|

市场调查报告书

商品编码

1632064

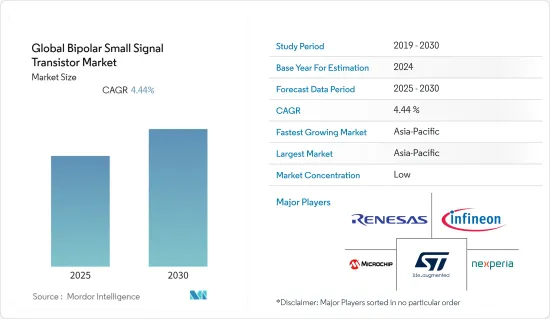

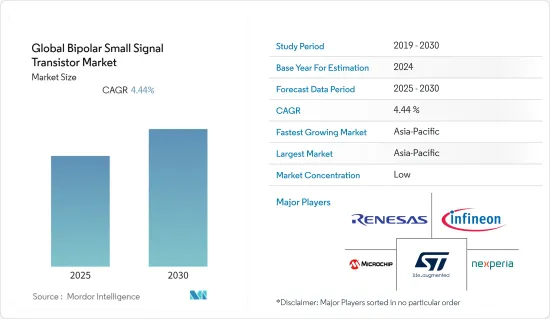

全球双极小讯号电晶体市场:市场占有率分析、产业趋势、成长预测(2025-2030)Global Bipolar Small Signal Transistor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

全球双极小讯号电晶体市场预计在预测期内复合年增长率为4.44%。

许多类型的晶体管用于电动车的生产。近年来汽车产业的成长显着推动了所研究市场的成长。例如,根据国际能源总署(IEA)的数据,2021年电动车销量比2020年翻一番,达到660万辆。 2021年,电动车将占全球汽车市场约9%,市场占有率较两年前增加一倍以上。

考虑到其潜力,汽车产业对所研究市场的成长做出了重大贡献。供应商越来越注重开发适用于汽车领域的产品。例如,ONSemi 的 MMBT6521L 是一款 NPN 双极小讯号电晶体,专为线性和开关应用而设计。

同样,电子元件和半导体装置的领先供应商罗姆提供各种封装的汽车双极晶体管,具有小讯号、薄型和高功率特性,以广泛覆盖该市场。

市场参与企业面临的主要挑战是继续应对电子设备小型化和晶体管尺寸缩小的成长趋势,同时保持组件的高性能效率。为了实现全部功能,必须在生产过程中引入电子束技术和X射线技术等新技术。必须建立先进的製造工厂,对生产商来说成本相当高。

COVID-19大流行减少了全球电子设备的总消费量,对双极小讯号电晶体市场产生了不利影响。由于供应链中断,疫情对全球製造业造成了严重影响。双极小讯号电晶体的各种最终用户已缩减其运作规模并受到影响。

双极小讯号电晶体市场趋势

消费性电子产品消费的增加推动市场成长

消费性电子产品的需求以及跨产业电子设备的使用不断增加,这对双极小讯号电晶体市场的成长产生了直接或间接的影响。双极小讯号电晶体用于整个消费性电子应用,例如智慧型手机、平板电脑、便携式消费性产品、线性和开关。

智慧型手机是该领域半导体的主要消费者,这些晶体管主要用于放大智慧型手机发送到基地台的讯号。因此,由于行动电话订阅数量的增加,行动电话使用量的增加预计将推动全球市场。例如,爱立信预计,到2027年终, 5G行动电话用户数将达到44亿。

这些趋势正在推动供应商开发满足消费性电子领域要求的产品。例如,东芝拥有丰富的双极电晶体产品阵容,从小讯号表面黏着技术微电晶体到引线型封装的高电流、低饱和度和超高速功率电晶体。

自COVID-19爆发以来,许多教育机构已经开始实施虚拟学习并提供线上课程。教育机构数位化的快速成长是推动个人电脑、笔记型电脑和平板电脑等设备成长的关键因素之一。因此,教育领域对电脑和周边设备不断增长的需求预计将对所研究市场的成长产生积极影响。

亚太地区预计将出现显着成长

由于经济的成长,亚太地区是晶体管市场成长最快的地区。中国、日本、韩国和印度是製造业、消费性电子产品和汽车等最终用户产业在过去几十年中显着成长的主要国家。

例如,中国政府推出了「中国製造2025」。这是一项由国家主导的工业计划,旨在使中国成为世界领先的高科技产品製造商之一。该计划旨在透过利用政府补贴、动员国有企业、寻求获取智慧财产权等方式来赶上并最终超越西方在先进领域的技术优势。

