|

市场调查报告书

商品编码

1632065

英国即时付款:市场占有率分析、行业趋势、统计数据和成长预测(2025-2030)United Kingdom Real Time Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

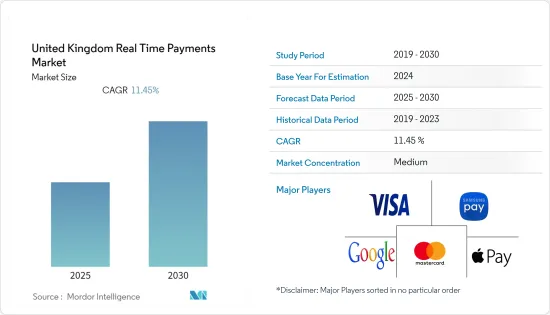

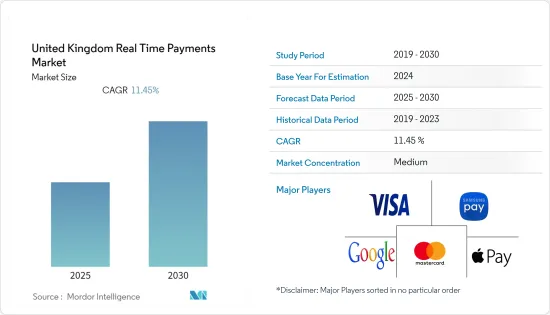

英国即时付款市场预计在预测期内复合年增长率为 11.45%。

据估计,2021年英国将记录34亿笔即时交易,为企业和消费者节省9.5亿美元的成本。这导致额外创造了32亿美元的经济产出,相当于该国GDP的0.10%。

到 2026 年,即时交易预计将成长至 58 亿笔,为消费者和企业节省的净成本将达到 18 亿美元。这占该国预计 GDP 的 0.11%,将有助于创造 38 亿美元的额外经济产出。这意味着即时付款的潜在经济效益仍未开发。

根据 Cebr 的说法,如果所有费用都是即时进行的,理论上到 2026 年可能会使官方 GDP 增加 2.7%。儘管消费者获得即时付款既简单又便宜,英国的付款仍然严重依赖传统工具,尤其是银行卡。

在COVID-19大流行期间,即时付款的份额相对较高(占所有交易的9.2%),但到2021年,英国消费者和企业从即时付款中获得的净收益将达到9.5亿美元。 。

其中最大的一项是付款系统内交易成本降低所带来的净节省。以每笔交易计算,英国即时付款目前的平均付款成本比所有非即时价格的加权平均组合低 14.1%。

英国即时付款市场趋势

对高度便捷的付款方式的需求日益增长

在英国,封锁措施导致 2020 年至 2021 年大部分经济停摆。企业也转向在家工作,减少差旅费用和在市中心的支出。景气和消费者信心下降导致消费者减少可自由支配支出和商业投资,导致 2020-21 年 GDP 下降 9.8%。

除了上述因素导致支付总额下降外,2020 年英国个人和企业的支付方式也发生了变化。这包括人们更多地使用非接触式、线上和行动钱包管道,主要以现金付款为代价。疫情也影响了英国即时付款市场。

2020年,新冠肺炎疫情席捲全球,大大影响了我们的生活和工作方式。毫不奇怪,这对英国付款额产生了影响,2020 年英国支付金额下降了 11% 至 356 亿日圆。

此外,2020 年卡片付款总额有所下降,但卡片付款的份额增加,2020 年超过一半(52%)的付款是卡片付款的。这是因为许多零售商鼓励刷卡和非接触式使用,而且由于封锁,许多人选择网路购物。同时,实体店和接触密集型服务被关闭。

减少对现金的依赖

- 在英国,2020年现金付款持续长期下降,受疫情影响,现金使用量与前一年同期比较下降35%。自 2017 年以来,现金使用量每年减少约 15%,因此这种下降在 2020 年加速。这主要是由于疫情对现金使用的影响,现金付款比许多其他付款受到更大的影响。

