|

市场调查报告书

商品编码

1630447

中东和非洲国防飞机航空燃料:市场占有率分析、产业趋势、统计和成长预测(2025-2030)Middle-East and Africa Defense Aircraft Aviation Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

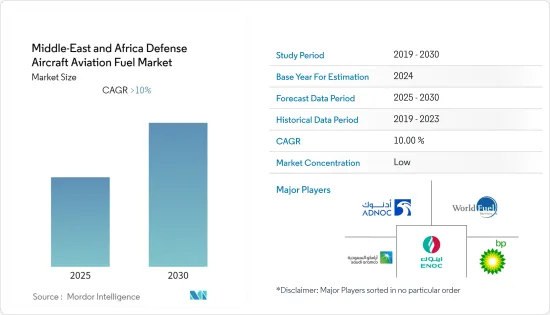

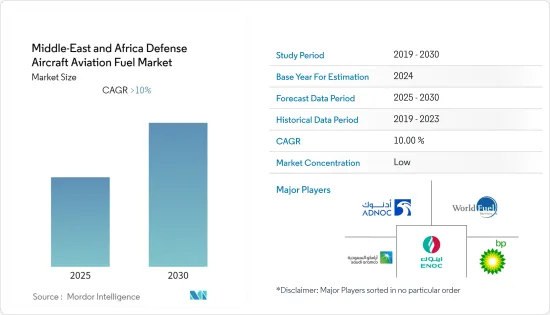

中东和非洲国防飞机航空燃油市场预计在预测期内复合年增长率将超过10%。

COVID-19 的爆发对市场产生了负面影响。目前,市场已达到疫情前水准。

主要亮点

- 战争性质的变化、国防开支的增加以及国家安全担忧的加剧等因素正在推动无人机和国防飞机的开发和投资增加,刺激对航空燃料的需求。

- 然而,油价上涨、严格的政府法规以及减少碳排放意识的增强是该地区航太和国防燃料市场面临的一些主要挑战。

- 在该地区的航空领域,政府为减少污染和提高清洁燃料意识而采取的措施可能会增加对生质燃料的需求,从而为市场创造机会。

预计沙乌地阿拉伯将在预测期内主导中东和非洲国防飞机航空燃料市场。

中东和非洲军用飞机航空燃油市场趋势

航空涡轮燃料(ATF)主导市场

- 航空涡轮燃料(喷射机燃料)有各种等级和形式,包括 Jet B、JP-8 和 JP-5,它们是军用飞机的理想选择。

- 对于军用喷射机,主要燃料是 JP-8,它是 Jet A-1 的军用等效燃料,添加了腐蚀抑制剂和防冰添加剂。 Jet B因其寒冷天气性能而主要用于军用飞机,而JP-5也是喷射机燃料,其闪点高于JP-8。

- 伊朗、卡达、沙乌地阿拉伯和阿拉伯联合大公国 (UAE) 2021 年的军事开支占国内生产总值的比例较高。

- 2022 年 1 月,卡达订购了 34 架大型双引擎 777X 飞机,并可选择另外购买 16 架。

- 此外,马利共和国共和国空军还增加了各种军用运输机,并宣布计划再增加21架战斗机,以增强该国的军事能力。

- 因此,国防应用投资增加和新飞机增加等因素预计将产生中东和非洲国防飞机航空燃料市场对空气涡轮燃料的需求。

沙乌地阿拉伯主导市场

- 沙乌地阿拉伯皇家空军 (RSAF) 继续开发其航空系统并使其现代化,并渴望采购最新的战斗机,以提供快速部署和快速干预能力的灵活性。

- 2021年,沙乌地阿拉伯的军事支出估计达到555.64亿美元,低于2020年的645.58亿美元。它是世界第三大军费开支国,也是迄今为止沿岸地区最大的军事开支国。

- 2021年,沙乌地阿拉伯签署了价值30亿美元的融资协议,为其订购的飞机提供部分资金。该航空公司在声明中表示,这笔金额将满足该航空公司直到 2024 年中期的飞机融资需求,并将有助于为购买先前订购的 73 架飞机提供资金。该航空公司已订购空中巴士 A320neo、A321neo、A321XLR 和波音 787-10 飞机。

- 战斗机在沙乌地阿拉伯空军持有中所占比例较高,约54%,其次是教练机和直升机。

- 此外,沙乌地阿拉伯的防空系统正在重组,以提供360度防空保护伞,并应对来自各个方向的新兴威胁,特别是无人机袭击。

- 因此,随着军事活动的活性化和国防支出的增加,预计沙乌地阿拉伯国防飞机航空燃料市场将在预测期内占据主导地位。

中东和非洲国防飞机航空燃油产业概况

中东和非洲国防飞机航空燃油市场得到巩固。该市场的主要企业包括(排名不分先后)阿布达比国家石油公司、世界燃料服务公司、英国石油公司、阿联酋国家石油有限责任公司和沙乌地阿拉伯石油公司。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 市场规模及2028年预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按燃料类型

- 航空涡轮燃油 (ATF)

- 航空生质燃料

- 按地区

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Abu Dhabi National Oil Company

- World Fuel Services Corp

- BP plc

- Emirates National Oil Co Ltd. LLC

- Saudi Arabian Oil Co.

