|

市场调查报告书

商品编码

1632088

针对特定应用的电脑类比IC的全球市场占有率分析、行业趋势和统计数据以及成长预测(2025-2030)Global Application Specific Computer Analog IC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

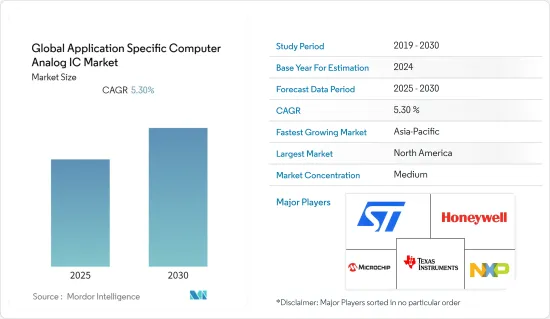

专用计算机类比IC的全球市场预计在预测期内复合年增长率为 5.3%

主要亮点

- 专用电脑类比类比IC是专门为特定应用而开发的积体电路 (IC)。现在可以使用现代处理技术(IC 的基本组件)来製造具有超过 10 亿个电晶体的 ASIC。可用电晶体的数量令人难以置信,需要非常复杂和强大的设计才能在 ASIC 中实现。

- LED 驱动器、时序控制器、射频 (RF) 收发器、串列器/解串器 (SerDes)、触控感应器、显示驱动器等都是一些专用类比类比IC。通用类比积体电路 (IC) 用于多种应用,包括扩大机、比较器和资料转换器。

- 专用晶片主要用于家用电子电器和通讯设备,但它们在汽车领域也占有重要地位。由于家用电子电器的需求和生产不断增加,该市场在整个预测期内可能会扩大。同时,智慧型手机和穿戴式装置的需求正在推动专用电脑类比IC市场的需求。

- 自订电路製造成本高、电路设计成本高、功能可靠性困难等是影响专用积体电路市场成长的主要限制因素。

- COVID-19 情况影响了包括积体电路业务在内的许多行业。大多数国家的死亡率和受伤率都在上升。因此,在线工作的需求不断增加,对新技术的需求不断增加。此外,市场分析正在推动自动化技术以令人难以置信的速度执行其适当功能的能力。然而,疫情的爆发清楚地表明,所有行业的财务回报都在恶化。因此,生产和供应链产业致力于描绘未来几年市场成长的恢復改善。

特定应用电脑的类比IC市场趋势

消费性电子和汽车产业推动市场成长

- 全球专用电脑类比IC市场机会不断涌现,前景看好。因此,我们能够透过对存取记忆体的初步评估以及车辆感测器和网际网路通讯协定核心的平稳运行,更深入地了解当前趋势。因此,可以得出结论,这个特定市场正在实施优化业务并保持竞争优势的计划。该应用的一个关键因素是消费性电子产业不断增长的需求。

- 智慧电子产品中使用的物联网等技术的扩展预计将在几乎所有行业领域中采用,这将推动未来的成长。新兴经济体的政府措施正在鼓励发展更多的电子製造单位并增加其全球类比IC市场占有率。

- 交通灯指示器和资料通讯等 LED 应用越来越多地利用类比积体电路来提高电源效率,从而推动市场成长。类比积体电路在医疗电子领域的使用以及住宅和商业建筑中的绿色能源管理将推动全球IC产业的发展。汽车领域电子产品的使用,例如复杂的引擎和安全控制、导航、音讯/视讯系统、混合动力驱动器和 LED 照明,正在推动类比IC市场的需求。美国、澳洲、挪威、法国和德国等国家汽车产业的进步预计将对类比IC市场的成长产生正面影响。

- ADAS(高级驾驶辅助系统)领域预计在预测期内将以更快的年复合成长率发展。 IC 等汽车积体电路的使用越来越多,可确保该应用中驾驶员和车辆的安全。此外,先进驾驶辅助系统在汽车领域的日益普及预计将加强车载积体电路的使用,进一步加速该类别的市场发展。

亚太地区占最大市场占有率

- 亚太地区是一个快速成长的市场,拥有大量电子元件製造商。此外,该地区不断增长的精通技术的客户群也推动了该行业的发展。此外,智慧型手机和电脑硬体在该地区越来越受欢迎,推动了该行业的发展。对轻型、紧凑型电子设备日益增长的需求正在推动专用电脑类比IC市场的成长。

- 此外,对乘客安全的日益关注以及政府对车辆法规的有利倡议也是推动亚太特定应用电脑类比IC市场成长的关键因素。

- 政府正在投资开发半导体市场。例如,2021年12月,印度政府批准“建立氮化镓(GaN)生态系统支援中心和高功率射频电子培养箱”,以促进半导体製造。该计划由位于班加罗尔奈米科学与工程中心 (CeNSE) 的创新与发展协会 (SID) 在印度科学研究所 (IISc) 的支持下实施,总成本为 29.866 亿印度卢比。

- 随着中国经济的不断扩张以及云端运算、5G、物联网、人工智慧(AI)、智慧汽车、联网汽车等新应用的出现,中国积体电路市场的需求预计将持续成长。工业与资讯化部电子资讯司司长乔跃山表示,「十三五」期间,中国积体电路产业成长率达到全球成长速度的4倍。

