|

市场调查报告书

商品编码

1630362

资料中心现场太阳能发电-市场占有率分析、产业趋势与统计、成长预测(2025-2030)On-Site Photovoltaic Solar Power For Data Centers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

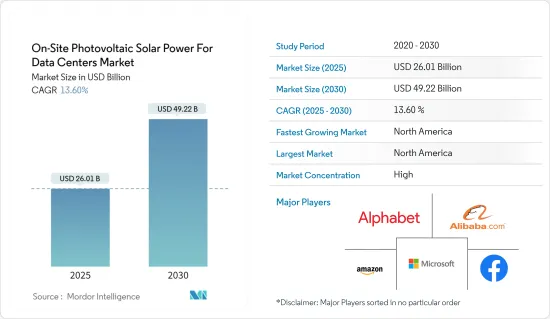

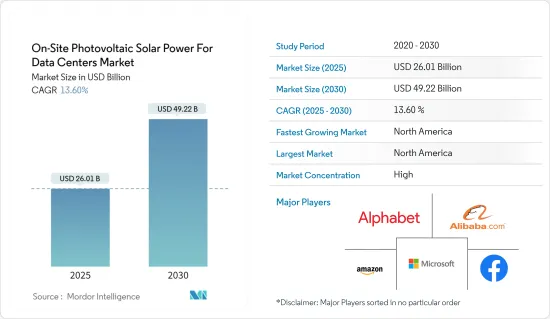

资料中心现场太阳能发电市场规模预计2025年为260.1亿美元,2030年将达492.2亿美元,预测期内(2025-2030年)复合年增长率为13.6%。

主要亮点

- 从中期来看,太阳能光电安装成本的下降和对实施永续商业实践的关注预计将推动资料中心的现场太阳能光电市场。

- 另一方面,小型资料中心缺乏安装太阳能板的空间预计将阻碍预测期内资料中心现场太阳能发电市场的成长。

- 小型资料中心建筑太阳能建筑一体化技术的大规模商业化预计将成为预测期内资料中心现场太阳能光电市场的重大机会。

- 北美占据市场主导地位,预计在预测期内仍将保持最高的复合年增长率。这一增长是由于政府加大了对安装太阳能发电系统为该地区(包括美国和加拿大)资料中心供电的支持和投资的推动。

资料中心现场太阳能发电市场趋势

安装太阳能发电成本的下降正在推动市场

- 资料中心被定义为建筑物的一部分、建筑物本身或专用于容纳电脑系统、储存系统、通讯系统和所有其他相关组件的一组建筑物。在资料中心,具有备用电源的不断电系统对于资料撷取至关重要。

- 典型的资料中心消耗的电力从几千瓦到数十兆瓦不等。对电力供应的高度依赖是资料中心营运成本较高的原因之一。

- 一些资料中心正在选择太阳能等现场可再生能源,以降低营运成本并减少对环境的影响。随着全球加权平均平准化能源成本 (LCOE) 从 2015 年的 0.129 美元/千瓦下降到 2022 年的约 0.049 美元/千瓦,多家营业单位正在采用太阳能光电发电。

- 此外,微软计划在 2025年终其资料中心将 100% 使用可再生能源运作。因此,随着安装成本下降,现场太阳能发电装置预计将逐年成长。

- 因此,太阳能发电安装成本的下降预计将在预测期内增加资料中心现场太阳能发电市场。

北美市场占据主导地位

- 根据Cloudscene统计,截至2022年,美国是全球最大的资料中心市场之一,拥有近5,375个资料中心。此外,加拿大(335)在全球资料中心市场也占有重要份额。

- 艾默生位于密苏里州的资料中心是美国领先的资料中心之一,采用校园太阳能技术为其资料中心供电。该中心安装了一座 100 千瓦的太阳能电池板设施,耗资约 5,000 万美元。加州的 Aiso.net 和亚利桑那州的 i/o 资料中心是少数拥有现场太阳能发电设施的资料中心。

- 资料中心营运商储备的再生能源电量在一年内增加了 50%,该产业目前消耗了美国企业可用再生能源的三分之二。

- 2023 年 3 月,Meta 透露可再生能源部署每年以 30% 的速度成长。 Meta 已部署了 356 万千瓦的太阳能发电容量,并在其长期开发平臺中拥有超过 900 万千瓦的太阳能发电容量。 Meta 是美国最大的商业和工业太阳能采购商。

- 北美市场预计将成长,因为人们专注于透过使用可再生能源来满足资料中心的能源需求,使计划和营运更具永续性。

资料中心现场太阳能发电产业概述

资料中心的现场太阳能市场正在整合。该市场的主要企业(排名不分先后)包括亚马逊公司、Alphabet公司、微软公司、阿里巴巴集团控股有限公司、Facebook公司、戴尔技术公司、Affordable Internet Services Online Inc等。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 降低引入太阳能发电的成本

- 越来越关注永续商业实践

- 抑制因素

- 小型资料中心缺乏太阳能板安装空间

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 卡达

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 埃及

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Amazon.com, Inc.

- Alphabet Inc.

- Microsoft Corporation

- Alibaba Group Holding Ltd.

- Facebook Inc.

- Dell Technologies Inc.

- Affordable Internet Services Online Inc.

- Market Player Ranking

第七章 市场机会及未来趋势

- 太阳能建筑一体化技术规模化商业化

The On-Site Photovoltaic Solar Power For Data Centers Market size is estimated at USD 26.01 billion in 2025, and is expected to reach USD 49.22 billion by 2030, at a CAGR of 13.6% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the decreasing solar power installation costs and growing focus on implementing sustainable business practices are expected to drive the on-site photovoltaic solar power for data centers market.