- 结果,许多现金较多的企业关门,零售商因担心现金成为 COVID-19 传播媒介而推动非接触式付款。

- 然而,2020 年,现金仍然是英国第二常用的付款方式,占付款的不到五分之一。儘管付款总量有所下降,但随着企业和消费者越来越多地使用线上和行动银行进行付款和汇款,更快的支付出现了强劲增长。

- 尤其是行动银行持续强劲成长,用户不断扩大他们可以使用这些服务执行的业务范围,不仅限于检查余额,还包括一次性付款和其他财务管理。

- 英国356亿笔支付中的大部分是由消费者支付的,占十分之九的支付。 81% 的消费者付款用于自发性购买,其余 19% 用于经常性帐单和承诺。

英国即时付款产业概况

随着消费者偏好的快速变化,英国即时付款市场已成为利润丰厚的选择,并吸引了大量投资。具有巨大的成长潜力,市场随着新参与企业变得越来越分散。服务提供者正在建立伙伴关係以促进产品创新。

2021年,英国金融市场研究显示,年轻人比老年人更有可能使用Apple Pay、Google Pay或Samsung Pay。 2020 年,近三分之一(32%,即 1,730 万)成年人口使用行动付款,较 2019 年增加了 740 万(75%)。在使用行动付款的人中,84% 的人进行了支付。这些註册用户中有一半 (50%) 每两週或更长时间付款一次。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 英国付款版图的演变

- 与英国无现金交易扩张相关的主要市场趋势

- COVID-19 对英国付款市场的影响

第五章市场动态

- 市场驱动因素

- 提高网路普及率

- 传统银行业趋势下降

- 对高度便捷的付款方式的需求日益增长

- 市场挑战

- 线上付款诈骗增加的威胁

- 缺乏政府监管

- 市场机会

- 随着政府政策鼓励数位付款的发展,即时付款可望在一般民众中普及。

- 数位付款产业的关键法规和标准

- 英国各地的监管情况

- 可能造成监管障碍的经营模式

- 经营状况变化带来的发展空间

- 关键案例和使用案例分析

第六章 市场细分

- 按付款类型

- P2P

- P2B

第七章 竞争格局

- 公司简介

- ACI Worldwide Inc.

- Fiserv Inc.

- Paypal Holdings Inc.

- Mastercard Inc.

- Google LLC(Google Pay)

- VISA Inc.

- Apple Inc.(Apple Pay)

- Samsung Electronics(UK)Limited(Samsung Pay)

- Diners Club International

- Finastra Limited

第八章投资分析

第九章 市场未来展望

The United Kingdom Real Time Payments Market is expected to register a CAGR of 11.45% during the forecast period.

The UK recorded 3.4 billion real-time transactions in 2021, which resulted in an estimated cost savings of USD 950 million for businesses and consumers. This helped unlock USD 3.2 billion of additional economic output, representing 0.10% of the country's GDP.

With real-time transactions rising to 5.8 billion in 2026, net savings for consumers and businesses are forecast to climb to USD 1.8 billion. That would help to generate an additional USD 3.8 billion of economic output, equivalent to 0.11% of the country's forecasted GDP. That means the potential economic benefits of real-time payments remain untapped.

According to the Cebr, the theoretical impact of all charges being real-time could add 2.7% to formal GDP by 2026. Payments in the UK are still very much tied to traditional tools - especially cards - despite being easy and cheap for consumers to access real-time payments.

During the COVID-19 pandemic, a relatively strong real-time payments mix share (9.2% of all transactions), in 2021, net benefits for consumers and businesses of real-time payments hit USD 950 million in the United Kingdom.

The largest component of this was net savings through the transaction costs within the payments system. On a per-transaction basis, real-time payments in the UK currently have a 14.1% lower average payments cost than the weighted average mix of all non-real-time prices.

UK Real Time Payments Market Trends

Growing Requirement of Convenient Payment Options

In the United Kingdom, lockdowns resulted in large parts of the economy shutting down for details 2020-2021. Businesses also switched to working from home, reducing expenditure on travel and spending in city centers. The fall in business and consumer confidence saw consumers reduce discretionary spending while lower levels of business investment resulted in GDP falling by 9.8% in 2020-21.

