|

市场调查报告书

商品编码

1630456

英国海上石油和天然气退役:市场占有率分析、行业趋势和成长预测(2025-2030)UK Offshore Oil And Gas Decommissioning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

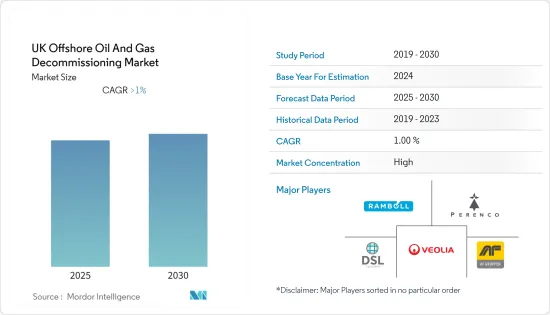

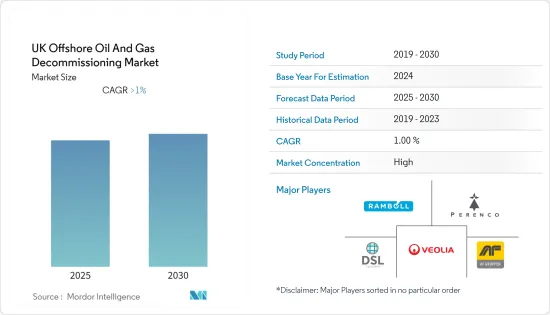

英国海上石油和天然气退役市场预计在预测期内复合年增长率将超过 1%。

COVID-19 对市场产生了负面影响。目前市场处于大流行前的水平。

主要亮点

- 市场可能受到天然气和原油产量下降以及替代能源增加的推动。

- 然而,由于除役所需的高成本和先进专业知识,市场可能会受到限制。

- 北海油田正在成熟,随着石油和天然气产量下降,除役需求预计将增加。这对市场相关人员来说可能是一个机会。

英国石油与天然气退役市场趋势

除役计划的增加推动市场

- 海上石油环境和退役监管机构 (OPRED) 隶属于商业、能源和工业战略部,负责确保遵守 1998 年《石油和天然气法案》的规定。

- 2022年9月,Spirit Energy聘请海洋顾问公司ABL协助除役英国水域的三座海上钻机。作为与 Spirit Energy Production 协议的一部分,ABL 的阿伯丁分店已将 MWS 和海洋咨询服务纳入英国营运商在北海南部和爱尔兰海的除役组合中。这三个石油和天然气平台将作为计划的一部分进行储存,该项目将持续到 2025 年。作为修復的一部分,奥黛丽 A、奥黛丽 B 和 Ensign 平台的上部结构和导管架需要拆除。许多计划正在准备退役,这可能会促进市场成长。

- 2022年2月,Ketch和Schooner天然气田的所有者和营运商DNO North Sea与合作伙伴Tullow Oil SK(总部位于英国的油气公司)完成了20天然气田平台井和1口海底井。这些公司在决定除役之前考虑了几种技术和商业选择,因为他们无法找到延长天然气田经济寿命的可行方法。此类设施可以奖励钻机因经济钻机结束而退役,从而促进市场成长。

- 该国天然气产量从2020年的38.1亿立方英尺/日减少到2021年的31.6亿立方英尺/日,下降16.9%。在预测期内,产量可能会进一步下降,如果市场参与者无法以低于成本价的价格生产足够的钻机,这将激励市场参与企业退役,从而减少英国海上石油,这可能会提振天然气退役市场。

- 未来几年,英国海上石油和天然气退役市场可能会受到退役计划增加的推动。

深水/超深水领域确认成长

- 深水平台的退役和拆除需要在拆除设计过程中仔细注意方法、工程和程序。这需要更先进的专业知识和更好的设备来完成计划。

- 在北海等地区,预计许多深水平台将达到使用寿命并需要退役。此类大型深水平台的退役过程预计将变得更加复杂,需要更详细的工程解决方案来安全有效地规划和执行此类操作。预计退役的钻机数量不断增加预计将提振市场。

- 必须清洁井眼并将塞子小心地安装在井眼中。必须准确地完成此操作,以防止环境问题导致水下井处于开放状态。在深海和超深海,废弃矿场的成本甚至更高。该领域生态影响现代化的努力正在不断增加,预计将促进市场成长。

- 据国际能源总署称,英国几乎所有的石油和天然气生产都来自海上油田。贝克休斯公司预计,到2022年12月,英国地区的钻机数量将达到10座左右。如果生产成本上升或油价低于开采成本,该地区的公司可能会退役钻机。

- 因此,由于投资增加和技术进步,深水和超深水领域预计将在预测期内呈现成长。

英国海上石油与天然气退役产业概况

英国海上石油和天然气退役市场适度整合。市场的主要企业包括(排名不分先后)Veolia Environnement SA、Derrick Services (UK) Ltd.、Perenco SA、Ramboll Group A/S 和 AF Gruppen ASA。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 原油产量(单位:百万桶/日,2021年)

- 天然气产量(十亿立方英尺,2021 年)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- PESTLE分析

第五章 市场深度细分

- 浅水

- 深海与超深海

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Veolia Environnement SA

- Derrick Services (UK) Ltd.

