|

市场调查报告书

商品编码

1632027

感测器和致动器:全球市场占有率分析、行业趋势和统计、成长预测(2025-2030)Global Sensors and Actuators - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

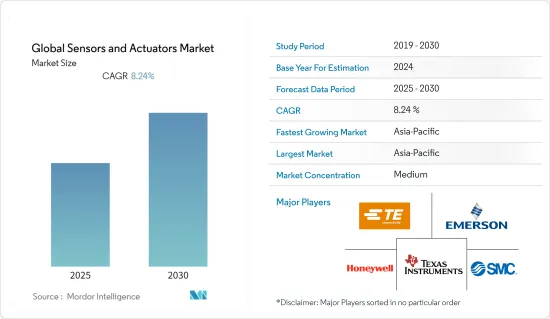

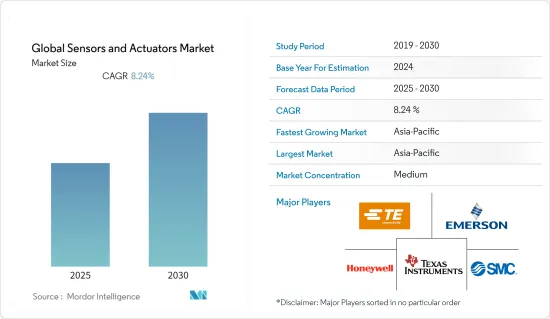

预计全球感测器和致动器市场在预测期内的复合年增长率为 8.24%。

主要亮点

- 工厂自动化产业旨在透过结合製造的数位和实体方面(方面感测器和致动器)来实现彻底变革并提供最佳性能。此外,对实现精益製造和缩短时间的关注正在加速感测器和致动器市场的成长。

- 离散製造业和流程工业中生产系统的自动化程度不断提高,对能够提供与生产过程相关的关键资料的组件的需求也不断增加。这些感测器透过检测金属物体的存在和位置来促进工厂的製程控制。

- 电动致动器是包括物联网在内的各种工业应用的标准选项,可将能量转换为机械扭矩。与其他致动器类型相比,电能在运作过程中噪音较小。电动致动器不需要流体来驱动并且是可程式设计的,可以实现精确的定位控制。这些致动器优于气动致动器,因此预计需求在不久的将来会增加。

- 气动致动器需要手动设定和调节,要获得准确的速度和位置回馈相对困难。相比之下,编码器整合到电动致动器中,可以实现更精确的运动。

- 在利用现有半导体专业知识开发新感测器和致动器模式的支援下,小型化正在推动感测器和致动器市场的发展。

感测器和致动器市场趋势

自动化和工业 4.0 的出现

- 感测器和致动器是工业自动化系统不可或缺的一部分,因为它们有助于实现精度和效率。使用感测器和致动器的运动控制技术的需求在工厂和工业自动化系统中发挥重要作用。

- SCADA(监控和资料采集)组件包括感测器和致动器。 SCADA 系统包括部署在现场收集即时资料的组件和相关系统,以实现资料收集和增强工业自动化。

- 伺服马达伺服俱有马达的功能,是实现传统的高速、高精度工厂自动化的重要零件。

- 此外,工业机器人在工业自动化的应用也不断进步。感测器和致动器是这些机器人的关键部件之一。中国、美国、日本在引进工业机器人方面走在前面。为了因应不断增长的需求,市场上的公司也在推出机器人专用产品。

- 例如,2022年4月,科尔摩根宣布了一项新技术,可以简化协作机器人、工业机器人、航太和国防机器人以及其他机器人的设计,同时在更轻、更紧凑的封装中提供更好的性能,我们也宣布了新的TBM2G系列。

亚太地区预估复合年增长率最高

- 中国对工业现代化的政治推动正在创造对智慧感测器、无线感测网路、改进致动器等智慧製造产品的巨大需求。国际感测器和致动器技术供应商现在正转向中国,以满足中国製造业不断增长的需求。中国工业对高阶工具机、智慧感测器等技术有着庞大的需求。

- 印度正迅速加速几种新兴感测器和物联网技术的部署。该国提供了更大规模部署这些技术并带来规模经济的机会。基于物联网的先进机会和生态系统正在不断发展。印度政府正在采取措施,透过「印度製造」、「数位印度」和「智慧城市」等创新措施来推动新兴技术的采用。这些努力预计将进一步推动该国的感测器和致动器市场。

