|

市场调查报告书

商品编码

1630439

欧洲航空燃油:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Europe Aviation Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

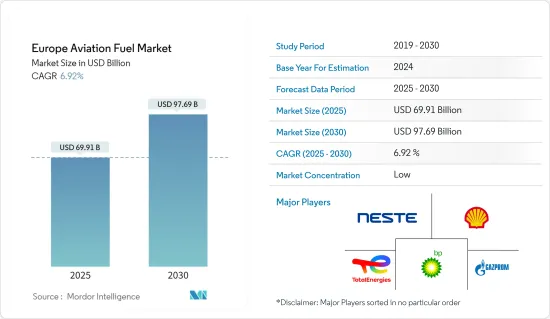

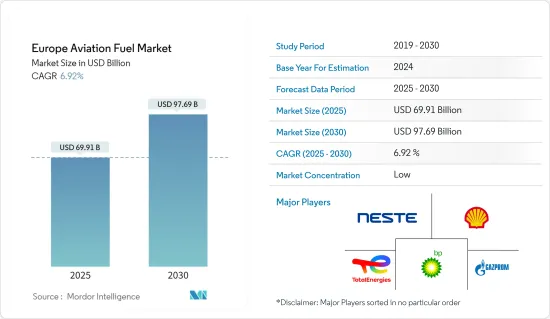

预计2025年欧洲航空燃油市场规模为699.1亿美元,预计2030年将达976.9亿美元,预测期内(2025-2030年)复合年增长率为6.92%。

主要亮点

- 从中期来看,有几个因素正在推动欧洲的喷射机燃料需求。这包括由于最近机票价格的降低和航线的扩展而导致航空乘客的增加。

- 然而,电动和混合动力飞机的不断引入给该市场的成长带来了挑战。

- 儘管面临这些挑战,欧盟委员会仍在推动扩大永续航空燃料(SAF)的授权,以减少温室气体排放。这些努力可以在航空燃油市场创造重大商机。

- 欧洲拥有最大的航空燃油市场规模,以英国为首。鑑于其目前的主导,英国未来可能会保持其主导地位。

欧洲航空燃油市场趋势

私部门主导市场

- 民用航空包括定期和不定期飞机的运营,并包括乘客或货物的商业航空运输。私营部门是航空燃油的最大消费者之一,占航空公司总营运支出的四分之一。

- 2023年,民航将主宰天空,占航班总量的91.9%,反映其在欧洲航空旅行中的重要角色。通用航空占6.5%,服务利基市场和个人出行需求。国防航空仍然发挥着虽小但重要的作用,占航班总数的1.6%。

- 在航空旅行的復苏和对永续航空解决方案的关注的推动下,欧洲民航燃油市场正在强劲增长。西班牙、英国和法国等欧洲主要国家正在经历旅游业的繁荣,商业部门从旅客数量的增加中获利。

- 自从新冠肺炎 (COVID-19) 疫情以来,全球旅行和旅游业出现反弹,机票价格实惠且经济状况改善,导致航空需求激增。航空需求的增加反过来又增加了民航部门的燃料消耗。

- 欧盟统计局资料显示,2024年第一季欧盟航空公司载客量为1.98亿人次,较2023年第一季成长11.5%。 2024 年 2 月的情况尤其引人注目,旅客人数自疫情大流行以来首次超过 2019 年 2 月的数字,增长了 1.0%。 2024年第一季,欧盟以外的国际运输占欧盟境内所有旅客的50.1%。鑑于全国旅游业的蓬勃发展,预计该地区的航空燃油需求在未来几年将大幅成长。

- 此外,欧洲旅游业的成长,尤其是义大利和西班牙等热点地区的旅游业的成长,显示燃料需求的持续成长轨迹。随着航空业的復苏和新航线的出现,这种成长预计将加速。

- 2024 年 9 月,达美航空宣布新增 7 条欧洲航线,并于 2025 年夏季扩大跨大西洋航班时刻表。此次扩建包括从波士顿飞往巴塞隆纳、底特律飞往都柏林和亚特兰大飞往布鲁塞尔的航线,以及四条飞往义大利的新航班。随着旅游和航空网路的扩大,对航空燃油的需求预计也会增加。

