|

市场调查报告书

商品编码

1630454

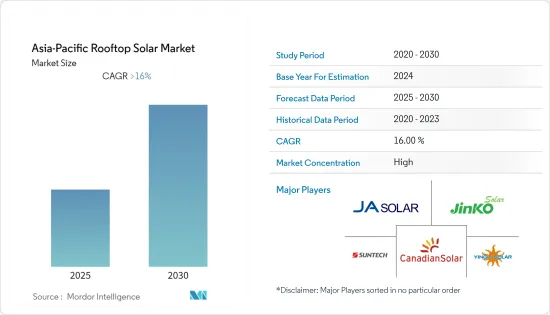

亚太地区屋顶太阳能:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Asia-Pacific Rooftop Solar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

预计亚太地区屋顶太阳能市场在预测期内的复合年增长率将超过 16%。

2020 年市场受到 COVID-19 的负面影响。目前,市场已达到疫情前水准。

主要亮点

- 短期内,有利的政府措施和对获得能源安全日益增长的兴趣预计将推动市场。

- 另一方面,风力发电等其他再生能源来源的渗透率不断提高是一个主要限制因素,预计将在预测期内阻碍市场成长。

- 此外,分散式太阳能发电因其经济效益和提供持续能源供应的能力而受到欢迎,消除了传统电网电压波动造成的设备损坏,并正在提高分散式太阳能发电在亚太地区的普及度。市场带来重大机会。

- 由于中国电力需求的持续成长以及预计增加可再生能源在电力结构中所占份额的目标,中国将在预测期内主导亚太屋顶太阳能发电市场。

亚太地区屋顶太阳能市场趋势

商业和工业领域预计将主导市场

- 屋顶太阳能市场是亚太地区商业和工业领域成长最快的清洁能源技术之一。受欢迎程度的提高是由于政府在安装激励和税收减免等财政支持方面加强了支持。此外,太阳能电池板成本的下降和效率的提高正在推动这一领域的需求。

- 亚太地区是重要的开发中地区,包括中国、印度等国家。这些国家的工业部门有庞大的能源需求,是太阳能屋顶公司进入的潜在市场。

- 亚太地区太阳能发电装置容量在过去几十年中大幅成长,从2012年的20.03GW达到2021年的504.37GW。过去十年,该地区的装置容量增加了 25 倍。这意味着该地区的太阳能发电组合正在增加。

- 此外,2022年7月,中国住宅部门和国家发展和改革委员会宣布,计划在2025年,都市区50%的新建公共建筑和工厂安装太阳能板。到2023年终,国家能源局将安装50%的政党和政府建筑屋顶、40%的学校、医院和其他公共设施、30%的工业场所、20%的农村住宅我提案用太阳能电池板覆盖它。已有31个省份、676个地市州报名参加该计划。

- 因此,随着屋顶太阳能发电工程在一些地区正在进行和完成,商业和工业领域预计将在预测期内主导市场。

中国主导市场

- 屋顶太阳能发电装置正在取得显着发展,这主要是受到政府有利措施和奖励的推动。该国的电力系统正在向低碳和分散模式转型。此外,为了加速实现净零排放目标,各国政府正加强支持力度,加速采用屋顶太阳能等清洁能源技术。

- 该国屋顶太阳能业务的主要驱动力之一是对永续能源的需求不断增长和太阳能价格下降。屋顶太阳能发电的成本已经与中国工商业需求者的零售电价竞争。

- 中国的太阳能发电装置正在显着增加。 2012年为672万千瓦,但截至2021年,中国已安装太阳能发电306.4吉瓦。 10年间该国装置容量增加了45倍以上。预计类似的趋势在预测期内也将持续。

- 2021年,中国国家能源局宣布了一项新倡议,要求地方政府与太阳能开发商合作建造屋顶阵列。该计划将允许建筑物业主购买太阳能电池板并将其产生的电力出售给开发商,或者开发商可以租用屋顶空间并安装自己的太阳能电池板。

- 此外,2022 年 8 月,中国政府宣布在中国江西省的 11 个屋顶上建造 120 兆瓦太阳能发电设施。本计划由11个子设备组成,占地工业屋顶总合面积约66.5万平方公尺。本计划采用中信博的BIPV-Zhiro解决方案,预计每年发电量约120GWh。

- 因此,由于价格下降以及政府对大多数建筑物屋顶太阳能安装的要求增加,预计中国将在预测期内主导市场。

亚太地区屋顶太阳能发电产业概况

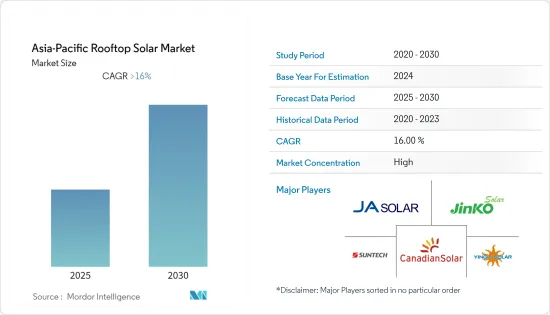

亚太地区屋顶太阳能市场区隔:市场主要企业包括(排名不分先后)晶澳太阳能、晶科能源、尚德电力、英利绿色能源和阿特斯阳光电力。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2028年装置容量及预测(单位:GW)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 最终用户

- 住宅市场

- 商业/工业

- 市场分析:按地区(2028 年之前的市场规模和需求预测)

- 印度

- 中国

- 日本

- 澳洲

- 其他亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- JA Solar Holdings Co., Ltd.

