|

市场调查报告书

商品编码

1630427

欧洲膳食补充剂包装:市场占有率分析、产业趋势、成长预测(2025-2030)Europe Dietary Supplement Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

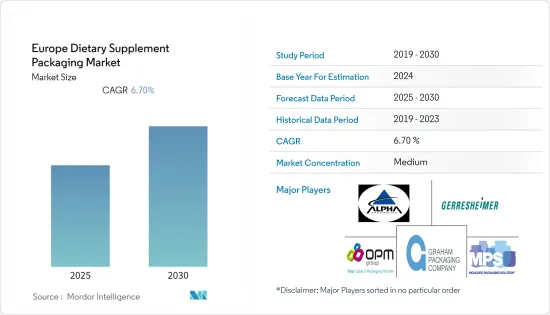

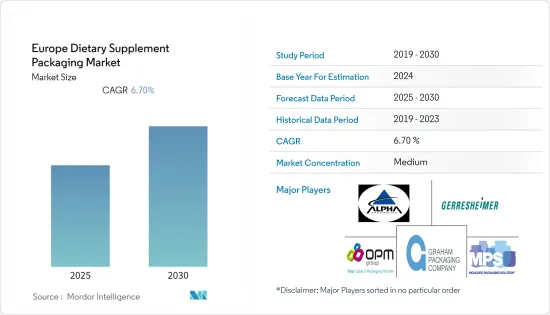

欧洲膳食补充剂包装市场预计在预测期内复合年增长率为 6.7%。

主要亮点

- 消费者生活方式的变化、对旅行友善包装的偏好以及削减成本的措施是推动包装产业采用轻量包装和需求成长的主要因素。

- 糖尿病、心血管疾病和其他慢性疾病的高盛行率正在促使人们采取更健康的生活方式,包括营养丰富的食物、使用营养补充品并增强免疫力。 COVID-19 导致这种营养补充剂包装的需求激增。与之前相比,销售额呈指数级增长,这是一个主要的市场驱动因素。

- 此外,销售膳食补充剂的公司越来越多地采用新的包装技术来建立品牌形象,并增加创新包装解决方案的支出,以占领更大的市场占有率。例如,2022 年 2 月,Britvic 与 Xampla 合作。开发豌豆蛋白包装的 Zampra 公司进行了一项创新,旨在使用微胶囊来保护透明塑胶瓶中强化饮料中的维生素。

- 然而,其主要缺点是活性成分的保质期短和製造成本高,预计将抑制胶囊製剂领域的成长。

- 最近爆发的新冠肺炎 (COVID-19) 疫情导致世界各地许多工厂的生产量减少,并扰乱了包装行业的供应链。此外,由于对医疗保健产品的需求增加,包装市场预计将扩大。

欧洲膳食补充剂包装市场的趋势

玻璃包装推动市场成长

- GDP 成长、高可支配收入、交通便利、生活水准不断提高、多样性以及市场上的国内外参与者等因素正在推动该地区的玻璃包装发展。

- 塑胶包装的妖魔化和对永续性的日益增长的需求,以及回收基础设施的改善,正在为整个全部区域的玻璃瓶带来新的推动力。此外,玻璃製造商在德国的再利用和回收系统中发挥了重要作用。例如,Gerresheimer 已开始在其位于德国的 Tetau 工厂生产玻璃,其中回收玻璃的比例增加。与格雷斯海默一样,许多大公司每天都在推动循环型社会和资源节约。

- 根据德国玻璃工业联邦协会统计,德国10大玻璃製造商的收入约占玻璃产业总收益的20%。目前,很少有主要的国际玻璃製造商占据市场主导地位,并且只对生产一种特定类型的瓶子感兴趣。该地区客製化产品的趋势也在不断增长,对客製化玻璃瓶的需求不断增加。

- 此外,欧洲国家维生素补充剂进口的增加预计也将推动成长。例如,根据联合国商品贸易统计资料库(UN Comtrade)的数据,2021年德国、荷兰、比利时、法国和西班牙等欧洲国家占据了大部分份额。

