|

市场调查报告书

商品编码

1630370

欧洲资料中心互连:市场占有率分析、产业趋势与成长预测(2025-2030)Europe Data Center Interconnect - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

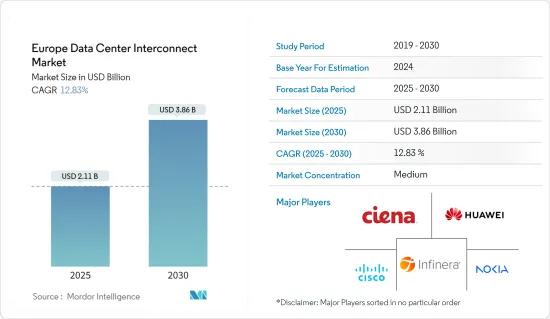

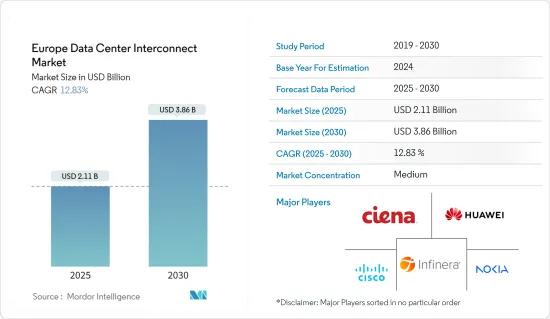

欧洲资料中心互连市场规模预计到2025年为21.1亿美元,预计2030年将达到38.6亿美元,预测期内(2025-2030年)复合年增长率为12.83%。

随着资料的激增以及人工智慧和高效能运算 (HPC) 等技术的扩展,快速、可靠且经济高效地连接资料中心资产的需求显着增加。吞吐量、延迟、操作简单性、维护、智慧和安全性等因素是资料中心供应商的关键优先事项。这是采用资料中心互连 (DCI) 技术的关键驱动因素之一,可增加资料中心之间的频宽、减少延迟并消除封包遗失。

主要亮点

- 在西欧和北欧,政府机构正在提供税收减免和其他激励措施,以吸引投资者建造超大规模资料中心。丰富的可再生能源资源、低廉的电价、有利的气候条件、良好的基础设施和熟练的劳动力使北欧国家适合建立资料中心和DCI,多年来外国投资激增。

- 云端运算产业的成长以及最近由于全国范围内的停电而导致 OTT 服务使用量的增加扩大了该研究覆盖的市场。此外,5G服务的推出可能会扩大互连资料中心解决方案的范围。自动驾驶汽车、智慧城市、数位双胞胎、虚拟实境、虚拟助理、视讯监控、游戏等正在推动市场需求。

- 云端运算是预计将显着推动资料中心互连市场的细分市场之一。近年来,由于企业营运成本的降低,云端运算一直在成长。託管和云端可以结合起来,以减少延迟、提高安全性并为云端互连创造机会。云端供应商公司需要高频宽、有弹性的专用网路以及强大的资料中心供应商的支援。

- 资料中心连接服务的成本是一个巨大的挑战,特别是对于中小型企业而言。建造新的资料中心需要在建设和维护方面进行大量投资。此外,资料中心之间的距离也很重要,因为它会降低资料中心的效率并限制资料中心互连产业的成长。

- 特别是近年来,线上活动的快速成长增加了对资料中心互连的需求,因为 COVID-19 大流行使得存取网路应用程式变得至关重要。随着越来越多的人依赖网路进行工作、社交网路、电子商务、银行业务和娱乐,对几乎无限的执行时间和互连性的需求不断增长。

欧洲资料中心互连市场趋势

云端迁移的持续趋势预计将推动市场发展

- 国内外企业和云端运算客户不断增长的需求正在推动企业扩大资料中心设施。欧洲资料中心市场以公共云端服务为主。政府机构正在增加对私有云端云服务的使用,因为他们计划在预测期内扩大政府对云端服务的使用。然而,混合云服务比私有云端公有云服务具有更大的成长潜力。云端技术的成长反过来又导致该地区资料中心互连技术市场不断扩大。

