|

市场调查报告书

商品编码

1689783

屋顶太阳能发电厂-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Rooftop Solar Photovoltaic Installation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

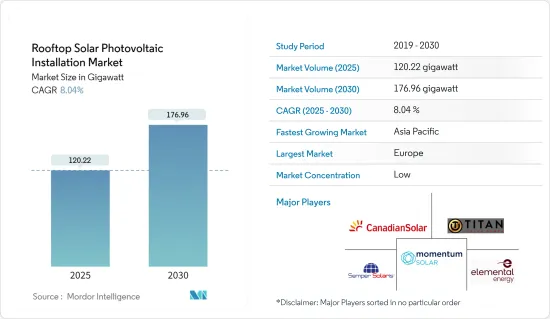

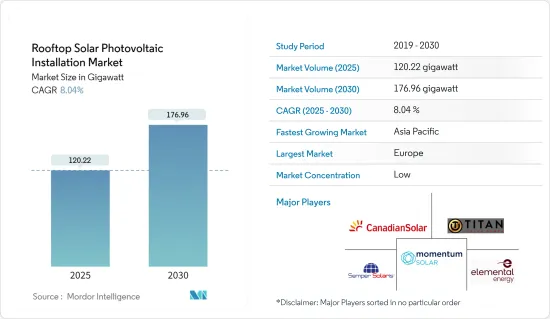

屋顶太阳能发电设备市场规模预计在2025年为120.22吉瓦,预计到2030年将达到176.96吉瓦,预测期间(2025-2030年)的复合年增长率为8.04%。

2020年,市场受到了新冠疫情的负面影响。目前市场已恢復到疫情前的水准。

从长远来看,预计预测期内,政府以激励和减税等形式推出的支持政策、光伏安装成本的下降以及电池板效率的提高将推动市场发展。

然而,预计高额的初始资本投资将阻碍预测期内的市场成长。

钙钛矿太阳能电池新技术的进步和市场的发展预计将为未来的屋顶太阳能设备市场带来许多机会。

到2022年,亚太地区将成为屋顶太阳能发电的最大市场。由于该地区包含中国和印度等多个新兴经济体,因此很可能成为预测期内成长最快的市场。

屋顶太阳能发电设备市场趋势

住宅屋顶设备可望主导市场

- 住宅部分包括个人住宅和多用户住宅。住宅屋顶系统比商用或工业屋顶系统小。住宅屋顶太阳能发电系统的容量通常高达 50kW。

- 近年来,受成本下降和政府支持的推动,全球住宅屋顶太阳能发电系统的采用率大幅增加。住宅屋顶太阳能装置也可配置成较小尺寸,用于微型电网或个人使用。各国居民对住宅屋顶系统的需求日益增长,需要便利、实惠且可靠的电力选择。在许多国家,太阳能光电在经济上比从电网购买电力更具吸引力。

- 例如,在美国,住宅屋顶太阳能光电装置容量近年来成长迅速。据太阳能产业协会称,2021年至2022年,住宅屋顶太阳能光电装置容量增加了约40%。 2021年的年装置容量为4.2GW,而2022年为5.9GW。

- 此外,2022 年美国住宅太阳能发电系统的平均成本为每瓦 3.21 美元。过去三年来,住宅太阳能发电的价格略有上涨,但仍不到 2010 年平均成本的一半。住宅太阳能係统成本的下降促使美国家庭安装的太阳能容量大幅增加。

- 欧盟正在积极推动太阳能板的国内生产,例如 Enel Green Power 已与欧盟合作扩建其在义大利的太阳能板超级工厂。在欧盟的资助下,Enel Green Power 计划将其生产能力扩大 15 倍,从目前的 20 万千瓦增加到 300 万千瓦。该生产设施预计将于 2024 年 7 月运作,总投资约 6.3 亿美元,其中欧盟预计将出资约 1.24 亿美元。预计此次合作将在短期内降低屋顶太阳能板的成本,从而增加整个欧洲对住宅屋顶太阳能係统的需求。在中国、印度和澳洲等国家,由于政府大力推广住宅领域的太阳能计划并降低资本成本,近年来住宅屋顶的需求增加。

- 例如,印度政府已启动印度新和可再生能源部(MNRE)併网屋顶太阳能发电计画的第二阶段。根据该计划,2022年4月,泰米尔南都能源发展局将邀请竞标在泰米尔南都邦安装12兆瓦併网住宅屋顶太阳能发电系统。同样,特伦甘纳邦可再生能源部已邀请竞标,指定承包商建造一个 50 兆瓦併网住宅屋顶太阳能发电工程。

- 鑑于上述情况,预计住宅屋顶太阳能市场将在预测期内占据主导地位。

亚太地区可望主导市场

- 亚太国家快速的都市化、人口成长和工业化正在推动电力消耗量大幅增加。作为回应,政府和企业越来越多地将屋顶太阳能作为增加能源供应并解决环境问题的可行手段。

- 此外,亚太地区阳光充足,非常适合发展太阳能发电。良好的气候条件和太阳能电池板效率的技术进步确保了屋顶装置的最佳能源产量。这一自然优势增强了该地区的吸引力和安装太阳能发电的可行性。

