|

市场调查报告书

商品编码

1632085

英国IT 服务:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)United Kingdom IT Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

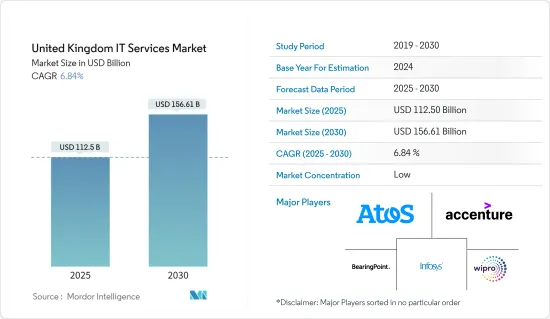

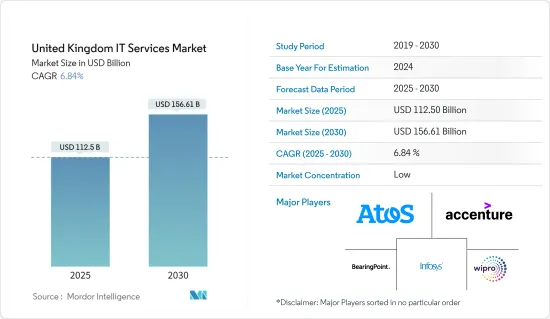

英国IT服务市场规模预计到2025年将达到1,125亿美元,预计2030年将达到1,566.1亿美元,预测期内(2025-2030年)复合年增长率为6.84%。

网路应用和服务使用量的增加、智慧型手机和其他智慧小工具及相关应用程式等无线设备的激增正在显着推动英国IT 服务市场的成长。

主要亮点

- 随着软体即服务 (SaaS) 的全面采用以及云端基础的产品的兴起,英国对一系列 IT 解决方案进行了大量投资,这表明行业对 IT 服务的需求不断增长。数位转型和自动化也是该国的趋势,刺激了对 IT 服务的需求。

- 许多着名的 SaaS 公司正在迁往英国,而且该市场正在不断成长。 SaaS 的成长主要由技术进步推动,例如人工智慧和机器学习的采用。该国的 SaaS 市场仍处于成熟阶段,为投资者提供了广泛的 IT 解决方案投资机会。例如,亚马逊网路服务于 2022 年 3 月宣布,随着对其公共云端服务的需求持续大幅成长,它将在未来两年内投资 18 亿英镑(22 亿美元),以加强其在英国资料中心的影响力。在此期间,AWS 在英国的业务与金融、医疗和製药服务业的私人公司和中央政府机构达成了许多利润丰厚且备受瞩目的交易。

- 此外,市场上正在发生各种合併、联盟和收购。例如,2022 年 10 月,量子安全加密技术供应商 Arqit Quantum Inc. 与主要为英国合规产业提供网路安全解决方案的 Nine23 Ltd. 达成协议,部署 Arqit 的 QuantumCloud。这主要是 Platform FLEX 上的通用金钥协定软体,FLEX 是 Nine23 的英国主权安全私有云端基础设施,为公司的客户和消费者提供最高等级的保证。

- 然而,各种资料安全相关问题和该国不断上升的资料外洩风险可能是限制预测期内整体市场成长的主要因素。

- 在 COVID-19 大流行期间,多家公司将工作实践转向远端工作场景,导致对云端运算服务的需求增加。 IT 公司将电脑运送到员工家中,并为其配备 Wi-Fi 转接器、备用电源和宽频连线。虚拟网路频宽已增加,后端容量已增加,以容纳更多远端使用者同时连线。借助基于云端基础的远端存取解决方案,现在可以进行虚拟工作。因此,虽然疫情初期市场面临挑战,但服务需求逐渐增加,对IT服务产生了正面影响。

英国IT服务市场趋势

近岸 IT 外包和 SaaS(软体即服务)产业的成长推动了英国IT 服务市场

- 国内外包是指一个国家的公司更愿意将服务外包给本国供应商的做法。由于接近性、语言、文化通用和轻微的时差等原因,向国外外包的近岸供应商大多受到青睐。例如,总部位于英国的Infinity Group是业界领先的IT外包公司之一,为英国1,000多家企业提供外包IT支援。该公司与各种客户合作,从快速发展的新兴企业和小型企业到成熟的大型企业。

- 近岸 IT 服务的关键技术趋势包括更多采用 5G 技术、IT 自动化、容器技术、无伺服器运算和虚拟桌面基础架构。未来几年,5G将对数位经济和整个社会的发展至关重要。 5G 技术完全有潜力影响英国居民生活的几乎各个领域,从个人化医疗到精密农业,智慧型能源电网到互联移动。

