|

市场调查报告书

商品编码

1631621

西班牙电力:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030)Spain Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

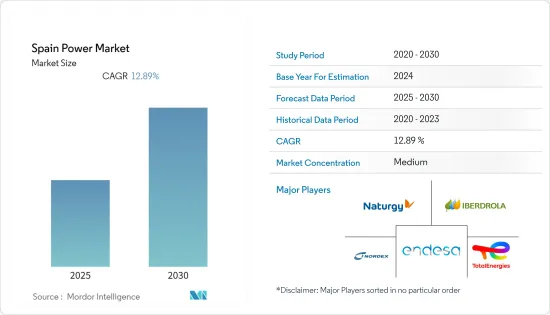

西班牙电力市场预计在预测期内复合年增长率为12.89%。

主要亮点

- 从中期来看,有利的政府政策和可再生能源发电的不断普及可能会支持西班牙电力市场在预测期内的成长。

- 另一方面,发电设备的高初始资本投资可能会阻碍研究期间的市场成长。

- 然而,再生能源来源与能源储存系统的日益普及预计将在未来的市场上创造一些商机。

西班牙电力市场趋势

可再生能源将成为重要部门

- 西班牙是一个快速发展的国家,采用太阳能和风力发电等再生能源来源。在西班牙,可再生能源发电主要是太阳能发电、风力发电、水力发电和生质能源能源发电。

- 根据国际可再生能源机构的数据,2022年西班牙可再生能源总设备容量装置容量为67.9GW 2022。这比上年装置容量增加了9.5%以上。

- 此外,西班牙政府也制定了雄心勃勃的可再生能源部署目标。 2022年7月,政府宣布计划在2030年引入超过160GW的可再生能源。这将占可再生能源发电量的74%,到2050年将增加至100%。

- 由于雄心勃勃的可再生能源目标,各公司纷纷进入国内可再生能源市场。例如,2023年5月,西门子歌美飒宣布与可再生能源公司雷普索尔签署协议。雷普索尔将为西班牙帕伦西亚的六个风电场(总容量为200兆瓦)交付40台陆上风力发电机SG 5.0-145。

- 此外,西班牙政府也宣布计画在2025年逐步淘汰燃煤电厂,到2030年逐步淘汰石油电厂,到2035年终核能发电厂。随着这些能源来源的逐步淘汰,对可再生能源的需求预计将大幅增加,以补充逐步淘汰的发电资源,同时满足国内不断增长的电力需求。

- 鑑于上述情况,可再生能源很可能在预测期内主导西班牙电力市场。

政府扶持政策带动市场

- 预计政府支持政策将在预测期内推动西班牙电力市场的发展。由于人口增长和基础设施发展活动,该国的电力需求不断增加。

- 据西班牙输电公司Red Electrica de Espana称,该国2022年发电能力较2021年成长6%以上。 2022年总发电量为276.31兆瓦时。这表明该国的电力需求正在增加。

- 该国大部分发电能力来自水力发电和复合迴圈发电。然而,近年来可再生能源发电量显着增加,到2022年将占全国总发电量的近43%。

- 此外,2023年4月,该国宣布正在准备向欧盟委员会提交的提案。该国正在考虑改革电力市场,旨在降低消费者的电费。 2022年,由于俄罗斯和乌克兰之间的衝突影响了整个欧洲的天然气供应,价格创下历史新高。

- 我们也致力于进一步扩大发电能力,透过从邻国进口电力和进口天然气发电来实现能源独立。

- 例如,2023年3月,西班牙电力部、能源转型和市政部宣布核准法国能源公司TotalEnergies SA提案的3GWp太阳能发电工程。太阳能发电工程将在马德里-穆尔西亚、安达卢西亚和西班牙其他地区开发。该计划预计将减少发电对进口石油和天然气产品的依赖。

- 综上所述,预计有利的政府政策将在预测期内推动市场。

西班牙电力产业概况

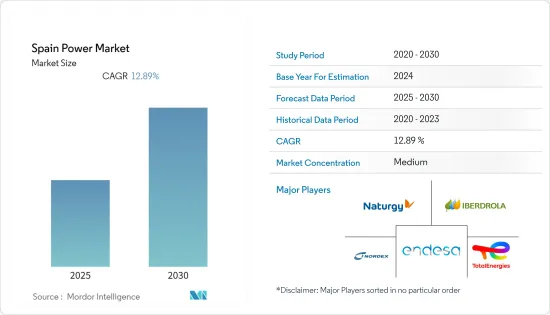

西班牙电力市场适度一体化。市场主要企业包括(排名不分先后)Endesa SA、Iberdrola SA、Naturgy Energy Group SA、Total Energies SE、Nordex SE 和 EDP Group。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2028 年之前的市场规模 (GW) 和需求预测

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 可再生能源併网

- 政府扶持政策

- 抑制因素

- 基础设施成本高

- 促进因素

- 供应链分析

- PESTLE分析

第五章市场区隔

- 发电源

- 热感的

- 水力发电

- 核能

- 可再生能源

- 输配电

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Endesa SA

- Iberdrola SA

- Naturgy Energy Group SA

- Total Energies SE

- Nordex SE

- EDP Group

- Grupo Red Electrica

- ABO Wind AG

第七章 市场机会及未来趋势

- 结合再生能源来源和能源储存系统

简介目录

Product Code: 72374

The Spain Power Market is expected to register a CAGR of 12.89% during the forecast period.

