|

市场调查报告书

商品编码

1642177

资料中心互连:市场占有率分析、产业趋势与成长预测(2025-2030 年)Data Center Interconnect - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

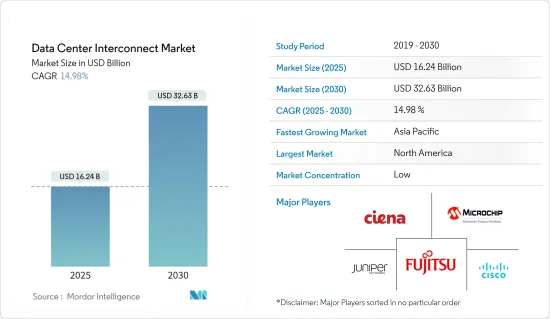

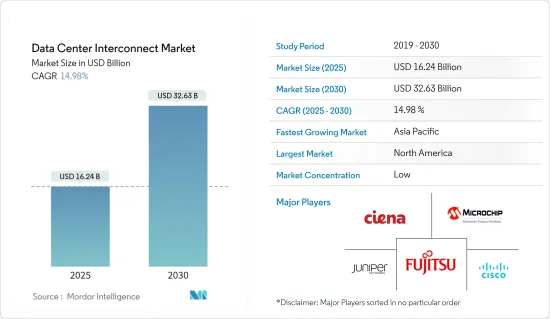

资料中心互连市场规模预计在 2025 年为 162.4 亿美元,预计到 2030 年将达到 326.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 14.98%。

随着资料的快速成长以及人工智慧和高效能运算 (HPC) 等技术的扩展,快速、可靠且经济高效地连接资料中心资产的需求正在迅速增加。

关键亮点

- 吞吐量、延迟、易操作和维护、智慧化和安全性等因素正在成为资料中心供应商的重点。这是推动资料中心互连 (DCI) 技术采用的主要驱动因素之一。这是因为它增加了资料中心之间的频宽,减少了延迟并防止了封包遗失。

- 此外,5G服务日益商业化可能会进一步扩大连网资料中心解决方案的范围。自动驾驶汽车、智慧城市、数位双胞胎、虚拟实境、人工智慧虚拟助理、视讯监控、游戏等都有可能推动市场需求。

- 资料中心互连市场正在不断增长,因为越来越多的人意识到它提供了许多好处,例如易于存取、方便、高度加密的资料以及与其他资料区段连接的能力。

- 边缘运算的趋势在 2020 年全国封锁的情况下至关重要,这进一步扩大了所研究的市场范围。大约 10-15% 的资料是在集中式资料中心或云端之外建立和处理的,但预计到 2025 年将达到 60-70%。亚马逊、Google、Equinix 和 DRT 等公司的超大规模资料中心相互连接,透过网路向最终用户提供资料和应用程式。边缘云端很可能是一个开放、互联的资料中心的生态系统。

- 一个主要的挑战,特别是对于中小型企业来说,是资料中心连接服务的成本。新的资料中心在建设和维护方面都需要大量投资。此外,资料中心之间的距离也很重要,因为它会降低资料中心的效率,从而限制资料中心互连产业的成长。

新冠疫情引发全球云端运算需求激增。资料中心市场的范围也扩大了。资料中心建设计划由于劳动力短缺而出现供应链中断,但预计一些计划的完成不会延迟。这仅在早期阶段才出现。视讯串流和会议的使用量激增,超出预期,尤其是在全国封锁期间,推高了全球网路的频宽需求。疫情过后,由于数位化的快速发展和5G服务的兴起,市场不断扩大。

资料中心互连市场趋势

资料中心数量的增加推动市场成长

- 据美国市场供应商Ciena公司称,近年来资料中心的数量不断增加,目前全球已有7,500多个,光是全球前20个城市就有2,600个。据华为称,到2025年,全球每年的资料产量将达到180ZB。此外,非结构化资料(如原始音讯、视讯和影像资料)的比例将持续成长,可能很快就会达到 95% 以上,从而推动全球资料中心的成长。

