|

市场调查报告书

商品编码

1631568

南美国防飞机航空燃料:市场占有率分析、产业趋势与成长预测(2025-2030)South America Defense Aircraft Aviation Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

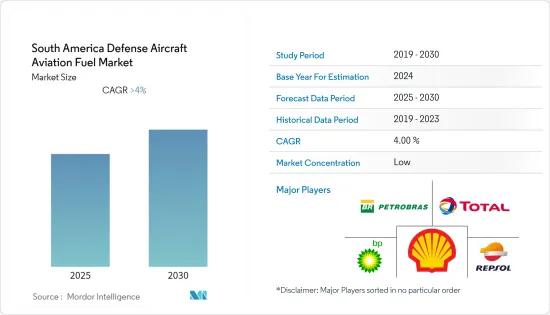

南美洲防务飞机航空燃油市场预计在预测期内复合年增长率将超过4%。

由于 COVID-19 爆发,市场受到区域封锁的负面影响。目前,市场已达到疫情前水准。

主要亮点

- 来自邻国和地方或区域恐怖组织日益增加的安全威胁迫使南美国家政府不断增加国防预算。此外,近几十年来,南美洲的飞机持有数量不断增加,不仅包括海军,还包括空军,这正在推动国防飞机的航空燃料市场。

- 然而,各国政府正在削减国防支出,这可能会阻碍南美洲国防飞机航空燃油市场的发展。

- 对飞机排放气体的日益关注以及各国政府采用现代发动机和生质燃料混合航空燃料来减少排放气体的努力预计将在未来几年为国防飞机航空燃料市场提供重大机会。

- 由于国防预算不断增加,巴西可能主导南美洲国防飞机燃料市场。

南美洲防务飞机航空燃油市场趋势

航空涡轮燃料主导市场

- 随着该地区各国政府继续推进军队现代化和资本重组,预计 2022 年国防支出将增加 3-4%。随后,国防航空部门预计也会增加,为国防部门增加新飞机铺路。

- 许多政府都制定了军用喷射机燃料的单独规格。规格不同的原因包括军事和民用行动和后勤方面的差异,以及高性能喷射战斗机发动机对燃料的额外要求。

- 到 2022 年,巴西预计将拥有最多的军用持有(679 架),其次是哥伦比亚(454 架)和智利(290 架)。然而,美国、欧洲和俄罗斯都为南美国家生产了许多飞机。这些飞机使用航空涡轮燃料(主要是Jet A-1燃料),因此可能在预测期内推动南美洲国防航空燃料市场。

- 2021 年 9 月 22 日,阿根廷国防部 (MoD) 透过公共信贷业务授权宣布,将为采购用于空域监控的多用途战斗机提供高达 6.64 亿美元的信贷业务。所有上述几点都可能改善和加强该地区的空军能力,从而增加新飞机对航空燃料的需求。

- 反过来,操作技术和政府法规等因素正在推动航空涡轮燃料的发展,预计这将推动南美洲国防航空燃料市场的发展。

巴西主导市场

- 巴西是南美洲最大的航空燃油消费国。该国指定用于飞机的产品有航空煤油(QAV)、航空汽油和替代航空煤油(alternative QAV)。该国拥有该地区最重要的空军和海军,总合679持有军用飞机。

- 近年来航空燃油总量保持稳定,2021年航空柴油量为51.4亿升,同年航空汽油量为405亿升,其中只有一小部分用于国防是 6-8%。

- 此外,在南美洲,巴西预计将率先开发甘蔗可再生燃料,预计将取代传统的喷射机燃料。目前,没有关于可持续航空燃料(SAF)的具体联邦政策,但州一级正在做出努力。

- 多年来,包括波音在内的许多组织一直在积极努力开始供应永续航空生质燃料,同时减少巴西的碳排放。

- 这可能会提振该国的国防飞机燃料市场,并预计在预测期内支持南美国防飞机燃料市场的成长。

南美洲军用飞机航空燃油工业概况

南美洲防务飞机航油市场集中度中等。该市场的主要企业(排名不分先后)包括 Petroleo Brasileiro SA、壳牌 PLC、BP plc、TotalEnergies SE 和 Repsol SA。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 燃料类型

- 空气涡轮燃料

- 其他燃料类型

- 地区

- 巴西

- 委内瑞拉

- 智利

- 南美洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Petroleo Brasileiro SA

- Repsol SA

- BP PLC

- Shell PLC

- TotalEnergies SE

- Pan American Energy SL

- Exxon Mobil Corporation

- Allied Aviation Services Inc.