- 此外,云端运算的日益普及(因 COVID-19 大流行进一步加剧)、外国云端供应商在欧洲的渗透率不断提高、该地区有关资料安全的政府规则和法规以及欧洲国内公司的投资增加。地区互联资料中心需求的关键因素之一。

- 此外,微软还在挪威投资了多个资料中心地点,谷歌有限责任公司正在扩大在芬兰的业务。云端运营商以及企业和互连提供商正在增加对北欧的投资。预计这将在预测期内推动该地区资料中心互连市场的成长。

- 2022 年 7 月,随着云端服务供应商寻求更快的网路连接,美国通讯基础设施供应商 Zayo 宣布开通英国和欧洲大陆之间的 Zeus 海底航线。海底电缆目前承载着全球几乎所有的网路资料流量,包括 Alphabet 旗下的Google和 Meta 在内的许多科技公司也正在投资海底电缆的建设。

- 随着人工智慧、5G 和边缘运算等云端解决方案和工业应用的激增,对资料中心的需求不断增加。反过来,预计将为资料中心互连市场带来巨大的商机。根据 Cloudscene 的数据,截至 2024 年 2 月,德国拥有 522 个资料中心,是欧洲国家中最多的。资料中心是容纳电脑系统并共用的资讯技术 (IT)业务的建筑物。

德国占有很大的市场占有率

- 资料中心数量的增加、云端技术投资的增加以及终端用户市场的扩大是推动德国资料中心投资互连市场的关键因素。 GDPR 和个人资料保护倡议(Gaia-X) 等严格的当地法律正在进一步推动该地区资料中心的建设和发展。

- 边缘运算解决方案的发展正在增加对大容量网路的需求。由于自动驾驶汽车、云端运算、物联网和先进机器人技术等颠覆性技术,德国经济正在推动对边缘运算解决方案的需求。这些技术的越来越多的使用需要更高的频宽和卓越的处理速度。

- 低延迟对于克服这些障碍至关重要,从而推动了资料中心託管的需求。云端服务供应商可以透过将其网路设计放置在更靠近用户的位置来提供高频宽和低延迟。 5G 的发展使互连服务供应商能够在德国的远端地点之间提供更好的连接性,从而刺激市场扩张。

- 5G 和扩增实境(AR)、虚拟实境和人工智慧等身临其境型技术的发展也增加了企业之间资料共用预留频宽的需求。欧洲互连的频宽容量正在迅速扩大,并且这一趋势预计将持续下去。由于对高速连接以改善客户体验的需求不断增长,通讯业拥有最大的市场占有率。此外,由于智慧型设备的快速采用,对改善连接性和减少资料传输延迟的需求不断增长,该地区的互连服务供应商也从中受益。

- 近年来,由于5G网路、人工智慧、物联网等颠覆性技术的发展,资料中心工作负载不断增加。企业内部云端运算和即服务模式的使用增加,以及高工作负载的管理,增加了对专业技能的需求。爱立信预计,到2028年,中东欧移动5G用户数量预计将达到2.294亿。德国是中欧最发达国家之一,预计行动 5G 用户数将大幅成长。

欧洲资料中心互连产业概述

欧洲资料中心互连市场为半固体市场,主要参与者包括华为科技公司、Ciena 公司、思科系统公司、英飞朗公司和诺基亚公司。市场参与企业正在采取联盟和收购等策略来加强其产品供应并获得可持续的竞争优势。

- 2023年,德国将成为欧洲第二大主机託管市场。过去五年,德国资料中心市场的成长受到企业数位转型策略、云端运算、物联网(IoT)、人工智慧的采用以及GDPR的实施的推动。德国大约 80% 的组织使用云端服务来提供一项或多项服务,而这一比例预计还会增加,未来 3-5 年的复合年增长率为 3-5%。鑑于服务资料的高成长率和营运网路的高成本,德国资料中心服务供应商AIXIT 宣布,他们决定在未来十年内开发连接,以在资料资料之间无缝扩展。

- 2022 年 10 月,诺基亚宣布扩大与欧洲最大的去中心化网路交换供应商 NL-ix 的合作关係。诺基亚介绍了其先进的 7750 SR-s 平台,该平台具有突破性的路由晶片 FP5。此次部署将使 NL-ix 能够为其国家研究和教育网路 (NREN) 和云端供应商客户提供 400GE 和 800GE 存取和互连服务。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场动态

- 云端迁移的持续趋势

- 最近网路消费的变化和预期的 5G 引入将推动市场成长

- 市场问题

- 容量和安装挑战

第六章 市场细分

- 按国家/地区

- 德国

- 英国

- 法国

- 爱尔兰

- 西班牙

- 欧洲其他地区

第七章 竞争格局

- 公司简介

- Huawei Technologies

- Ciena Corporation

- Cisco Systems Inc.