- 资料通讯网路(DCN)和资料中心互联(DCI)解决方案保证零丢包、低时延、高吞吐的无损网络,保证DCN和DCI的频宽满足业务快速发展的需求。连接资料中心的DCI网路正在演进为10Tbit/s的分波多工(WDM)互连网路。

- 此外,资料中心服务供应商正在投资扩展其主机託管和云端功能。终端用户企业(如电讯、金融等)选择建立自己的资料中心,使得资料中心互连市场成为全球投资热点。由于资料中心的成长和分布、光纤利用率的提高和低成本插件模组,发展中产业(主要是 OTT、ISP、金融部门和公共部门)正在开发 DCI 网路的使用案例。

- 随着资料中心的激增也推动了 DCI 的兴起,因为公司将自己的资料中心、云端供应商和其他资料中心营运商连接起来,以实现更简单的资料和资源共用。据 CloudScene 称,印度每 100 人中就有 29 名网路用户,其连接生态系统由 122 个主机託管资料中心、348 个云端服务供应商和 8 个网路结构组成。

虚拟和云端运算的成长、行动资料的扩展、视讯消费和随选服务等多种因素正在推动印度乃至全球对 DCI 的需求。其他关键驱动因素包括资料和数位智慧型装置(如 Amazon Alexa 和 Google Home)的大量成长以及政府雄心勃勃的「数位印度」计画。

欧洲占有较大市场占有率

- 资料中心数量的增加、对云端技术的投资增加以及终端用户市场的扩大是推动欧洲资料中心互连市场投资的一些关键因素。 GDPR和个人资料保护倡议(Gaia-X)等严格的当地法律正在进一步推动该地区资料中心的建设和发展。

- 德国、英国、荷兰和法国是受调查市场中领先的投资和采用国家。该地区资料中心领域的投资和成长正在上升。这主要是由于云端技术的采用率很高。例如,微软最近将其欧洲资料中心的容量增加了一倍。

- 预计资料流量的增加将对市场成长做出重大贡献。例如,根据Equinix的数据,伦敦预计将继续成为欧洲最重要的资料市场。此外,欧洲资料法令遵循的加强预计将成为催化剂,推动48%的年增长,并占全球互连频宽的23%。

- 此解决方案使DCspine能够提供更多的云端和互连服务,促进网路扩展,并实现网路营运自动化。

- 该建筑将更名为 Equinix HH1 国际商业交易所 (IBX)资料中心。这将为 Equinix 的全球互连平台 Platform Equinix 在德国增加第四个市场,有助于满足整个欧洲对数位基础设施连接日益增长的需求。

资料中心互连产业概况

由于全球参与企业和中小型企业的存在,资料中心互连市场呈现细分化。最近,资料中心供应商也一直在捆绑资料中心互连解决方案。市场参与企业正在采用产品创新、合併、收购和合作等策略。

2022 年 11 月,诺基亚将向非洲资料中心提供其 7250 IXR(互连路由器)系统的 400Gigabit位元接口,非洲资料中心是非洲大陆最大的互连运营商中立和云中立资料中心设施提供商。宣布将提供非洲资料中心是泛非洲科技公司 Cassava Technologies 的一部分,它将能够为许多非洲国家的客户提供低成本、高容量的互连服务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

第五章 市场动态

- 市场驱动因素

- 资料中心数量不断增加(边缘和超大规模)

- AI、HPC等应用程式推动超大频宽、极简、智慧的DCI网路需求

- 市场问题

- 市场机会

- 5G商业化的兴起

- 自动驾驶汽车、智慧城市等市场的成长。

第六章 新冠肺炎疫情对产业的影响评估

第 7 章 技术简介

第 8 章市场细分

- 按应用

- 灾害復原和业务永续营运

- 共用资料和资源

- 资料(储存)移动性

- 其他的

- 按最终用户产业

- 通讯服务供应商(CSP)

- 网路内容和营运商中立供应商 (ICP/CNP)

- 政府/研究与教育 (Government/R&E)

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第九章 竞争格局

- 公司简介

- Ciena Corp.

- Cisco Systems Inc.

- Juniper Networks Inc.

- Fujitsu Ltd.

- Microsemi Corp.