第七章 市场机会及未来趋势

简介目录

Product Code: 71624

The South America Defense Aircraft Aviation Fuel Market is expected to register a CAGR of greater than 4% during the forecast period.

The market was negatively impacted by the outbreak of COVID-19 due to regional lockdowns. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Factors such as the security threats from a neighboring country and local or regional terror groups intensified, requiring governments around South America to continue increasing their defense budgets. Moreover, in recent decades, South America has witnessed an increasing number of aircraft fleets for the air force as well as for the navy, which is likely to drive the defense aircraft aviation fuel market.

- However, the government is reducing defense expenditure, which is likely to hinder the South American defense aircraft aviation fuel market in the coming future.

- Increasing concerns over emissions from aircraft and initiatives by governments to adopt modern engines and bio-fuel blended aviation fuel to reduce emissions are expected to provide significant opportunities for the defense aircraft aviation fuel market in the future.

- Brazil is likely to dominate the South American defense aviation fuel market owing to its growing defense budget.

South America Defense Aircraft Aviation Fuel Market Trends

Air Turbine Fuel to Dominate the Market

- Defense expenditure was expected to grow between 3 and 4% in 2022 as governments in the region continued to modernize and recapitalize their militaries. Subsequently, the defense aviation sector is also expected to increase, paving the way for the addition of new aircraft in the defense sector.

- The governments of many countries maintain separate specifications for jet fuel for military use. The reasons for different specifications include the operational and logistical differences between the military and civilian systems and the additional demands high-performance jet fighter engines place on the fuel.

- In 2022, Brazil was expected to have the highest number of military aircraft (679 units), followed by Columbia (454 units) and Chile (290). However, the United States, Europe, or Russia all produce a lot of aircraft for South American nations.These aircraft are using air turbine fuel (majorly jet A-1 fuel) and, therefore, are likely to drive the South American defense aviation fuel market during the forecast period.

- On September 22, 2021, the Argentinian Ministry of Defense (MoD) announced that, by means of a Public Credit Operations Authorization Note, it requested the inclusion in the 2022 Budget of the authorization to manage credit for up to USD 664 million for the acquisition of multipurpose fighter aircraft for the surveillance and control of the air space. All the aforementioned points are likely to increase and strengthen the region's air force capacity, thus increasing the demand for aviation fuel from the new aircraft.

- In turn, factors such as operating technology and government regulation are driving air turbine fuel, which is expected to drive the South American defense aviation fuel market.

Brazil to Dominate the Market

- Brazil is the largest consumer of aviation fuel in South America. The products specified for use in aircraft in the country are aviation kerosene (QAV), aviation gasoline, and alternative aviation kerosene (alternative QAV). The country has the most significant air force and navy in the region, with a total of 679 military aircraft.

- The sales of total aviation fuels remained stable in the past few years, with 5.14 billion liters of aviation diesel sold in 2021 and 40.5 billion liters of aviation gasoline sold in the same year, of which only 6% to 8% were used for defense purposes.

- Further, in South America, Brazil is expected to pioneer the development of renewable fuels from sugarcane, which are expected to replace traditional jet fuel. Currently, although there are no specific federal policies in place for sustainable aviation fuel (SAF), initiatives are in place at the state level.

- Over the years, many organizations, such as The Boeing Company, have been working aggressively to initiate the supply of sustainable aviation biofuels while reducing Brazil's carbon emissions.

- This, in turn, is likely to boost the defense aviation fuel market in the country, which is expected to support the growth of the South American defense aircraft aviation fuel market during the forecast period.

South America Defense Aircraft Aviation Fuel Industry Overview

The South America defense aircraft aviation fuel market is moderately concentrated. Some of the key players in this market (in no particular order) include Petroleo Brasileiro S.A., Shell PLC, BP plc, TotalEnergies SE, Repsol S.A., and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecasts in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 Air Turbine Fuel

- 5.1.2 Other Fuel Types

- 5.2 Geography

- 5.2.1 Brazil

- 5.2.2 Venezuela

- 5.2.3 Chile

- 5.2.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Petroleo Brasileiro S.A

- 6.3.2 Repsol SA

- 6.3.3 BP PLC

- 6.3.4 Shell PLC

- 6.3.5 TotalEnergies SE

- 6.3.6 Pan American Energy S.L.

- 6.3.7 Exxon Mobil Corporation

- 6.3.8 Allied Aviation Services Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219