此外,全部区域工厂的快速自动化,机器人解决方案的使用也正在增加。例如,2021年3月,日本工业机器人製造商FANUC在其上海工厂投资260亿日圆。该投资是透过与当地企业上海电气集团成立的合资企业进行的。由于这些电晶体主要用作机器人内部的电子开关,因此预计在预测期内其需求将会增加。

此外,为了使电动车的成本与汽油车相当,政府呼吁根据印度(混合动力和)电动车的快速采用和製造计划对电动车提供支持和奖励。例如,根据 FAME India 计画的第二阶段,重工业部已批准在 25 个邦/联邦直辖区的 68 个城市设立 2877 个充电站。由于电动车服务站基础设施开发对电子设备的需求,预计这种趋势将对双极小讯号电晶体产生正面影响。

双极小讯号电晶体产业概况

双极小讯号电晶体市场竞争激烈,全球主要市场参与者众多。例如,意法半导体、瑞萨电子公司、英飞凌科技股份公司和 Microchip Technology Inc.WEE Technology Company Limited 等供应商提供双极小讯号电晶体,并在全球拥有重要影响力。为了在市场上脱颖而出,供应商专注于针对特定应用推出新产品。

2022 年 4 月 - 精密、高效能、小型讯号离散半导体设计商和製造商 Linear Integrated Systems, Inc. 宣布发布 2022 年小型讯号分立资料辑。 2022 年线性系统资料辑中包含双极单路和双路 NPN 和 PNP 电晶体产品

2021 年 7 月 - Nexperia 宣布推出九款新型功率双极电晶体。这些公告扩展了适用于 2A 至 8A、45V 至 100V 应用的热和电优势 DPAK 封装的产品系列。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 消费性电子产品的普及以及电子产品在工业领域的使用不断增加

- 汽车工业的成长

- 市场限制因素

- 平衡晶体管小型化和保持高性能

第六章 市场细分

- 按类型

- PNP

- NPN

- 按最终用户产业

- 製造业

- 汽车应用

- 通讯

- 家电

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 世界其他地区

第七章 竞争格局

- 公司简介

- STMicroelectronics

- Renesas Electronics Corporation

- Infineon Technologies AG

- Microchip Technology Inc.

- WEE Technology Company Limited

- Nexperia BV

- Semiconductor Components Industries, LLC

- Diodes Incorporated

- Central Semiconductor Corp

- National Instruments Corp

第八章投资分析

第9章市场的未来

The Global Bipolar Small Signal Transistor Market is expected to register a CAGR of 4.44% during the forecast period.

During the production of electric vehicles, many types of transistors are employed. The recent growth of the automotive industry is significantly driving the growth of the studied market. For instance, according to the International Energy Agency (IEA), Electric car sales doubled in 2021 compared to 2020 and reached 6.6 million. In 2021, electric automobiles accounted for approximately 9% of the worldwide car market, more than doubling their market share from two years earlier.

Considering the potential, the automotive industry is contributing significantly to the studied market's growth. The vendors are increasingly focusing on developing products that can have applications in the automotive sector. For instance, Onsemi's MMBT6521L is an NPN bipolar small signal transistor designed for linear and switching applications.

Similarly, to cover the market extensively, ROHM, a leading provider of electronic components and semiconductor devices, offers automotive bipolar transistors in various packages with the nature of small-signal, thin, and high-power.

The major challenge for market participants is keeping up with the growing trend of downsizing electronic devices and shrinking transistor sizes while maintaining high component performance efficiency. To attain full functioning, new technologies such as electron beam or x-ray technology will be required to be implemented in production processes. Advanced fabrication factories must be set up, which will be quite expensive for the producers.

The Covid-19 pandemic has negatively impacted the bipolar small signal transistor market by reducing the total global consumption of electronic devices. Due to supply chain disruptions, the pandemic has severely affected the global manufacturing sector. It has affected various end-users of bipolar small signal transistors by downsizing their businesses.

Bipolar Small Signal Transistor Market Trends

Increasing Consumption of Consumer Electronic Goods to Drive the Market Growth

The demand for consumer electronic products and the usage of electronics across industries has been increasing, directly or indirectly impacting the bipolar small signal transistor market to growth. Bipolar small-signal transistors are used throughout consumer electronics applications such as smartphones, tablets, portable consumer products, linear and switching, etc.