- 因此,鑑于以上几点,私营部门可望主导市场。

英国主导市场

- 英国的航空业是经济的重要组成部分,也是欧洲最大的航空业之一。对机场基础设施的大量投资和强大的旅游业支撑着英国航空市场,并为其强劲的业绩做出了贡献。

- 2023年,英国平均每天航班数量最高,达5,290架次,比2022年增加13%。西班牙的航班数量位居第二,每天有 4,616 架次航班,成长 9%,其次是德国,每天有 4,532 架次航班,成长 7%。因此,英国对航空燃油的需求量很大,正在推动欧洲航空燃油市场的成长。

- 预计该国的航空燃油市场在预测期内将大幅成长,这主要是由于游客人数增加、全球地缘政治局势、国内航空交通以及政府措施。

- 例如,英国政府于 2024 年 4 月宣布,到 2030 年,所有喷射机燃料的 10% 必须来自永续来源。此举旨在减少温室气体排放并促进永续航空燃料 (SAF) 产业的发展,预计将带来超过 18 亿英镑的经济影响并创造超过 10,000 个就业机会。

- 此外,英国政府也透过先进燃料基金拨款1.35亿英镑,支持全国13个突破性的SAF计划。该资金旨在加速永续航空燃料的开发和生产。

- 因此,由于上述因素,预计英国在预测期内将主导航空燃油领域的市场。

欧洲航空燃油产业概况

欧洲航空燃油市场已减半。主要企业(排名不分先后)包括 PJSC Gazprom、BP PLC、Shell PLC、TotalEnergies SE 和 Neste Oyj。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2029年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 航空客运量增加

- 永续航空燃料 (SAF) 任务

- 抑制因素

- 燃料成本上升

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 投资分析

第五章市场区隔

- 燃料类型

- 空气涡轮燃料 (ATF)

- 航空生质燃料

- 阿布加斯

- 目的

- 商业的

- 防御

- 通用航空

- 地区

- 英国

- 德国

- 义大利

- 法国

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 欧洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Repsol SA

- BP PLC

- Royal Dutch Shell PLC

- Total SA

- Exxon Mobil Corporation

- Gazprom Neft PJSC

- Neste Oyj

- 其他主要国家名单

- 市场排名分析

第七章 市场机会及未来趋势

- 旨在扩大永续航空燃料(SAF)的使用,以减少温室气体排放

简介目录

Product Code: 71499

The Europe Aviation Fuel Market size is estimated at USD 69.91 billion in 2025, and is expected to reach USD 97.69 billion by 2030, at a CAGR of 6.92% during the forecast period (2025-2030).

Key Highlights

- In the medium term, several factors are driving the demand for jet fuel in Europe. These include a rise in air passengers due to recent reductions in airfare and the expansion of flight routes.

- However, the growing adoption of electric and hybrid aircraft poses a challenge to this market growth.

- Despite these challenges, the European Commission is pushing for increased mandates on sustainable aviation fuel (SAF) to curb greenhouse gas emissions. Such initiatives are poised to unlock substantial opportunities in the aviation fuel market.

- Europe boasts the largest market size for aviation fuel, with the United Kingdom at the forefront. Given its current leadership, the UK is set to maintain its dominance in the coming years.

Europe Aviation Fuel Market Trends

Commercial Sector to Dominate the Market

- Commercial aviation includes operating scheduled and non-scheduled aircraft, which involves commercial air transportation of passengers or cargo. The commercial segment is one of the largest consumers of aviation fuel, accounting for a quarter of an airline operator's total operating expenditure.

- In 2023, commercial aviation dominated the skies, accounting for 91.9 percent of total flights, reflecting its critical role in European air travel. General aviation contributed 6.5 percent, serving niche markets and private travel needs. While minor, defense aviation still played a vital role, with 1.6 percent of total flights.

- The European commercial aviation fuel market is witnessing robust growth, fueled by a resurgence in air travel and a strong emphasis on sustainable aviation solutions. Major European countries, including Spain, the United Kingdom, and France, are witnessing a tourism boom, leading the commercial sector to capitalize on rising passenger numbers.