- 此外,确保欧盟未来5G网路安全的重要性促使该国主要企业优先考虑国内外包5G服务。例如,2022年5月,波罗的海通讯和媒体集团爱立信签署了向英国市场引入5G技术的框架协议。该协议将为人口最密集的城市和地区提供5G网路覆盖,并计划扩大媒体娱乐、游戏、云端、资料中心和物联网等领域的客户服务。

- 英格兰银行预测,未来 10 年内 40-90% 的银行工作负载将託管在公共云端或 SaaS 上。如果您的供应商之一失败,考虑对业务永续营运的影响至关重要。这就是为什么英国和世界各地的金融当局,包括英格兰银行、金融行为监理局(FCA)和审慎监理局(PRA)都在密切关注事态发展。预计这将为英国IT 服务市场创造多个成长机会。

- 预计2020年至2025年英国SaaS(软体即服务)产业将大幅成长。此外,预计到2025年该市场将从75亿欧元大幅扩张至145亿欧元。整个 SaaS 领域份额的不断上升预计将为预测期内市场的显着增长创造充足的机会。

BFSI 领域的数位化推动英国IT 服务市场的成长

- 英国因其丰富的人力资源和高品质的服务而成为最具吸引力的IT外包目的地之一。该国整体金融科技投资显着增加。这些金融科技公司拥有设计各种金融科技解决方案所需的专业知识和经验,例如数位银行、汇款、个人财务管理、风险与合规管理、P2P借贷以及各种其他应用程式。

- 例如,2022年6月,为网路银行提供帐户验证服务的欧洲平台SurePay与英国Virgin Money合作推出了英国受益人验证解决方案。

- 此外,BaaS(银行即服务)是开放银行的关键要素。这使得银行能够透过允许第三方即时存取资料来开放其係统并改善其服务。国内 BaaS 业务正在颠覆零售银行经营模式,改变现有银行的客户关係,并使金融科技公司更容易进入英国市场。随着管理方案在全球蔓延,英国在开放银行业中处于领先地位,并推动英国IT 服务市场的发展。例如,11:FS Foundry 是一家总部位于英国的 SaaS/PaaS 企业,主要开发一个提供基本银行功能的平台,无需在敏捷性和可扩展性之间进行选择。

- 此外,Bankable 是一家总部位于伦敦的公司,旨在让传统金融机构和其他企业更容易推出创新付款方式。虚拟帐本管理、数位银行、付款卡程式和电子钱包是该公司的主要 BaaS 产品。该公司的端到端付款服务经过 PCI-DSS(付款卡产业 -资料安全标准)认证,并託管在层级4 级资料中心的专有可互通平台上,以提高安全性。 Bankable 在帮助合作伙伴克服创建创新金融服务的技术和监管障碍方面也发挥关键作用。

- 此外,全球各大跨国公司都热衷于收购英国金融科技公司。例如,2022 年 3 月,苹果收购了总部位于伦敦的金融科技公司 Credit Kudos。 Credit Kudos 是一家软体新兴企业,透过利用开放银行业务帮助企业提高负担能力和风险评估。金融机构主要使用该软体来加快承保速度、提高决策准确性和改善客户服务。

- 根据英格兰银行的数据,在英国营运的金融机构总数约为 377 家,其中 130 家总部位于英国。金融机构(MFI)主要包括所有在英国获准吸收存款的建房互助协会和银行。因此,随着国内金融机构(MFI)数量的增加,各种IT服务的整体需求,尤其是银行业的需求将大幅增加,这将倍增整体市场的成长。

英国IT服务业概况

英国IT 服务市场竞争激烈,竞争对手很少。一些主要企业占据了市场的主要份额。此外,正在进行各种併购和产品创新,以获得相对于竞争对手的优势。

- 2024 年 7 月:英国政府在一份公告中透露了加强科学、技术和创新部 (DSIT) 的计画。该部宣布,其目标是将政府数位服务(GDS)、人工智慧培养箱(iAI)和中央数位和资料办公室(CDDO)等关键组织纳入其伞下。

- 2024 年 4 月:微软宣布成立 Microsoft AI,这是一个旨在推动消费者 AI 产品和研究(包括 Copilot)的新组织。 MicrosoftAI 也在伦敦市中心开设了一个新的人工智慧中心。 Microsoft AI London 将与 Microsoft 的 AI 团队和包括 OpenAI 在内的合作伙伴密切合作,推动开创性工作,发展语言模型和支援基础设施,并为基础模型创建工具。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 英国的数位转型

- 英国近岸IT外包的成长

- 市场限制因素

- 资料安全与外洩风险

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 宏观经济因素对市场的影响

第五章市场区隔

- 按类型

- IT外包

- IT咨询与实施

- 业务流程

- 按最终用户

- 资讯科技/通讯

- 政府机构

- BFSI

- 能源/公共产业

- 消费品/零售

- 其他的

第六章 竞争状况

- 公司简介

- Atos Consulting

- Accenture PLC

- BearingPoint

- Infosys

- Wipro

- TCS

- Capgemini

- IBM Corporation

- HCL

第七章 投资分析

第八章市场的未来

The United Kingdom IT Services Market size is estimated at USD 112.50 billion in 2025, and is expected to reach USD 156.61 billion by 2030, at a CAGR of 6.84% during the forecast period (2025-2030).

