|

市场调查报告书

商品编码

1631578

欧洲和中东/非洲的瓦楞包装:市场占有率分析、行业趋势和成长预测(2025-2030)EMEA Corrugated Board Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

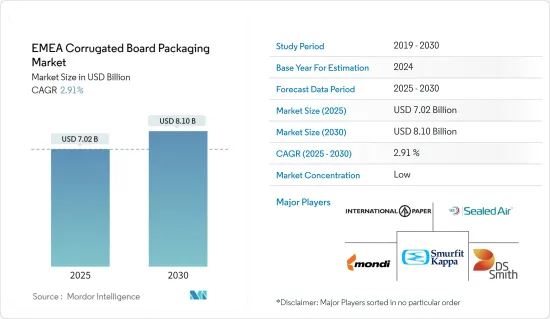

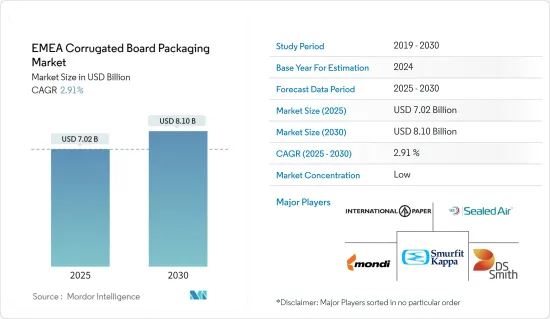

欧洲、中东和非洲瓦楞包装市场规模预计到 2025 年为 70.2 亿美元,预计到 2030 年将达到 81 亿美元,预测期内(2025-2030 年)复合年增长率为 2.91%。

瓦楞包装是保护、储存和运输各种产品的多功能且经济高效的方式。重量轻、生物分解性和可回收性等特性使其成为包装产业的重要元素。

主要亮点

- 预计欧洲和中东/非洲对瓦楞纸箱的需求将受到生鲜食品和饮料、家居和个人产品、物流应用、电子产品、消费者对永续包装意识的增强以及电子产品成长等因素的推动。业预计将有所成长。

- 近年来,电子商务产业已成为重要参与者。亚马逊等着名电子商务公司使用瓦楞纸箱作为主要包装,而个别产品则依赖塑胶包装。纸板用途广泛。因此,它们可以采用盒子以外的多种形式,并且出于永续性考虑,它们正在逐渐取代柔性塑胶袋。此外,纸板是多种印刷技术的完美基础。

- 加工食品产业占纸板使用量的最大份额。该细分市场由于其包装、储存和运输食品到欧洲和中东/非洲内外不同地点消费的大规模先决条件而引领整个市场。此外,禁止一次性塑胶的严格法律的实施增加了对环保包装材料,特别是纸包装解决方案的需求。

- 德国是欧洲重要的瓦楞纸箱市场之一。医药、汽车、食品、电子等主要产业对瓦楞纸箱的需求量大。例如,根据德国联邦统计局的数据,到2023年,德国瓦楞纸/纸板和纸/瓦楞容器的生产收益达到约240.3亿美元。

- 原料价格的波动影响瓦楞製品的製造成本,降低瓦楞纸箱的硬度和强度。纸板包装的耐火性也较低。因此,瓦楞纸板材料的强度低、阻隔性差正在阻碍市场的成长。

欧洲和中东/非洲瓦楞包装市场趋势

加工食品领域预计将占据主要市场占有率

- 由于忙碌的生活方式,欧洲和中东/非洲对方便食品的需求预计将会增加。加工食品对消费者很有吸引力,因为它们可以快速准备。随着人口的增长,对方便、健康的加工食品的需求也预计会增加。此外,用户对环保产品实践的认识不断提高预计将推动该地区对瓦楞包装的需求。

- 政府刺激环保包装材料的倡议,加上瓦楞纸包装联盟(瓦楞纸产业旨在加强瓦楞纸包装的倡议)的努力,正在进一步推动该市场的成长。

- 根据德国联邦统计局的数据,2022 年德国简便食品製造业务的收益为 63.5 亿美元,2023 年将增加至 63.5 亿美元。方便食品产业在很大程度上依赖确保产品保护和安全运输的包装选择。随着德国简便食品製造业的发展,满足这些需求的瓦楞包装的需求可能会增加。