- 从长远来看,COVID-19 的影响将使在亚太地区运营的製造商能够采用工业 4.0 程序,变得更加敏捷并降低生产成本,如果类似事件再次发生,预计这将减少生产成本。

- 亚太地区长期以来一直是主要的製造中心,该行业继续积极采用物联网 (IoT)。根据 2022 年 2 月发布的微软物联网讯号报告,物联网现在在行业和全球整体得到更广泛的采用,其中智慧空间是亚太地区许多市场的重点关注点,成为主要应用之一。

感测器和致动器产业概述

全球感测器和致动器市场由多家国际公司经营,包括 TE Connectivity、德克萨斯、Honeywell国际、艾默生电气公司和 SMC 公司。

- 2021 年 9 月,主要企业TE Connectivity 收购了工厂自动化和汽车电子连接领域的主要企业ERNI Group AG (ERNI)。收购 ERNI 补充了 TE Connectivity 广泛的连接产品系列,专门生产用于汽车、工厂自动化和其他工业应用的高速和细间距连接器。

- 2021年8月,主要企业派克汉尼汾公司宣布收购航太和国防运动控制技术公司Meggitt PLC。 Meggitt PLC 总部位于英国考文垂,2020 年年销售额约 23 亿美元。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 自动化和工业 4.0 的出现

- 汽车产业需求增加

- 市场挑战

- 根据产品的不同,初始设备成本和安装/维护成本可能会增加。

第六章 市场细分

- 依产品类型

- 感应器

- 压力感测器

- 温度感测器

- 位置感测器

- 液位感测器

- 影像感测器

- 化学感测器

- 扭力感测器

- 致动器

- 使用电源类型

- 液压致动器

- 气动致动器

- 电动式致动器

- 磁致动器

- 机械致动器

- 操作类型

- 线性致动器

- 旋转致动器

- 感应器

- 按最终用户产业

- 车

- 卫生保健

- 石油和天然气

- 家电

- 製造业

- 航太/国防

- 其他最终用户产业(能源、水、用水和污水、采矿等)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- TE Connectivity

- Texas Instruments Inc.

- Honeywell International Inc.

- Bosch Sensortec GmbH

- Renesas Electronics Corporation

- Emerson Electric Co.

- SMC Corporation

- Flowserve Corporation

- Schlumberger Limited

- Parker-Hannifin Corporation

第八章投资分析

第9章市场的未来

简介目录

Product Code: 90887

The Global Sensors and Actuators Market is expected to register a CAGR of 8.24% during the forecast period.

Key Highlights

- The factory automation industry has been revolutionized by combining the digital and physical aspects of manufacturing, including sensors and actuators, which aim to deliver optimum performance. Further, the focus on achieving zero waste production and shorter time to market has augmented the sensors and actuators market growth.

- The rise in automation of production systems in both discrete and process industries has increased the demand for components capable of providing critical data related to the production process. These sensors facilitate process control in factories by detecting the presence and position of metal objects.

- Electric actuators, a standard option for various applications across industries, including IoT, convert energy into mechanical torque. Electric energy is considered less noisy in operation than other actuator types. Electric actuators don't require fluid to run, and they offer high-control precision positioning owing to programmability. These actuators are poised to witness increasing demand in the near future due to their advantages over pneumatic actuators.

- Manual setup and adjustment are required for pneumatic actuators, and it is relatively difficult to get precise feedback on their speed and position. In contrast, the encoder is embedded into the electric actuator enabling more precise movement.

- Miniaturization has been driving the sensors and actuators market, supported by the development of new sensor and actuator modalities by leveraging the available semiconductor expertise.

Sensors and Actuators Market Trends

Emergence of Automation and Industry 4.0

- Sensors and actuators are an integral part of the industrial automation system as they help achieve precision and efficiency. The need for motion control technologies using sensors and actuators plays a significant role in the factory and industrial automation systems.

- SCADA (supervisory control and data acquisition) components include sensors and actuators. SCADA systems include components deployed in the field to collect real-time data and related systems to allow data collection and enhance industrial automation.

- Servo motors have become an essential component for realizing factory automation where the servo motor itself functions as a sensor and the traditional high-speed and high-precision performance.

- Moreover, industrial robots have been increasingly utilized in industrial automation. Sensors and actuators are one of the key components of these robots. China, the United States, and Japan are at the forefront of industrial robots adoption. In response to the growing demand, market players also introduce robot-specific products.

