|

市场调查报告书

商品编码

1635353

全球电力工业阀门市场:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Global Valves in Power Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

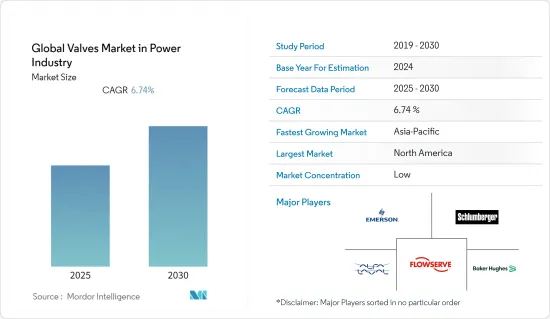

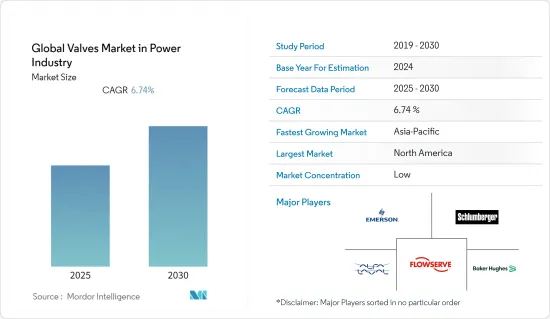

全球电力产业阀门市场预计在预测期间内复合年增长率为6.74%

主要亮点

- 由于气候变迁以及开发更好、可再生和破坏性较小的发电来源的需要,电力消耗不断增加。因此,发电厂工业阀门製造商正在寻找能够提高电力生产效率的加工机械。

- 此外,收购和合作等策略发展的增加也将提高成长率。例如,2022年4月,Vexve Armatury Group收购了Armatury Group GmbH,后者在奥地利和德国市场销售用于电力、天然气和冶金行业的ARMATURY Group阀门。此次收购增强了 Vexve Armatury 集团的地位,特别是在 DACH 地区(德国、奥地利和瑞士)。

- COVID-19 扰乱了供应链,并在停工期间严重影响了能源生产。然而,影响是短期的。

- 这增加了更换阀门的额外成本。设备必须拆卸并重新组装。管理阀门库存所需的人员和材料也会增加成本。此外,由于处置旧阀门造成的环境破坏,可能会产生成本。所有这些还不包括因员工加班而给客户带来的额外成本以及因不得不关闭设施(即使是暂时关闭)而造成的收益损失。这是限制市场的一个因素。

阀门动力产业市场趋势

不断增长的电力行业预计将推动市场成长

- 每个发电应用都需要不同的流量控制需求。因此,发电厂中的特定管道系统可能包含多种阀门。发电厂的工业阀门还必须根据管道系统特定区域中发生的操作发挥不同的作用。

- 此外,可再生能源工厂的多样性意味着不同的製程需要不同的阀门,例如一侧需要低温低压原料,另一侧需要高温高压蒸气。这些工厂根据所涉及的特定任务使用不同类型的阀门来执行特定活动的情况并不少见。

- 控制阀在核能发电厂中常用于控制流体流量,一座核能发电厂的主迴路中有1500多个控制阀。控制阀可将流量引导至精确量的蒸气或水,确保核能发电厂的能源效率。核子反应炉产生的电力约占世界电力的 10%。目前有 55 座核子反应炉正在兴建中,约占目前发电能力的 15%。

- 此外,政府加强对核能发电厂发展的援助也是推动市场成长的因素。例如,2021年11月,美国政府宣布了《两党基础设施法案》。该立法包括为美国能源局(DOE) 提供超过 620 亿美元的资金,以帮助美国向清洁能源经济转型,并规定使用美国最大的单一清洁核能。该法案包括约 25 亿美元的资金,用于在 2028 年之前示范两座先进的美国核子反应炉,以及 60 亿美元的资金用于启动民用核能信贷计画。

根据分析,北美将占据主要市场份额。

- 由于发电厂数量众多,预计北美将占据很大的市场份额。此外,美国拥有最多的运作中核子反应炉。美国有92座正在运作的核子反应炉,总合容量为94.7 GWe。加拿大目前有 19 座核子反应炉在运作中,总合净容量为 13.6 GWe。 2020年,核能发电厂发电量分别占美国和加拿大的14.6%和19.7%(资料来源:世界核能协会)。

- 此外,分析认为,发电阀门先进技术整合方面不断加强的合作将提高预测期内的市场成长率。例如,2021 年 5 月,柯蒂斯-莱特核能事业部宣布与 Exelon Generation Company LLC 达成协议,许可该公司阀门专案的性能资料。 Curtiss-Wright 与 Exelon Generation 合作,利用性能资料提高 StressWave超音波洩漏检测技术的效率,并促进美国核能和发电行业采用阀门评估、分析和性能最佳实践。

