|

市场调查报告书

商品编码

1631639

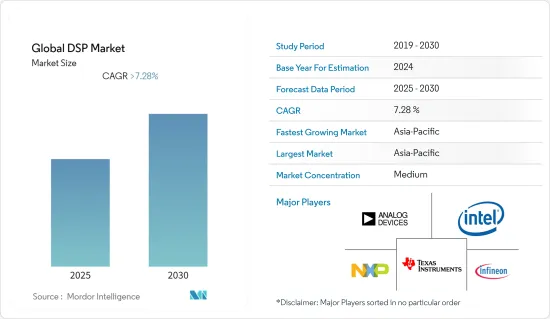

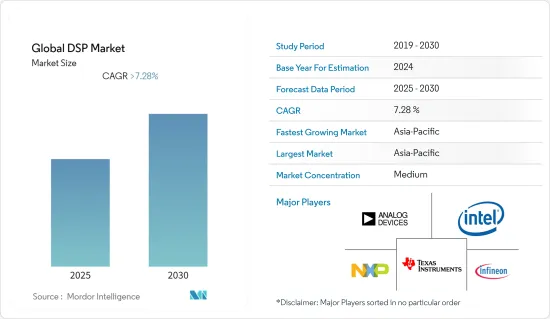

全球 DSP -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Global DSP - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

全球DSP(数位讯号处理器)市场预计在预测期内复合年增长率将超过7.28%

主要亮点

- 在行动电话产业,大多数客户使用智慧型手机。智慧型手机用户数将从2020年的60.2亿增加到2021年的63.7亿。此外,根据爱立信和 Radicati Group 的预测数据,到 2025 年,智慧型手机用户数量预计将增加至 73.3 亿。行动装置是采用数位讯号处理器的主要设备,其成长预计将在预测期内进一步扩大数位讯号处理器的市场规模。

- 此外,资料流量的增加以及用于视讯监控的网际网路通讯协定(IP)摄影机等技术的使用预计将导致全球产品需求的增加。此外,由于其成本优势,数位讯号处理日益成为开发高性能通讯系统的关键技术。

- 然而,由于具有挑战性的即时限制,在比较数位讯号处理处理器的品质时,效能一直是最重要的参数,但这种情况在过去 20 年里发生了变化。随着数位讯号处理器迅速从军事应用转向笔记型电脑、智慧型手机和 CD参与企业等便携式设备中的低成本应用,功耗和成本成为选择数位讯号处理器的关键参数。

- 此外,新冠肺炎 (COVID-19) 对行动装置市场的影响不大。此外,疫情可能会改变人们对当前全球製造业供应链的看法,导致价值链更加本地化和进一步区域化,以在短期内最大限度地减少类似风险。

- 疫情导致的消费者支出下降,导致智慧型手机销售下降到一定程度,短期内也减少了对数位讯号处理器的需求。可支配所得减少主要是因为疫情对经济状况的负面影响。

数位讯号处理器市场趋势

扩大在汽车产业的应用

- 数位讯号处理器广泛应用于汽车产业,製造车辆监控设备和车辆零件。定位服务供应商在远距离诊断系统、对准系统和智慧交通系统中使用这些处理器来微调引擎性能、追踪车辆和控制交通流量。

- 数位讯号处理器通常用于需要讯号处理性能的车载资讯娱乐系统和控制系统。这些处理器包括特殊功能,例如高记忆体频宽、快速乘法累加硬体以及组合多个操作的指令。

- 此外,不断提高的安全要求正在推动汽车中安装数位讯号处理器控制的煞车、防撞系统和安全气囊。因此,它有助于市场的成长。

- 汽车业首当其衝,乘用车需求和投资大幅下降。根据OICA公布的资料,2020年全球乘用车销量为5,390万辆,而前一年为6,400万辆。然而,从2021年开始,该行业呈现出积极的成长趋势。

亚太地区在预测期间内复合年增长率最高

- 亚太数位讯号处理器市场预计将在预测期内快速成长。该地区是电子製造的主要市场,数位讯号处理器在电子行业的广泛使用预计将推动该地区数位讯号处理器市场的成长。

- 印度、中国、日本和韩国等国家对智慧型手机的庞大需求鼓励许多供应商在该地区设立生产设施。容易取得的原材料以及较低的设置和人事费用也激励公司在该地区建立生产。除了製造优势外,强劲的需求和快速成长也推动行动电话企业在亚太地区设立生产设施。该地区行动电话营运商的扩张预计将进一步推动数位讯号处理器的需求并加强该地区市场的成长。

- 由于印度拥有庞大的行动电话消费群体,预计行动电话产值将从2021财年的3,000万美元增加到2026财年的1.26亿美元。

- 中国是汽车生产的世界领导者,开发下一代汽车的投资和扩张正在促进市场成长。 2021年8月,本田宣布计画在中国增加电动车和其他新能源车的产能。本田将透过合资公司投资约30亿元人民币,扩大在广州的现有工厂。