Keeping above mentioned factors contributing to the fall in total payment volumes, 2020 in the UK also saw changes in how people and businesses paid. This included people making greater use of contactless, online, and mobile wallet channels, largely at the expense of cash payments. This is a permanent change to people's behavior, as in many other parts of people's lives; the pandemic has also affected UK real-time payment markets.

In 2020, the coronavirus pandemic hit the world, significantly impacting how most of us live and work. Unsurprisingly this also affected payment volumes in the UK, which declined by 11% to 35.6 billion in 2020.

Moreover, overall card payments in 2020 declined, and their share of payments increased, with over half (52%) of all payments made by cards in 2020. This was due to many retailers encouraging card and contactless use, along with lockdowns resulting in many people opting to shop online. At the same time, physical stores and contact-intensive services were shut down.

Declining Cash Dependency

- In the United Kingdom, cash payments continued their long-term decline in 2020, with the pandemic resulting in cash use falling by 35% compared to the previous year. Since 2017 cash use had been declining by around 15% each year, so 2020 represented an acceleration of this decline. This is largely attributed to the impact of the pandemic on cash use, with cash payments being affected to a greater degree than many other payments.

- They resulted in retailers pushing contactless payment options amid fears about cash being a vector for COVID-19 transmission, while many businesses with high levels of cash spend were closed.

- However, cash remained the second most frequently used payment method in the UK in 2020, being used for just under a fifth of the total number of payments made. Despite overall payment volumes falling, strong growth was seen in Faster Payments as businesses and consumers increasingly used online and mobile banking to make payments and transfer money.

- Mobile banking, in particular, continued to grow strongly, with users continually widening the range of tasks they perform using such services, exploring beyond checking their balances to make one-off payments and manage other aspects of their finances.

- Consumers made the large majority of the 35.6 billion payments in the UK, accounting for nearly nine out of ten costs. Spontaneous purchases accounted for 81% of payments made by consumers, with the other 19% of payments being made for regular bills and commitments

UK Real Time Payments Industry Overview

With consumer preferences changing rapidly, the United Kingdom real-time payments market has become a lucrative option and thus, has attracted a huge amount of investments. Due to the huge growth potential, the market is moving towards fragmentation due to the new entrants. The service providers are engaging in partnerships to promote product innovation.

In 2021, according to UK Finance market research, younger people were more likely than older people to use either Apple Pay, Google Pay, or Samsung Pay. Nearly a third (32%, 17.3 million people) of the adult population had registered for mobile payments in 2020, an increase of 7.4 million people (75%) compared with 2019. Of those noted for mobile payments, 84% of these people recorded a payment. Half (50%) of these registered users made payments fortnightly or more frequently.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Evolution of the payments landscape in the United Kingdom

- 4.4 Key market trends pertaining to the growth of cashless transaction in the United Kingdom

- 4.5 Impact of COVID-19 on the payments market in the United Kingdom

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Internet Penetration

- 5.1.2 Decreasing Traditional Banking trend

- 5.1.3 Growing Requirement of Convenient Payment Options

- 5.2 Market Challenges

- 5.2.1 Threat of Growing Online Payment Fraud

- 5.2.2 Lack of Government Regulation

- 5.3 Market Opportunities

- 5.3.1 Government Policies Encouraging the Growth of Digital Paymentis expected to aid the growth of Real Time Payment methods amongst commoners

- 5.4 Key Regulations and Standards in the Digital Payments Industry

- 5.4.1 Regulatory Landscape Across the United Kingdom

- 5.4.2 Business Models with Potential Regulatory Roadblocks

- 5.4.3 Scope for Development in Lieu of Evolving Business Landscape

- 5.5 Analysis of major case studies and use-cases

6 Market Segmentation

- 6.1 By Type of Payment

- 6.1.1 P2P

- 6.1.2 P2B

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 ACI Worldwide Inc.

- 7.1.2 Fiserv Inc.

- 7.1.3 Paypal Holdings Inc.

- 7.1.4 Mastercard Inc.

- 7.1.5 Google LLC (Google Pay)

- 7.1.6 VISA Inc.

- 7.1.7 Apple Inc. (Apple Pay)

- 7.1.8 Samsung Electronics (UK) Limited (Samsung Pay)

- 7.1.9 Diners Club International

- 7.1.10 Finastra Limited