|

市场调查报告书

商品编码

1635402

拉丁美洲 POS 终端:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Latin America POS Terminal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

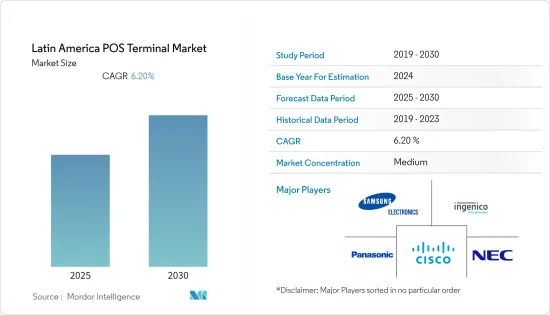

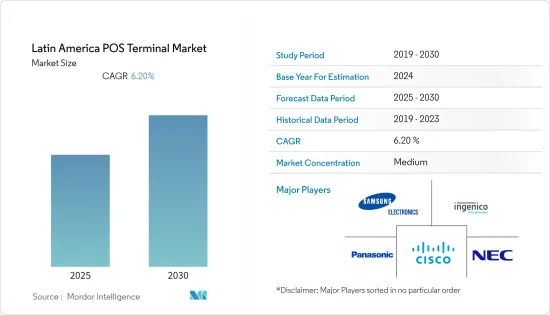

拉丁美洲 POS 终端市场预计在预测期内复合年增长率为 6.2%。

主要亮点

- 由于投资收益率的提高和可访问的便利性,POS 终端市场在过去几年中显着增长。 POS 系统促进零售、餐旅服务业、运输和银行等各行业企业核心要素的交易,多年来对于各种规模的企业都变得越来越重要。

- 在该市场运营的公司也致力于透过推出新产品来支持墨西哥的数位付款。 2020年10月,着名付款技术公司Epos Now宣布在墨西哥推出云端POS系统。该 POS 解决方案为墨西哥中小企业 (SMB) 开闢了新的数位收益来源,使他们能够连接全球客户群并应对当前环境下快速变化的消费者习惯。

- POS 终端系统正在从以交易为中心的终端/设备发展为可以与公司的 CRM 和其他金融解决方案整合的系统。这种演变为最终用户提供了商业情报,以更好地管理收益流和库存。降低维护成本、准确交易和即时库存管理是 POS 系统的主要优点。先进的 POS 系统提供的功能优势正在使企业以 POS 系统取代传统的收费软体,从而确保 POS 系统市场的成长。

- 与其他付款管道相比,该市场的主要驱动力之一是拥有成本较低。与传统系统相比,增强型 POS 系统具有更高的耐用性和可靠性,从而降低了拥有成本,从而增加了中小型企业对 POS 解决方案的需求。

- 市场成长面临的挑战之一是由于使用敏感资讯而导致的安全问题。由于 POS 终端连接到网路和互联网,因此它们很容易受到试图存取或操纵它们的攻击,就像任何其他不安全的机器一样。终端与网路其余部分的通讯方式意味着攻击者可能能够存取窃取或克隆支付卡所需的未加密的卡片资料,包括 Track2 和 PIN 资讯。

拉丁美洲POS终端市场趋势

行动/可携式POS 终端预计将获得显着的市场占有率

- mPOS 是传统 POS 的智慧型 POS 替代品,透过蓝牙连接到您的智慧型手机。行动 POS 系统允许用户透过平板电脑、智慧型手机和其他手持装置接受付款,而无需绑定到单一 POS 收银机。交易包括信用卡磁条阅读器支付和无线交易。我们利用行动电话的资料连线来处理交易。

- 行动 POS 系统越来越受欢迎,因为它们允许销售和服务企业在客户所在的地方进行交易,从而增加了整个流程的灵活性并改善了客户体验。

- 电子商务的成长以及实体零售和网路零售业的交织预计也将影响终端的未来成长。事实上,由于主要电子商务平台提供货到付款选项,行动 POS 终端机的采用率激增。

- mPOS 终端可能没有像 POS 终端那样强大的安全通讯协定,特别是如果您使用 Apple 或 Android 智慧型手机和平板电脑等商用现成 (COTS) 终端,因此资料保护至关重要。

