|

市场调查报告书

商品编码

1643234

系统整合商:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)System Integrators - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

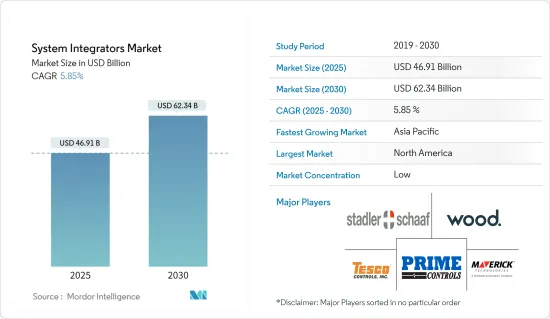

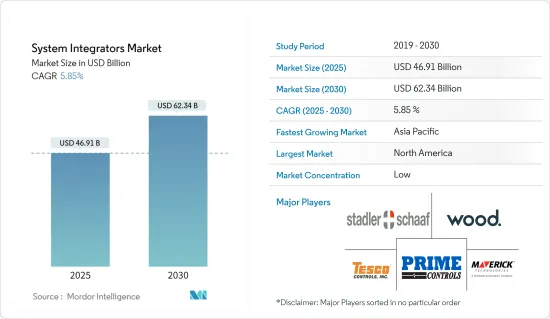

系统整合商市场规模预计在 2025 年为 469.1 亿美元,预计到 2030 年将达到 623.4 亿美元,在市场估计和预测期(2025-2030 年)内以 5.85% 的复合年增长率增长。

系统整合商专门负责组装组件子系统并使这些子系统协同工作。当今世界,製造商正在采用弹性製造系统 (FMS) 来消除可靠性和品质之间的传统权衡。

FMS 可减少劳动力和製程变更并物料输送产品品质。这使得系统整合商能够轻鬆地将需要灵活控制软体的机器与其他系统(如 PLC 系统和资料库)整合在一起。

主要亮点

- 对低成本、节能生产流程的需求正在推动市场的发展。就最终能源需求和温室气体排放而言,工业部门是最大的终端使用部门之一。系统整合商参与了许多传统的效率改进活动,例如更换马达和安装逆变器,这些活动直接意味着减少能源使用。然而,系统整合商也可以透过营运优化来帮助公司减少对环境的影响。

- 透过连接来自生产工厂的资讯并将其与能源消耗资讯和销售点 (POS) 详细资讯相结合,我们可以提供有助于确定可能的最佳化的报告。此外,透过加入我们的系统整合商计划,您可以获得低成本的开发工具以及所需的培训和支援。

- 此外,物联网在工业自动化领域的日益广泛应用也推动了市场的发展。在许多公司中,物联网解决方案的使用正在从 IT 转向运营,并且由于营运和系统整合商之间存在的关係,系统整合商发现与 IIoT 供应商合作更加容易。

- 随着物联网在工业自动化的应用越来越广泛,市场扩展的机会可能会越来越多。自动化系统整合商面临许多机会,这不仅是因为大多数公司之间已经存在关係,而且系统整合商与市场营运之间也存在关係。此外,市场相关人员对灵活製造供应商的需求日益增长,也可能有利于未来几年系统整合商业务的成长。

- 在当今科技主导的商业环境中,巨量资料已成为提高製造业生产力和效率的关键驱动力之一。连网型设备和感测器的广泛采用使得 M2M通讯成为可能,从而导致製造业产生的资料点数量显着增加。

系统整合商市场趋势

工业物联网 (IIoT) 的兴起

- 透过实施 IIoT 等自动化技术,发电厂营运商可以收集即时资料并远端监控设备,以提高生产效率并检测未来的问题。这使得涡轮机、往復式引擎和太阳能电池板能够更有效率地运作。配电系统可提高运作、降低成本、改善资料收集、改善警报和监控系统并实现自主解决问题。

- 工业物联网 (IIoT) 正在推动工厂,尤其是机器人自动化系统的更高水准的连接。这种连接可以显着提高生产力并提高自动化设备的投资收益。

- 工业自动化技术的日益普及,尤其是在中国和印度,也促进了市场的成长。大型电子契约製造製造商已经开始实现业务自动化。为了满足日益增长的电动和混合动力汽车需求,大型电池製造设施也正在建设中。工业自动化的需求预计将推动系统整合商市场的发展。