- Infinera Corporation

- Nokia Corporation

- ZTE Corporation

第八章投资分析

第九章 市场机会及未来趋势

The Europe Data Center Interconnect Market size is estimated at USD 2.11 billion in 2025, and is expected to reach USD 3.86 billion by 2030, at a CAGR of 12.83% during the forecast period (2025-2030).

With the proliferation of data and expansion of technologies like AI and high-performance computing (HPC), the need to connect data center assets quickly, reliably, and cost-effectively is growing significantly. Factors such as throughput, latency, simplified operations, maintenance, intelligence, and security are becoming significant priorities for data center vendors. This is one of the major factors driving the adoption of data center interconnect (DCI) technology, owing to its ability to boost inter-data center bandwidth, reduce latency, and eliminate packet loss.

Key Highlights

- Government agencies offer tax breaks and other benefits to attract the maximum number of investors to construct a hyperscale data center market in Western Europe & the Nordics. Due to vast resources of renewable energy, low power prices, favorable climate conditions, good infrastructure, and a skilled workforce, Nordic countries are well suited for data centers and, therefore, for DCI and have resulted in a surge of foreign investments over the years.

- The market studied is expanding due to the growing cloud computing industry and the recent increase in OTT service use due to a nationwide shutdown. Furthermore, introducing 5G services may broaden the scope of interconnected data center solutions. Autonomous cars, smart cities, digital twins, virtual reality, AI virtual assistants, video surveillance and monitoring, and gaming are fueling market demand.

- Cloud computing is one sector estimated to be a significant driver of the data center interconnect market. Cloud computing has been increasing over the past few years, owing to lower operational expenses faced by enterprises. Combining colocation with the cloud can reduce latency, increase security, and create cloud interconnection opportunities. Cloud provider companies require high bandwidth and resiliency private networks and support from a robust data center provider.

- The major challenge, especially for small and medium-sized businesses, is the cost of data center connectivity services. A new data center necessitates a significant investment in both construction and maintenance. Furthermore, the distance between data centers is important since it might reduce a data center's efficiency, limiting the growth of the data center interconnect industry.

- The fast growth of online activity has raised the demand for data center interconnection, particularly in recent years, as the COVID-19 pandemic made access to internet applications a requirement. With more people relying on the Internet for work, social networking, e-commerce, banking, and entertainment, the demand for almost limitless uptime and interconnection is growing.

Europe Data Center Interconnect Market Trends

Ongoing Trend Toward Cloud Migration is Expected to Drive the Market

- The growing demand from domestic and international enterprises and cloud computing customers has pushed companies to expand data center facilities. Public cloud services dominate the data center market in Europe. The use of private cloud services by government agencies is growing as they plan to make greater use of cloud services in public administration during the forecast period. However, hybrid cloud services have more substantial growth potential than private and public cloud services. The growth in cloud technology is, in turn, a growing market for data center interconnect technology in the region.

- Moreover, the growing adoption of cloud computing (which further escalated due to the COVID-19 pandemic), increasing penetration of foreign cloud vendors across Europe, governmental rules and regulations for local data security, and the increasing investments by domestic European players are some of the major factors that are driving the demand for interconnected data centers in the region.

- Furthermore, Microsoft Corporation has invested in multiple data center locations in Norway, while Google LLC has expanded its operations in Finland. It is not just the cloud enterprise players; enterprises and interconnection providers are also increasingly investing in the Nordics. This is expected to boost the growth of the data center interconnect market in the region over the forecast period.

- In July 2022, the US communications infrastructure provider Zayo announced that it had launched the Zeus subsea route that connects the United Kingdom and continental Europe as cloud service providers seek faster internet connections. Currently, undersea cables transmit nearly all the world's internet data traffic, and many technology companies, including Alphabet's Google and Meta, have also invested in building their subsea cables.

