|

市场调查报告书

商品编码

1632116

北美阀门:市场占有率分析、产业趋势、成长预测(2025-2030)North America Valves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

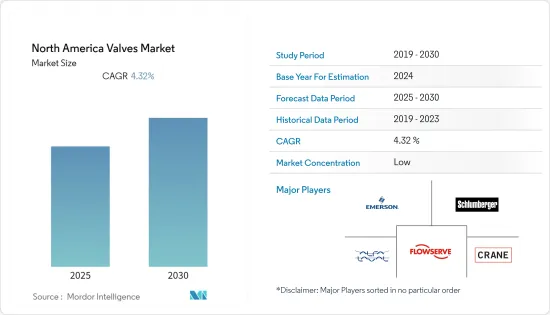

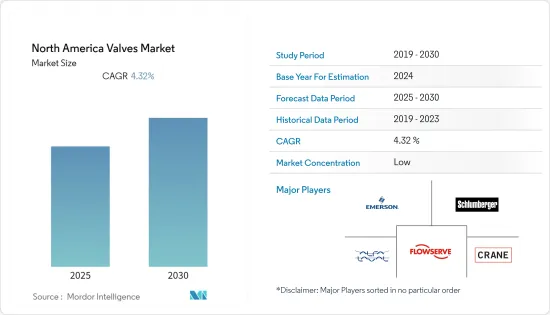

预计北美阀门市场在预测期内的复合年增长率为4.32%。

主要亮点

- 阀门是各种工业机械的重要零件。如果阀门发生故障,工厂运作可能会中断。传统的基于计划的维护技术无法提醒製造组织潜在的阀门故障。因此,技术人员在检查阀门时更有可能报告缺陷,从而导致计划外停机,而使用工业物联网 (IIoT) 本来可以避免这种情况。

- 运算能力和连接性的最新进展使公司能够利用工业物联网技术来减少因阀门故障而导致的计划外停机。在工业物联网的帮助下,阀门专家可以远端检查工厂阀门的健康状况,并评估其有效性、使用寿命和故障风险。这确保了卓越的阀门性能和安全的工作环境。

- 阀门製造商必须遵守多项标准和法规。就阀门而言,不同的地点有不同的认证和政策。需求多种多样,因为阀门用于许多不同的行业,包括石油和天然气、食品和饮料、製药、能源和电力、水和污水处理、建筑、化学品以及纸浆和造纸。然而,这种变化正在阻碍阀门市场的成长。这是因为阀门製造商必须调整相同的产品以适应当地政策,这很难获得理想的安装成本。

- COVID-19大流行对石油和天然气产业造成了毁灭性影响,油价大幅下跌。 2020年和2021年,全球政府实施的石油和天然气产量限制大幅下降,导致供需之间出现严重错配。使用阀门的主要行业之一是石油和天然气。阀门的其他重要最终用户是用水和污水处理以及电力和电力行业,这两个行业的需求因全球大流行而减少。

北美阀门市场趋势

用水和污水预计将显着增长

- 当前的气候挑战使得水资源管理的永续性比以往任何时候都更加重要。污水处理设施是这些关键网路的关键组成部分。污水阀门执行多种工作,并在污水管系统中发挥重要作用。

- 排水阀是调节液体和气体等流体的压力和流量的组件。不同类型的排水阀将允许不同量的流体通过。不同的排水阀设计范围从简单到复杂。排水阀由流量计和温度计控制。

- 由于自动化技术的持续采用,在预测期内对阀门的需求将进一步增强。此外,该领域合作的加强以及政府对污水管理的投资增加正在推动市场成长率。

- 例如,美国农业部 (USDA) 负责农村发展的助理部长表示,该机构正在 106 个计划投资 2.81 亿美元,以升级 36 个州和波多黎各农村地区的用水和污水基础设施。美国农业部的水和废弃物处理贷款和津贴计划正在为这些计划提供资金。

- 此外,自2017财年以来,WIFIA(水基础设施融资与创新法案)已选定192个计划提交融资申请。选定的借款人索赔总额约为 300 亿美元。

- 市政当局和原住民社区严重依赖用水和污水管理系统。 2021 年 12 月,政府间事务、基础设施和社区部以及市政事务部联合宣布为四个计划提供超过 1,920 万加元的资金,以加强不列颠哥伦比亚省的饮用水和污水基础设施。这些计划依照国家规定维修现有污水处理设施或新建饮用水设施,以提高水处理能力,改善地表水质量,保护环境。

- 2022年2月,专门针对製造商的独立数位销售平台InmindCloud宣布与领先的跨国阀门製造商之一VAG建立为期五年的策略合作关係。 VAG 用于用水和污水行业的工业阀门的全球 GTM 销售活动将继续由 In Mind Cloud 提供支援。

美国预计创下最快成长率

- 美国是2021年市场的主要股东,由于各种製造业的存在,预计在整个预测期内将保持其地位。分析了石油和天然气、食品和饮料、化学和石化以及离散製造业的大规模投资和扩张,以加强对阀门的需求。