- Post-COVID-19, global travel and tourism have rebounded, driven by affordable airfares and improved economic conditions, leading to a surge in air travel demand. This uptick in flight demand has, in turn, increased fuel consumption in the commercial aviation sector.

- Eurostat Data highlights that in Q1 2024, EU air carriers transported 198 million passengers, an 11.5% increase from Q1 2023. February 2024 was particularly notable, with passenger numbers exceeding February 2019 figures for the first time since the pandemic, marking a 1.0% uptick. In Q1 2024, international extra-EU transport made up 50.1% of all passengers within the EU. Given the nationwide tourism surge, the region's aviation fuel demand is poised for significant growth in the coming years.

- Moreover, Europe's tourism upswing, especially in hotspots like Italy and Spain, signals a sustained growth trajectory for fuel demand. As the aviation sector rebounds and new flight routes emerge, this growth is set to accelerate.

- In September 2024, Delta Air Lines announced the addition of seven new European routes, expanding its transatlantic schedule for summer 2025. This expansion includes four new services to Italy, alongside routes from Boston to Barcelona, Detroit to Dublin, and Atlanta to Brussels. With such an expansion in tourism and aviation networks, the demand for aviation fuels is anticipated to rise.

- Therefore, based on the above mentioned points, the commercial sector is expected to dominate the market.

The United Kingdom to Dominate the Market

- The United Kingdom's aviation sector is a cornerstone of its economy, ranking among the largest in Europe. Substantial investments in airport infrastructure and a strong tourism industry support the aviation market in the United Kingdom, contributing to its robust performance.

- In 2023, the United Kingdom had the highest average number of daily flights, at 5290, a 13 percent increase from 2022. Spain was the second busiest, with 4616 flights per day, up 9 percent, followed by Germany, with 4532 flights per day, up 7 percent. Due to this, the demand for aviation fuel in the UK is substantial, driving growth in the European aviation fuel market.

- The country's aviation fuel market is expected to grow significantly during the forecast period, mainly driven by increasing tourism, global geopolitical conditions, domestic air traffic, and mainly by government policies.

- For instance, in April 2024, the United Kingdom government announced that by 2030, 10 percent of all jet fuel must come from sustainable sources. This move aims to cut greenhouse gas emissions and boost the sustainable aviation fuel (SAF) industry, potentially adding over 1.8 billion British Pounds to the economy and creating more than 10,000 jobs.

- Furthermore, the United Kingdom government allocated 135 million British Pounds through the Advanced Fuels Fund to support 13 groundbreaking SAF projects nationwide. This funding aims to accelerate the development and production of sustainable aviation fuels.

- Therefore, due to the factors above, the United Kingdom is expected to dominate the market in the aviation fuel sector during the forecast period.

Europe Aviation Fuel Industry Overview

The Europe aviation fuel market is semi-fragmented. Some of the major companies (in no particular order)include PJSC Gazprom, BP PLC, Shell PLC, TotalEnergies SE, Neste Oyj, and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rising Air Passenger Traffic

- 4.5.1.2 Sustainable Aviation Fuel (SAF) Mandates

- 4.5.2 Restraints

- 4.5.2.1 High Volatile Fuel Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 Air Turbine Fuel (ATF)

- 5.1.2 Aviation Biofuel

- 5.1.3 Avgas

- 5.2 Application

- 5.2.1 Commercial

- 5.2.2 Defense

- 5.2.3 General Aviation

- 5.3 Geography

- 5.3.1 United Kingdom

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 France

- 5.3.5 Spain

- 5.3.6 Nordic

- 5.3.7 Turkey

- 5.3.8 Russia

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Repsol SA

- 6.3.2 BP PLC

- 6.3.3 Royal Dutch Shell PLC

- 6.3.4 Total SA

- 6.3.5 Exxon Mobil Corporation

- 6.3.6 Gazprom Neft PJSC

- 6.3.7 Neste Oyj

- 6.4 List of Other Prominent Countries

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Aim to increase sustainable aviation fuel (SAF) use to reduce greenhouse gas emissions

02-2729-4219

+886-2-2729-4219