- 禁止使用一次性塑胶的严格法律正在增加对环保包装材料的需求,特别是纸质解决方案。电子商务平台在该地区越来越受欢迎,进一步提振了市场需求。电子商务大大改变了零售业格局。推动中东(特别是沿岸地区)电子商务扩张的关键因素包括强劲的人均收入、成熟的运输和物流网路、不断提高的网路普及率以及技术进步。

- 对包装食品日益增长的需求增加了对纸板包装的需求。根据包装展览会Interpack统计,中东地区消耗了全球5%的包装商品,而且其业务正在快速成长。据预测,2026年需求量将激增21%,达4,400万吨。沙乌地阿拉伯的份额略低于 30%,是中东地区包装食品消费量的领导者。此外,随着越来越多的单身家庭倾向于外带和宅配服务,食品服务的重组预计将进一步推动市场成长。

饮料业务预计将占据较大份额

- 饮料产业在欧洲和中东/非洲发挥重要作用。推动饮料产业成长的关键决定因素包括人口稳定成长、人均收入和生活方式的改善。经济限制迫使一些品牌所有者简化昂贵的包装。二次包装是一个很好的替代品,瓦楞纸箱是经济实惠的包装选择之一。

- 随着供应商优先考虑永续性,传统的硬质包装解决方案正在让位给更环保的瓦楞包装。随着对以客户为中心的产品和卓越的产品保护的需求不断增长,液体包装正在成为可行且经济的选择。此类别包括各种尺寸和厚度的纸板,具体取决于所需的保护等级。

- 政府活动预计将增加消费者对酒精饮料市场的兴趣。据德国包装和装瓶机械製造商克朗斯股份公司称,中东和非洲的包装饮料消费量预计将从2021年的约1,180亿公升增加到2024年的1,271亿公升。

- 为了实现差异化,品牌策略性地采用瓦楞纸包装解决方案,利用各种瓦楞纸选项、厚度和设计来满足其需求。借助各种可自订的列印选项,最终用户可以确保他们的包装在货架上脱颖而出并推动销售成长。

- 对乳製品的需求不断增长正在推动市场成长,因为乳製品被包装在液体饮料的瓦楞纸箱中。根据英国软性饮料协会预测,2023年碳酸饮料将以38.6%的比例成为英国排名第一的非酒精饮料,其次是稀释饮料、瓶装水和其他饮料。

欧洲和中东/非洲瓦楞包装产业概况

欧洲和中东/非洲的瓦楞包装市场较为分散,许多公司提供瓦楞包装解决方案。瓦楞包装是保护、储存和运输各种产品的经济高效的解决方案。轻量、生物分解性和可回收等特性巩固了瓦楞纸板作为包装产业基石的作用。纸板是适合各种印刷技术的理想画布。

该市场由 International Paper、DS Smith、Smurfit Kappa、Mondi、Westlock、Cyca、Model 和 Danapac Packaging 等公司主导。随着大公司收购小公司以扩大其在欧洲、中东和非洲内外的业务和收益,市场正在整合。併购是最常用的策略之一,而这一趋势预计将持续下去。开发商不断创新,开发永续包装,提供环保包装产品。该公司正在为各种最终用户行业推出瓦楞纸箱设计,以利用市场成长机会。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 由于高回收价值和应对力,促进了对瓦楞纸箱的需求

- 生鲜食品和水果和蔬菜市场的高需求

- 市场挑战

- 对瓦楞纸产品的材料可得性和耐用性的担忧

第六章 市场细分

- 按最终用户产业

- 加工食品

- 生鲜食品和水果和蔬菜

- 饮料

- 纸製品

- 其他最终用户产业(电气产品、其他)

- 按地区

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 中东/非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 欧洲

第七章 竞争格局

- 公司简介

- International Paper Company

- Mondi Group

- Smurfit Kappa Group

- DS Smith PLC

- Sealed Air Corporation

- WestRock

- Saica Group

- SCA Group

- Neopack

- Dunapack Packaging

- Arabian Packaging LLC

- VPK Packaging Group

- National Packaging Industries

- Corruseal Group

第八章投资分析

第9章 市场的未来

The EMEA Corrugated Board Packaging Market size is estimated at USD 7.02 billion in 2025, and is expected to reach USD 8.10 billion by 2030, at a CAGR of 2.91% during the forecast period (2025-2030).