- 过去十年来,石油和天然气行业对自动化的依赖增加,该行业宣布了大量裁员,市场相关人员留下了低技能的劳动力。因此,美国石油和燃气公司越来越依赖自动化来顺利完成其流程。近年来,美国原油、液化天然气和成品油出口稳定成长,这与新政府「美国能源主导地位」的座右铭不谋而合。

- 近 100 个国家生产原油。 2021年,五个国家的原油产量将占全球原油产量的约51%,其中美国将占14.5%。原油产于美国32 个州和沿海水域。 2021年,五个州的原油产量占美国原油总产量的71%以上。 (资料来源:美国能源资讯署)。

- 此外,加拿大石油和天然气、污水和製造业的大量投资正在推动阀门市场的需求。例如,加拿大萨斯喀彻萨斯喀彻尔省政府关係和政府间事务、基础设施和地区事务部宣布为萨斯喀彻尔周围的 24 个新基础设施计划提供超过3590 万加元的联邦和省级资金。加拿大政府和萨斯喀彻尔省政府透过绿色基础设施项目提供的超过 430 万加元和 360 万加元将加强梅尔维尔的污水处理系统。

- 2022年4月,挪威Equinor ASA提案的120亿美元海上石油计划在环境评估显示没有重大不利影响后获得加拿大政府核准。

北美阀门产业概况

北美阀门市场分散且竞争激烈。公司正在利用策略合作措施来提高市场占有率和盈利。阀门市场较为分散。製造商应该能够透过併购来丰富自己的产品阵容并获得更大的市场占有率。主要企业包括艾默生电气公司、斯伦贝谢有限公司、阿法拉伐公司、福斯公司和克瑞公司。

- Zahroof Valves, Inc. (ZVI) 是一家压缩机阀门製造商,与压缩和设备服务专家 Arkos Field Services 合作,成为美国的授权服务供应商。这种合作关係使 ZVI 客户能够更好地获取本地库存的消耗品和支援知识。

其他好处

- Excel 格式的市场评估 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 价值链/供应链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 自动化技术在流程产业的采用率不断提高

- 炼油厂和石化厂扩建

- 需要更换旧阀门并采用智慧阀门

- 市场限制因素

- 缺乏标准化政策

第六章 市场细分

- 按类型

- 球

- 蝴蝶

- 门/手套/检查

- 插头

- 控制

- 其他类型

- 按行业分类

- 石油和天然气

- 发电

- 化学

- 用水和污水

- 矿业

- 其他最终用户产业

- 国家名称

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Emerson Electric Co.

- Schlumberger Limited

- Alfa Laval Corporate AB

- Flowserve Corporation

- Crane Co.

- Rotork Plc

- Valmet Oyj

- KITZ Corporation

- IMI Critical Engineering

- Samson Controls Inc.

第八章投资分析

第9章 未来趋势

The North America Valves Market is expected to register a CAGR of 4.32% during the forecast period.

Key Highlights

- Valves are essential parts of a variety of industrial machinery. Plant operations could be disrupted if valves malfunction. Manufacturing organizations are unable to be warned about probable valve failures using conventional schedule-based maintenance techniques. As a result, when inspecting valves, technicians frequently report defects, which leads to unplanned downtime that could have been avoided by the use of the Industrial Internet of Things (IIoT).

- Recent advancements in computing power and connectivity have made it possible for businesses to use IIoT technology to cut down on unplanned downtime caused by valve failures. With the help of the IIoT, valve specialists can remotely check on the health of the valves in a plant and assess their effectiveness, lifespan, and failure risk. This ensures superior valve performance and a safe working environment.

- Several standards and rules must be followed by valve makers. When it comes to valves, different locations have distinct certifications and policies. As valves are used in so many different industries, such as oil & gas, food & beverage, pharmaceuticals, energy & power, water & wastewater treatment, building & construction, chemicals, and pulp & paper, demand is diverse. However, such variation is impeding the valves market's growth because manufacturers must adopt the same product to regional policies, making it difficult for valve makers to obtain an ideal cost of installation.

- The COVID-19 pandemic has had a devastating impact on the oil and gas sector, with oil prices falling sharply. Due to the significant drop in global government-imposed limits on oil and gas production in 2020 and 2021, there was a significant mismatch between supply and demand. One of the major industries that use valves is oil and gas. Other significant end-users of valves are the water and wastewater treatment and the electricity and power industries; both of these sectors experienced decreased demand as a result of the global pandemic.

North America Valves Market Trends

Water and Wastewater is Expected to Grow at Significant Rate

- Sustainability in water management is now more important than ever because of the present climate issue. Facilities for wastewater treatment are important components of these vital networks. Wastewater valves perform a lot of work and serve a crucial function in wastewater piping systems.

- A wastewater valve is a component that regulates the pressure and flow of fluids, such as liquids and gases. Different types of wastewater valves allow different volumes of fluid to pass through them. The various wastewater valves come in simple to complicated designs. Wastewater valves are managed by flow meters and temperature gauges.