- 中国几乎拥有全球所有最大的光伏 (PV) 製造公司和设施,全球近 70% 的太阳能光伏製造产能位于中国。这些公司也控制多晶硅、硅锭和硅片製造等其他业务,这些业务对于太阳能板供应链至关重要。在全球太阳能供应链中占据绝对主导地位,使得中国製造商相较于其他国家的太阳能设备製造商拥有显着优势。

- 此外,积极的政府政策和奖励在推动亚太地区成为屋顶太阳能光电市场的前沿方面发挥关键作用。该地区各国政府已经建立了强有力的支持机制,包括上网电价、税额扣抵和法规结构,以鼓励采用屋顶太阳能光电系统。这些奖励减轻了消费者和企业的经济负担,刺激了市场的快速成长。

- 2022 年 6 月,澳洲政府宣布了新的屋顶太阳能法规。政府在 2021-22 年预算中拨款 1,920 万美元用于小型可再生能源计画 (SRES) 改革。修订后的法规旨在加强消费者保护并改善屋顶太阳能发电领域的健康状况。修改内容如下:

- 简化安装人员、太阳能零售商和製造商的报告要求。让监管机构在製定需要小规模技术认证的太阳能组件要求方面发挥更直接的作用。预计这些规定将在预测期内推动屋顶太阳能装置数量的大幅增加。

- 由于这些原因,预计亚太地区将在预测期内主导屋顶太阳能光电设备市场。

屋顶太阳能发电设备产业概况

从本质上来说,屋顶太阳能安装市场是整合的。市场上的主要企业(不分先后顺序)包括 Titan Solar Power NV Inc、Momentum Solar、Canadian Solar Inc、Elemental Energy Inc 和 Semper Solaris Construction Inc。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 至2029年的市场规模及需求预测(单位:美元)

- 2029年屋顶光伏(PV)市场(吉瓦)

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 太阳能板成本下降

- 政府支持措施

- 限制因素

- 初始成本高

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 地点

- 住宅

- 商业和工业

- 区域(区域市场分析(截至 2029 年的市场规模和需求预测(仅限区域)))

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 亚太地区

- 中国

- 印度

- 澳洲

- 日本

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 欧洲

- 德国

- 英国

- 西班牙

- 义大利

- 法国

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 南非

- 埃及

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Titan Solar Power NV Inc.

- Momentum Solar

- Canadian Solar Inc.

- Elemental Energy Inc.

- Semper Solaris Construction Inc.

- Pink Energy

- ReVision Energy LLC

- ADT Solar

- Baker Electric Home Energy

- Infinity Energy Inc.

- 市场排名/份额分析

第七章 市场机会与未来趋势

- 钙钛矿太阳能电池新技术进展与发展

The Rooftop Solar Photovoltaic Installation Market size is estimated at 120.22 gigawatt in 2025, and is expected to reach 176.96 gigawatt by 2030, at a CAGR of 8.04% during the forecast period (2025-2030).

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Over the long term, supportive government policies in the form of incentives and tax benefits for solar panel installation, declining PV installation costs, and rising panel efficiencies are expected to drive the market during the forecast period.

On the other hand, high initial capital investment are expected to hinder the growth of the market during the forecasted period.

Nevertheless, new technological advancements and the development of perovskite solar cells are expected to create several opportunities for the rooftop solar PV installation market in the future.

Asia-Pacific was the largest market for rooftop solar PV installation in 2022. The region is also likely to be the fastest-growing market during the forecast period due to the presence of several developing economies, such as China and India.

Rooftop Solar Photovoltaic Installation Market Trends

Residential Rooftop Installation Expected to Dominate the Market

- The residential segment includes individual houses and residential building complexes. Residential rooftop-mounted systems are small compared to commercial and industrial rooftop systems. The residential rooftop solar PV system typically has a capacity range of up to 50 kW.

- The deployment of residential rooftop solar PV systems has increased significantly in recent years worldwide, owing to the declining costs and the government's supportive policies. Residential rooftop solar PV installations can be arranged in smaller configurations for mini-grids or personal use. There is a rise in demand for residential rooftop systems from various countries where residents need accessible, affordable, and reliable electricity options. In many countries, the electricity generated from solar PV is more economically attractive than buying electricity from the grid.

- For instance, in the past couple of years, the United States experienced rapid growth in residential rooftop solar installed capacity; according to the Solar Energy Industries Association, the residential rooftop solar PV installed capacity grew by around 40% between 2021 and 2022. In 2022, the annual installed capacity was 5.9 GW compared to 4.2 GW in 2021.

- Further, In 2022, the average cost of residential solar systems in the United States stood at USD 3.21 per watt. Although the price of residential solar has slightly increased in the last three years, it is still less than half the average cost registered in 2010. The decrease in the cost of residential solar systems has contributed to the significant increase in the solar capacity installed in United States households across the country.