- 因此,由于上述因素,亚太地区的收益占有率预计在预测期内的成长速度将快于其他地区。

数位讯号处理器产业概述

全球DSP市场竞争温和,主要厂商包括德州仪器公司、英特尔公司、Analog Devices Inc.、英飞凌科技公司和恩智浦半导体公司。从市场占有率来看,目前很少大型企业占据市场主导地位。然而,许多公司正在透过创新和技术进步赢得新契约并开发新市场来扩大其市场份额。

- 2022 年 1 月,英飞凌科技股份公司宣布推出全新 AURIX TC4x 系列 28 奈米微控制器 (MCU),适用于下一代电动车、ADAS、汽车 E/E 架构和经济实惠的人工智慧。全新 AURIX TC4x 系列透过新一代 TriCore 1.8 和 AURIX 加速器套件实现了可扩展的效能改进。它由一个新的平行处理单元 (PPU) 和一个 SIMD 向量数位讯号处理器组成,可满足多种人工智慧拓扑的需求。

- 2021 年 12 月,ADI 公司宣布推出突破性的 RadioVerse系统晶片(SoC) 系列 ADRV9040。提供8路发射与接收,400MHz频宽,支援载波数位下变频(CDDC)、载波数位上变频(CDUC)、数位预失真(DPD)、波峰因数降低(CFR)等,融合先进的数位讯号处理能力。这种讯号处理扩展预计将消除对现场可编程闸阵列 (FPGA) 的需求,从而减少热足迹以及整个系统的重量、尺寸、功耗和成本。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争强度

- 产业价值链分析

- COVID-19 市场影响评估

第五章 五种市场动态

- 促进因素

- 无线基础设施的重大发展

- 对 VoIP 和 IP 视讯的需求不断增长

- 连网型设备的普及

- 抑制因素

- 高复杂性和初始开发成本

- 效能、功耗和价格权衡

第六章 市场细分

- 按核心

- 单核

- 多核心

- 按最终用户产业

- 通讯

- 车

- 家用电子电器

- 工业的

- 航太/国防

- 医疗保健

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章 竞争格局

- 公司简介

- Texas Instruments Inc.

- Intel Corporation

- Analog Devices Inc.

- Infineon Technologies AG

- NXP Semiconductors NV

- Renesas Electronics Corp.

- Xilinx Inc.

- Broadcom Inc.

- Toshiba Corp.

- Samsung Electronics Co. Ltd.

- STMicroelectronics NV

- Cirrus Logic Inc.

第八章投资分析

第九章 市场机会及未来趋势

第10章 关于出版商

The Global DSP Market is expected to register a CAGR of greater than 7.28% during the forecast period.

Key Highlights

- Within the mobile phone industry, a major portion of customers uses smartphones. The number of smartphone users increased from 6.02 billion in 2020 to 6.37 billion in 2021. Further, based on forecast figures by Ericsson and The Radicati Group, smartphone users are expected to increase to 7.33 billion by 2025. Mobile devices are the major adopters of digital signal processors, and their growth is further anticipated to boost the market size for digital signal processors during the forecast period.

- Additionally, an increase in data traffic and the usage of technologies such as Internet Protocol (IP) cameras for video surveillance are expected to boost product demand worldwide. Moreover, due to its cost benefits, digital signal processing has grown as the leading technology for developing high-performance communication systems.

- However, due to challenging real-time limitations, although performance has always been the most critical parameter for digital signal processor quality comparison, the past two decades have seen a drift. Through the rapid migration of digital signal processors from military applications to low-cost applications in portable devices such as laptops, smartphones, and CD players, power consumption and cost have become crucial parameters when selecting a digital signal processor.

- Further, the effect of COVID-19 on the mobile devices market has been moderate. Moreover, the pandemic changed the perception of the current global supply chain in manufacturing, potentially leading to more localized value chains and further regionalization to minimize similar risks shortly.

- The decline in consumer spending owing to the pandemic has led to a decline in smartphone sales to a certain level, which has eventually declined the demand for digital signal processors on a short-term basis. The decline in disposable income is mainly due to the negative effect of the pandemic on economic conditions.

Digital Signal Processor Market Trends

Growing Applications in Automotive Industry

- Digital signal processors find widespread usage in the automotive sector for manufacturing vehicle surveillance equipment and vehicle parts. Location-based service vendors use these processors for remote diagnostic systems, alignment systems, and intelligent transportation systems to fine-tune engine performance, track vehicles, and control traffic flow.

- Digital signal processors are often used in in-cabin infotainment systems and in control systems, which have demanding signal-processing performance needs. These processors involve specialized features such as high memory bandwidth, fast multiply-accumulate hardware, and instructions that combine multiple operations.

