|

市场调查报告书

商品编码

1631595

英国工业自动化系统整合商:市场占有率分析、产业趋势与成长预测(2025-2030)United Kingdom System Integrator for Industrial Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

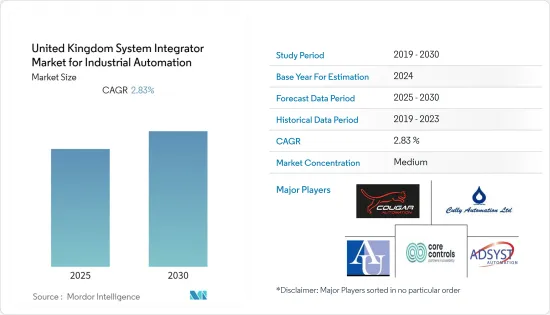

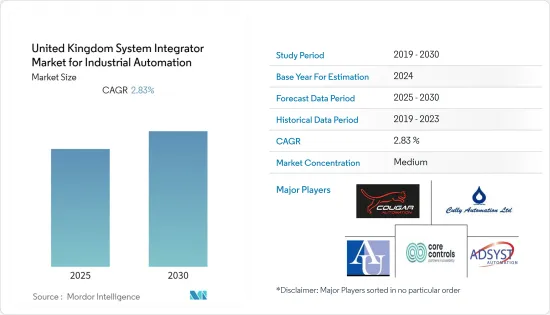

英国工业自动化系统整合商市场预计在预测期内复合年增长率为 2.83%。

COVID-19大流行暂时停滞了市场的供应链,最终增加了市场的工业自动化需求。

主要亮点

- 系统整合将工业中所有这些系统整合起来,以实现智慧工厂的利用。他们负责产品开发、从OEM采购硬体和软体资源,并为最终用户(製造商)整合它们。

- 在最近的趋势中,微型和奈米级中引入的小型 PLC 正在提供以前仅在大型系统中可用的功能。为了满足市场需求,现在低成本的 PLC 中提供了许多功能和特性。预计小型PLC将继续发展,并配备许多与高阶PLC相关的功能。

- 此外,对改善控制、安全连接和提高效能的需求不断增长,推动 PLC 製造商利用机器对机器通讯、智慧感测器、工业云端和网路安全等 IIoT 技术。此外,为了适应先进的功能、成本效率和互通性,PLC 製造商一直致力于创新并将传统 PLC 系统与最新的尖端技术整合。

- SCADA 系统是工业流程的核心,因为它们帮助组织管理现代需求。例如,横河马达致力于发展SCADA,以在SCADA应用中实现高性能、高可用性、广泛的可扩展性和平台独立性。因此,组织还可以受益于横河马达SCADA软体(FAST/TOOLS)的强大功能和灵活性,这是一个全面且完全整合的SCADA应用套件。

- 同样,全球领先的设备供应商三菱电机提供 SCADA 软体 MC Works64,这是下一代物联网 (IoT) 整合监控的最新解决方案。随着物联网加速数位转型倡议,此类解决方案有可能创造巨大的需求。此外,三菱解决方案还附带各种工厂自动化产品,可促进视觉化、分析和改进。

英国工业自动化系统整合商市场趋势

数位转型和工业 4.0 措施推动市场成长

- 数位化和工业 4.0 革命极大地刺激了製造业自动化的发展,需要机器人和控制系统等智慧和自动化解决方案来改善生产流程。

- 政府委託的一项审查发现,如果该国成功拥抱第四次工业革命并开创脱欧后的未来,该国的製造业将在未来 10 年内收回 4550 亿英镑,并创造数千个就业岗位。的可能性。

- 与其他已开发国家相比,日本製造业在机器人和其他自动化方面的投资不足。整体而言,製造业创新投资占GDP的1.7%左右,远低于经合组织2.4%的平均值。

- 市场上观察到的主要趋势是采用整合解决方案/设备,例如结合 PLC 和各种其他工业控制设备(例如 HMI 和 SCADA)。这种整合提高了工厂运作的效率和可视性,并减少了中央控制设备的工作量。

