|

市场调查报告书

商品编码

1630440

中东和非洲航空燃油:市场占有率分析、产业趋势、统计、成长趋势预测(2025-2030)Middle-East and Africa Aviation Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

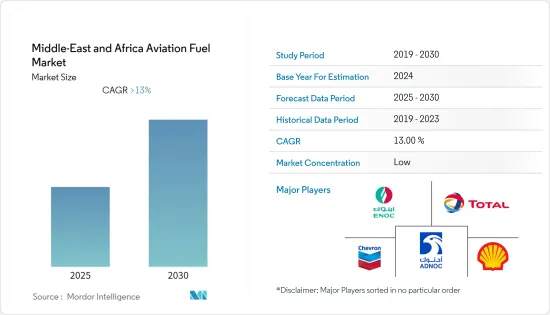

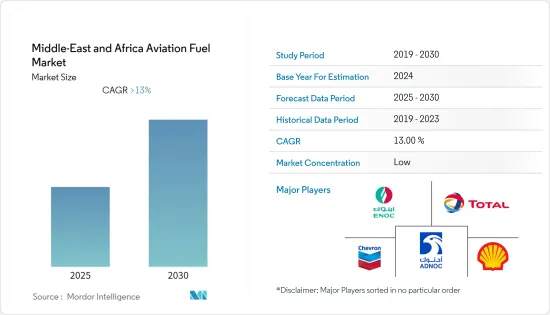

预计中东和非洲航空燃油市场在预测期内的复合年增长率将超过13%。

市场受到 COVID-19 爆发的负面影响,导致地区关闭和航班限制。目前,市场已达到疫情前水准。

主要亮点

- 由于近期机票价格低廉、经济状况改善以及可支配收入增加,航空乘客数量增加是市场的主要驱动力。该地区各国正在进行和即将进行的战斗机交易预计也将进一步增加航空燃料需求。

- 然而,航空燃油成本高且波动预计将抑制市场。

- 未来 20 年,中东国家将需要 2,600 多架新飞机,以满足该地区不断增长的航空旅客数量。随着这种扩张,预计参与企业将面临商机。

- 阿拉伯联合大公国是中东和非洲最大的市场,也是该地区的市场领导者,并且很可能会继续保持这一地位。

中东和非洲航空燃油市场趋势

私部门主导市场

- 民用航空包括定期和不定期飞机的运营,并包括乘客或货物的商业航空运输。私营部门是航空燃油的最大消费者之一,占航空公司总营运支出的四分之一。

- 俄罗斯和乌克兰之间的衝突进一步加剧了高油价问题,由于欧佩克+国家减产,油价一直高于应有水准。原油价格上涨对作为国内主要用户的民航部门的航空燃油需求产生了负面影响。

- 2021年,沙乌地阿拉伯签署了价值30亿美元的融资协议,为订单飞机提供部分融资。该航空公司在声明中表示,这笔金额将满足该航空公司直到 2024 年中期的飞机融资需求,并将有助于为购买先前订购的 73 架飞机提供资金。该航空公司已订购空中巴士 A320neo、A321neo、A321XLR 和波音 787-10。

- 2022年,沙乌地阿拉伯机场接待了870万名旅客。沙乌地阿拉伯政府的目标是到 2030 年年旅客吞吐量达到 3.3 亿人次、国际目的地达到 250 个、游客数量达到 1 亿人次。

- 2022 年 1 月,卡达订购了 34 架通用电气公司的巨型双引擎 777X 飞机,并可选择另外订购 16 架。我们还订购了两架波音目前的 777 货机。波音预计 777X 客机将于 2023 年下半年投入使用,比原计划晚了大约三年。

- 2021年,南非的航空运输量为非洲最高,旅客总数约2,100万人次。

- 由于上述因素,私营部门预计将在预测期内主导市场。

阿联酋主导市场

- 阿联酋国家航空公司飞往全球 108 个国家的 224 个目的地,截至 2021 年 10 月,阿联酋航空部门的投资达到 2,700 亿美元。

- 阿联酋航空运输量大,原油产量大,精製能力高,国内航空燃油供应量大,阿联酋航空和阿提哈德两大航空公司是世界领先国家之一。

- 2022年1月至3月阿布达比机场的旅客人数为2,563,297人次,较2021年同期成长218%。该机场本季共有航班 22,689 架次,较 2021 年成长 38%。

- 此外,杜拜阿勒马克图姆国际机场完工后预计将成为全球最大的机场,年旅客吞吐量为1.6亿人次,航空货运量为1,200万吨。

- 酋长国机场的航班总数为 883,000 架次,以货运量计算,杜拜机场成为全球第六大机场,运输货物 6,865 万公斤(杜拜机场概况介绍)。阿拉伯联合大公国持有191 架波音飞机(世界上最大的飞机持有)和 119 架空中巴士 380 飞机。这四家国家航空公司持有约 498 架飞机。

- 由于上述因素,预计阿拉伯联合大公国将在预测期内主导市场。

中东和非洲航空燃油产业概况

中东和非洲航空燃油市场适度整合。主要企业(排名不分先后)包括阿联酋国家石油公司、雪佛龙公司、壳牌公司、TotalEnergies SE 和阿布达比国家石油公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 燃料类型

- 空气涡轮燃料 (ATF)

- 航空生质燃料

- 阿布加斯

- 目的

- 商业的

- 防御

- 通用航空

- 地区

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 卡达

- 埃及

- 南非

- 其他中东/非洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Emirates National Oil Company

- Repsol SA

- BP PLC

- Shell PLC

- TotalENergies SE

- Chevron Corporation

- Exxon Mobil Corporation

- Abu Dhabi National Oil Company

第七章 市场机会及未来趋势

The Middle-East and Africa Aviation Fuel Market is expected to register a CAGR of greater than 13% during the forecast period.