- 在预测期结束时,随着商家增加相关服务,以满足对非接触式和易于使用的支付方式不断增长的需求,该细分市场预计将增加其在市场上的影响力。由于 mPOS 解决方案是专门为平板电脑而不是桌上型电脑设计的,因此更小、更便携的设备的趋势预计将促进市场成长。

巴西可望获得显着的市场占有率

- 数位付款的扩张正在推动巴西市场的成长。各种金融服务机构正在与当地企业合作,加速使用 POS 终端机的数位付款。

- 此外,2021 年 8 月,全球知名金融服务技术解决方案提供商 Fiserv 宣布与 Caixa Economia Federal 子公司 Caixa Cartoes 签署独家协议,帮助巴西各地的公司透过 Caixa 获得收购服务。

- 此次合作的目的是促进拉丁美洲地区的数位付款。 Caixa 品牌的 POS 终端可以接受签帐金融卡、信用卡、代金券付款以及透过卡片或二维码进行的近距离付款(例如使用 Caixa Tem 应用程式进行的付款)。 2021 年 7 月使用 Caixa 终端机完成第一笔交易后,该终端已在巴西 174 个 Caixa分店进行试用。

- 此外,根据 Fiserv 2021 年的一项研究,巴西人首选的支付方式是信用卡和签帐金融卡卡(28%),其次是PIX (22%)、数位钱包(11%)、条码支付(9%) 和现金。巴西对信用卡和签帐金融卡付款的高度依赖正在为市场创造新的机会。

- 然而,POS 终端的更换工作也在进行中,预计这将影响该地区基于硬体的 POS 终端的成长。 2021 年 3 月,软体定义信任 (SDT) 领域的知名参与者 Magiccube 宣布推出 i-Accept,这是巴西验收终端的完全基于软体的替代品。

拉美POS终端产业概况

拉丁美洲 POS 终端市场竞争温和,拥有大量区域和全球参与者。主要企业包括三星电子、Ingenico 集团和思科系统公司。

- 2021 年 10 月 - Hash 是一家专门从事付款基础设施的金融科技公司,在由 QED Investors 和 Kaszek 共同管理的 C 轮资金筹措中筹集了 4000 万美元。 Hash 为希望提供银行服务的非金融 B2B 公司提供端到端付款基础设施,从销售点 (POS) 软体和行动应用程式到仪表板和付款。

- 2021 年 8 月 - 根据 Caixa Economia Federal 子公司 Caixa Cartes 与付款和金融服务技术提供商 Fiserv, Inc. 之间达成的独家协议,巴西各地的企业将透过 Caixa 品牌的 POS 终端获得采购服务。所有 4,300 个 Caixa分店均配备 Caixa 品牌终端。企业可以使用该终端透过卡片和二维码进行感应支付,包括签帐金融卡、信用卡、礼品卡支付以及使用 Caixa Tem 应用程式进行支付。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 价值链分析

- COVID-19 市场评估

第五章市场动态

- 市场驱动因素

- 与其他付款管道相比,整体拥有成本较低

- 非接触式和行动 POS 终端需求大幅成长

- 市场限制

- 由于使用敏感资讯而引起的安全性问题

- 市场机会

- 无现金交易增加

- POS终端主要法规及申诉标准

- 关于非接触式付款的日益使用及其对行业影响的说明

- 重大案例分析

第六章 市场细分

- 按类型

- 固定POS系统

- 行动/可携式POS 系统

- 按国家/地区

- 墨西哥

- 巴西

- 阿根廷

第七章 竞争格局

- 公司简介

- PAX Technology

- BBPOS

- VeriFone System Inc.

- DSpread

- Castles

- YourTransactor

- Ingenico SA

- SZZT

- Spectra

- WizarPOS

第八章投资分析

第九章 市场未来展望

简介目录

Product Code: 91659

The Latin America POS Terminal Market is expected to register a CAGR of 6.2% during the forecast period.

Key Highlights

- The POS terminal market has grown significantly over the past few years, owing to its ability to offer an increased return on investment and ease of access. POS systems that facilitate transactions from the central component of businesses across industries, like retail, hospitality, transportation, and banking, have gained importance in companies of small and big sizes, over the years.

