|

市场调查报告书

商品编码

1630396

服务整合与管理:全球市场占有率分析、产业趋势与统计、成长预测(2025-2030)Global Service Integration and Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

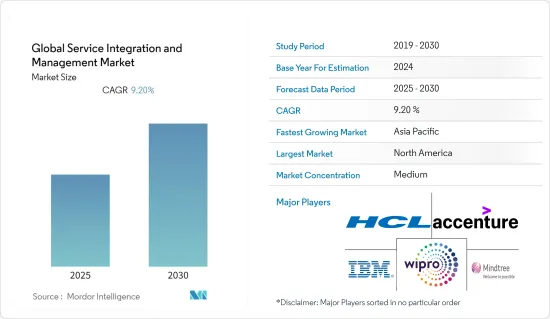

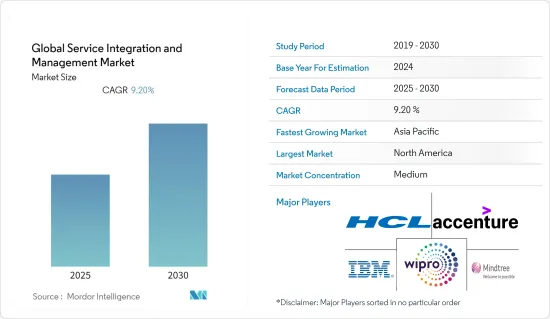

全球服务整合和管理市场在预测期内预计复合年增长率为 9.2%。

主要亮点

- 近年来,由于越来越多的供应商提供的混合技术和服务的兴起,企业 IT 环境变得更加复杂。公司面临的主要挑战是克服以统一方式有效协调和管理多个供应商的复杂性。

- IT 支出的增加和降低成本的需求是推动市场成长的主要因素。根据 Flexera 2021 年技术支出状况,全球近一半 (49%) 的企业预计在 2021 年增加 IT 支出。此外,降低成本是企业的首要任务,预计成本将从 2020 年的 9% 成长两倍至 2021 年的 27%。服务整合和管理有助于降低管理多个业务和服务的成本。

- 此外,中小企业的外包趋势也为SIAM市场创造了新的机会。根据提供客製自订网页开发和网页设计的 Tech Behemoths 对中小型 IT 公司进行的一项调查(2021 年 6 月),大约 38.5% 的受访者将计划外包,76% 的受访者指出了外包的好处成本效益和灵活性。此外,38.5%的受访者建议更高的利润率。 (n=来自 38 个国家的 324 家中小企业)。

- 然而,缺乏统一的 SLA 和监管协调预计将阻碍预测期内的市场成长。 2021 年 8 月,金融业监理局 (FINRA) 提醒企业委託第三方供应商的业务保持充分的监督。该机构也强调遵守网路安全规则 3110、规则 1220、规则 4370 和业务永续营运计画等法规。

- 由于已开发国家和新兴国家经济暂时放缓,许多公司减少了综合服务支出,因此 COVID-19 的传播对市场产生了负面影响。对于大型企业来说,由于云端基础设施支出的增加,市场预计将稳定成长。随着病毒影响的消退,由于管理服务和技术外包的成长,市场预计将扩大。

服务整合和管理市场趋势

云端技术显着成长

- 随着企业出于各种目的而采用云,资料的数量、种类和来源呈爆炸式增长,推动了对即时利用资料的应用程式的需求。此外,整合来自多个供应商的本地、私有云端和公共云端中的资料和服务的需求不断增加,正在推动整合平台即服务 (iPaaS) 市场的发展。

- 如今,随着市场上基于 SaaS 的供应商的激增,企业面临着为其公司选择合适平台的问题。随后,控制和管理驻留在组织防火墙内部边界之外的资料的需求导致越来越多地采用云端基础的服务整合解决方案。

- 如果您的公司混合使用本地和云端应用程序,则对这两种应用程式使用单独的整合工具会为IT基础设施增加不必要的复杂性和延迟。混合整合消除了在云端和私有云之间来回移动时重写整合的需要。

- 此外,资讯科技基础设施库是最广泛采用的用于实施和记录资讯技术服务管理 (ITSM) 的最佳实践指导框架,它管理着向客户提供的端到端 IT 服务的使用。由于其提供的广泛优势,将进一步扩大云端服务整合和管理市场。

- 此外,Epicor Software 的年度洞察报告发现,2021 年 94% 的美国中型企业采用了云,而 2020 年宣布云作为战略优先事项的比例为 25%。云端迁移的关键驱动因素包括加密、多重身份验证 (MFA)、透过 24 小时监控提高安全性 (34%) 和品管(32%)。此外,COVID-19 在加速日本的云端采用方面也发挥了重要作用,82% 的受访者表示,COVID-19 加速了他们的云端迁移计画。

北美预计将占据很大份额

- 北美地区预计在预测期内将显着增长,这主要是由于多个行业参与者的存在以及该地区各个组织对云端基础的服务的快速采用。预计还有多种因素将推动对 IPaaS 解决方案的需求,包括对高度整合服务不断增长的需求以及工作负载日益向云端环境的转移。