- 此外,2022 年 6 月,加速运算技术领导者 READY Robotics 宣布对软体定义自动化先驱 Robotics 进行策略性投资。几十年来,机器人供应商之间的软体孤岛一直制约着製造业的发展。机器人技术透过标准介面打破了这一障碍,简化了企业部署并大幅扩展了自动化产业的市场机会。

- SCADA 系统是工业流程的支柱,可协助组织满足现代需求。例如,横河马达专注于SCADA的发展,以实现SCADA应用的高性能、高可用性、广泛的扩充性和平台独立性。因此,企业可从横河马达的 SCADA 软体 (Fast/Tools)、一套全面且完全整合的 SCADA 应用程式以及公司的强大功能和灵活性中获益。预计各行业将越来越多地采用此类工具将推动全球对系统整合商的需求。

- 此外,工业IoT的采用是一个成熟的过程,随着企业从基本的机器连接到分析、自动化和边缘运算等先进方法,它们将获得越来越多的利益。随着企业意识到采用 IIoT 的好处越来越大,73% 的技术采用者预计将在未来 12 个月内增加投资,其中运输业和製造业将紧随石油和天然气行业之后。用户期望未来几年的持续投资将带来自动化和即时监控等业务重点的实现。

北美占据主要市场占有率

- 预计北美将占据整个系统整合商市场的大部分份额。该地区人力资源稀缺,处理复杂流程的熟练人力成本高。因此,各公司越来越多地实现其製造工厂的自动化。

- 由于技术进步,北美在工业自动化市场竞争激烈,美国是一个在工业运作中采用先进技术的已开发国家。随着5G无线技术日益普及,各产业的自动化解决方案也越来越普遍。此外,随着扩增实境(AR)和虚拟实境(VR)的需求不断增长,工业自动化和物联网市场也不断扩大。

- 2022 年 3 月,OMRON自动化美国公司宣布已将 RAMP Inc. 加入其认证系统整合商计画中。 RAMP 是一家开发客自订自动化和机器人系统的技术开发公司。该公司帮助客户利用 IIOT 改造工厂并安全有效地整合机器人技术。

- 此外,该地区对机器人技术的使用也日益增多。通用机器人解决方案的全球先驱 Flexiv 和领先的机械製造和系统整合公司 Cardinal Machines 于 2023 年 5 月宣布建立新的合作关係。 Flexiv 将为 Cardinal 提供实施业界领先的力感和 AI 机器人系统所需的工具。打磨、抛光、堆迭和精细组装等以前需要手工劳动的任务现在可以完全自动化。

系统整合商行业概况

由于国内、区域和国际上存在各种参与者,系统整合商市场比较分散。此外,其他参与者的收购也加剧了市场竞争。主要企业是 John Wood Group Plc、Tesco Controls Inc. 和 Prime Controls, LP。为了维持市场竞争力,顶尖公司推出各种创造性产品进行竞争。为了满足各行业的需求,市场主要企业正在采取各种方法。在市场上,伙伴关係、协作和收购是两种主要的发展策略。

- 2023 年 6 月 - OSARO SightWorks 是电子商务机器学习机器人领域的先驱,现在可供系统整合商和第三方物流公司 (3PL) 使用,为履约业务提供独特的解决方案。这包括挑选、卸垛、引导、配套和其他自动化任务。透过执行此活动,解决方案提供者可以为其客户的系统提供提高生产力的新功能。此外,它将大大扩大 OSARO 在蓬勃发展的电子商务领域的影响力。

- 2022 年 1 月 – Proud Automation 已加入北美移动工业机器人 (MiR) 认证系统整合商名单。 RG Group 的子公司 Proud Automation 已被认可为行动工业机器人 (MiR) 的认证系统整合商,MiR 是北美领先的自主移动机器人製造商。此外,MiR AMR 的采用正以惊人的速度加速,公司已准备好满足客户的需求。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

第五章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 驱动程式

- 数位转型和工业 4.0 计划

- 限制因素

- 自动化和维护需要高投资

- 评估新冠肺炎对市场的影响

第六章 市场细分

- 按最终用户产业

- 石油和天然气

- 车

- 航太和国防

- 卫生保健

- 能源和电力

- 化工和石化

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- John Wood Group

- TESCO CONTROLS, INC.

