|

市场调查报告书

商品编码

1632115

美国阀门:市场占有率分析、产业趋势、统计、成长预测(2025-2030)United States Valves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

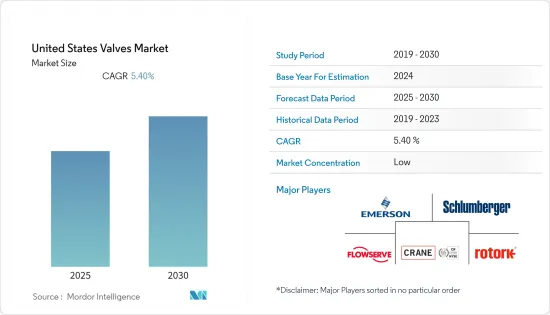

预计美国阀门市场在预测期内的复合年增长率为 5.4%。

主要亮点

- 石油和天然气行业对阀门的需求不断增加以及该国食品和饮料加工业的成长是推动阀门成长的主要因素。石油和天然气产业是下游和上游流程业务中阀门的主要消费者。

- 然而,缺乏标准化政策、认证和政府政策可能会阻碍市场成长。此外,工业物联网技术在工业阀门中的整合可能会创造市场成长机会。

- 市场主要企业正在透过创新智慧阀门、控制产品和自动流体控制系统等新产品来适应市场状况和最终用户向数位解决方案的逐步过渡,以增强工业物联网的使用。我们也从以产品为中心的方法转向提供增强的服务,以保持市场竞争力。

- 例如,2021 年 11 月,水过滤公司 Rusco 推出了一款新的应用程式驱动的球阀。这款智慧球阀可轻鬆与 Apple 或 Android 装置配对,实现程式自动化,并简化两个关键功能:沉积物冲洗和流量切断。

- 石油和天然气产业因 COVID-19 大流行导致需求减少而受到严重影响。石油和天然气需求下降主要是因为政府监管。这些因素极大地阻碍了疫情期间阀门市场的成长。

美国阀门市场趋势

扩大加工过程中自动化的采用

- 加工产业对自动化的需求不断增长,从而提高了效率,减少了错误和风险,并提高了合规性。此外,它还有助于管理生产流程和营运的各个领域。

- 主要供应商和製造商之间日益激烈的竞争预计将导致使用不同类型阀门的各种过程中工业自动化的快速增长。此外,政府有利的行业政策将支持工厂自动化市场的成长,预计将增加对阀门的需求。

- 2022年2月,美国钢铁公司与卡内基铸造厂联合宣布战略投资与合作。总部位于匹兹堡的公司将致力于加速和扩大由先进机器人和人工智慧驱动的工业自动化。透过这项投资,卡内基铸造厂将在先进製造领域实现其机器人和人工智慧技术的工业自动化产品组合的商业化和规模化。

- 石油和天然气行业对自动化的依赖日益增加,并且预计将继续以显着的速度成长。 COVID-19 大流行造成了劳动力短缺,影响了企业营运和业务。因此,石油和天然气行业的公司正在采用流程自动化。

石油天然气产业占有较大份额

- 在 COVID-19大流行后,石油和天然气行业正在復苏,由于钻井成本降低、新生产技术和油价上涨等因素,石油价格持续上涨。

- EIA预测,亨利港价格将从2020年的2美元/百万英国热单位(MMBtu)上涨至2021年的3.01美元/MMBtu和2022年的3.27美元/MMBtu。

- 对柴油、重油、汽油、煤油、液化天然气、液化石油气等成品油的需求将推动油气基础设施投资。

- 石油业的几家公司正在该国推出新的生产设施。例如,2021年12月,康菲石油公司阿拉斯加国家石油储备的GMT-2石油计划开始生产。此计划预计高峰期产量为 30,000 桶/天。该计划的开发成本为140万美元。

- 美国石油和天然气生产设施的活动数量不断增加以及石油和天然气生产设施的扩张预计将在预测期内为该国的阀门市场提供许多机会。

美国阀门产业概况

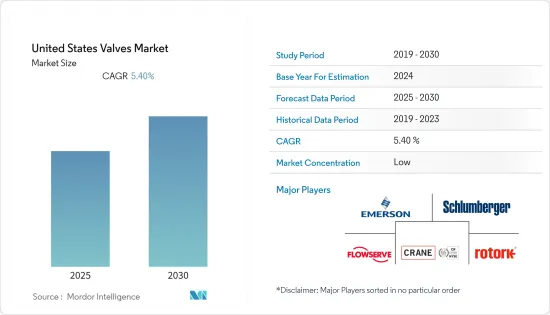

美国阀门市场高度分散,随着世界各地加工工业的成长,对阀门的需求不断增加。艾默生电气公司、斯伦贝谢有限公司、福斯公司等市场主要企业不断创新新产品,并活性化併购和产能扩张等活动,进一步加剧了竞争。

- 2021 年 11 月 - Valtorc International 推出首款 316 不锈钢三通蝶阀组件。在美国工厂製造。三通自动蝶阀可以气压或电动操作。

- 2021 年 10 月 - Valtorc International 向市场推出高性能全不銹钢熔断球阀和蝶阀套件。完全按订单生产,我们有全不銹钢、凸耳式、晶圆式、金属板、API 607 第五版、聚四氟乙烯板,尺寸为 2"-12"。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 石油和天然气产业对阀门的需求不断增加

- 自动化技术在流程产业的采用率不断提高

- 市场挑战

- 缺乏标准化政策

第 6 章 细分

- 按类型

- 球

- 蝴蝶

- 门/手套/检查

- 插头

- 控制

- 其他类型

- 按行业分类

- 石油和天然气

- 发电

- 化学

- 用水和污水

- 矿业

- 按行业分類的其他最终用户

第七章 竞争格局

- 公司简介

- Emerson Electric Co.