- The demand for data centers is growing with the popularity of cloud solutions and industry applications, such as AI, 5G, and edge computing. In return, it is anticipated to give immense opportunities to the data center interconnect market. According to Cloudscene, as of February 2024, there are 522 data centers located in Germany, the most in any European nation. Data centers are buildings that house computer systems and centralize organizations' shared information technology (IT) operations.

Germany to Hold a Significant Market Share

- The growing number of data centers, increasing investment in cloud technologies, and expanding end-user markets are major factors driving the German data centers' investment in the interconnect market. The stringent regional laws, like GDPR and Personal Data Protection Initiatives (Gaia-X), further boost the region's local data center construction and development.

- With the development of edge computing solutions, there has been an increase in the demand for high-capacity networks. The German economy has increased the need for edge computing solutions due to disruptive technologies like autonomous vehicles, cloud computing, IoT, and advanced robotics. Higher bandwidths and better processing speeds are now necessary due to the expanding use of these technologies.

- Low latency is crucial to overcoming these obstacles, raising the demand for colocation in data centers. Cloud service providers can offer high bandwidth and low latency by colocating their network design close to the users. The development of 5G has allowed interconnection service providers to deliver these services with better connections across remote German locations, fueling the market's expansion.

- The development of 5G and immersive technologies like augmented reality, virtual reality, and AI has also increased the demand for more bandwidth to be set aside for data sharing across businesses. The bandwidth capacity of Europe's interconnections is growing quickly, and this trend is expected to continue. The telecommunications industry has the most significant market share because of the rising need for high-speed connectivity to improve client experiences. In addition, the region's interconnection service providers benefit from expanding demand for enhanced connectivity and decreased data transfer latency due to the rapid uptake of smart devices.

- Over the past few years, data center workloads have increased due to the development of 5G networks and other disruptive technologies like AI and the Internet of Things. Along with managing high workloads, the rising use of cloud computing and As-a-Service models within businesses has boosted the demand for specialized skill sets. According to Ericsson, the number of mobile 5G subscriptions in Central and Eastern Europe is expected to reach 229.40 million by 2028. Germany, being one of the most developed countries in Central Europe, is expected to witness a significant growth in the number of mobile 5G subscriptions.

Europe Data Center Interconnect Industry Overview

The European data center interconnect market is semi-consolidated with the presence of major players like Huawei Technologies, Ciena Corporation, Cisco Systems Inc., Infinera Corporation, and Nokia Corporation. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In 2023, Germany was Europe's second-largest colocation market. Over the past five years, the growth of the data center market in Germany has been driven by the digital transformation strategies adopted by enterprises, the introduction of cloud computing, the Internet of Things (IoT), AI, and the implementation of the GDPR. About 80% of the organizations in Germany use cloud services for one or more services, which has increased and is projected to register a CAGR of 3-5% over the next 3-5 years. Given the high growth rate of service data as well as the high cost of the network operation, German data center service provider aixit announced that it has decided to create connectivity for non-blocking the data flow and seamless expansion across the data centers in the next decade. aixit announced that it would build its own DCI network with Huawei's DC OptiX.

- In October 2022, Nokia announced an expanded partnership with NL-ix, Europe's largest distributed internet exchange provider. Nokia would supply its advanced 7750 SR-s platforms powered by its ground-breaking routing silicon, FP5. With this deployment, NL-ix can provide 400GE and 800GE access and interconnection services to its national research and education network (NREN) and cloud provider clients.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Ongoing Trend Toward Cloud Migration

- 5.1.1 Recent Changes in Network Consumption Coupled with Anticipated Adoption of 5G to Drive Market Growth

- 5.2 Market Challenges

- 5.2.1 Capacity and Installation Related Challenges

6 MARKET SEGMENTATION

- 6.1 By Country

- 6.1.1 Germany

- 6.1.2 United Kingdom

- 6.1.3 France

- 6.1.4 Ireland

- 6.1.5 Spain

- 6.1.6 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Huawei Technologies

- 7.1.2 Ciena Corporation

- 7.1.3 Cisco Systems Inc.

- 7.1.4 Infinera Corporation

- 7.1.5 Nokia Corporation

- 7.1.6 ZTE Corporation