- Perenco SA

- Ramboll Group A/S

- AF Gruppen ASA

- John Lawrie Group Ltd.

第七章 市场机会及未来趋势

简介目录

Product Code: 71572

The UK Offshore Oil And Gas Decommissioning Market is expected to register a CAGR of greater than 1% during the forecast period.

COVID-19 had a detrimental effect on the market.Presently, the market has reached pre-pandemic levels.

Key Highlights

- The market is likely to be driven by things like the decrease in natural gas and crude oil production and the rise in alternative energy sources.

- But the market is likely to be limited by the high cost and high level of expertise needed for decommissioning.

- The North Sea fields are maturing, and the demand for decommissioning is expected to rise as crude oil and natural gas production reduces. This may act as an opportunity for the market players.

UK Offshore Oil And Gas Decommissioning Market Trends

Increasing Decommissioning Projects to Drive the Market

- The Petroleum Act of 1998 says how offshore oil and gas infrastructure and pipelines on the United Kingdom Continental Shelf (UKCS) should be taken down.The Offshore Petroleum Regulator for Environment and Decommissioning (OPRED), which is part of the Department for Business, Energy, and Industrial Strategy, is in charge of ensuring that the Petroleum Act of 1998's provisions are followed.

- In September 2022, Spirit Energy hired marine consultancy ABL to assist in the decommissioning of three offshore rigs in the United Kingdom's seas. As part of the contract with Spirit Energy Production, ABL's Aberdeen branch will provide MWS and maritime consultancy services for the UK operator's decommissioning portfolio in the southern North Sea and the Irish Sea. The three oil and gas platforms will be put into storage as part of the project, which will last until 2025. The topside and jackets for the Audrey A, Audrey B, and Ensign platforms will need to be removed as part of the restoration. Many projects are in preparation for decommissioning and may aid the growth of the market.

- In February 2022, the operator DNO North Sea and the partner Tullow Oil SK, an oil and gas firm with headquarters in the UK, which are the owners of the Ketch and Schooner gas fields, will have 20 platform wells and one subsea well. The firms considered several technical and business alternatives before deciding to decommission the fields since they were unable to discover a workable way to extend their economic life. The cost of decommissioning has been estimated at USD 33 million.Facilities such as these may incentivize the decommissioning of the rigs due to the end of the rig's economic life, which may aid the growth of the market.

- Natural gas production in the country decreased by 16.9%, to 3.16 billion cubic feet per day in 2021 from 3.81 billion cubic feet per day in 2020. The output may decline further in the forecast period, which could incentivize the market players to decommission the rigs in case they are not able to produce enough below the cost price and thereby boost the United Kingdom offshore oil and gas decommissioning market.

- In the next few years, the United Kingdom's offshore oil and gas decommissioning market is likely to be driven by a growing number of decommissioning projects.

Deepwater and Ultra-Deep Water Segment to Witness Growth

- For the decommissioning and removal of a deepwater platform, the removal design process needs to pay close attention to the methodology, engineering, and procedures. All of these are likely to be more complicated than for smaller shallow water platforms.This requires higher expertise and better equipment to complete the project.

- Many of the platforms in deeper water are reaching the end of their useful lives in areas such as the North Sea, and decommissioning is expected to become necessary. The process of decommissioning these larger and deeper water platforms is expected to be more complex and require more detailed and engineered solutions to plan and execute such operations safely and effectively. An increasing number of rigs to decommission is expected to aid the market.

- The main parts of the decommissioning process are plugging and abandoning the wells, which also cost the most.The wellbore must be cleaned out and plugs carefully installed in the well. This must be done correctly to prevent any environmental issues from leaving the underwater well open. In deep and ultra-deep water, it accounts for even higher costs for decommissioning. Increasing efforts to modernize the ecological effects in this area are expected to aid the market's growth.

- According to the IEA, nearly all United Kingdom petroleum and natural gas production comes from offshore fields. The rig count in the United Kingdom region was estimated by Baker Hughes Company to be around 10 units in December 2022. The companies in the region may choose to decommission the rigs if the production costs increase or the crude oil prices go below the extraction costs.

- Hence, the deep water and ultra-seep water segments are expected to witness growth in the forecast period due to an increase in investments and advancements in technology.

UK Offshore Oil And Gas Decommissioning Industry Overview

The United Kingdom offshore oil and gas decommissioning market is moderately consolidated. Some of the key players (not in any particular order) in this market are Veolia Environnement S.A., Derrick Services (UK) Ltd., Perenco SA, Ramboll Group A/S, and AF Gruppen ASA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Crude Oil Production, in million barrels per day, till 2021

- 4.4 Natural Gas Production, in billion cubic feet, till 2021

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.2 Restraints

- 4.8 Supply Chain Analysis

- 4.9 PESTLE Analysis

5 MARKET SEGMENTATION BY WATER DEPTH

- 5.1 Shallow Water

- 5.2 Deepwater and Ultra-Deep Water

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Veolia Environnement S.A.

- 6.3.2 Derrick Services (UK) Ltd.

- 6.3.3 Perenco SA

- 6.3.4 Ramboll Group A/S

- 6.3.5 AF Gruppen ASA

- 6.3.6 John Lawrie Group Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219