|

市场调查报告书

商品编码

1635393

止回阀市场:全球市场占有率分析、产业趋势/统计、成长预测(2025-2030)Global Check Valve - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

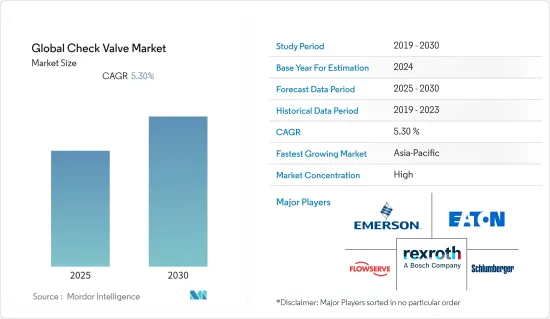

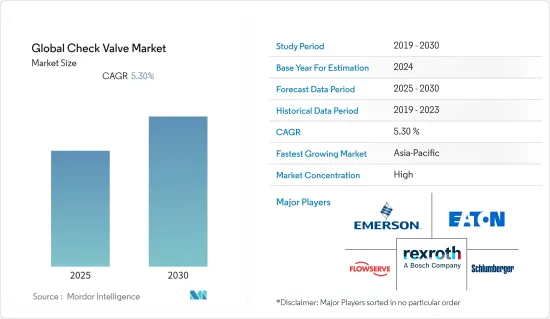

全球止回阀市场预计在预测期内复合年增长率为 5.3%。

用水和污水处理、石油和天然气、能源和电力等最终使用领域的需求不断增长正在推动止回阀市场的发展。此外,工业自动化使用的增加正在推动智慧止回阀的发展,并可能在预测期内刺激市场扩张。

主要亮点

- 全球发电厂、石油和天然气工业的增加,以及新兴国家不断增长的能源和电力需求正在推动对止回阀的需求。这些阀门用于核能发电厂的化学处理、供水、冷却水和蒸气涡轮控制系统。

- 此外,製造商致力于提供耐腐蚀和耐恶劣环境的阀门。在 COVID-19 大流行期间,由于 2020 年上半年的封锁导致工业生产停止,收益暂时下降。市场中断全面影响了原材料的供需、产品的製造和分销。止回阀是需求因此减少的物品和零件之一。

- 然而,食品饮料、化学、製药、金属、采矿等行业对高品质工业阀门的需求不断增长,以降低污染风险,目前对钢製止回阀的需求不断增加。对卫生的日益关注可能会推动水和用水和污水处理厂的不銹钢止回阀市场,因为耐腐蚀不銹钢阀门还可以承受高温、化学、压力和硬水条件。

- 此外,旋启式止回阀的需求量也很大,并且由于其设计简单、通过阀门的压力损失最小以及易于现场维护,经常提案用于用水和污水系统应用。此外,由于新兴市场的石油和天然气、化学品以及能源和电力等最终用户行业的需求不断增加,线性止回阀预计将主导市场。

止回阀市场趋势

石油和天然气领域推动全球止回阀市场

- 石油和天然气领域预计将占据全球止回阀市场的最大市场占有率。波湾合作理事会(GCC)国家能源消耗的增加和钻探活动的扩大是这项扩张的主要驱动力。

- 生产和精製平台上的高压、高温和不利的腐蚀条件正在推动对止回阀的需求。这些平台主要用于陆上和海上石油和天然气活动。这些阀门也用于石油和天然气行业的大多数关键系统。它不仅调节流体的流动,还调节其方向、体积、速度和压力。

- 此外,上游石油和天然气行业是止回阀的最大用户,止回阀安装在数百万个井口处,用于分段和控制数百万英里的总管道中的流量。止回阀也用于主要的跨国管道,将原油和天然气输送到精製,并将汽油、柴油和天然气等精炼产品输送到最终用户市场。