- RNGS Trading

第七章 市场机会及未来趋势

The Middle-East and Africa Defense Aircraft Aviation Fuel Market is expected to register a CAGR of greater than 10% during the forecast period.

The outbreak of COVID-19 had a negative effect on the market. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Factors such as the changing nature of warfare, increasing defense spending, and increasing national security concerns are scaling up the development and investment in unmanned drones and defense aircraft, giving thrust to the demand for aviation fuel.

- However, the high volatility of crude oil prices, stringent government regulations, and increasing awareness of the reduction of carbon emissions are some of the key challenges in the regional aerospace and defense fuel market.

- The government's efforts to decrease pollution and increase awareness towards cleaner fuels in the aviation sector across the region are likely to increase demand for biofuels, which in turn is likely to provide an opportunity in the market.

Saudi Arabia is expected to dominate the Middle East and Africa defense aircraft aviation fuel market over the forecast period.

Middle-East And Africa Defense Aircraft Aviation Fuel Market Trends

Aviation Turbine Fuel (ATF) to Dominate the Market

- Aviation turbine fuel, or jet fuel, is available in various grades and forms, including Jet B, JP-8, JP-5, etc., which are ideal for military aircraft.

- For military jets, the main fuel is JP-8, which is the military equivalent of Jet A-1 with the addition of corrosion inhibitors and anti-icing additives. Jet B is primarily used in military aircraft for cold weather performance, and JP-5 is also a jet fuel that has a higher flash point than JP-8.

- Iran, Qatar, Saudi Arabia, and the United Arab Emirates (UAE) had high levels of military expenditure as a share of their gross domestic product in 2021.

- Qatar placed an order for 34 of the 777X, a sizable, twin-engine aircraft, in January 2022, as well as options for 16 additional aircraft.

- Furthermore, the Republic of Mali Air Force added various military transport aircraft and announced plans to add another 21 fighter jets to increase the military power of the country.

- Therefore, factors such as increasing investment and new aircraft additions in defense applications are expected to create demand for air turbine fuel in the Middle East and Africa defense aircraft aviation fuel market.

Saudi Arabia to Dominate the Market

- The Royal Saudi Air Force (RSAF) is continuously developing and modernizing its air systems and is keen on acquiring modern fighters to provide the flexibility of rapid deployment and the ability to intervene quickly.

- In 2021, Saudi Arabia's military spending amounted to an estimated USD 55.564 billion, down from 64.558 billion in 2020. It was the third-largest military spender globally and by far the largest military spender in the Gulf region.

- In 2021, Saudi Arabia signed a financing agreement worth USD 3 billion to partially finance the requirements for aircraft it ordered. The amount covers the airline's aircraft financing requirements until mid-2024, helping finance the purchases of 73 aircraft previously ordered, it said in a statement. The airline has ordered Airbus A320neo, A321neo, A321XLR, and Boeing 787-10 jets.

- Fighter jets account for a large share of the total Saudi Arabian Air Force fleet-about 54%-followed by trainers and helicopters.

- Furthermore, Saudi Arabia's air defenses are undergoing realignment to provide a 360-degree air defense umbrella that could counter threats emerging from all sides, especially drone attacks.

- Therefore, with the increasing military activities and increasing defense expenditure, the market for defense aircraft aviation fuel in Saudi Arabia is expected to dominate during the forecast period.

Middle-East And Africa Defense Aircraft Aviation Fuel Industry Overview

The Middle-East and Africa defense aircraft aviation fuel market is consolidated. Some of the major players in the market (in no particular order) include Abu Dhabi National Oil Company, World Fuel Services Corp, BP plc, Emirates National Oil Co Ltd LLC, and Saudi Arabian Oil Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 Aviation Turbine Fuel (ATF)

- 5.1.2 Aviation Biofuel

- 5.2 Geography

- 5.2.1 United Arab Emirates

- 5.2.2 Saudi Arabia

- 5.2.3 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Abu Dhabi National Oil Company

- 6.3.2 World Fuel Services Corp

- 6.3.3 BP plc

- 6.3.4 Emirates National Oil Co Ltd. LLC

- 6.3.5 Saudi Arabian Oil Co.

- 6.3.6 RNGS Trading