- For instance, in April 2022, Kollmorgen announced a new TBM2G series of frameless servo motors having features that simplify the design of collaborative, industrial, aerospace and defense, and other robots while offering better performance in a lighter and more compact package.

Asia-Pacific is Expected to Grow with the Highest CAGR

- China's political push for industrial modernization creates a huge demand for smart manufacturing products, like smart sensors, wireless sensor networks, improved actuators, etc. International suppliers of sensors and actuator technologies are currently focusing on China to cater to growing demand from the country's manufacturing industry. China's industry has an enormous demand for high-end machine tools, smart sensors, and other technologies.

- India is fast accelerating the deployment of several emerging sensors and IoT technologies. The country provides an opportunity to deploy these technologies at a larger scale to bring economies of scale. Advanced IoT-based opportunities and ecosystems are developing consistently. The Indian Government is taking steps to push the adoption of emerging technologies with innovative initiatives, including Make in India, Digital India, Smart Cities, etc. These initiatives are expected to further boost the sensors and actuators market in the country.

- With the COVID-19 impact, in the long-term, it is expected that manufacturers operating in the Asia Pacific adopt Industry 4.0 procedures to become more agile and limit production and distribution shortfalls should an event similar to this ever happen again.

- The Asia-Pacific region has long been a major manufacturing base, and the industry continues to be a strong adopter of the Internet of Things (IoT). According to Microsoft IoT Signals Report published in February 2022, IoT is currently much more widely adopted across industry verticals, and across the world, with smart spaces, a significant focus for many markets in the Asia Pacific region, becoming one of the leading application areas.

Sensors and Actuators Industry Overview

The global sensors and actuators market is fragmented as numerous international companies, such as TE Connectivity, Texas Instruments Inc., Honeywell International Inc., Emerson Electric Company, and SMC Corporation, are operating.

- In September 2021, TE Connectivity, a leading company in connectivity and sensors, acquired ERNI Group AG (ERNI), a leading player in electronic connectivity for factory automation and automotive. The acquisition of ERNI complements TE Connectivity's wide connectivity product portfolio, specifically in high-speed and fine-pitch connectors for automotive, factory automation, and other industrial applications.

- In August 2021, Parker Hannifin Corporation, a leading market player in motion and control technologies, announced the acquisition of Meggitt PLC, a company operating in aerospace and defense motion and control technologies. In Coventry, United Kingdom, Meggitt PLC had approximately USD 2.3 billion in annual revenue in annual revenue in 2020.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of Automation and Industry 4.0

- 5.1.2 Increasing Demand from Automotive Industry

- 5.2 Market Challenges

- 5.2.1 Higher Initial Equipment Cost coupled with Installation and Maintenance Costs for Some Products

6 MARKET SEGMENTATION

- 6.1 Product Type

- 6.1.1 Sensors

- 6.1.1.1 Pressure Sensors

- 6.1.1.2 Temperature Sensors

- 6.1.1.3 Position Sensors

- 6.1.1.4 Level Sensors

- 6.1.1.5 Image Sensors

- 6.1.1.6 Chemical Sensors

- 6.1.1.7 Torque Sensors

- 6.1.2 Actuators

- 6.1.2.1 Type of Power Used

- 6.1.2.1.1 Hydraulic Actuators

- 6.1.2.1.2 Pneumatic Actuators

- 6.1.2.1.3 Electrical Actuators

- 6.1.2.1.4 Magnetic Actuators

- 6.1.2.1.5 Mechanical Actuators

- 6.1.2.2 Type of Motion

- 6.1.2.2.1 Linear Actuators

- 6.1.2.2.2 Rotary Actuators

- 6.1.1 Sensors

- 6.2 End-user Industry

- 6.2.1 Automotive

- 6.2.2 Healthcare

- 6.2.3 Oil & Gas

- 6.2.4 Consumer Electronics

- 6.2.5 Manufacturing

- 6.2.6 Aerospace & Defense

- 6.2.7 Other End-user Industries (Energy, Water & Wastewater, Mining, etc.)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 TE Connectivity

- 7.1.2 Texas Instruments Inc.

- 7.1.3 Honeywell International Inc.

- 7.1.4 Bosch Sensortec GmbH

- 7.1.5 Renesas Electronics Corporation

- 7.1.6 Emerson Electric Co.

- 7.1.7 SMC Corporation

- 7.1.8 Flowserve Corporation

- 7.1.9 Schlumberger Limited

- 7.1.10 Parker-Hannifin Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219