- 根据分析,亚太地区在预测期内显着成长。电力产业的庞大需求是市场的驱动因素。例如,2021年,中国发电量8.11兆千瓦时(KWh),比上年增长8.1%。 2021年发电量较2019年成长11%,近两年平均成长率为5.4%。 12月,中国风能、太阳能和核能发电量与前一年同期比较%(资料来源:中国国家统计局)。

- 此外,为满足发电领域需求而不断进行的产品创新也进一步满足了市场需求。 2022年5月,ARMATURY集团宣布为菲律宾水力发电设施生产了三种型号的蝶阀,DN为1,800至2,000。作为截止阀,蝶阀 L32.71 PN 10 和 PN 6 完全打开和关闭工作介质通过管道的通道。

阀门产业电力产业概况

据分析,全球电力产业阀门市场分散且竞争激烈。两家公司正在利用策略性联合措施来增加市场占有率和盈利。製造商应该能够透过併购来改善其产品范围并获得更大的市场占有率。主要企业包括艾默生电气公司、斯伦贝谢有限公司、阿法拉伐公司、福斯公司和克瑞公司。

- 2021 年12 月- 包括Severn 和LB Bentley 在内的专门从事高端阀门工程和製造的跨国公司塞文集团(Severn Group) 很高兴地宣布,专门从事高端阀门工程和製造的跨国公司塞文集团(Severn Group),包括 Severn 和 LB Bentley 收购的先锋 Valv Technologies。该协议是 Evern 集团实现成为工业能源产业严酷工况阀门全球领先供应商此目标的垫脚石。作为更大集团的一员,ValvTechnologies 将与 Severn 和 LB Bentley 一起获得更多的资源和知识,同时保持营运独立。

- 2021 年 6 月 - Neles Corp 签订资产收购协议,收购 Flowrox 的阀门和泵浦业务。这些公司为采矿、选矿、冶金、建筑、能源、环境和化学工业开发和製造阀门和泵浦解决方案。这些解决方案包括夹管阀、刀闸阀和蠕动帮浦。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 价值链/供应链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 电力产业在全球经济的成长

- 电力业采用智慧阀门

- 市场限制因素

- 缺乏标准化措施,更换成本高

第六章 市场细分

- 按类型

- 球

- 蝴蝶

- 门/手套/检查

- 插头

- 控制

- 其他的

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章 竞争格局

- 公司简介

- Emerson Electric Co.

- Schlumberger Limited

- Alfa Laval Corporate AB

- Flowserve Corporation

- Crane Co.

- Baker Hughes

- Valmet Oyj

- KITZ Corporation

- IMI Critical Engineering

- L&T Valves Limited

第八章投资分析

第9章 未来趋势

The Global Valves Market in Power Industry is expected to register a CAGR of 6.74% during the forecast period.

Key Highlights

- Power consumption is increasing due to climate change and the need to develop better, renewable, and less damaging resources to create electricity. Due to this, manufacturers of industrial valves for the power plant sector look for process machinery that can improve the effectiveness of electricity production.

- Further, the growing strategic developments such as acquisitions, collaborations, and so on are set to bolster the growth rate. For instance, in April 2022, Vexve Armatury Group acquired Armatury Group GmbH, a distributor of ARMATURY Group valves in the Austrian and German markets for the power, gas, and metallurgy sectors. Through the acquisition, Vexve Armatury Group's position is strengthened, particularly in the DACH region (Germany, Austria, Switzerland).

- COVID-19 has created supply chain disruptions and has significantly impacted energy production during the lockdowns. However, the impact has been short-term.

- Along with additional expenses, valve replacement adds up. Equipment needs to be taken apart and then put back together. The personnel and materials required to manage valve inventory control have a cost. Additionally, there can be a fee for the environmental damage caused by the disposal of old valves. All of this is on top of the additional costs for customers caused by employee overtime and the revenue lost due to the facility having to shut down, even momentarily. This acts as a restraint on the market.

Power Sector in Valves Market Trends

Growing Power Sector is Expected to Cater the Market Growth

- A different set of flow control requirements are needed for each kind of power generation application. That so, a power plant's particular pipeline system may contain a wide variety of valves. Industrial valves for power plants also need to play diverse roles depending on the operations occurring in a specific area of the pipe system.

- Moreover, due to the diversity of renewable energy plants, different valves are needed for different processes, such as low temperature, low-pressure raw material at one end of the process and high temperature, high-pressure steam at the other. It's not unusual for these plants to use various valve types to carry out particular activities, depending on the exact duties involved.