专用电脑类比IC产业概述

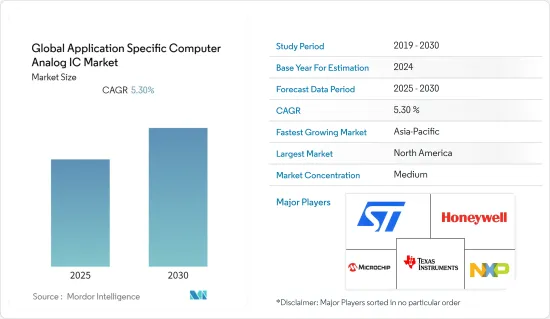

全球专用计算机类比IC市场高度细分。市场竞争十分激烈。为了在竞争环境中生存,公司正在积极投资电脑类比IC的开发。该市场的主要企业包括意法半导体、德州仪器、Microchip Technology 和霍尼韦尔国际公司。

- 2022年3月,义法半导体发布了用于下一代卫星的新版本2.5V耐辐射数位类比转换器。 STMicroElectronics 的 RHRDAC121 耐辐射数位类比转换器 (DAC) 工作电压为 2.5V,可用于现今无法使用传统 3.3V 元件的低功耗系统设计。

- 2022 年 4 月,意法半导体的 AMOLED 电源管理 IC 提高了行动装置的显示品质和电池寿命。意法半导体用于 AMOLED 显示器的新型全整合电源管理 IC (PMIC) 结合了更低的静态电流和更大的灵活性,可延长行动装置的电池寿命。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

- COVID-19 对产业的影响

第四章市场动态

- 市场驱动因素

- 对先进家用电子电器产品的需求不断增长

- 透过人工智慧和机器学习功能扩大专用类比电脑积体电路市场

- 市场限制因素

- 类比积体电路的复杂设计可能会阻碍全球市场的成长

第五章市场区隔

- 按地区

- 美洲

- 欧洲

- 日本

- 中国

- 其他亚太地区

第六章 竞争状况

- 公司简介

- Texas Instruments Incorporated

- Intel Corporation

- Renesas Electronics Corporation

- STMicroelectronics NV

- Infineon Technologies AG

- Analog Devices, Inc.

- Qualcomm, Inc.

- Maxim Integrated Products Inc.

- ON Semiconductor

- NXP Semiconductors

- Skyworks Solutions, Inc.

- Broadcom Corporation

- Taiwan Semiconductor Co., Ltd.

- Microchip Technology

- Honeywell international inc

第七章 投资分析

第八章市场的未来

简介目录

Product Code: 91220

The Global Application Specific Computer Analog IC Market is expected to register a CAGR of 5.3% during the forecast period.

Key Highlights

- An Application-Specific Integrated Circuit (ASIC) is an integrated circuit (IC) developed explicitly for a specific application. ASICs with over one billion transistors can now be produced using modern processing techniques (the basic building block of an IC). Because of the incredible amount of transistors available, extremely sophisticated and powerful designs need to be implemented on an ASIC.

- LED drivers, timing control, radio frequency (RF) transceivers, Serializer/Deserializer (SerDes), touch sensors, and display drivers are some of the application-specific analog ICs. General-purpose analog integrated circuits (ICs) are utilized in various applications such as amplifiers, comparators, and data converters.

- Application-specific chips are primarily utilized in consumer electronics and communications equipment, but they also have a considerable presence in the automobile sector. This market will likely expand throughout the forecasted period due to rising consumer electronics demand and production. Simultaneously, demand for smartphones and wearables is driving demand for this Application Specific Computer Analog IC Market.

- The high cost of manufacturing custom circuits, circuit design costs, and functional reliability difficulties will be the primary restraints that will affect the growth of the Application Specific Integrated Circuit Market.

- The COVID- 19 scenario has impacted numerous industries, including the integrated circuit business. It has been shown that the death and injury rates have increased in the majority of nations. As a result, there has been an increase in the need for online work, and the requirement for new technology is growing. Furthermore, the market analysis has boosted the functioning of automated technologies for proper functioning at an incredible pace. Despite this, it has been seen that the financial profits of all industries have suffered due to the pandemic outbreak. As a result, it devotes itself to portraying that the production and supply chain industry has resumed improved market growth in the coming years.

Application Specific Computer Analog IC Market Trends

Consumer Electronics and Automotive Industry drive growth towards the market

- The opportunity arises, which leads to possible prospects within the worldwide regional ASIC market. As a result, the automobile sensor and its access memory towards the internet protocol cores and its initial assessment of the smooth working have provided a deeper grasp of the current trends. As a result, it can be concluded that this specific market optimizes its operations and has implemented a plan for maintaining a competitive advantage. The application's primary element is the increasing consumer electronics industry demand.

- The expansion of technologies such as the Internet of Things is used in smart electronic devices that are predicted to be employed in practically all industrial verticals, which will drive growth in the future. The emerging economies with government policies encourage the development of more electronic manufacturing units to increase the global analog IC market share.