Key Highlights

- Over the medium term, favorable government policies and increasing penetration of renewable energy in power generation will likely support Spain's Power Market growth during the forecast period.

- On the other hand, factors such as high initial capital investments for power-generating equipment are likely to hinder market growth during the study period.

- Nevertheless, an increase in the adoption of renewable energy sources coupled with energy storage systems is expected to create several opportunities for the market in the future.

Spain Electricity Market Trends

Renewable Expected to be a Significant Sector

- Spain is a quickly growing country adopting renewable energy sources like solar and wind energy. In Spain, renewable energy sources are primarily solar, wind, hydropower, and bioenergy power generation sources.

- According to International Renewable Energy Agency, in 2022, Spain's total installed renewable energy capacity was around 67.9 GW 2022. It increased by over 9.5% compared to the previous year's installed capacity.

- Furthermore, the government of Spain contains an ambitious renewable energy installation target. In July 2022, the government announced its plans to install more than 160 GW of renewable energy sources by 2030. It will comprise 74% of electricity generation through renewable energy sources and 100% through 2050.

- Due to the ambitious renewable energy targets, various companies entered the renewable energy market in the country. For instance, in May 2023, Siemens Gamesa announced that it had signed agreements with renewable energy company Repsol. It is to deliver its 40 SG 5.0-145 onshore wind turbine products for 6 wind farms in Palencia in, Spain, with a total wind generating capacity of 200 MW.

- Furthermore, the Government of Spain announced plans for decommissioning coal power plants by 2025, oil power plants by 2030, and nuclear power plants by the end of 2035. With the decommissioning of these energy sources, the demand for renewable energy is expected to increase significantly to make up for the decommissioned power-generating sources while matching the increasing demand for electricity in the country.

- Therefore, according to the above points, renewable energy sources will likely dominate the Spain power market during the forecasted period.

Supportive Government Policies to Drive the Market

- The supportive government policies are expected to drive the power market for Spain during the forecasted period. The country's electricity demand constantly rose due to the increasing population and infrastructure development activities.

- According to the Red Electrica de Espana, Spain's electricity transmission company, the country's electricity production capacity in 2022 increased by more than 6% compared to 2021. In 2022 the total power production was 276.31 Terra-Watthours. It signifies the increasing power demand in the country.

- The country's power generating capacity derives most power through hydraulic and combined cycle power generating sources. However, the renewable energy capacity increased significantly in recent years, and in 2022, they comprised almost 43% of the total electricity generation in the country.

- Additionally, in April 2023, the country announced they are preparing a proposal to present to the European Commission. It will look to reform its electricity market, which is looking to decrease the electricity prices for the consumer. It is at an all-time high in 2022 due to the Russia-Ukraine conflict, which affected the gas supply throughout Europe.

- The country is also working on further expanding its electricity generation capacity to gain energy independence from importing electricity through neighboring countries and importing natural gas for electricity generation.

- For instance, in March 2023, the Spanish power ministry, the Ministry of Energy Transition and Autonomous Communities, announced the approval of its 3 GWp solar energy project proposed by the French energy company TotalEnergies SA. The solar energy project will be developed in Madrid Murcia, Andalusia, and various other locations in Spain. The project is expected to reduce dependency on imported oil and gas products for power generation.

- Therefore, according to the above points, favorable government policies are expected to drive the market during the forecasted period.

Spain Electricity Industry Overview

The Spain power market is moderately consolidated. The key players in the market (in no particular order) include Endesa SA, Iberdrola SA, Naturgy Energy Group SA, Total Energies SE, Nordex SE, and EDP Group, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in GW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Integration of Renewable Energy

- 4.5.1.2 Supportive Government Policies

- 4.5.2 Restraints

- 4.5.2.1 High infrastructure costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Power Generation Source

- 5.1.1 Thermal

- 5.1.2 Hydroelectric

- 5.1.3 Nuclear

- 5.1.4 Renewable

- 5.2 Power Transmission and Distribution

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Endesa S.A

- 6.3.2 Iberdrola SA

- 6.3.3 Naturgy Energy Group S.A

- 6.3.4 Total Energies SE

- 6.3.5 Nordex SE

- 6.3.6 EDP Group

- 6.3.7 Grupo Red Electrica

- 6.3.8 ABO Wind AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Coupling of Renewable Energy Sources with Energy Storage Systems

02-2729-4219

+886-2-2729-4219