义大利市场占有率最高

- 义大利包装产业受到市场流行的各种趋势的推动。生活水准的提高正在推动各种产品的消费,导致对营养补充剂的需求相应增长。营养保健品受益于日益增长的健康文化,并推动成长,因为它们注重预防而不是长期健康的治疗。

- 此外,义大利国家健康食品製造商协会(Feder Salus)的报告显示,65%的义大利成年人每年消耗2.5种营养补充剂,从能量和心血管补充剂到骨骼和骨骼补充剂种类繁多。

- 包装工艺的不断创新以及对易于回收材料的关注正在推动整个全部区域的成长。在义大利,消费者越来越希望在整个包装行业中回收大部分废弃物,从而帮助该行业进一步发展整个包装行业。据欧洲玻璃包装联合会称,义大利78%的玻璃瓶和瓶子被收集并回收成食品级材料,进一步推动了市场成长。

- 此外,根据新线市场研究,增加饮食中营养成分并降低健康问题风险的物质的使用增加,预计这将促进生长。这些补充剂用于心理健康、助眠、肠道健康产品和女性健康。

欧洲膳食补充剂包装产业概况

欧洲膳食补充剂包装市场适度分散。参与者正在全部区域投资研发活动以及策略联盟、併购,以扩大其在全球的影响力。

- 2022 年 8 月 - Amcor 宣布收购位于捷克共和国的世界级软包装工厂。该工厂的战略定位增强了 Amcor 满足欧洲软包装网路强劲需求和客户成长的能力。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 糖尿病、心血管疾病等慢性病盛行率高

- 更多采用轻量化包装方法

- 市场限制因素

- 活性成分的保质期缩短并增加製造成本

- 产业供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按材质

- 塑胶

- 聚丙烯(PP)

- 聚对苯二甲酸乙二酯 (PET)

- 聚乙烯(PE)

- 其他材料

- 玻璃

- 金属

- 纸板

- 塑胶

- 依产品类型

- 塑胶瓶

- 玻璃瓶

- 小袋

- 泡壳

- 纸盒

- 其他产品类型

- 按剂型分

- 锭剂

- 胶囊

- 粉末

- 液体

- 其他的

- 按国家/地区

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 其他的

第六章 竞争状况

- 公司简介

- Alpha Packaging

- Gerresheimer AG

- Law Print & Packaging Management Ltd.

- Moulded Packaging Solutions Limited

- OPM(labels and packaging)Group Ltd

- Novio Packaging BV

- Graham Packaging Company

第七章 投资分析

第八章 市场机会及未来趋势

简介目录

Product Code: 71384

The Europe Dietary Supplement Packaging Market is expected to register a CAGR of 6.7% during the forecast period.

Key Highlights

- The main drivers of the packaging industry's adoption of lightweight packaging and the growth of demand are the changing consumer lifestyle, preference for travel-friendly packaging, and cost-saving measures.

- People are being urged to adopt a healthier lifestyle, including nutrient-rich foods, use nutritional supplements, and boost their immunity due to the high prevalence of diseases like diabetes, cardiovascular disease, and other chronic diseases. COVID-19 has caused a sudden increase in this dietary supplement packaging demand. Compared to previous years, the sales reached exponentially high levels, which was a major market driver.

- Also, to establish their brand identity and increase spending on innovative packaging solutions for a significant market share, companies that sell dietary supplements are increasingly adopting newer packaging technologies. For instance, in February 2022, Britvic collaborated with Xampla. The company that developed pea protein packaging, on an innovation aimed at using microscopic capsules to protect vitamins in fortified drinks in clear plastic bottles.

- However, the major drawbacks are the lower shelf life of active ingredients and the higher manufacturing cost is projected to restrain the growth of the capsule formulation segment.

- The recent COVID-19 outbreak has resulted in decreased manufacturing at many sites worldwide and disruptions to the supply chain for the packaging industry. In addition, the packaging market can anticipate expansion due to the rising demand for medical and healthcare supplies.

Europe Dietary Supplement Packaging Market Trends

Glass Material to Drive the Market Growth

- Factors such as GDP growth, high disposable income, ease of availability, improvement in living standards, wide variety, and domestic and international players in the market are fueling the glass packaging in the region.