- In nuclear power plants, control valves are frequently employed to control fluid flux, and the principal circuit of one nuclear power plant contains more than 1500 control valves. They enable the flux to be directed to a precise amount of steam or water, ensuring the nuclear power plant's energy efficiency. Nuclear power reactors generate around 10% of the world's electricity. A total of 55 more reactors, or roughly 15% of the current capacity, are now being built.

- Further, the growing government aid in developing nuclear power plants is set to boost the market growth rate. For instance, in November 2021, the US government announced The Bipartisan Infrastructure Law that includes over USD 62 billion for the US Department of Energy (DOE) to assist in the country's transition to a clean energy economy, which provides for utilizing nuclear energy, the country's greatest single source of clean power. The law includes around USD 2.5 billion to enable the demonstration of two advanced American reactors by 2028 and USD 6 billion to launch a Civil Nuclear Credit program.

North America is Analyzed to Major Share in the Market

- North America is expected to hold the major share in the market owing to the significant presence of the power generation plants. Moreover, The United States has the most operational nuclear reactors. The 92 operating nuclear reactors in the USA have a net combined capacity of 94.7 GWe. With a total net capacity of 13.6 GWe, Canada has 19 nuclear reactors that are currently in operation. Nuclear power plants produced 14.6% and 19.7% of the nation's electricity in 2020 in the US and Canada, respectively (Source: World Nuclear Association).

- Further, the growing collaborations in integrating advanced technologies in the valves in power generation are analyzed to boost the market growth rate during the forecast period. For instance, in May 2021, The Nuclear Division of Curtiss-Wright stated that it had reached a contract with Exelon Generation Company LLC to license the firm's valve program performance data. Curtiss-Wright will use the performance data in collaboration with Exelon Generation to improve the efficiency of its StressWave ultrasonic leak detection technology and encourage the adoption of best practices in valve assessment, analysis, and performance throughout the U.S. nuclear fleet and the power generation sector.

- Asia-Pacific is analyzed to grow at a significant rate during the forecast period. The significant demand from the power sector is a driving factor for the market. For instance, in 2021, China generated 8.11 trillion kilowatt-hours (KWh), an increase of 8.1 percent from the previous year. Power generation in 2021 increased by 11% from 2019, making the average rise over the last two years 5.4%. In December, China's wind, solar, and nuclear energy production increased year over year by 30.1%, 18.8%, and 5.7%, respectively (Source: National Bureau of Statistics (NBS)).

- Moreover, the growing product innovations to meet the demand in the power generation sector further contribute to the market's need. In May 2022, The ARMATURY Group announced that the company had manufactured three butterfly valves with DNs ranging from 1,800 to 2,000 for the Philippine hydroelectric power facility. As shut-off valves, butterfly valves L32.71 PN 10 and PN 6 will completely open or close the passage of the working medium through the pipeline.

Power Sector in Valves Industry Overview

The Global Valves Market in Power Industry is fragmented and is analyzed to be highly competitive. The companies are leveraging strategic collaborative initiatives to increase market share and profitability. Manufacturers should be able to improve their product ranges and get a larger market share through mergers and acquisitions. Major firms include Emerson Electric Co., Schlumberger Limited, Alfa Laval Corporate AB, Flowserve Corporation, and Crane Co., among others.

- December 2021- Severn Group, a multinational company of dedicated high-end valve engineering and manufacturing companies that includes Severn and LB Bentley, has acquired ValvTechnologies, a pioneer in the design and manufacture of metal-seated, zero-leakage isolation valve products for demanding applications. The agreement is a milestone toward Severn Group's goal of being the leading global expert in severe service valves for the industrial and energy industries. Along with Severn and LB Bentley, ValvTechnologies will remain operationally independent while gaining access to a larger pool of resources and knowledge as a larger group member.

- June 2021- Neles Corp has inked an asset acquisition agreement to buy Flowrox's valve and pump operations. The companies develop and produce valve and pump solutions for the mining, minerals processing, metallurgy, construction, energy, environmental, and chemical industries. These solutions include pinch valves, knife gate valves, and peristatic pumps.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Power Sector in the Global Economy

- 5.1.2 Adoption of Smart Valves in the Power Industry

- 5.2 Market Restraints

- 5.2.1 Lack of Standardized Policies and High Replacement Costs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Ball

- 6.1.2 Butterfly

- 6.1.3 Gate/Globe/Check

- 6.1.4 Plug

- 6.1.5 Control

- 6.1.6 Other Types

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Emerson Electric Co.

- 7.1.2 Schlumberger Limited

- 7.1.3 Alfa Laval Corporate AB

- 7.1.4 Flowserve Corporation

- 7.1.5 Crane Co.

- 7.1.6 Baker Hughes

- 7.1.7 Valmet Oyj

- 7.1.8 KITZ Corporation

- 7.1.9 IMI Critical Engineering

- 7.1.10 L&T Valves Limited