- STADLER+SCHAAF

- Prime Controls, LP

- MAVERICK Technologies, LLC

- Adsyst Automation Ltd.

- George T. Hall Company

- Avanceon Ltd.

- Wunderlich-Malec Engineering, Inc.

- Burrow Global, LLC

第八章投资分析

第九章:市场的未来

The System Integrators Market size is estimated at USD 46.91 billion in 2025, and is expected to reach USD 62.34 billion by 2030, at a CAGR of 5.85% during the forecast period (2025-2030).

System Integrators specialize in conducting component subsystems together into a whole and ensuring that those subsystems function together. In today's era, manufacturing companies are introducing Flexible Manufacturing Systems (FMS) to break the classic trade-off between dependability and quality.

FMS reduces labor and process variability, improving the quality of the product, and consists of various production, material handling, and computer control modules. This further demands system integrators where the requirement of highly flexible control software makes it simple to integrate the machines with a system such as the PLC system and database.

Key Highlights

- The demand for low-cost and energy-efficient production processes drives the market. The industry sector is one of the largest end-use sectors in terms of final energy demand and greenhouse gas emissions. System integrators have been involved in many traditional efficiency improvement activities like a motor replacement, inverters installation, etc., which are strictly related to energy usage reduction. But system integrators can also help a company reduce its environmental impact through operations optimization.

- Connecting the information coming from the production plant and then crossing them with energy consumption information and point-of-sale (POS) details can provide reports that can help identify possible optimizations, whereas having all the information separate could not have been enlightening. Further, one can expect low-cost development tools and the necessary training and support by participating in the system integrator program.

- Further, the growing use of IoT in industrial automation drives the market. The automation systems integrators are equipped with opportunity because, in most businesses, the usage of IoT solutions is shifted from being handled by the IT department to operations, and due to an existing relationship between operations and system integrators, it will, therefore, be easy for systems integrators to cooperate with IIoT vendors.

- Due to the increasing use of the Internet of Things in industrial automation, there will be a wide range of opportunities for market expansion. The vast majority of businesses as well as the already-existing relationship between system integrators and market operations offer automation systems integrators a plethora of opportunity. The market players' growing need for flexible manufacturing suppliers also increases the likelihood that the system integrator business will grow favorably over the next years.

- In the current business environment, which is technology-driven, Big Data stands as one of the primary drivers of manufacturers' productivity and efficiency. With the high rate of adoption of connected devices and sensors and the enabling of M2M communication, there has been a massive increase in the data points generated in the manufacturing industry.

System Integrators Market Trends

Advancement of the Industrial Internet of Things (IIoT)

- Implementing automation technologies such as IIoT enables power plant operators to collect real-time data and remotely monitor equipment to improve production efficiency and detect future problems. Running turbines, reciprocating engines, and solar cells/panels efficiently are possible. Power distribution systems improve uptime, lower costs, improve data collection, improve alarm and monitoring systems, and enable autonomous problem resolution.

- The IIoT is driving higher levels of connectivity in factories, especially in robotic automation systems. This connectivity enables significant productivity improvements and enhances return on investment in automation equipment.

- The increased adoption of industrial automation technologies, particularly in China and India, has also contributed to market growth. Major electrical product contract manufacturers have already begun to automate their operations. Massive battery manufacturing facilities are also being built to meet the growing demand for electric and hybrid vehicles. The need for industrial automation is expected to bolster the system integrator market.

- Furthermore, in June 2022, READY Robotics, the leader in accelerated computing technology, announced a strategic investment in Robotics, the pioneers in software-defined automation. For decades, software silos between robot vendors have constrained manufacturing. It has broken down those barriers with a standard interface that simplifies enterprise deployment and significantly expands the market opportunity for the automation industry.

- SCADA systems are at the root of industrial processes, assisting organizations in meeting modern demands. Yokogawa, for example, focuses on SCADA evolution to deliver high performance, high availability, broad scalability, and platform independence in their SCADA applications. As a result, organizations benefit from Yokogawa's SCADA software (Fast/Tools), a comprehensive, fully-integrated SCADA application suite, and the company's power and flexibility. Increasing adoption of such tools across industries is anticipated to boost the global demand for system integrators.