- 此外,科技公司还提供许多设定工具来检测止回阀洩漏和其他缺陷。例如,特瑞堡密封系统将于2022年7月推出互动式 Variseal油气密封选择,这是一种线上配置工具,可为客户提供高性能密封的技术提案参数。该工具主要用于石油、天然气和能源产业。该工具允许用户快速轻鬆地创建用于密封设计的标准或自订密封提案。该工具专门用于配置止回阀。

- 然而,由于 COVID-19 大流行,世界目前正在经历一场经济灾难。疫情对石油和天然气业务产生了重大影响,原油价格暴跌至每桶0美元以下。此外,新冠肺炎 (COVID-19) 疫情导致整个行业的新管道、炼油厂和石化厂计划被取消和推迟。

亚太地区占比较大

- 亚太地区预计将占据全球止回阀市场的很大份额,由于中国和印度的快速工业化以及能源需求的增加,止回阀的需求预计将在全球越来越受欢迎。

- 此外,政府不断增加的永续发展措施预计将在预测期内推动市场成长。亚太市场受到对节能产品不断增长的需求的推动。此外,该地区主要止回阀製造商的存在也是推动市场扩张的重要因素。

- 此外,淡水资源的减少正促使中国、印度和印尼等不断发展的经济体采用现代水和污水处理系统。为此,已开发国家和新兴国家的政府正在大力投资对现有供水基础设施进行现代化改造,这推动了对工业止回阀的需求。

- 因此,亚太地区是止回阀产业许多主要参与者的所在地。推动该地区市场扩张的两个主要因素是增加与自动化阀门使用相关的研发力度以及不断增长的安全应用需求。

- 此外,亚太地区最大的止回阀市场是中国。区域市场的扩张得益于研发力度的加大以及止回阀在各最终用户行业的使用增加。使用止回阀来管理介质流并确保安全有效的製程自动化的这些产业包括石油和天然气、能源和电力、水和用水和污水处理等。此外,根据国际能源总署的石化报告,预计2021年至2025年中国将启动512个石化计划。

止回阀产业概况

我们分析止回阀市场的竞争格局,涵盖最新的市场趋势和竞争策略,如业务扩张、产品推出/开发、联盟、併购和收购。本研究确定并分析了全球止回阀市场每个类别的主要市场参与者,并调查了他们的主要竞争力量。主要企业包括艾默生电气、伊顿公司、斯伦贝谢、博世力士乐、福斯公司和 Flomatic Valves。

- 2022 年 5 月 - Fromatic Valve 宣布推出采用全 316 不銹钢 8 英吋设计的 408S6 型球止回阀。 Fromatic 的 408S6 型球形止回阀接受 AWWA C508 标准节距,并且符合 AIS(美国钢铁公司)标准。 Flomatic Valves 继续投资美国製造的阀门产品,提供最全面的符合 AIS 标准的球止回阀产品组合之一。

- 2022 年 3 月 - 维美德宣布在其灵活蝶形止回阀产品线中添加 Neles Q-Disc,这是一种新的高性能功能,可帮助工业阀门实现流量平衡。该新产品是 2021 年 6 月推出市场的模组化 Neles Neldisc 和 Jamesbury 对夹止回阀平台的补充。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 新兴经济体发电厂数量不断增加,能源和电力需求不断增加

- 技术进步促进智慧阀门和致动器的应用

- 市场挑战

- 缺乏适当的标准化和认证造成的问题

第六章 市场细分

- 依材料类型

- 不銹钢

- 合金底座

- 铸铁

- 低温

- 其他的

- 按阀门类型

- 旋转阀

- 线性阀

- 按用途

- 开 关/隔离

- 控制

- 按最终用户产业

- 石油和天然气

- 用水和污水处理

- 能源/电力

- 饮食

- 化学

- 建筑/施工

- 纸浆/造纸製造

- 药品/医疗保健

- 金属/矿业

- 农业

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Emerson Electric Co.

- Eaton Corporation

- Bosch Rexroth

- Flowserve Corporation

- Schlumberger NV

- Honeywell International Inc.

- Flomatic Pumps

- The Weir Group PLC

- Colfax

- Herose Gmbh

- Danfoss AS

- Curtiss-Wright Corp.