- Pluribus Networks Inc.

- Huawei Technologies Co. Ltd.

- ADVA Optical Networking SE

- Infinera Corp.

- Nokia Oyj

第十章 投资分析

第 11 章 市场的未来

The Data Center Interconnect Market size is estimated at USD 16.24 billion in 2025, and is expected to reach USD 32.63 billion by 2030, at a CAGR of 14.98% during the forecast period (2025-2030).

With the proliferation of data and expansion of technologies like AI and High-Performance Computing (HPC), the need to connect data center assets quickly, reliably, and cost-effectively is growing significantly.

Key Highlights

- Factors such as throughput, latency, simplified operations and maintenance, intelligence, and security are becoming significant priorities for data center vendors. This is one of the major factors driving the adoption of Data Center Interconnect (DCI) technology. This is because they can increase bandwidth between data centers, cut down on latency, and stop packet loss.

- The market being studied is getting bigger because of the growing cloud computing industry and the recent rise in OTT service use due to a nationwide lockdown.Moreover, the increasing commercialization of 5G services may further expand the scope of interconnected data center solutions. Autonomous vehicles, smart cities, digital twins, virtual reality, AI virtual assistants, video surveillance and monitoring, and gaming can drive the market's demand.

- The data center interconnection market is growing because more and more people are becoming aware of its many benefits, such as easy access, more convenience, highly encrypted data, connecting with other data segments, and so on.

- The edge computing trend, essential in the 2020 nationwide lockdown scenario, further expands the studied market scope. About 10-15 percent of data is created and processed outside a centralized data center or cloud, but it is expected to reach 60-70 percent by 2025. The hyperscale data centers of Amazon, Google, Equinix, and DRT, are interconnected and stream data and applications over the network to end users. The edge cloud may be a unique ecosystem of open and interconnected data centers.

- The major challenge, especially for small and medium-sized businesses, is the cost of data center connectivity services. A new data center necessitates a significant investment in both construction and maintenance. Furthermore, the distance between data centers is important since it might reduce a data center's efficiency, limiting the growth of the data center interconnect industry.

The COVID-19 outbreak sparked a surge in demand for cloud computing globally. It also expanded the scope of the data center market. Although the data center construction projects witnessed a supply chain disruption due to the labor shortage, it was not expected to delay the completion of several projects. This was only seen in the initial phases. Video streaming and conferencing usage surged beyond expectations, particularly during the nationwide lockdown period, driving up bandwidth demands for networks globally. After the pandemic, the market is currently growing due to rapid digitization and increased 5G services.

Data Center Interconnect Market Trends

Increasing Number of Data Centers to Drive the Market Growth

- According to the US-based market vendor, Ciena Corporation, the number of data centers has increased in recent years, as there are now more than 7,500 around the globe, with 2,600 packed into the top 20 global cities alone. According to Huawei, global data produced annually may reach 180 ZB in 2025. The proportion of unstructured data (such as raw voice, video, and image data) may also continue to increase, reaching more than 95% shortly, boosting the growth of data centers globally.

- Data Communication Network (DCN) and Data Center Interconnect (DCI) solutions are increasingly concerned with quickly increasing DCN and DCI bandwidth to ensure zero packet loss, low latency, and high throughput of lossless networks, meeting the requirements of rapid service development. The DCI network connecting data centers has evolved into a 10 Tbit/s Wavelength Division Multiplexing (WDM) interconnection network.

- Further, data center service providers are investing in expanding their colocation and cloud capabilities. End-user enterprises (like telecom and financial organizations) opting to build their own data centers are mainly making the interconnected market for data centers a global investment hotspot. Industries, mainly OTT, ISPs, the financial sector, and the public sector, are developing their use cases for DCI networks due to data center growth and distribution, improved fiber utilization, and low-cost pluggable modules.

- The growth of data centers is also driving an increase in DCI, which allows enterprises to connect their data centers, cloud providers, and other data center operators to enable simpler data and resource sharing. According to CloudScene, India has 29 internet users for every 100 people, and its connectivity ecosystem is made up of 122 colocation data centers, 348 cloud service providers, and eight network fabrics.