The market was negatively impacted by the outbreak of COVID-19 due to regional lockdowns and flight restrictions. Currently, the market has reached pre-pandemic levels.

Key Highlights

- The increasing number of air passengers, on account of the cheaper airfare in recent times, stronger economic conditions, and increasing disposable income, are among the major driving factors for the market. Ongoing and upcoming fighter jet deals in different countries in the region are also expected to increase aviation fuel demand further.

- However, the high and volatile cost of aviation fuel is expected to restrain the market.

- Countries in the Middle-Eastern region need over 2,600 new aircraft in the next 20 years to cater to the increasing number of air travelers in the region. With this large-scale, opportunities are expected for the aviation fuel market players.

- With the largest market size in the Middle East and Africa, the United Arab Emirates is leading the market in the region and is likely to continue its dominance.

MEA Aviation Fuel Market Trends

Commercial Sector to Dominate the Market

- Commercial aviation includes operating scheduled and non-scheduled aircraft, which involves commercial air transportation of passengers or cargo. The commercial segment is one of the largest consumers of aviation fuel, and it accounts for a quarter of the total operating expenditure for an airline operator.

- The Russia-Ukraine conflict has further aggravated the issue of high prices of oil, which had been maintained above their original prices due to supply cuts by OPEC+ nations. An increase in the prices of crude oil will adversely impact the requirement for aviation fuel in the commercial aviation sector, which is the major user of the commodity in the country.

- In 2021, Saudi Arabia signed a financing agreement worth USD 3 billion to partially finance requirements for aircraft it has ordered. The amount covers the airline's aircraft financing requirements until mid-2024, helping finance the purchases of 73 aircraft previously ordered, it said in a statement. The airline has ordered Airbus A320neo, A321neo, A321XLR, and Boeing 787-10 jets.

- The number of passengers that passed through Saudi Arabia's airports in 2022 was 8.7 million. Saudi government aims to reach 330 million passengers, 250 international destinations, and 100 million tourists annually by 2030.

- In January 2022, Qatar signed an order for 34 of the 777X, a giant, twin-engine plane powered by General Electric, as well as options for 16 more of the jets. The airline also ordered two of Boeing's current 777 freighter models. Boeing expects the passenger 777X to enter into service in late 2023, about three years behind schedule.

- In 2021, South Africa witnessed the highest air traffic in Africa, with the total air passenger traveled being approximately 21 million.

- Due to the aforementioned factors, the commercial sector is expected to dominate the market during the forecast period.

The United Arab Emirates to Dominate the Market

- The UAE's national carriers fly to 108 countries and 224 cities around the world, and the value of the UAE's investments in the aviation sector amounted to USD 270 billion as of October 2021 (ICAO).

- The United Arab Emirates is one of the major countries in the aviation fuel sector in the Middle East due to significant air traffic, large production of crude oil, significant refining capacity, availability of large domestic aviation fuel supply, and its two major airlines, the Emirates and Etihad.

- Abu Dhabi airports served 2,563,297 passengers during the first three months of 2022, an increase of 218% from the same period in 2021. The airports logged 22,689 flights in the quarter, an increase of 38% from 2021.

- Moreover, once the Al Maktoum International Airport in Dubai is completed, it is expected to emerge as the largest airport in the world, with a capacity of up to 160 million passengers and 12 million metric tons of air freight volume annually.

- A total of 883,000 flights were handled by Emirati airports, with Dubai Airport ranking sixth globally in terms of shipment, transporting 68.65 million kg of goods (Dubai Airport Factsheet). The United Arab Emirates has one of the largest fleets of Boeing aircraft in the world, with 191 aircraft, and it also has 119 Airbus 380 aircraft. Its four national carriers have approximately 498 aircraft.

- Due to the aforementioned factors, the United Arab Emirates is expected to dominate the market during the forecast period.

MEA Aviation Fuel Industry Overview

The Middle East and African aviation fuel market are moderately consolidated. Some of the major companies (in no particular order) include Emirates National Oil Company, Chevron Corporation, Shell PLC, TotalEnergies SE, Abu Dhabi National Oil Company, and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 Air Turbine Fuel (ATF)

- 5.1.2 Aviation Biofuel

- 5.1.3 AVGAS

- 5.2 Application

- 5.2.1 Commercial

- 5.2.2 Defense

- 5.2.3 General Aviation

- 5.3 Geography

- 5.3.1 United Arab Emirates

- 5.3.2 Saudi Arabia

- 5.3.3 Qatar

- 5.3.4 Egypt

- 5.3.5 South Africa

- 5.3.6 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Emirates National Oil Company

- 6.3.2 Repsol SA

- 6.3.3 BP PLC

- 6.3.4 Shell PLC

- 6.3.5 TotalENergies SE

- 6.3.6 Chevron Corporation

- 6.3.7 Exxon Mobil Corporation

- 6.3.8 Abu Dhabi National Oil Company