- Further, an increase in the requirement for safety boosts the usage of digital signal processor-controlled braking, collision avoidance systems, and airbags in vehicles. Thus, contributing to the growth of the market.

- The automotive industry has faced the brunt of the pandemic, with an exponential decline in demand for passenger vehicles and investments. According to the data published by OICA, in 2020, the number of passenger cars sold across the world stood at 53.9 million, which was 64.0 million during the previous year. However, the industry has been witnessing a positive growth trend since 2021.

APAC to Register Highest CAGR in Market During Forecast Period

- The digital signal processor market in the Asia-Pacific region is expected to increase rapidly during the forecast period. The region is a major market for electronics manufacturing and extensive usage of digital signal processors in the electronics industry, which is expected to fuel the growth of the digital signal processor market in the region.

- Significant demand for smartphones from countries such as India, China, Japan, and South Korea, are encouraging many vendors to set up production facilities in the region. The availability of raw materials and the low establishment and labor costs have also motivated companies to establish their regional production centers. Along with manufacturing benefits, the strong demand and rapid growth are also influencing mobile phone companies to set up their production facilities in the Asia Pacific. Expanding mobile phone companies in the region are further anticipated to drive the demand for digital signal processors and strengthen regional market growth.

- India has a large consumer base for mobile phones; hence the production of mobile handsets is further slated to increase in value from USD 30 million in FY 21 to USD 126 million in FY 26, as stated by Invest in India, the National Investment Promotion and Facilitation Agency of the Government of India.

- China is a global leader in automotive production, and the growing investments and expansions in the sector in developing the next-generation vehicles are contributing to the market growth. In August 2021, Honda motor announced plans to ramp up its capacity to build electric cars and other new-energy vehicles in China. Honda will invest around 3 billion yuan through a joint venture to expand an existing factory in Guangzhou.

- Thus, owing to the aforementioned factors, the revenue share from Asia-Pacific is anticipated to grow faster than the other geographical regions during the forecast period.

Digital Signal Processor Industry Overview

The Global DSP Market is moderately competitive and consists of several major players such as Texas Instruments Inc., Intel Corporation, Analog Devices Inc., Infineon Technologies AG, NXP Semiconductors NV, etc. In terms of market share, few major players currently dominate the market. However, many companies are increasing their market presence by securing new contracts and tapping new markets with innovations and technological advancements. Some of the recent developments in the market are:

- In January 2022, Infineon Technologies AG introduced a new AURIX TC4x family of 28 nm microcontrollers (MCUs) for next-generation eMobility, ADAS, automotive E/E architectures, and affordable AI applications. The new AURIX TC4x family features the next-generation TriCore 1.8 and scalable performance improvements from the AURIX accelerator suite. This comprises the novel parallel processing unit (PPU), a SIMD vector digital signal processor that addresses several AI topologies' demands.

- In December 2021, Analog Devices, Inc. introduced a breakthrough RadioVerse System-on-Chip (SoC) series, ADRV9040. It offers eight transmit and receive channels of 400MHz bandwidth and incorporates advanced digital signal processing functions, such as carrier digital down-converters (CDDC), carrier digital up-converters (CDUC), and digital pre-distortion (DPD), and crest factor reduction (CFR). This expanded signal processing is expected to eliminate the requirement of a field-programmable gate array (FPGA), thus reducing thermal footprint and total system weight, size, power, and cost.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitute

- 4.2.5 Intensity Of Competition Rivarly

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Significant developments in wireless infrastructure

- 5.1.2 Growing demand for VoIP and IP video

- 5.1.3 Rise in adoption of connected devices

- 5.2 Restraints

- 5.2.1 High complexity and initial development costs

- 5.2.2 Trade-off between performance, power consumption, and price

6 MARKET SEGMENTATION

- 6.1 By Core

- 6.1.1 Single-core

- 6.1.2 Multi-core

- 6.2 By End-user Industry

- 6.2.1 Communication

- 6.2.2 Automotive

- 6.2.3 Consumer Electronics

- 6.2.4 Industrial

- 6.2.5 Aerospace & Defense

- 6.2.6 Healthcare

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Texas Instruments Inc.

- 7.1.2 Intel Corporation

- 7.1.3 Analog Devices Inc.

- 7.1.4 Infineon Technologies AG

- 7.1.5 NXP Semiconductors NV

- 7.1.6 Renesas Electronics Corp.

- 7.1.7 Xilinx Inc.

- 7.1.8 Broadcom Inc.

- 7.1.9 Toshiba Corp.

- 7.1.10 Samsung Electronics Co. Ltd.

- 7.1.11 STMicroelectronics N.V.

- 7.1.12 Cirrus Logic Inc.