- Further, the adoption of industrial IoT is a maturation process in which businesses gain increasing levels of benefit as they progress from basic machine connectivity to advanced approaches such as analytics, automation, and edge computing. As organizations realize the growing benefits of implementing IIoT, 73% of technology adoption expect their investment to increase in the next 12 months, with transportation and manufacturing leading O&G. Users anticipate increased achievement of business priorities such as automation and real-time monitoring as a result of this ongoing investment over the coming years.

North America to Hold a Significant Market Share

- North America is anticipated to hold a significant share of the overall system integrator market. Human resources are scarce in the region, and skilled resources for complex processes are expensive. As a result, companies have increased automation in their manufacturing plants.

- Due to technological advancements, North America has been highly competitive in the industrial automation market, with the United States being a developed country that accepts advanced technologies for industrial operations. Automation solutions across industries are becoming more prevalent as 5G wireless technology becomes more widely available. Furthermore, as demand for augmented reality (AR) and virtual reality (VR) grows, the industrial automation and IoT markets are expanding.

- In March 2022, Omron Automation Americas announced that it had added RAMP Inc. to its Certified System Integrator plan. RAMP is a technology development firm that creates custom automation and robotic systems. It enables customers to use IIOT to transform their factories and integrate robotics safely and effectively.

- Additionally, the region is witnessing a rise in the use of robotic technologies. For Flexiv, a global pioneer in general-purpose robotics solutions, and Cardinal Machine, a major player in machine building and systems integration, announced their new collaboration in May 2023. Flexiv will give Cardinal the tools necessary to implement robotic systems that make use of industry-leading force sensitivity and AI. It will be possible to fully automate operations like sanding, polishing, palletizing, and delicate assembling that would traditionally need manual labor.

System Integrators Industry Overview

The system integrator market is fragmented as various local, regional, and international players exist. Further, the players' acquisition is setting high market competitiveness. The key players are John Wood Group Plc, Tesco Controls Inc., Prime Controls, and LP. o stay competitive in the market, the top firms compete with a variety of creative goods. To meet demand originating from diverse industries, the market's top players are using a variety of methods. In the market, partnerships, collaborations, and acquisitions are the two main development tactics.

- June 2023 - OSARO SightWorks, a pioneer in machine learning-enabled robotics for e-commerce, is now accessible to system integrators and third-party logistics companies (3PLs) that provide distinctive solutions for fulfillment operations. This includes picking, depalletizing, induction, kitting, and other automated jobs. By taking this activity, solution providers can give clients' systems new capabilities that increase productivity. Additionally, it significantly expands OSARO's reach in the explosively growing e-commerce sector.

- January 2022 - Proud Automation has been added to North America's Mobile Industrial Robots (MiR) certified system integrators. Proud Automation, an RG Group subsidiary, has been named a Certified Systems Integrator by North America's leading manufacturer of autonomous mobile robots and Mobile Industrial Robots (MiR). Furthermore, the adoption of MiR AMRs is accelerating at an incredible rate, and companies are poised to meet customers' demands.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

5 MARKET DYNAMICS

- 5.1 Market Overview

- 5.2 Industry Attractiveness - Porter's Five Forces Analysis

- 5.2.1 Threat of New Entrants

- 5.2.2 Bargaining Power of Buyers/Consumers

- 5.2.3 Bargaining Power of Suppliers

- 5.2.4 Threat of Substitute Products

- 5.2.5 Intensity of Competitive Rivalry

- 5.3 Drivers

- 5.3.1 Digital Transformation and Industry 4.0 initiatives

- 5.4 Restraints

- 5.4.1 Requirement of High Investments for Automation Implementation and Maintenance

- 5.5 Assessment of the COVID-19 Impact on the Market

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Oil and Gas

- 6.1.2 Automotive

- 6.1.3 Aerospace and Defense

- 6.1.4 Healthcare

- 6.1.5 Energy & Power

- 6.1.6 Chemical and Petrochemical

- 6.1.7 Others

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 John Wood Group

- 7.1.2 TESCO CONTROLS, INC.

- 7.1.3 STADLER + SCHAAF

- 7.1.4 Prime Controls, LP

- 7.1.5 MAVERICK Technologies, LLC

- 7.1.6 Adsyst Automation Ltd.

- 7.1.7 George T. Hall Company

- 7.1.8 Avanceon Ltd.

- 7.1.9 Wunderlich-Malec Engineering, Inc.

- 7.1.10 Burrow Global, LLC