The increasing use of internet applications and services, as well as the growing availability of wireless devices such as smartphones, other smart gadgets, and associated apps, are significantly driving the growth of the UK IT services market.

Key Highlights

- Significant investments in various IT solutions in the United Kingdom have been made, with the overall adoption of software-as-a-service (SaaS) and increased cloud-based products demonstrating the rising industrial requirements for IT services. Digital transformation and automation are also trending in the country, fueling the demand for IT services.

- Many prominent SaaS companies have ventured into the United Kingdom, where the market is expanding. SaaS growth is mainly fueled by technological advancements, such as the adoption of artificial intelligence and machine learning. The country's SaaS market is still maturing, offering investors a broad scope of opportunities to invest in IT solutions. For example, in March 2022, Amazon Web Services announced plans to invest more than GBP 1.8 billion (USD 2.2 billion) over the next two years in building out its overall UK data center presence as the demand for its public cloud services continues to increase significantly. During the intervening years, its presence in the United Kingdom has allowed AWS to secure many lucrative and high-profile deals with private sector organizations and central government departments in the financial, healthcare, and pharmaceutical services industries.

- Moreover, the market is witnessing various mergers, partnerships, and acquisitions. For instance, in October 2022, Arqit Quantum Inc., a provider of quantum-safe encryption, signed a contract with Nine23 Ltd, a cyber security solutions provider primarily for the UK-compliant and regulated industries, to deploy Arqit's QuantumCloud. It is mainly a symmetric key agreement software on Nine23's UK Sovereign Secure Private Cloud infrastructure, Platform FLEX, to deliver the highest level of assurance for its clients and customers.

- However, the rise in various data security-related issues and data breaching risks in the country could be a significant factor, restricting the overall market's growth throughout the forecast period.

- Working techniques of several companies transitioned to remote working scenarios during the COVID-19 pandemic, resulting in an increased demand for cloud computing services. IT companies shipped computers to employees' homes and had them equipped with Wi-Fi adapters, power backup sources, and broadband connections. The virtual private network bandwidth was increased, and backend capacity was increased to meet the increased number of concurrently connected remote users. Virtual working was made possible because of cloud-based remote access solutions. Thus, the market initially faced challenges during the pandemic, but gradually, it had a good impact on IT services because of the increasing need for service.

United Kingdom IT Services Market Trends

Growth in Nearshoring IT Outsourcing and the SaaS (Software-as-a-Service) Industry Driving the UK IT Services Market

- Domestic outsourcing is a technique in which a country's corporations prefer to outsource services to vendors within their own country. They primarily favor nearshore providers outsourcing overseas because of proximity, language, cultural commonalities, and minor time differences. For example, Infinity Group, a UK-based company, is one of the industry's leading IT outsourcing organizations, providing outsourced IT support to over 1,000 businesses across the United Kingdom. The company works with many kinds of clients, ranging from fast-growing start-ups and SMEs to well-established larger corporations.

- Some key technology trends for nearshore IT services include a rise in the adoption of 5G technology, IT automation, container technology, serverless computing, and virtual desktop infrastructure. Over the coming years, 5G will be critical to the growth of the overall digital economy and society. 5G technology has the full potential to impact practically every area of UK residents' lives, from personalized medicine to precision agriculture and smart energy grids to connected mobility.

- Moreover, the key corporates of the country are prioritizing domestic outsourcing of 5G services because it is critical to ensure the security of the European Union's future 5G networks. For example, in May 2022, Baltic telecommunications and media group Ericsson signed a framework agreement to introduce 5G technology in the UK market. The deal would provide 5G network coverage in the most densely populated cities and districts, with plans to expand customer services in media entertainment and gaming, cloud, data centers, and the Internet of Things.

- The Bank of England estimates that 40-90% of bank workloads will be hosted on the public cloud or software-as-a-service in the coming ten years. It is crucial to examine the impact on business continuity if one of the suppliers fails. Hence, the financial authorities in the United Kingdom and worldwide, notably the Bank of England, the Financial Conduct Authority (FCA), and the Prudential Regulation Authority (PRA), are keeping a close eye on this. This will create several growth opportunities for the UK IT services market.