- The European Union is actively promoting the domestic production of solar panels, exemplified by initiatives such as Enel Green Power's collaboration with the European Union to expand a solar panel Gigafactory located in Italy. Supported by European Union funding, Enel Green Power aims to increase its production capacity by a significant factor, specifically fifteen-fold, from the existing 200 MW to a substantial 3 GW. Anticipated to be operational by July 2024, this production facility represents a considerable investment totaling approximately USD 630 million, with an expected contribution from the European Union of around USD 124 million. This concerted effort is poised to drive down the cost of rooftop solar panels in the near term and to stimulate heightened demand for residential rooftop solar systems throughout Europe. The need for residential rooftops has increased in countries such as China, India, and Australia in the past couple of years due to government initiatives to promote solar energy projects in the residential sector and reduce installation costs.

- For instance, the Government of India initiated phase II of the Ministry of New and Renewable Energy's (MNRE) grid-connected rooftop solar program. Under this program, in April 2022, the Tamil Nandu Energy Development Agency issued a tender to install 12 MW of grid-connected residential rooftop solar systems in Tamil Nandu. Similarly, Telangana state's Renewable Energy Department Corporation invited bids to appoint suppliers to build 50 MW of grid-connected residential rooftop solar projects.

- Therefore, owing to the above points, the residential rooftop solar PV installation market is expected to dominate during the forecast period.

Asia-Pacific Expected to Dominate the Market

- Rapid urbanization, population growth, and industrialization across Asia-Pacific countries have fueled a substantial rise in electricity consumption. In response, governments and businesses are increasingly turning to rooftop solar PV installations as a viable means to augment energy supply while addressing environmental concerns.

- Moreover, the Asia-Pacific region offers an abundance of sunlight, making it exceptionally conducive to solar energy generation. The favorable climatic conditions and technological advancements in solar panel efficiency ensure optimal energy yield from rooftop installations. This natural advantage bolsters the region's attractiveness and viability of solar PV installations.

- China is home to nearly all the largest solar photovoltaic (PV) manufacturing companies and facilities globally, with almost 70% of the global solar PV manufacturing capacity in China. These companies also dominate other businesses, such as polysilicon, ingot, and wafer-making, which are integral to the solar panel supply chain. This extraordinary control of the global solar PV supply chain puts Chinese manufacturers at a more significant advantage when compared to solar equipment manufacturers from other countries.

- Furthermore, proactive government policies and incentives play a pivotal role in propelling Asia-Pacific to the forefront of the rooftop solar PV market. Governments across the region have implemented robust support mechanisms, including feed-in tariffs, tax credits, and regulatory frameworks that encourage the adoption of rooftop solar PV systems. These incentives reduce the financial burden on consumers and businesses, stimulating rapid market growth.

- In June 2022, the Australian government released new rooftop solar PV regulations. The government committed USD 19.2 million in the 2021-22 budget to reform the SRES (Small-scale Renewable Energy Scheme). The amendment regulations aim to protect consumers better and improve integrity in the rooftop solar sector. The amendments are as follows:

- Streamline reporting requirements for installers, solar retailers, and manufacturers. Allow the Regulator to take a more direct role in setting the conditions for solar PV components eligible for small-scale technology certificates. Such mandates are expected to see a massive rise in rooftop solar PV adoption during the forecast period.

- Therefore, owing to the above points, Asia-Pacific is expected to dominate the rooftop solar PV installation market during the forecast period.

Rooftop Solar Photovoltaic Installation Industry Overview

The rooftop solar installations market is consolidated in nature. Some of the key players in the market (in no particular order) include Titan Solar Power NV Inc, Momentum Solar, Canadian Solar Inc., Elemental Energy Inc., and Semper Solaris Construction Inc, and among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Rooftop Solar Photovoltaic (PV) Installed Market in GW, till 2029

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Declining Solar Panel Costs

- 4.6.1.2 Supportive Government Policies

- 4.6.2 Restraints

- 4.6.2.1 High Upfront Cost

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Residential

- 5.1.2 Commercial and Industrial

- 5.2 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2029 (for regions only)})

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Asia-Pacific

- 5.2.2.1 China

- 5.2.2.2 India

- 5.2.2.3 Australia

- 5.2.2.4 Japan

- 5.2.2.5 Malaysia

- 5.2.2.6 Thailand

- 5.2.2.7 Indonesia

- 5.2.2.8 Vietnam

- 5.2.2.9 Rest of Asia-Pacific

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Spain

- 5.2.3.4 Italy

- 5.2.3.5 France

- 5.2.3.6 Nordic Countries

- 5.2.3.7 Turkey

- 5.2.3.8 Russia

- 5.2.3.9 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 Qatar

- 5.2.5.4 South Africa

- 5.2.5.5 Egypt

- 5.2.5.6 Nigeria

- 5.2.5.7 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Titan Solar Power NV Inc.

- 6.3.2 Momentum Solar

- 6.3.3 Canadian Solar Inc.

- 6.3.4 Elemental Energy Inc.

- 6.3.5 Semper Solaris Construction Inc.

- 6.3.6 Pink Energy

- 6.3.7 ReVision Energy LLC

- 6.3.8 ADT Solar

- 6.3.9 Baker Electric Home Energy

- 6.3.10 Infinity Energy Inc.

- 6.4 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 New Technological Advancements and the Development of Perovskite Solar Cells