- The increased usage of analog integrated circuits in LED applications such as traffic light indicators and data communication systems for power efficiency is likely to fuel market growth. The use of analog integrated circuits in medical and healthcare electronics and green energy management for residential and commercial buildings or premises propels the worldwide IC industry. The vehicle sector's usage of electronics in complex engine and safety controls, navigation, audio/video systems, hybrid electric drives, and LED lighting is likely to fuel Analog IC market demand. The advancement of the automotive sector in nations such as the United States, Australia, Norway, France, and Germany is predicted to impact the Analog IC market growth positively.

- The Advanced Driver Assistance System sector is expected to develop at a faster compound annual growth rate during the forecast period. The rising use of automotive integrated circuits, such as ICs, assures the safety of drivers and vehicles in this application. Furthermore, the growing use of sophisticated driver assistance systems in the automotive sector will enhance the use of automotive integrated circuits, accelerating the market development of this category even further.

Asia-Pacific to Hold the Largest Market Share

- The Asia-Pacific is the fastest-growing market that has witnessed the widespread presence of electronic component manufacturers. Furthermore, the region's growing tech-savvy customer base propels the industry. Moreover, the region's increased penetration of smartphones and computer hardware drives the industry. The growing need for lightweight and small electronic gadgets drives the application-specific computer analog IC market growth.

- Additionally, rising passenger safety concerns and favorable government initiatives regarding vehicle regulations are some of the important factors driving the growth of the APAC application-specific computer analog IC Market.

- The government is investing money in developing the semiconductor market. For Instance, In December 2021, the Indian government authorized the 'Establishment of Gallium Nitride (GaN) Ecosystem Enabling Centre and Incubator for High Power and High-Frequency Electronics' to boost semiconductor manufacturing. The project is being carried out by Society for Innovation and Development (SID) at the Centre for Nano Science and Engineering (CeNSE), Bengaluru, under the auspices of the Indian Institute of Science (IISc) at a total cost of Rs 298.66 crore.

- With the constant expansion of China's economy and new applications such as cloud computing, 5G, Internet of Things, artificial intelligence (AI), and intelligent and connected cars, demand for China's integrated circuit market is expected to continue growing. Qiao Yueshan, head of the electronic information department at China's Ministry of Industry and Information Technology, said China's Integrated Circuit Industry growth rate was four times the world growth rate during the country's 13th Five-Year Plan period.

Application Specific Computer Analog IC Industry Overview

The Global Application Specific Computer Analog IC Market is highly fragmented. The market is quite competitive. Companies are progressively investing in developing computer analog ICs to sustain themselves in the competitive environment. Key players in the market are STMicroelectronics N.V, STMicroelectronics N.V, Texas Instruments Incorporated, Microchip Technology, and Honeywell International Inc.

- In March 2022, STMicroelectronics released a new version of a 2.5V rad-hard digital-to-analog converter for next-generation satellite applications. The RHRDAC121 radiation-hardened digital-to-analog converter (DAC) from STMicroelectronics runs at 2.5V for usage in current, low-power system designs that older 3.3V components cannot support.

- In April 2022, The AMOLED power-management IC from STMicroelectronics improves viewing quality and battery life in portable devices. The new fully integrated Power-Management IC (PMIC) from STMicroelectronics for AMOLED displays combines a low quiescent current with more flexibility to prolong the battery life of portable devices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 MARKET INSIGHTS

- 3.1 Market Overview

- 3.2 Industry Attractiveness - Porter's Five Forces Analysis

- 3.2.1 Bargaining Power of Suppliers

- 3.2.2 Bargaining Power of Consumers

- 3.2.3 Threat of New Entrants

- 3.2.4 Threat of Substitute Products

- 3.2.5 Intensity of Competitive Rivalry

- 3.3 Technology Snapshot

- 3.4 COVID-19 impact on the Industry

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing demand for advanced consumer electronics products

- 4.1.2 Artificial Intelligence and Machine learning capabilities to expand application specific analog computer Integrated Circuit Market

- 4.2 Market Restraints

- 4.2.1 Complex designing of analog integrated circuits is expected to hinder the global market growth

5 MARKET SEGMENTATION

- 5.1 By Geography

- 5.1.1 Americas

- 5.1.2 Europe

- 5.1.3 Japan

- 5.1.4 China

- 5.1.5 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Texas Instruments Incorporated

- 6.1.2 Intel Corporation

- 6.1.3 Renesas Electronics Corporation

- 6.1.4 STMicroelectronics N.V

- 6.1.5 Infineon Technologies AG

- 6.1.6 Analog Devices, Inc.

- 6.1.7 Qualcomm, Inc.

- 6.1.8 Maxim Integrated Products Inc.

- 6.1.9 ON Semiconductor

- 6.1.10 NXP Semiconductors

- 6.1.11 Skyworks Solutions, Inc.

- 6.1.12 Broadcom Corporation

- 6.1.13 Taiwan Semiconductor Co., Ltd.

- 6.1.14 Microchip Technology

- 6.1.15 Honeywell international inc

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219