- Between 2020 and 2025, the SaaS (software-as-a-service) industry is estimated to grow significantly in the United Kingdom. Moreover, the market is anticipated to experience a drastic increase, from EUR 7500 million to EUR 14,500 million in 2025. This rise in the overall share of the SaaS segment will create ample opportunities for the market to grow extensively throughout the forecast period.

Digitalization in the BFSI Segment Driving the Growth of the UK IT Services Market

- With a significant talent pool and high-service quality offerings, the United Kingdom is one of the most appealing IT outsourcing destinations. The overall fintech investments in the country are rising significantly. These fintech companies have the requisite domain expertise and experience in designing various fintech solutions like digital banking, money transfers, personal financial management, risk and compliance management, peer-to-peer lending, and various other applications.

- For instance, in June 2022, SurePay, a European platform that provides online banking account verification services, teamed up with Virgin Money in the United Kingdom to launch its UK Confirmation of Payee solution.

- Moreover, banking-as-a-service (BaaS) is a crucial component of open banking. It involves banks opening their systems and allowing third parties to access their data in real time to improve their services. BaaS businesses within the country are disrupting retail banking business models, altering incumbents' client relationships, and making it easier for fintech companies to enter the UK market. With regulatory initiatives echoing worldwide, the United Kingdom is leading the open banking industry, driving the UK IT services market. For instance, 11:FS Foundry, a UK-based SaaS/PaaS business, is working on a platform to provide fundamental banking features that mainly eliminate the need to choose between agility and scalability.

- In addition, Bankable is a London-based firm aiming to make it easier for traditional financial institutions and other businesses to launch innovative payment options. A virtual ledger manager, digital banking, payment card programs, and e-wallets are among the company's key BaaS offerings. Its end-to-end payment services are accessible through a unique interoperable platform that is PCI-DSS (payment card industry - data security standards) certified and hosted in tier-4 data centers for increased security. Bankable also plays a significant role in assisting its partners in overcoming the technological and regulatory obstacles that arise while creating innovative financial services.

- Moreover, various key global MNCs are well-indulged in acquiring UK-based fintech companies. For instance, in March 2022, Apple purchased Credit Kudos, a fintech firm based in London. Credit Kudos is a software start-up that helps businesses improve their affordability and risk assessments by utilizing open banking. Lenders mainly use the software to expedite underwriting, increase decision-making accuracy, and improve customer service.

- As per the Bank of England, there is a total count of around 377 monetary financial credit institutions operating in the United Kingdom, 130 of which are UK-headquartered. Monetary financial institutions (MFI) primarily include all the building societies and the banks that have permission to accept deposits in the United Kingdom. Hence, with the rise in the number of monetary financial institutions (MFI) within the country, the overall demand for various IT services, especially in the banking industry, will rise significantly, expediting the overall market's growth exponentially.

United Kingdom IT Services Industry Overview

The UK IT services market is extremely competitive, with only a few significant competitors. Some of the key players hold a major share of the market. Moreover, the variables are involved in various mergers and acquisitions and product innovation, among others, to gain a competitive edge over others.

- July 2024: The UK government, in an announcement, revealed plans to bolster the Department for Science, Innovation, and Technology (DSIT). The department announced aims to broaden its scope and scale by incorporating key entities like the Government Digital Service (GDS), the AI Incubator (iAI), and the Central Digital and Data Office (CDDO) under its purview.

- April 2024: Microsoft announced the creation of Microsoft AI, a newly formed organization aimed at advancing its consumer AI products and research, including Copilot. Microsoft AI further opened a new AI hub in the heart of London. Microsoft AI London was established to drive pioneering work to advance language models and their supporting infrastructure and to create tooling for foundation models, collaborating closely with Microsoft's AI teams and partners, including OpenAI.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Digital Transformation in the United Kingdom

- 4.2.2 Growth in Nearshoring IT Outsourcing in the United Kingdom

- 4.3 Market Restraints

- 4.3.1 Data Security and Breaching Risks

- 4.4 Value Chain/Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of Macroeconomic Factors on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 IT Outsourcing

- 5.1.2 IT Consulting & Implementation

- 5.1.3 Business Process

- 5.2 By End User

- 5.2.1 IT and Telecommunication

- 5.2.2 Government

- 5.2.3 BFSI

- 5.2.4 Energy & Utilities

- 5.2.5 Consumer Goods & Retail

- 5.2.6 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Atos Consulting

- 6.1.2 Accenture PLC

- 6.1.3 BearingPoint

- 6.1.4 Infosys

- 6.1.5 Wipro

- 6.1.6 TCS

- 6.1.7 Capgemini

- 6.1.8 IBM Corporation

- 6.1.9 HCL