- 各种最终用户公司正在扩大在该地区的业务,从而产生了外包 IT 职能的需求。 2021年8月,亚马逊公司宣布计画在美国开设多家大型百货公司式零售店。开设大型门市的计画标誌着这家网路购物公司线下零售的另一个扩张。

- 由于旨在提高生产力、员工满意度和成本效益的 BYOD 政策的迅速采用,云端基础的ITSM 正在该地区不断发展。此类政策需要远端存取讯息,而云端基础的资讯技术服务管理解决方案可以促进这一点。

- 思科互联网业务解决方案小组进行的一项研究发现,透过实施全面的 BYOD 政策,美国公司每年可为每位员工节省 3,150 美元。此外,员工每年平均在设备上花费 965 美元,在资料计划上花费 734 美元。

- 该地区IT、通讯和BFSI行业的投资和发展的增加预计将为市场带来机会。此外,COVID-19 加速了客户对数位技术的需求,以确保全部区域公司业务营运的恢復,从而导致云端基础的产品取代了传统产品。

服务整合与管理行业概览

服务整合和管理市场适度分散,主要企业包括: IBM Corporation 和 SreviceNow Inc. 占据重要份额,为了维持市场并留住客户,这两家公司正在采用多种竞争策略,包括产品创新和合作伙伴关係。

- 2021 年 9 月 - HCL Technologies (HCL)推出了专门的 HCL 思科生态系统部门,以开发加速客户数位转型的解决方案。 HCL 的思科生态系统部门开发利用思科技术的专业知识、解决方案和业务成果模型。目标是支援复杂的转型倡议,例如软体定义的网路转型、网路即服务、数位化工作场所、多云现代化、超自动化、安全性、增强的应用程式体验、私人 5G 和电信现代化。

- 2021 年 7 月 - Zypro Technology Corporation (Xypro) 宣布扩大与 Hewlett Packard Enterprise (HPE) 的合作伙伴关係,透过 HPE NonStop 系统提供一整套产品。这将使 Zypro 能够将关键任务资料库管理、安全性和整合解决方案的可用性扩展到 HPE基本客群的新市场。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 服务管理复杂性

- 多供应商外包的需求增加

- 市场限制因素

- 缺乏统一的 SLA 和法规遵从性

第六章 市场细分

- 按成分

- 解决方案

- 商业解决方案

- 技术解决方案

- 按服务

- 解决方案

- 按组织规模

- 小型企业

- 大公司

- 按最终用户产业

- BFSI

- 资讯科技/通讯

- 卫生保健

- 零售

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争格局

- 公司简介

- HCL Technologies

- Hewlett Packard Enterprise(HPE)

- IBM Corporation

- Infosys Limited

- Mindtree Limited

- Capgemini SE

- AtoS SE

- Accenture PLC

- Fujitsu Limited

- Wipro Limited

第八章投资分析

第9章市场的未来

简介目录

Product Code: 70785

The Global Service Integration and Management Market is expected to register a CAGR of 9.2% during the forecast period.

Key Highlights

- Lately, the enterprise IT environment has become more complex with the rise of hybrid technologies and services provided by an ever-increasing number of suppliers. The major challenge for the enterprises is to get their multiple suppliers to work together effectively and overcome the complexities of governing them uniformly, thus, giving rise to the adoption of service integration and management (SIAM) services and solutions.

- The increase in the IT spending and the need for cost savings are major factors that are contributing to the growth of the market. According to Flexera 2021 State of Tech Spend, almost half (49%) of the companies globally expect to increase IT spending in 2021. In addition, cost-saving is a top initiative for the companies, which is expected to triple from 9% in 2020 to 27% in 2021. Service integration and management assist in reducing the costs of managing multiple operations and services.

- Moreover, the outsourcing trend amongst small to medium enterprises is also creating new opportunities for the SIAM market. According to a survey of small and medium IT companies by Tech Behemoths (June 2021), a custom web development and web design provider, about 38.5% of the respondents outsourced their projects, and 76% of the respondents pointed out that they have both cost efficiency and flexibility benefits. In addition, 38.5% of the respondents suggested higher profit margins. (n=324 SME from 38 countries).

- However, the lack of uniform SLAs and regulatory compliances is expected to hinder the growth of the market over the forecast period. In August 2021, Financial Industry Regulatory Authority (FINRA) cautioned firms to maintain a sufficient supervisory system for activities outsourced to third-party vendors. The organization also emphasized following rules such as Rule 3110, Rule 1220, Rule 4370 for cybersecurity, business continuity plans, and others.

- The spread of COVID-19 has negatively impacted the market as many organizations would be reducing the integration services spending due to temporary slowdown in developed as well as emerging countries. In the case of large organizations, the market is expected to grow at a steady pace due to increased spending on the cloud infrastructure. As the impact of the virus subsides, the market is anticipated to grow due to the growth of managed services and technology outsourcing.