The smartphone is the major consumer of semiconductors in this segment as these transistors are used primarily for the amplification of signals the smartphone sends to the base station. Hence, with the number of mobile subscriptions growing, the increasing usage of mobile phones is anticipated to drive the global market. For instance, according to Ericsson, By the end of 2027, 5G mobile subscriptions are expected to reach 4.4 billion.

Such trends are encouraging the vendors to develop products that can fulfill the requirements of the consumer electronic sector. For instance, Toshiba offers an extensive lineup of bipolar transistors ranging from small-signal, surface-mounted, ultra-small transistors to power transistors with lead-type packages, including high current, low-saturation, and ultra-high-speed types.

Since the outbreak of COVID-19, many institutions have started implementing virtual learning methods and offering online courses. The surge in digitization in educational institutions is one of the key factors driving the increase in devices such as computers, laptops, and tablets. As a result, the increased demand for computers and peripherals in the education sector is expected to positively influence the growth of the studied market.

Asia-Pacific Region is Expected To Witness Significant Growth

Asia-Pacific is the fastest-growing transistor market because of the region's growing economy. China, Japan, South Korea, and India are among the major countries wherein the end-user sectors such as manufacturing, consumer electronics, and automotive have grown significantly over the past few decades.

For instance, the Chinese government has launched "Made in China 2025," a state-led industrial program to make China the world's leading manufacturer of high-tech goods. The program aims to leverage government subsidies, mobilize state-owned firms, and seek intellectual property acquisition to catch up to and eventually surpass Western technological superiority in sophisticated sectors.

Additionally, robotic solutions are increasingly being used, as factories across the region are fast becoming automated. For instance, in March 2021, Fanuc, a Japanese industrial robot manufacturer, invested JPY 26 billion in its Shanghai facility. The investment was made through a joint venture with Shanghai Electric Group, a local company. As these transistors are used inside robots primarily as electronic switches, the demand is expected to increase during the forecast period.

Furthermore, to bring the cost of electric vehicles at par with petrol vehicles, the government, under the Faster Adoption and Manufacturing of (Hybrid and) Electric Vehicles in India scheme, supports electric vehicles and demand incentives. For instance, under Phase II of the FAME India Scheme, the Ministry of Heavy Industries has sanctioned 2877 charging stations in 68 cities across 25 states/UTs. Such trends are expected to positively impact the bipolar small signal transistor, owing to the need for electronic devices in the infrastructural development for EV service stations.

Bipolar Small Signal Transistor Industry Overview

The bipolar small signal transistor market is competitive, with various global key market players. For instance, the majority of vendors such as STMicroelectronics, Renesas Electronics Corporation, Infineon Technologies AG, Microchip Technology Inc. WEE Technology Company Limited provide Bipolar small-signal transistors and are having significant global presence. To achieve market differentiation, the vendors focus on new product launches that deal with a specific application.

April 2022 - Linear Integrated Systems, Inc., a designer and manufacturer of precision, high-performance, small-signal discrete semiconductors, announced the release of its 2022 Small Signal Discrete Data Book. Bipolar Single and Dual NPN and PNP Transistors Products included in the 2022 Linear Systems Data Book.

July 2021 - Nexperia announced nine new power bipolar transistors. These recent announcements will extend the company's portfolio of products in the thermally and electrically advantageous DPAK package to cover applications from 2 A to 8 A and from 45 V up to 100 V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Proliferation of Consumer Electronics and Increased Use of Electronics in the Industrial Sector

- 5.1.2 Growth of the Automotive Sector

- 5.2 Market Restraints

- 5.2.1 Scaling Down the Size of Transistors and Simultaneously maintaining High Performance

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 PNP

- 6.1.2 NPN

- 6.2 By End-user Industry

- 6.2.1 Manufacturing

- 6.2.2 Automotive Applications

- 6.2.3 Communication

- 6.2.4 Consumer Electronics

- 6.2.5 Others

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 STMicroelectronics

- 7.1.2 Renesas Electronics Corporation

- 7.1.3 Infineon Technologies AG

- 7.1.4 Microchip Technology Inc.

- 7.1.5 WEE Technology Company Limited

- 7.1.6 Nexperia B.V

- 7.1.7 Semiconductor Components Industries, LLC

- 7.1.8 Diodes Incorporated

- 7.1.9 Central Semiconductor Corp

- 7.1.10 National Instruments Corp