- 此外,英国自动化和机器人协会(BARA)也宣布了英国首个机器人整合商认证计画。 BARA希望透过推出机器人整合商认证计划,提升整合商的技术力,进而增强英国製造业。

已从 COVID-19 影响中迅速恢復的市场

- COVID-19 的爆发和封锁规定影响了该国的工业活动。封锁的影响包括供应链中断、製造过程中使用的原材料缺乏、价格波动可能导致最终产品产量增加并超出预算,以及运输问题。

- 为因应COVID-19造成的全球景气衰退,英国工业自动化系统整合商市场在2020年上半年经历了需求面和供应面的双重影响。

- 智慧工厂倡议帮助製造商克服了 COVID-19 的挑战,导致裁员、某些产品销量减少、社交距离以及最终用户行业(主要是製造业和汽车行业)的大多数企业关闭。 ,使我们能够解决极端压力等问题,从而降低营运成本。

- 三菱电机是全球领先的工业自动化公司之一,由于疫情造成的供应限制,自 2020 年第二季以来收益不断下降。然而,自动化被认为是对抗疫情的最前线。例如,自动化工作站正在加快製药公司的工作速度,因为它们努力在这场大流行中发挥关键作用。

- 此外,市场参与者正在提供远端监控解决方案,以帮助最终用户行业的企业抵御疫情的影响。

英国工业自动化系统整合商产业概况

英国工业自动化系统整合商市场竞争适中,一些公司试图进入现有市场。公司不断创新解决方案并形成战略伙伴关係以保持市场占有率。市场主要企业包括 Adsyst Automation Ltd 和 Cougar Automation Ltd。

- 2021 年 1 月 - Cougar Automation 成为三菱电机“授权解决方案合作伙伴”,因其在产品和服务整合方面取得了出色的专业知识水平。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 数位转型和工业 4.0 倡议

- 市场限制因素

- 自动化实施和维护需要高投资

- 评估 COVID-19 对市场的影响

- 各产业的关键使用案例

第五章竞争状况

- 公司简介

- Au Automation

- Adsyst Automation Ltd

- Core Control Solutions

- Cougar Automation Ltd

- Cully Automation

- Automated Control Solutions Ltd

- Wood PLC

- Altec Engineering Ltd

- Applied Automation

- Adelphi Automation

The United Kingdom System Integrator Market for Industrial Automation Industry is expected to register a CAGR of 2.83% during the forecast period.

The COVID-19 pandemic temporarily slowed the market's supply chain, thus, eventually increasing the demand for industrial automation in the market.

Key Highlights

- System integration assimilates all these systems in the industry to achieve smart factory utilization. It is responsible for contracting product development, sourcing hardware and software resources from OEMs, and integrating them for end users (manufacturers).

- Recent trends have shown that smaller PLCs introduced in the micro- and nano-classes, providing features, were previously found only in the larger systems. In response to market demands, many functions and features are now offered by lower-end PLCs. It is expected that small PLCs may continue to evolve to include many of the features associated with higher-level PLCs.

- Furthermore, the rising demand for improved control, secured connectivity, and enhanced performance has pushed PLC manufacturers to bank on IIoT technologies, such as machine-to-machine communication, smart sensors, industrial cloud, and cybersecurity. Moreover, to accommodate advanced features, cost-effectiveness, and interoperability, PLC manufacturers have been involved in innovating and integrating conventional PLC systems with modern and contemporary technologies.

- SCADA systems are at the crux of industrial processes as they help organizations manage modern demands. For instance, Yokogawa zeros in on the evolution of SCADA to deliver high performance, high availability, broad scalability, and platform independence in its SCADA applications. Therefore, organizations also benefit from the power and flexibility of Yokogawa's SCADA software (FAST/TOOLS), a comprehensive, fully integrated SCADA application suite.