Numerous factors, including the growth of virtualization and cloud computing, mobile data expansion, video consumption, and on-demand services, are driving a greater need for DCI in India and globally. Other key drivers include a significant increase in data and digital intelligent devices (such as Amazon's Alexa and Google Home) and the government's ambitious Digital India initiative.

Europe to Hold Significant Market Share

- The growing number of data centers, increasing investment in cloud technologies, and the expansion of end-user markets are some of the major factors driving the European data center's investment in the interconnect market. The stringent regional laws, like GDPR and the Personal Data Protection Initiative (Gaia-X), further boost the region's local data center construction and development.

- Germany, the United Kingdom, the Netherlands, and France are some of the major investors and adopters in the market studied. Investment and growth in the data center sector in the region have been increasing. This is mainly due to the high rate of adoption of cloud technologies. For instance, Microsoft alone has doubled its European data center capacity recently.

- Data traffic growth is expected to contribute to the market's growth significantly. For instance, according to Equinix, London is expected to remain the most important European market for data. Furthermore, an increasing number of European data compliance regulations serve as a catalyst, which is expected to grow 48% per year, accounting for 23% of global interconnection bandwidth.

- Furthermore, Nokia announced the availability of its 7220 IXR data center hardware platforms running SR Linux to DCspine, a subsidiary of Eurofiber Cloud Infra that provides digital infrastructure and connectivity services across European data centers, in November of this year.With this solution, DCspine will be able to offer more cloud and interconnection services, make the network easier to scale, and automate network operations.

- The building would be renamed the Equinix HH1 International Business Exchange (IBX) data center. It would add a fourth market in Germany to the company's global interconnection platform, Platform Equinix, and help meet the growing demand for connecting digital infrastructure across Europe.

Data Center Interconnect Industry Overview

The Data Center Interconnect Market is fragmented due to the presence of both global players and small and medium-sized enterprises. Lately, the vendors offering data centers are also combining data center interconnect solutions. Market players are adopting strategies such as product innovation, mergers, acquisitions, and partnerships.

In November 2022, Nokia announced that it will provide 400-gigabit-enabled interfaces for its 7250 IXR (interconnect router) systems to Africa Data Centers, the continent's largest provider of interconnected, carrier- and cloud-neutral data center facilities. Africa Data Centres, a business of Cassava Technologies, a pan-African technology company, would be able to offer its clients in many African countries low-cost, high-capacity interconnection services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Data Centers (Edge and Hyperscale)

- 5.1.2 Increasing Need for Ultra- broadband, Simplified, and Intelligent DCI Networks due to Applications, like AI and HPC

- 5.2 Market Challenges

- 5.3 Market Opportunities

- 5.3.1 Rising Commercialization of 5G

- 5.3.2 Growth in Markets, Such as Autonomous Vehicle, Smart City

6 ASSESSMENT OF COVID-19 IMPACT ON THE INDUSTRY

7 TECHNOLOGY SNAPSHOT

8 MARKET SEGMENTATION

- 8.1 By Application

- 8.1.1 Disaster Recovery and Business Continuity

- 8.1.2 Shared Data and Resources

- 8.1.3 Data (Storage) Mobility

- 8.1.4 Other Applications

- 8.2 By End-user Industry

- 8.2.1 Communications Service Providers (CSPs)

- 8.2.2 Internet Content and Carrier- neutral Providers (ICPs/CNPs)

- 8.2.3 Government/Research and Education (Government/R&E)

- 8.2.4 Other End-user Verticals

- 8.3 By Geography

- 8.3.1 North America

- 8.3.2 Europe

- 8.3.3 Asia Pacific

- 8.3.4 Rest of the World

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Ciena Corp.

- 9.1.2 Cisco Systems Inc.

- 9.1.3 Juniper Networks Inc.

- 9.1.4 Fujitsu Ltd.

- 9.1.5 Microsemi Corp.

- 9.1.6 Pluribus Networks Inc.

- 9.1.7 Huawei Technologies Co. Ltd.

- 9.1.8 ADVA Optical Networking SE

- 9.1.9 Infinera Corp.

- 9.1.10 Nokia Oyj