Corrugated board packaging is a versatile and cost-efficient method of protecting, preserving, and transporting a wide range of products. Its attributes, such as light weight, biodegradability, and recyclability, have made it an integral component in the packaging industry.

Key Highlights

- Factors such as increasing demand for fresh food and beverages, home and personal products, logistics applications, electronic goods, building consumer awareness toward sustainable packaging, and the growth of the e-commerce industry are expected to increase corrugated box demand in EMEA during the forecast period.

- The e-commerce industry has emerged as a significant player in recent years. Prominent e-commerce companies, such as Amazon, have been using corrugated board boxes as their principal packaging while relying on plastic packaging for individual items. The corrugated board is highly versatile. Thus, it can take various forms other than the box, and due to sustainability issues, it is slowly replacing flexible plastic bags. Moreover, corrugated boxes are a perfect base for several printing techniques.

- The processed food segment accounts for the largest share in terms of the use of corrugated boards. The segment leads the overall market due to the massive prerequisite of foodstuffs being packed, stored, and transported to various places for consumption within and outside EMEA. Also, the need for green packaging materials, particularly paper packaging solutions, is fueled by the enforcement of strict legislation regarding the ban on single-use plastic.

- Germany is one of the prominent European markets for corrugated boxes. The country's principal industries, including pharmaceutical, automotive, food, and electronics, generate a high demand for corrugated boxes. For instance, according to the Federal Statistical Office of Germany, revenue from manufacturing corrugated paper and paperboard and containers of paper and cardboard in Germany amounted to approximately USD 24.03 billion by 2023.

- Fluctuations in raw material prices affect the production costs of corrugated products, which decreases the firmness and strength of corrugated boxes. Corrugated packing also has poor fire resistance. Hence, the low strength of corrugated materials and poor barrier properties hinder the growth of the market.

EMEA Corrugated Board Packaging Market Trends

The Processed Foods Segment is Expected to Occupy a Significant Market Share

- The need for convenience foods is anticipated to grow owing to the busy lifestyles in EMEA. Processed food can be cooked in less time, which attracts consumers. The growing population is anticipated to drive the need for processed food, which is convenient and healthy. Additionally, the increasing realization among users regarding the practice of environment-friendly products is expected to drive the demand for corrugated board packaging in the region.

- Government drives to stimulate eco-friendly packaging materials, coupled with the efforts of the Corrugated Packaging Alliance, a corrugated industry initiative to strengthen corrugated packaging, provide an added stimulus to this market's growth.

- According to Statistisches Bundesamt, the German convenience food production business earned USD 6.35 billion in revenue in 2022, which increased to USD 6.35 billion in 2023. The convenience food industry significantly relies on packaging options to guarantee its products' protection and safe transit. As the convenience food production industry in Germany develops, the demand for corrugated board packaging to satisfy these needs will rise.

- Strict legislation banning single-use plastics has intensified the demand for green packaging materials, especially paper-based solutions. The rising popularity of e-commerce platforms in the region further drives market demand. E-commerce has significantly transformed the retail landscape. Key drivers fueling e-commerce's expansion in the Middle East, particularly in the Gulf region, include robust per capita income, advanced transportation and logistics networks, rising internet penetration, and technological advancements.

- The rising appetite for packaged food is increasing the demand for corrugated board packaging. According to Interpack (a packaging trade fair), the Middle East consumes 5% of the world's packaged goods, and its business is rapidly growing. Projections indicate a 21% surge in demand, reaching 44 million tons by 2026. Saudi Arabia, holding just under a 30% share, tops the Middle East in packaged food consumption. Additionally, as more single households lean toward takeaway and delivery services, the reshaped foodservice industry is expected to further propel the growth of the market.