Service Integration & Management Market Trends

Cloud Technology to witness significant growth

- The increased adoption of cloud by businesses for various purposes has led to an explosion in the volume, variety, and sources of data, surging demand for applications that leverage data in real-time and an increasing need to integrate data and services that live on-premises, in private clouds, and in multiple vendors' public clouds and thus has boosted the market for Integration Platform as a Service (iPaaS).

- With the recent increase of SaaS-based providers in the market, enterprises are facing issues in choosing the right platform for their organizations. Subsequently, data that exists outside the internal boundary of the organization's firewall needs to be controlled and managed, thus increasing the adoption of cloud-based service integration solutions.

- When the enterprises have a mix of on-premise and on-cloud applications, using separate integration tools for both of them creates an unwanted complexity in the IT infrastructure as well as introduces latency. Hybrid integration eliminates the task of rewriting integration while moving back and forth from cloud to private.

- Moreover, the increased emphasis on the use of Information Technology Infrastructure Library (ITIL 4), the most widely adopted best-practices guidance framework for implementing and documenting Information Technology Service Management (ITSM) which is responsible for managing end-to-end delivery of IT services to customers will further proliferate the market for cloud service integration and management due to the wide range of benefits provided.

- Additionally, according to Epicor Software's annual insights report, 94% of mid-sized essential businesses in the United States are adopting cloud in 2021, up from 25%, which declared cloud a strategic priority in 2020. Some of the major drivers for cloud migration included improved security (34%) via encryption, multifactor authentication (MFA) and 24-hour monitoring, and quality control (32%). In addition, COVID-19 has also played a major role in pushing cloud adoption in the country, with 82% of the respondents suggesting that they accelerated their cloud migration plans because of COVID-19.

North America is Expected to Hold Major Share

- The North American region is expected to significant growth during the forecast period, primarily owing to the presence of multiple industry players, coupled with the rapid adoption of cloud-based services among various organizations in the region. Various factors, such as the increased need for advanced integration services and the increased shift of the workloads to the cloud environment, are also expected to drive the demand for IPaaS solutions.

- Various end-user companies are expanding their presence in the region, which creates a need for outsourcing IT functions. In August 2021, Amazon Inc. announced plans to open several large retail locations in the United States which would operate akin to the departmental stores. The plan to launch large stores marks a new expansion for the online shopping company in offline retail.

- The region is witnessing the growth of cloud-based ITSM, owing to the rapid adoption of BYOD policies for improved productivity, employee satisfaction, and cost-effectiveness. These policies require remote accessibility of information, which is facilitated by cloud-based Information Technology Service Management solutions.

- According to a study conducted by Cisco's Internet Business Solutions Group, the companies in the United States can save as much as USD 3,150 per employee every year if they implement a comprehensive BYOD policy. Moreover, employees are spending an average of USD 965 on their devices as well as USD 734 each year on data plans.

- The growing investments and developments in the IT and telecommunication and BFSI industry in the region are expected to create opportunities for the market. Furthermore, Covid-19 has accelerated customer demand for digital technologies to ensure resilient enterprise business operations across the region, resulting in cloud-based offerings replacing traditional products.

Service Integration & Management Industry Overview

The Service Integration and Management Market is moderately fragmented, with some major players such as IBM Corporation and SreviceNow Inc. occupying a significant share. To sustain the market and retain their clients, the companies are employing several competitive strategies, including product innovations and partnerships.

- September 2021 - HCL Technologies (HCL) has initiated a dedicated HCL Cisco Ecosystem Unit to develop solutions to help clients accelerate their digital transformations. HCL's Cisco Ecosystem Unit would develop expertise, solutions, and business outcome models using Cisco technology. Its goal is to make complicated transformation initiatives such as software-defined network transformation, network-as-a-service, digital workplace, multi-cloud modernization, hyper-automation, security, enhanced application experience, private 5G, and telco modernization a success.

- July 2021 - XYPRO Technology Corporation (XYPRO), announced the expansion of its partnership with Hewlett Packard Enterprise (HPE) to deliver its entire suite through HPE NonStop systems. The expansion would support XYPRO to extend the availability of mission critical database management, security and integration solutions into new markets within HPE's customer base.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Assessment of impact of COVID-19 on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Complexities of Service Management

- 5.1.2 Increasing Demand for Multi-Vendor Outsourcing

- 5.2 Market Restraints

- 5.2.1 Lack of Uniform SLAs and Regulatory Compliances

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solutions

- 6.1.1.1 Business Solutions

- 6.1.1.2 Technology Solutions

- 6.1.2 Services

- 6.1.1 Solutions

- 6.2 By Organization Size

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By End user Industry

- 6.3.1 BFSI

- 6.3.2 IT and Telecom

- 6.3.3 Healthcare

- 6.3.4 Retail

- 6.3.5 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 HCL Technologies

- 7.1.2 Hewlett Packard Enterprise (HPE)

- 7.1.3 IBM Corporation

- 7.1.4 Infosys Limited

- 7.1.5 Mindtree Limited

- 7.1.6 Capgemini SE

- 7.1.7 AtoS SE

- 7.1.8 Accenture PLC

- 7.1.9 Fujitsu Limited

- 7.1.10 Wipro Limited

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219