- Similarly, Mitsubishi Electric, a world-leading equipment supplier, offers the SCADA software, MC Works64, which is a modern solution for next-generation integrated monitoring for the Internet of Things (IoT). With IoT accelerating digital transformation initiatives, solutions like these have the potential to create significant demand for themselves. Furthermore, Mitsubishi solutions come with a wide range of factory automation products to catalyze visualization, analysis, and improvement.

UK Industrial Automation System Integrator Market Trends

Digital Transformation and Industry 4.0 Initiatives to Drive Market Growth

- Digitization and the Industry 4.0 revolution significantly stimulated the growth of automation among manufacturing industries by necessitating smart and automated solutions, such as robotics and control systems, to improve production processes.

- According to a government-commissioned review, the country's manufacturing sector could unlock GBP 455 billion over the next decade, creating thousands of jobs, if the country can successfully adopt the fourth industrial revolution and carve out a successful post-Brexit future.

- In comparison with other developed countries, it is observed that the country's manufacturing sector has underinvested in robotics and other forms of automation. Generally, it invests around 1.7% of its GDP into manufacturing innovation, well behind the OECD average of 2.4%.

- The major trend observed in the market is the adoption of integrated solutions/devices, such as the embedding of PLCs with various other industrial controls (such as HMIs or SCADA). These integrations have offered higher efficacy and visibility in factory operations and allowed the workload on central controllers to be lowered.

- Further, the British Automation & Robot Association (BARA) announced the UK's first robot integrator certification scheme. By launching a certification scheme for robot integrators, BARA is hoping to improve the technical capabilities of integrators and ultimately enhance the UK manufacturing sector.

Market Witnessed Fast Recovery from the Impact of COVID-19

- The COVID-19 outbreak and lockdown restrictions affected industrial activities across the country. Some of the effects of the lockdown include supply chain disruptions, the lack of availability of raw materials used in the manufacturing process, fluctuating prices that could cause the production of the final product to inflate and go beyond budget, and shipping problems.

- Following the global economic recession due to COVID-19, the UK system integrator market for industrial automation witnessed a positive impact from the demand side and mixed impact from the supply side in 1st half of 2020.

- Smart factory initiatives have helped manufacturers overcome COVID-19 challenges and address issues, such as workforce reductions, drops in sales for some specific products, social distancing, and extreme pressure to cut operational costs since most enterprises operating in the end-user industries (majorly manufacturing, automotive) had to shut down their production sites due to lockdown restrictions.

- Mitsubishi Electric, one of the leading global companies in industrial automation, has seen decreased revenue since the second quarter of 2020 due to the supply restrictions imposed as a result of the pandemic. However, automation is considered to be on the front lines in the battle against the pandemic. For example, automated workstations are speeding up the work of pharmaceutical companies striving to play an important part in the pandemic.

- Further, players in the market are providing remote monitoring solutions to help enterprises in the end-user industries withstand the impact of the pandemic.

UK Industrial Automation System Integrator Industry Overview

The UK system integrator market for industrial automation is moderately competitive, with new firms trying to enter the existing market. The firms keep on innovating their solutions and entering strategic partnerships to retain their market shares. Key players in the market include Adsyst Automation Ltd and Cougar Automation Ltd, among others.

- January 2021 - Cougar Automation became an "Approved Solution Partner" for Mitsubishi Electric, as it reached an exceptional standard of expertise in the integration of products and services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Digital Transformation and Industry 4.0 initiatives

- 4.3 Market Restraints

- 4.3.1 Requirement of High Investments for Automation Implementation and Maintenance

- 4.4 Assessment of the COVID-19 Impact on the Market

- 4.5 Key Use-cases Across Different Verticals

5 COMPETITIVE LANDSCAPE

- 5.1 Company Profiles

- 5.1.1 Au Automation

- 5.1.2 Adsyst Automation Ltd

- 5.1.3 Core Control Solutions

- 5.1.4 Cougar Automation Ltd

- 5.1.5 Cully Automation

- 5.1.6 Automated Control Solutions Ltd

- 5.1.7 Wood PLC

- 5.1.8 Altec Engineering Ltd

- 5.1.9 Applied Automation

- 5.1.10 Adelphi Automation