- The growing adoption of automation is set to further bolster the demand for the valves during the forecast period. Further, the growing collaborations in the sector and the growing government investments in wastewater management are boosting the market growth rate.

- For instance, the U.S. Government of Agriculture (USDA) Deputy Under Secretary for Rural Development stated that the department is investing USD 281 million in 106 projects to upgrade water and wastewater infrastructure in rural areas in 36 states and Puerto Rico. The Water and Waste Disposal Loan and Grant program of the USDA provides money for the projects.

- Moreover, Since fiscal Year 2017, 192 projects have been chosen by the Water Infrastructure Finance and Innovation Act (WIFIA) to submit a loan application. Selected borrowers have claimed about USD 30 billion in total.

- Municipalities and First Nations communities rely heavily on their water and wastewater management systems. In December 2021, to strengthen drinking water and wastewater infrastructure in British Columbia, the Ministry of Intergovernmental Affairs, Infrastructure and Communities and the Ministry of Municipal Affairs jointly announced over CAD 19.2 million in funding for four projects. To increase water capacity, according to provincial regulations, boost surface water quality, and safeguard the environment, the projects will either renovate current wastewater treatment facilities or build new drinking water facilities.

- In February 2022, In Mind Cloud, a manufacturer-focused independent digital sales platform, announced a five-year strategic relationship with VAG, one of the leading multinational valve manufacturer. VAG's global go-to-market (GTM) sales activities for industrial valves used in the water and wastewater industry will continue to be driven by In Mind Cloud.

United States is Expected to Register the Fastest Growth Rate

- The United States is the major shareholder of the market in 2021 and is analyzed to maintain its position throughout the forecast period owing to the presence of various manufacturing industries. The significant investments and expansions in oil and gas, food and beverage, chemical and petrochemical, and discrete industries are analyzed to bolster the demand for Valves.

- The dependence of the oil and gas industry on automation has grown in the last decade, and many rounds of industry layoffs were announced that left market players with less-skilled workers. This led to the increasing dependence of the United States oil and gas companies on automation to complete processes without any delay. In the last few years, the United States exports of crude and LNG (liquefied natural gas) and refined products continued to grow, which aligned with the new administration's motto of 'energy dominance for the United States.

- Crude oil is produced by almost 100 countries. In 2021, five countries accounted for around 51% of global crude oil production with the United States holding 14.5% of the share. Crude oil is produced in 32 states and coastal waters off the coast of the United States. Five states accounted for over 71% of total crude oil output in the United States in 2021. (Source: U.S. Energy Information Administration).

- Further, the significant investments in Canada's oil and gas, wastewater, and manufacturing sectors are bolstering the demand for the valves market. For instance, The Saskatchewan Government Relations Ministry and the Ministry of Intergovernmental Affairs, Infrastructure and Communities Canada announced more than CAD 35.9 million in federal-provincial funding for 24 new infrastructure projects around Saskatchewan. According to investments of over CAD4.3 million from the Government of Canada and around CAD3.6 million from the Government of Saskatchewan through the Green Infrastructure Stream, the wastewater treatment system in Melville will be enhanced.

- In April 2022, A USD12 billion offshore oil project proposed by Norway's Equinor ASA was approved by the Canadian government after an environmental evaluation revealed no substantial adverse implications.

North America Valves Industry Overview

The market for North America Valves is fragmented and is analyzed to be highly competitive. The companies are leveraging strategic collaborative initiatives to increase market share and profitability. The market for valves is fragmented. Manufacturers should be able to improve their product ranges and get a larger market share through mergers and acquisitions. Major firms, include Emerson Electric Co., Schlumberger Limited, Alfa Laval Corporate AB, Flowserve Corporation, and Crane Co. among others.

- April 2022- Zahroof Valves, Inc. (ZVI), a manufacturer of compressor valves, formed a partnership with compression and equipment servicing expert Arkos Field Services as an authorized service provider in the USA. Customers of ZVI now have better access to locally stocked supplies and support knowledge due to this arrangement.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising adoption of automation technologies in process industries

- 5.1.2 Expansion of refineries and petrochemical plants

- 5.1.3 Need for replacement of outdated valves and adoption of smart valves

- 5.2 Market Restraints

- 5.2.1 Lack of standardized policies

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Ball

- 6.1.2 Butterfly

- 6.1.3 Gate/Globe/Check

- 6.1.4 Plug

- 6.1.5 Control

- 6.1.6 Other Types

- 6.2 By End-User Vertical

- 6.2.1 Oil and Gas

- 6.2.2 Power Generation

- 6.2.3 Chemical

- 6.2.4 Water and Wastewater

- 6.2.5 Mining

- 6.2.6 Other End User Verticals

- 6.3 Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Emerson Electric Co.

- 7.1.2 Schlumberger Limited

- 7.1.3 Alfa Laval Corporate AB

- 7.1.4 Flowserve Corporation

- 7.1.5 Crane Co.

- 7.1.6 Rotork Plc

- 7.1.7 Valmet Oyj

- 7.1.8 KITZ Corporation

- 7.1.9 IMI Critical Engineering

- 7.1.10 Samson Controls Inc.