室内和室外天线都具有内建放大器,可放大远处的讯号,非常适合在农村地区使用。

北美市场占有率最高

- 由于有线和卫星电视频道数量的迅速增加,北美地区占据了很大的市场占有率。此外,网路的广泛使用使得广播公司能够向观众提供高品质的内容,这是广播设备需求的主要原因之一。

- 此外,RFStar 的天线为该地区的单通道或双通道固定极化应用提供了简单可靠的选择。当需要高性能天线时,RFStar UHF 缝隙阵列天线是理想的选择,可实现目前和未来频道操作之间的频率捷变。

- 此外,全部区域日益增长的文化多样性也是导致数位频道数量增加的关键因素之一,从而推动了该地区对广播设备的需求。在该地区,广播和数位媒体领域的主要公司正在活性化创新新技术、进行收购和组建联盟。

- 此外,国际公司正在新兴国家寻找机会,增加对该领域的投资。总体而言,预计市场在预测期内将以健康的速度成长。

广播天线产业概况

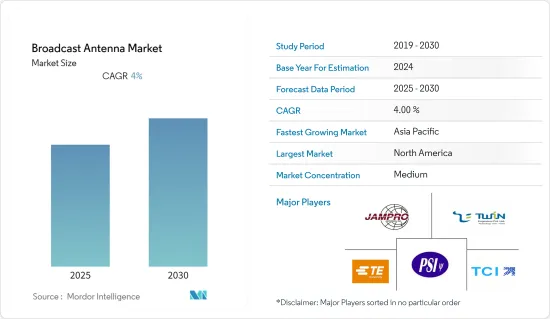

广播天线市场适度分散,有几家大公司和几家大企业提供媒体和娱乐解决方案。领先公司正在采用各种策略来扩大其在该市场的影响力,包括新产品推出、扩张、协议、合资、伙伴关係和收购。以下是市场的一些主要发展:

- 2021 年 1 月,SPX 公司子公司 Dielectric Communications ME 宣布已签订收购 TCI International Inc. 的最终协议。 Dielectric 对 TCI 的收购扩大了 Dielectric 为美国广播公司提供的电视和调频产品以及为国际广播公司提供的高中频产品的多样化产品范围。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 市场驱动因素

- 市场限制因素

- 光纤的发展预计将成为天线采用的挑战

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对广播天线市场的影响

第五章市场区隔

- 按类型

- 电视机

- FM

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争状况

- 公司简介

- TE Connectivity Ltd.

- Jampro Antennas Inc.

- Propagation Systems Inc.(PSI Antenna)

- TCI International Inc.

- Twin Engineers Private Limited

- Dielectric Inc.

- OMB Sistemas Electronicos SA

- ELETEC Broadcast Transmitters Sarl

- ABE Elettronica srl

- Electronics Research Inc.

- ALDENA TELECOMUNICAZIONI Srl

- RVR Elettronica Srl

- Kathrein Broadcast GmbH

第七章 投资分析

第八章市场展望

简介目录

Product Code: 69900

The Broadcast Antenna Market is expected to register a CAGR of 4% during the forecast period.

Key Highlights

- Direct broadcasting, or satellite television, has become a significant form of distribution for television content. The broad and controllable coverage areas available combined with the much larger bandwidths enables more channels to be broadcast, and this makes satellite television very attractive.

- Further, within a decade after seeing the last rusty old roof-mounted television antennas finally hauled away to recycling centers, the return of the best TV antenna options to homes has been a surprising turn of events in media along with innovation in televisions such as smart TVs. Today's antennas are smaller, more streamlined, and much more powerful. Whether for indoor or outdoor installation, many antennas come with built-in amplifiers to boost signals from further afield, making them ideal for rural areas

- Many households are now choosing a combination of streaming platforms (for OTT content) and an antenna (to pick up the major network broadcasts and local news and information). This cuts out the need for expensive satellite services, saving most households up to USD 2,000 per year. For instance, the Sukses Indoor HDTV Digital TV Antenna provides a powerful, detachable HDTV amplifier signal booster allowing reception from up to 120 miles away. The filtering technology helps in eliminating interference from cellular and FM signals. Further, it supports programming in 1080p HDTV and 4 K technology.

- Broadcast TV antennas have several advantages over pay-TV services, including inexpensive costs, uncompressed HD signals, consistent service, and a large selection of local channels. These are the key factors projected to propel the global broadcast antenna market forward during the forecast period. Furthermore, improved picture quality such as HD, 2K, and 4K and sporting events in 4K is driving the rise of broadcast antennas.