- The demonization of plastic packaging and the increasing push for sustainability, along with the long-established infrastructure for recycling, have created a renewed push for glass bottles across the region. Moreover, glass manufacturers have been key players in the reuse and recycling system of Germany. Gerresheimer, for instance, began producing glass with a higher proportion of recycled glass at the Tettau site in Germany. Many leading players, like Gerresheimer, are driving circularity and resource savings every day.

- According to The Federal Association of the German Glass Industry, ten big glass producers in Germany generate around 20% of the total glass industry revenue. Few big international glassmakers are presently dominating the market and are more interested in producing only one specific type of bottle. Also, the trend of customization is growing in the region, with demand for bespoke glass bottles increasing.

- Additionally, the increasing import of Vitamin supplements by the countries in the Europe region is anticipated to promote growth. For instance, according to UN Comtrade, the European countries, such as Germany, Netherlands, Belgium, France, and Spain, combined held a majority share in 2021.

Italy to Hold Highest Market Share

- The Packaging industry in Italy is driven by various trends prevailing in the market. There is an increase in the living standard and personal disposable income, fueling consumption across a broad range of products and subsequent growth in demand for dietary supplements. Dietary supplements benefit from the growing health culture and focus on prevention, rather than cure, for long-term health, hence driving growth.

- Additionally, a report from Feder Salus, the Italian National Association of Health Products Manufacturers, reveals that 65% of Italian adults consume 2.5 kinds of dietary supplements every year, ranging from energy and cardiovascular supplements to bone and many others, which is fuelling the growth of the market.

- Increasing innovation in the packaging process and focus on easily recyclable materials across the region have propelled growth. The consumer's growing desire to recycle most of the waste materials across the packaging industry in Italy is thereby helping the industries in further development across the packaging sector. According to the European Glass Container Federation, 78% of the glass bottles and jars are collected and recycled into Italy's food-grade material, further increasing the market's growth.

- Moreover, according to New Line Ricerche di mercato, increasing the use of substances that add nutrients to the diet or lower the risk of health problems is anticipated to propel growth. These supplements are used for mental well-being, sleep aid, bowel wellness products, and women's wellness.

Europe Dietary Supplement Packaging Industry Overview

The European dietary supplement packaging market is moderately fragmented. Players invest in R&D activities across the region, along with strategic collaborations, mergers, and acquisitions to expand their presence on the global level. Some of the developments in the market are :

- August 2022- Amcor announced that it had acquired a world-class flexible packaging plant in the Czech Republic. The site's strategic location will enhance Amcor's ability to satisfy strong demand and customer growth across its flexible packaging network in Europe.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Prevalence of Diseases like Diabetes, Cardiovascular disease, and other Chronic diseases

- 4.2.2 Increasing Adoption of Lightweight Packaging Methods

- 4.3 Market Restraints

- 4.3.1 Lower Shelf Life of Active Ingredients and the Higher Manufacturing Cost

- 4.4 Industry Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.1.1 Polypropylene (PP)

- 5.1.1.2 Polyethylene Terephthalate (PET)

- 5.1.1.3 Polyethylene (PE)

- 5.1.1.4 Other Types of Materials

- 5.1.2 Glass

- 5.1.3 Metal

- 5.1.4 Paper & Paperboard

- 5.1.1 Plastic

- 5.2 By Product Type

- 5.2.1 Plastic Bottles

- 5.2.2 Glass Bottles

- 5.2.3 Pouches

- 5.2.4 Blisters

- 5.2.5 Paperboard Boxes

- 5.2.6 Other Product Types

- 5.3 By Formulation

- 5.3.1 Tablets

- 5.3.2 Capsules

- 5.3.3 Powder

- 5.3.4 Liquids

- 5.3.5 Others

- 5.4 By Country

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Alpha Packaging

- 6.1.2 Gerresheimer AG

- 6.1.3 Law Print & Packaging Management Ltd.

- 6.1.4 Moulded Packaging Solutions Limited

- 6.1.5 OPM (labels and packaging) Group Ltd

- 6.1.6 Novio Packaging B.V.

- 6.1.7 Graham Packaging Company

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219