- Crane Co.

第八章投资分析

第九章 未来市场展望

The Global Check Valve Market is expected to register a CAGR of 5.3% during the forecast period.

Increased demand from end-use sectors such as water and wastewater treatment, oil and gas, and energy and power is driving the check valve market. Furthermore, the growing use of industrial automation is encouraging smart check valves, which will likely fuel market expansion throughout the forecast period.

Key Highlights

- The increasing number of power-producing plants, the oil & gas industry around the world, and the growing energy and power needs of emerging nations are driving the demand for check valves. These valves are utilized in nuclear power reactors for chemical processing, feed water, cooling water, and steam turbine control systems.

- Additionally, manufacturers are concentrating their efforts on providing valves that are resistant to corrosion and extreme environments. During the COVID-19 pandemic, revenues fell temporarily when lockdowns halted industrial production in the first half of 2020. The suspension of the marketplace has entirely affected the demand and supply of raw materials, as well as product manufacturing and distribution. Check valves are one of the items and components that have seen a decrease in demand as a result of this.

- However, increased need for high-quality industrial valves in the food and beverage, chemical, pharmaceutical, metal, and mining industries to reduce contamination risk is currently increasing demand for steel check valves. The growing concern about sanitation is likely to drive the stainless steel check valves market in water and wastewater treatment plants, as corrosion-resistant stainless steel valves can endure high temperatures, chemicals, and pressures, as well as hard water conditions.

- Furthermore, Swing check valves are also in huge demand and frequently suggested for use in water and wastewater system applications due to its straightforward design, minimal pressure drop through the valve, and easy field serviceability. Additionally, because of the increasing demand from end-user industry including oil and gas, chemicals, and energy and electricity in developing nations, linear check valves are expected to control the market.

Check Valve Market Trends

Oil and Gas Segment Will Fuel the Check Valve Market Globally

- The oil and gas segment is anticipated to hold the largest market share in the global check valve market. Rising energy consumption and expanding drilling activities in the Gulf Cooperation Council (GCC) nations are mainly responsible for this expansion.

- The high-pressure, high-temperature, and unfavorable corrosion conditions on production and refinery platforms have increased the demand for check valves. These platforms are primarily employed in onshore and offshore oil and gas activities. These valves are also used in most critical systems in the oil and gas industry. They regulate not just the flow of fluids but also their direction, volume, pace, and pressure.

- Furthermore, the upstream oil and gas industry is the most prolific user of check valves, which are used to outfit millions of wellheads and segment and control flow through millions of miles of gathering pipelines. Check valves are also used in cross-country trunk pipelines that transport crude oil and gas to refineries and refined products like gasoline, diesel, and natural gas to end-user markets.

- Furthermore, many setup tools are being provided by technology businesses to detect leaks and other faults in check valves. For example, Trelleborg sealing solutions will introduce its interactive Variseal Oil & Gas Seal selection, an online configuration tool that will give customers technical proposal parameters for high-performance sealing, in July 2022. It is primarily intended for use in the oil, gas, and energy industries. It allows users to quickly and easily construct a standard or custom seal proposal document for use in seal design. The tool is particularly used for check valve configuration.

- However, the world is currently in the grip of an economic catastrophe as a result of the COVID-19 pandemic. This pandemic has had a significant impact on the oil and gas business, with oil prices plunging below zero dollars per barrel. Furthermore, due to the COVID-19 epidemic, the entire sector has seen project cancellations and delays for new pipelines, refineries, and petrochemical plants.

Asia Pacific to Hold Significant Share

- Check valves are anticipated to become more and more prevalent in the Asia-Pacific region due to the region's predicted substantial market share in the global check valve market, as well as the region's growing demand for them due to the rapid industrialization of China and India, as well as rising energy demands.

- Furthermore, increased government initiatives toward sustainable development are expected to drive market growth throughout the forecast period. The Asia-Pacific market is being driven by rising demand for energy-efficient products. Furthermore, the presence of major check valve manufacturers in this region is a crucial factor driving market expansion.