- JinkoSolar Holding Co., Ltd.

- Suntech Power Holdings Co., Ltd.

- Yingli Green Energy Holding Co., Ltd.

- Canadian Solar Inc.

- Huawei Technologies Co., Ltd.

- Sungrow Power Supply Co. Ltd

- Trina Solar Limited

- Hanwha SolarOne Co. Ltd.

第七章 市场机会及未来趋势

简介目录

Product Code: 71565

The Asia-Pacific Rooftop Solar Market is expected to register a CAGR of greater than 16% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the short term, favorable government policies and an increasing focus on gaining energy security are expected to drive the market.

- On the other hand, increasing penetration of other renewable energy sources like wind energy is major restraint expected to hinder the market's growth during the forecasted period.

- Moreover, the increasing popularity of distributed solar power generation in terms of economic benefits and ability to provide constant energy, which eliminates equipment damage due to voltage fluctuations in the conventional power grid, is expected to create significant opportunities for the Asia-pacific rooftop solar market.

- China is expected to dominate in the Asia-Pacific rooftop solar market over the forecast period due to the constantly increasing power demand in the country and the target for increasing renewable energy share in the power mix.

Asia-Pacific Rooftop Solar Market Trends

Commercial and Industrial Segment is Expected to Dominate the Market

- The rooftop solar PV market is one of the fastest-growing clean energy technologies in Asia-Pacific commercial and industrial segments. The increasing popularity is due to the increasing government supports in incentives and financial assistance like tax benefit for installation. Moreover, the declining cost of solar panels and their increasing efficiency have propelled their demand in the segment.

- The Asia-pacific region is a significant developing region with countries like China and India, amongst others. These countries have massive energy demand from their industrial segment, serving as a high-potential market for solar rooftop companies to penetrate.

- The solar PV installation capacity in the Asia-Pacific region has increased significantly in past decades, from 20.03 GW in 2012 to 504.37 GW in 2021. The installed capacity in the region has grown by 25 folds in the last decade. This signifies the increasing solar PV portfolio in the region.

- Furthermore, In July 2022, China's housing department and the National Development and Reform Commission announced the plans for new-build public buildings and factories in towns and cities to be covered at 50% by solar panels by 2025. By the end of 2023, the National Energy Bureau proposed to cover with solar panels 50% of rooftop space on party and government buildings, 40% of schools, hospitals, and other public buildings, 30% of industrial and commercial spaces, and 20% of rural households. A total of 676 counties from 31 provinces have registered for the scheme.

- Therefore, with the regions undergoing and completing rooftop solar projects, the commercial and industrial segment is expected to dominate the market over the forecast period.

China to Dominate the Market

- The rooftop solar PV installations are witnessing significant developments driven mainly by favorable government policies and incentives. The country's electricity system is transitioning to low carbon and a more distributed model. Further, to foster the change to the net zero-emission target, the government is offering increased support to increase the penetration of clean energy technologies such as rooftop solar PV.

- One of the critical drivers for the country's rooftop solar business is the rising demand for sustainable energy and falling solar PV prices. Rooftop solar costs are already competitive with retail electricity prices for industrial and commercial customers in China.

- Solar PV installations have increased significantly in the country. As of 2021, China had installed 306.4 GW of solar PV compared to 6.72 GW in 2012. The installation capacity in the country has increased by more than 45 folds in 10 years. A similar trend is expected to be followed during the forecasted period.

- In 2021, China's National Energy Bureau announced a new initiative for local governments to partner with solar developers to build rooftop arrays. Under the scheme, building owners can purchase solar panels and sell the power they generate to developers, or developers can lease rooftop space to install solar panels they own.

- Furthermore, in August 2022, the Chinese government announced a new 120 MW solar installation spread across 11 rooftops in China's Jiangxi province, which is expected to be the world's largest single-capacity, building-integrated PV project. The project consists of 11 sub-installations covering a total rooftop space of roughly 665,000 square meters in an industrial park. The project uses the CITIC Bo BIPV-Zhiro solution and is expected to generate around 120 GWh of solar energy annually.

- Hence China is expected to dominate the market during the forecasted period due to declining prices and increasing government mandate on most buildings' solar rooftop installations.

Asia-Pacific Rooftop Solar Industry Overview

The Asia-Pacific rooftop solar market is fragmented. Some of the primary critical players in the market include (in no particular order) JA Solar Holdings Co., Ltd., JinkoSolar Holding Co., Ltd., Suntech Power Holdings Co., Ltd., Yingli Green Energy Holding Co., Ltd., and Canadian Solar Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast in GW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End-Users

- 5.1.1 Residential

- 5.1.2 Commercial and Industrial

- 5.2 Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)}

- 5.2.1 India

- 5.2.2 China

- 5.2.3 Japan

- 5.2.4 Australia

- 5.2.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 JA Solar Holdings Co., Ltd.

- 6.3.2 JinkoSolar Holding Co., Ltd.

- 6.3.3 Suntech Power Holdings Co., Ltd.

- 6.3.4 Yingli Green Energy Holding Co., Ltd.

- 6.3.5 Canadian Solar Inc.

- 6.3.6 Huawei Technologies Co., Ltd.

- 6.3.7 Sungrow Power Supply Co. Ltd

- 6.3.8 Trina Solar Limited

- 6.3.9 Hanwha SolarOne Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219