- Schlumberger Limited

- Flowserve Corporation

- Crane Holdings, Co.

- Rotork Plc

- Valtorc International

- Valve Solutions

- Flow Line Valve and Controls

- American Production Valve

第八章投资分析

第9章市场的未来

简介目录

Product Code: 91381

The United States Valves Market is expected to register a CAGR of 5.4% during the forecast period.

Key Highlights

- The increasing demand for valves in the oil and gas industry and the growing food & beverages processing industry in the country are the major factors boosting the growth of valves. The oil and gas industry is the major consumer of valves in their downstream and upstream process operations.

- However, the lack of standardized policies & certifications and government policies may hinder the market growth. Further, the integration of IIOT technology in industrial valves may create opportunities for market growth.

- The key players in the market are responding to market situations and the gradual transition of end-users to digital solutions by innovating new products such as smart valves, control products, and automatic fluid control systems to augment the use of IIoT. Also, they are shifting from a product-centric approach to strengthening their service offerings to remain competitive in the market.

- For instance, in November 2021, Water filtration firm Rusco launched a new ball valve driven by an app. This Smart Ball Valve pairs easily with Apple and Android devices allowing for program automation and simplifying two primary functions, sediment flushing and flow shut-off, and can be used in home filtration, well water, and commercial and municipal applications.

- The oil & gas industry has been severely affected due to the Covid-19 pandemic as the demand decreased. The decline in oil & gas demand is mainly due to the restrictions by the government. Such factors has hampered the growth of the valves market significantly during the pandemic.

US Valve Market Trends

Growing Adoption of Automation in Processing

- The growing demand for automation in processing industries has led to increased efficiency, reduced errors and risk, and proper compliance. Furthermore, it helps in the management of various areas of the production process and operations.

- The increased competitiveness among the key vendors and manufacturers is projected to bring rapid growth prospects in industrial automation for the different processes where different kinds of valves are used. The government-favored industry-friendly policies will also help the factory automation market growth that is expected to add demand for valves.

- In February 2022, United States Steel and Carnegie Foundry jointly announced a strategic investment and partnership. The two Pittsburgh-based companies will work to accelerate and scale industrial automation driven by advanced robotics and artificial intelligence. Carnegie Foundry will use this investment to commercialize and scale its industrial automation portfolio of robotics and AI technologies in advanced manufacturing.

- The oil and gas industry's reliance on automation growing day by day, and it is expected to continue at a significant rate. Due to the Covid-19 pandemic worker shortage occurs and that affected the company's operations and operational efficiency. Hence, the companies in the oil & gas sector are adopting process automation.

Oil & Gas Industry to Hold Significant Share

- The market oil & gas industry is recovering post-Covid-19 pandemic, as crude oil prices are continuously rising owing to factors such as reduction in the cost of drilling, new and production technologies, and increasing oil prices.

- According to EIA forecasts, the Henry Hub price will increase from USD 2.00 per million British thermal units (MMBtu) in 2020 to USD 3.01/MMBtu in 2021 and USD 3.27/MMBtu in 2022, which will likely increase Appalachia's natural gas production in the country.

- The demand for finished petroleum products such as diesel fuel, fuel oil, gasoline, kerosene, liquefied natural gas, and liquefied petroleum gas are likely to encourage more investments in infrastructure for oil and gas.

- Several oil industry players are starting new production facilities in the country. For instance, in December 2021, ConocoPhillips started production at its GMT-2 oil project in the National Petroleum Reserve-Alaska. The project is expected to produce 30,000 b/d at its peak. The development costs for the project were USD 1.4 million.

- Such an increase in the number of activities and oil and gas production facility expansion in the United States is expected to provide many opportunities for the valves market in the country during the forecast period.

US Valve Industry Overview

The United States valves market is highly fragmented as the demand for valves is increasing with the growing processing industry across the globe. The key players in the market like Emerson Electric Co., Schlumberger Limited, Flowserve Corporation, and others, are continuously innovating new products and rising activities such as mergers and acquisitions and capacity expansion, further increasing the competition.

- November 2021 - Valtorc International launched the first-ever 316 stainless steel 3-way butterfly valve assembly. It is fabricated in its USA facility. The 3-Way automated butterfly valve is available with pneumatic or electric actuation.

- October 2021 - Valtorc International has introduced into the marketplace its high performance, all stainless-steel fusible link ball and butterfly valve packages. The fully fabricated units build to order are available in all Stainless-steel material in either Lug style or Wafer style, with either metal seated design fire safe API 607 5TH EDITION, Teflon seats, at 2"-12" sizes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand of Valves in Oil & Gas Industry

- 5.1.2 Rising Adoption of Automation Technologies in Process Industries

- 5.2 Market Challenges

- 5.2.1 Lack of standardized policies

6 SEGMENTATION

- 6.1 By Type

- 6.1.1 Ball

- 6.1.2 Butterfly

- 6.1.3 Gate/Globe/Check

- 6.1.4 Plug

- 6.1.5 Control

- 6.1.6 Other Types

- 6.2 By End-user Vertical

- 6.2.1 Oil & Gas

- 6.2.2 Power Generation

- 6.2.3 Chemical

- 6.2.4 Water & Wastewater

- 6.2.5 Mining

- 6.2.6 Other End-user Verticals

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Emerson Electric Co.

- 7.1.2 Schlumberger Limited

- 7.1.3 Flowserve Corporation

- 7.1.4 Crane Holdings, Co.

- 7.1.5 Rotork Plc

- 7.1.6 Valtorc International

- 7.1.7 Valve Solutions

- 7.1.8 Flow Line Valve and Controls

- 7.1.9 American Production Valve

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219