- Additionally, Amid the COVID-19 pandemic, the penetration of broadcast TV and antennas increased marginally. Over 30% of US broadband households report owning a TV antenna. It is expected to witness an upward trend both in ownership and usage to continue, especially during the pandemic period.

Broadcast Antenna Market Trends

Television Type to Hold Highest Market Share

- Broadcast TV antennas offer a wide range of benefits over pay-TV services, some of which are low cost, uncompressed HD signals, uninterrupted services, and a wide range of local channels. These are the key factors expected to drive the growth of the global broadcast antenna market during the forecast period. Moreover, increased picture quality like HD, 2K, 4K, and sports events in 4K are fuelling the growth of broadcast antennas.

- However, the limited channels available, which can be viewed using TV antennas, are comparatively less than other paid subscriptions, which is expected to hamper the market's growth to a certain extent.

- Over the last decade, countries have switched from broadcasting using an older analog television standard to newer digital television (DTV). Generally, however, the same broadcast frequencies are used, so the same antennas can be used for older analog television and can also receive new DTV broadcasts.

- Currently, TV antenna manufacturers are focusing on introducing TV antennas, especially indoor antennas, that support both UHF and VHF functionality and HD content. This trend is expected to gain traction soon.

- Furthermore, within a decade after seeing the last rusty old roof-mounted television antennas finally hauled away to recycling centers, the return of the best TV antenna options to homes has been a surprising turn of events in the world of media along with innovation in the televisions such as smart TVs. Today's antennas are smaller, more streamlined, and are much powerful. Whether for indoor or outdoor installation, many antennas come with built-in amplifiers to boost signals from further afield, making them ideal for rural areas.

North America to Hold Highest Market Share

- The North American region holds a significant market share due to the rapidly increasing number of cable and satellite television channels. Additionally, the increasing internet penetration has allowed broadcasters to provide high-quality content to the viewers, which is one of the primary reasons for the demand for broadcast equipment.

- Furthermore, players provide a simple and reliable option for single or dual-channel fixed polarization applications in the region, where their antennas can be utilized by single or multiple broadcasters for interim or auxiliary usage. The RFStar UHF slotted array antennas are ideally suited when a high-performance antenna is needed, which allows for frequency agility between current and future channel operation.

- Furthermore, the rising cultural diversity across the region is also one of the primary factors that led to an increase in the number of digital channels, which in turn boosts the demand for broadcast equipment in the region. In the region, major players operating in the broadcast and digital media sectors are increasingly innovating new technologies and catering to acquisitions and partnerships.

- Moreover, with international companies exploring the potential in emerging nations, this sector is witnessing increasing investments. Overall, the market is expected to grow at a healthy rate over the forecast period.

Broadcast Antenna Industry Overview

The Broadcast Antenna Market is moderately fragmented, with some large and several medium-sized companies offering solutions for media and entertainment. The major players use various strategies such as new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, and others to increase their footprints in this market. Some of the key developments in the market are:

- January 2021: Dielectric Communications ME, a unit of SPX Corporation, announced it had signed a definitive agreement to purchase TCI International Inc. The acquisition of TCI by Dielectric expands Dielectric's diverse product offerings to US broadcasters for TV and FM products and overseas broadcasters in the high frequency and medium frequency spectrum.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.3.1 Evolution of Optic Fiber is Expected to Challenge the Antenna Adoption

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of Impact of COVID-19 on the Broadcast Antenna Market

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Television

- 5.1.2 FM

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 TE Connectivity Ltd.

- 6.1.2 Jampro Antennas Inc.

- 6.1.3 Propagation Systems Inc. (PSI Antenna)

- 6.1.4 TCI International Inc.

- 6.1.5 Twin Engineers Private Limited

- 6.1.6 Dielectric Inc.

- 6.1.7 OMB Sistemas Electronicos S.A.

- 6.1.8 ELETEC Broadcast Transmitters Sarl

- 6.1.9 ABE Elettronica s.r.l.

- 6.1.10 Electronics Research Inc.

- 6.1.11 ALDENA TELECOMUNICAZIONI Srl

- 6.1.12 R.V.R. Elettronica S.r.l

- 6.1.13 Kathrein Broadcast GmbH

7 INVESTMENT ANALYSIS

8 MARKET OUTLOOK

02-2729-4219

+886-2-2729-4219