The Beverage Segment is Expected to Hold a Significant Share

- The beverage industry plays an essential role in EMEA. The principal determinants driving the growth of the beverage segment include a steadily growing population, per capita revenue, and improving lifestyles. Due to economic constraints, some brand owners must simplify their pricey packaging. Secondary packaging is a good substitute, and corrugated boxes are among the affordable packaging options.

- As vendors prioritize sustainability, traditional rigid packaging solutions give way to more eco-friendly corrugated board packaging. With the rising demand for customer-centric products and superior product protection, liquid packaging is emerging as a viable and economical choice. This category includes corrugated boards in various sizes and thicknesses tailored to the required protection level.

- The government's activities are anticipated to increase consumer interest in the alcoholic beverage market. According to Krones AG, a German packaging and bottling machine manufacturer, consumption of packaged beverages in Middle East and Africa is expected to increase to 127.1 billion liters by 2024 from nearly 118 billion liters in 2021.

- Brands strategically employ corrugated packaging solutions to differentiate themselves, utilizing various fluting options, thicknesses, and designs tailored to their needs. With a range of customizable printing options, end users can ensure their packages are eye-catching on shelves, driving sales growth.

- The growing demand for milk-based products is boosting market growth as they are packaged in liquid beverage corrugated milk carton boxes. According to the British Soft Drinks Association, in terms of non-alcoholic beverages in the United Kingdom in 2023, carbonated soft drinks took the top position with 38.6%, followed by dilutables, bottled water, and other drinks.

EMEA Corrugated Board Packaging Industry Overview

The corrugated board packaging market in EMEA is fragmented, with many companies offering corrugated board packaging solutions. Corrugated board packaging is a cost-effective solution for safeguarding, preserving, and transporting diverse products. Attributes like lightweight, biodegradability, and recyclability have cemented the corrugated board's role as a cornerstone of the packaging industry. Corrugated boxes provide an ideal canvas for various printing techniques.

The market is dominated by players, including International Paper, DS Smith, Smurfit Kappa, Mondi, WestRock, Saica, Model, and Dunapack packaging. The market is set for consolidation as the big players acquire smaller players to expand their presence and revenue throughout and outside EMEA. Mergers and acquisitions have been among the most adopted strategies; this trend is expected to continue in the coming years. Businesses continually innovate to develop sustainable packaging and render environment-friendly packaging goods. The players are launching corrugated box designs for various end-user industries to leverage market growth opportunities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Recyclable Value and Ability to Support Innovations in Printing to aid Demand for Corrugated Boxes

- 5.1.2 High Demand from the Fresh Food & Produce Segment

- 5.2 Market Challenges

- 5.2.1 Concerns over Material Availability and Durability of Corrugated Board-based Products

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Processed Foods

- 6.1.2 Fresh Food and Produce

- 6.1.3 Beverages

- 6.1.4 Paper Products

- 6.1.5 Other End-user Industries (Electrical Products and Others)

- 6.2 By Geography

- 6.2.1 Europe

- 6.2.1.1 United Kingdom

- 6.2.1.2 Germany

- 6.2.1.3 France

- 6.2.1.4 Spain

- 6.2.1.5 Italy

- 6.2.2 Middle East and Africa

- 6.2.2.1 South Africa

- 6.2.2.2 Saudi Arabia

- 6.2.2.3 United Arab Emirates

- 6.2.1 Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 International Paper Company

- 7.1.2 Mondi Group

- 7.1.3 Smurfit Kappa Group

- 7.1.4 DS Smith PLC

- 7.1.5 Sealed Air Corporation

- 7.1.6 WestRock

- 7.1.7 Saica Group

- 7.1.8 SCA Group

- 7.1.9 Neopack

- 7.1.10 Dunapack Packaging

- 7.1.11 Arabian Packaging LLC

- 7.1.12 VPK Packaging Group

- 7.1.13 National Packaging Industries

- 7.1.14 Corruseal Group