- On the other hand, the lack of space for small data centers to install solar panels is expected to hinder on-site photovoltaic solar power for data centers market growth during the forecast period.

- Nevertheless, the large-scale commercialization of building-integrated photovoltaic technology into small data centers is expected to be a significant opportunity for the on-site photovoltaic solar power for data centers market duringthe forecast period

- North America is expected to dominate the market and likely witness the highest CAGR during the forecast period. This growth is attributed due to the increasing investments, coupled with supportive government policies for installing solar PV systems to power data centers in the region, including the United States of America (USA) and Canada.

On-Site Photovoltaic Solar Power For Data Centers Market Trends

Decrease in Solar Power Installation Cost is Likely to Drive the Market

- Data centers are defined as a part of a building, a building itself, or a cluster of buildings dedicated to housing computer systems, storage systems, telecommunication systems, and all other associated components. An uninterrupted power supply with backup power is the utmost importance in data centers for data capturing.

- A typical data center consumes power between a few kilowatts to several tens of megawatts. High dependency on the power supply is one of the high operating costs of the data center.

- Several data centers are opting for onsite renewable power sources like solar photovoltaic to reduce operating costs and have a less environmental impact. With decrease in Global Weighted Average Solar PV Levelized Cost of Energy (LCOE) from USD 0.129/kW in 2015 to nearly USD 0.049/kW in 2022 several entities have started adopting it.

- Moreover, Microsoft is planning to run 100% of its data center by renewable energy by the end of 2025. Thus, with a decrease in installation cost, onsite solar photovoltaic facilities are expected to grow over the years.

- Hence, deceresing solar power installation costs are expected to aid the growth of the on-site photovoltaic solar power for data centers market during the forecast period.

North America to Dominate the Market

- North America is one of the largest software and information technology markets globally, and according to Cloudscene, as of 2022, the United States was the largest data centre market in the world, housing nearly 5375 data centres. Additionally, Canada (335) also held signficant shares in the global datacentre market.

- Emerson data center in Missouri is one of the key data centers in the United States that is using solar photovoltaic technology on its campus to power its data center. The center has a 100-kilowatt solar panel facility, that was installed at the cost of around USD 50 million. Aiso.net in California, i/o Data Centers in Arizona are few other data centers that are facilitated with onsite photovoltaic solar power facilities.

- The amount of renewable power booked by data center operators increased by 50 percent in a year, and the sector now consumes two-thirds of the renewable power available to corporates in the United States.

- In March 2023, Meta revealed that its renewable energy deployments are growing by 30% each year. Meta has already deployed 3.56 GW of solar capacity, and has over 9 GW in its long-term development pipeline. Meta stands as the largest commercial and industrial purchaser of solar power in the United States.

- Hence, due to rising focus on increasing project and business sustainability by using renewable energy to power the energy needs of datacentres, the market is expected to witness a positive growth in North America.

On-Site Photovoltaic Solar Power For Data Centers Industry Overview

The on-site photovoltaic solar power for data centers market is consolidated. Some of the key players in this market (in no particular order) includes Amazon.com Inc, Alphabet Inc, Microsoft Corporation, Alibaba Group Holding Ltd, Facebook Inc, Dell Technologies Inc, and Affordable Internet Services Online Inc among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Decreasing Solar Power Installation Costs

- 4.5.1.2 Growing focus on Implementing Sustainable Business Practices

- 4.5.2 Restraints

- 4.5.2.1 Lack of Space for Small Data Centers to Install Solar Panels

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Geography

- 5.1.1 North America

- 5.1.1.1 United States

- 5.1.1.2 Canada

- 5.1.1.3 Rest of North America

- 5.1.2 Europe

- 5.1.2.1 Germany

- 5.1.2.2 France

- 5.1.2.3 United Kingdom

- 5.1.2.4 Italy

- 5.1.2.5 Spain

- 5.1.2.6 NORDIC

- 5.1.2.7 Turkey

- 5.1.2.8 Russia

- 5.1.2.9 Rest of Europe

- 5.1.3 Asia-Pacific

- 5.1.3.1 China

- 5.1.3.2 India

- 5.1.3.3 Japan

- 5.1.3.4 Australia

- 5.1.3.5 Malaysia

- 5.1.3.6 Thailand

- 5.1.3.7 Indonesia

- 5.1.3.8 Vietnam

- 5.1.3.9 Rest of Asia-Pacific

- 5.1.4 South America

- 5.1.4.1 Brazil

- 5.1.4.2 Argentina

- 5.1.4.3 Chile

- 5.1.4.4 Colombia

- 5.1.4.5 Rest of South America

- 5.1.5 Middle-East and Africa

- 5.1.5.1 United Arab Emirates

- 5.1.5.2 Qatar

- 5.1.5.3 Saudi Arabia

- 5.1.5.4 South Africa

- 5.1.5.5 Nigeria

- 5.1.5.6 Egypt

- 5.1.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Amazon.com, Inc.

- 6.3.2 Alphabet Inc.

- 6.3.3 Microsoft Corporation

- 6.3.4 Alibaba Group Holding Ltd.

- 6.3.5 Facebook Inc.

- 6.3.6 Dell Technologies Inc.

- 6.3.7 Affordable Internet Services Online Inc.

- 6.4 Market Player Ranking

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Large-scale Commercialization of Building-integrated Solar PV Technology