- Also, diminishing freshwater sources are prompting growing economies such as China, India, and Indonesia to employ contemporary water and wastewater treatment systems. Governments in established and emerging economies are investing extensively in modernizing existing water supply infrastructure for this purpose, which is increasing demand for industry check valves.

- As a result, the Asia-Pacific area is home to numerous major participants in the check valve industry. Two major drivers driving the regional market expansion are increased R&D efforts connected to the use of automated valves and rising demand for safety applications.

- Additionally, In Asia Pacific Region, the largest check valves market is in China. The expansion of the regional market is accelerated by increased R&D effort and increased use of check valves across a variety of end-user industries. These industries, which employ check valves to manage media flow and guarantee a secure and effective process automation, include oil and gas, energy and power, and water and wastewater treatment. Also, According to International Energy Agency's petrochemicals Report, it is anticipated that 512 petrochemical projects in China will go up between 2021 and 2025.

Check Valve Industry Overview

The competitive landscape in the check valve market has been analyzed, and it covers recent market developments and competitive tactics such as expansion, product launch and development, collaboration, merger, and acquisition. The study identifies and profiles the main market players in each category of the worldwide check valve market, as well as examines their primary competencies. Among the leading companies are Emmerson Electric, Eaton Corporation, Schlumberger N.A., Bosch Rexroth, Flowserve Corporation, Flomatic Valves, and many more.

- May 2022 - Flomatic Valves has announced that the Model 408S6 ball check valve is available in an entirely 316 stainless steel 8-inch design. The Model 408S6 ball check valves from Flomatic are AWWA C508 standard lay length compatible and American Iron and Steel (AIS) compliant. Flomatic Valves continues to make investments in American-made valve products and offers one of the most comprehensive portfolios of ball check valves that are AIS compliant.

- March 2022 - Valmet announced the addition of Neles Q-Disc, a new high-performance feature that aids flow balancing in indutrial valve applications, to its flexible butterfly check valve product line. The new product complements the modular Neles Neldisc and Jamesbury Wafer-Sphere butterfly check valve platforms, which were launched to the market in June 2021.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness -Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in the Number of Power Generation Plants and the Increasing Energy and Power Requirements of Emerging Economies

- 5.1.2 Technological Advancements Propelling Application of Smart Valves and Actuators

- 5.2 Market Challenges

- 5.2.1 Lack of Proper Standardization and Certification Creating Issues

6 MARKET SEGMENTATION

- 6.1 Material Type

- 6.1.1 Stainless Steel

- 6.1.2 Alloy Based

- 6.1.3 Cast Iron

- 6.1.4 Cryogenic

- 6.1.5 Others

- 6.2 By Valve Type

- 6.2.1 Rotary Valves

- 6.2.2 Linear Valves

- 6.3 By Application

- 6.3.1 On-Off/Isolation

- 6.3.2 Control

- 6.4 By End-User Industry

- 6.4.1 Oil and Gas

- 6.4.2 Water and Wastewater Treatment

- 6.4.3 Energy and Power

- 6.4.4 Food and Beverage

- 6.4.5 Chemicals

- 6.4.6 Building and Construction

- 6.4.7 Pulp and Paper

- 6.4.8 Pharmaceuticals and Healthcare

- 6.4.9 Metals and Mining

- 6.4.10 Agriculture

- 6.4.11 Others

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Emerson Electric Co.

- 7.1.2 Eaton Corporation

- 7.1.3 Bosch Rexroth

- 7.1.4 Flowserve Corporation

- 7.1.5 Schlumberger N.V.

- 7.1.6 Honeywell International Inc.

- 7.1.7 Flomatic Pumps

- 7.1.8 The Weir Group PLC

- 7.1.9 Colfax

- 7.1.10 Herose Gmbh

- 7.1.11 Danfoss AS

- 7.1.12 Curtiss-Wright Corp.

- 7.1.13 Crane Co.