- Companies operating in the market are also focusing on supporting the digital payments in Mexico with the launch of new products. In October 2020, Epos Now, a prominent payment technology company, announced the launch of its cloud POS system in Mexico. The POS solution offers Mexican small and medium-sized businesses (SMBs) the ability to open new digital revenue streams, connect to a global customer base, and cater to rapidly shifting consumer habits in the current climate.

- POS terminal systems have evolved from being transaction-oriented terminals/devices to systems that can integrate with the company's CRM and other financial solutions. This evolution has empowered the end-users with business intelligence to better manage their revenue streams and inventory. Lower maintenance costs, accurate transactions, and real-time inventory are key advantages of the POS systems. With the functional benefits that the advanced POS systems offer, companies have replaced their traditional billing software with POS systems, thus, securing the growth of the POS system market.

- One of the major drivers of the market is the low cost of ownership compared to other payments channels. The enhanced POS systems provide higher durability and reliability, which leads to a lower cost of ownership, thus raising the demand for POS solutions in both medium and small-sized businesses compared to the traditional system.

- One of the challenge to the market's growth is the security concerns due to the usage of critical information. POS terminals are connected to the network and the internet, making them vulnerable to attacks to gain access to and manipulate it like any other insecure machine. The way the terminal communicates with the rest of the network means attackers could access unencrypted card data, including Track2 and PIN information, providing all the necessary information required to steal and clone payment cards.

Latin America POS Terminal Market Trends

Mobile/Portable Point-of-Sale Terminals Expected to Witness Significant Market Share

- An mPOS is a smarter alternative to the traditional POS which connects to smartphones via Bluetooth. A mobile point of sale system allows users to accept payments via tablets, smartphones, and other handheld devices without being tied to a POS register in a single location. The transactions can include credit card magstripe reader payments and wireless transactions. It utilizes a mobile phone's data connection to process transactions.

- Mobile POS systems are gaining traction as they allow sales and service industries to conduct the transaction at the customer's location, adding flexibility to the whole process and improving customer experience.

- The growth in e-commerce and the entangling of the brick-and-mortar and online retail practices are also expected to affect the future growth of the terminals. In fact, with the option of cash on delivery, provided by major e-commerce platforms, a sudden surge in the adoption of mobile POS terminal has been recognized.

- Data protection is paramount as mPOS devices may not have security protocols as robust as their POS counterparts, especially if you're using commercial-off-the-shelf (COTS) devices such as Apple or Android smartphones and tablets.

- Towards the end of the forecast period, the segment is expected to multiply in market presence as vends increase their relevant offerings in response to the increased demand for contactless ease-of-use payment methods. As mPOS solutions are specially designed for tablets instead of desktop computers, the trend of smaller and more portable devices will augment the growth of the market.

Brazil Expected to Witness Significant Market Share

- The growth of digital payments is fueling the growth of the market in Brazil. Various financial services organizations are partnering with regional companies to accelerate digital payments using POS terminals.

- Further, in August 2021, Fiserv, a prominent global provider of financial services technology solutions, announced that it has entered into an exclusive agreement with Caixa Cartoes a subsidiary of Caixa Economia Federal, which enables businesses throughout Brazil to have access to acquiring services through Caixa-branded point-of-sale (POS) terminals.

- The aim of the partnership is to push digital payments in the Latin America region. The Caixa-branded terminals allow businesses to accept payments via debit or credit card or voucher and proximity payments via card or QR code, such as those made using the Caixa Tem app. Following the first transaction completed using a Caixa terminal in July 2021, the terminals were made available through a pilot at 174 Caixa branches throughout Brazil.

- Furthermore, according to a 2021 study by Fiserv, Credit cards and Debit cards are preferred payment methods by the Brazilians (28%), followed by PIX (22%), digital wallets (11%), payments by barcode (9%), and cash (6%). The strong dependence on credit and debit cards for payments creates new opportunities for the market in Brazil.

- However, there have been efforts to replace the POS terminals which is expected to affect the growth of the hardware-based POS terminals in the region. In March 2021, Magiccube, a prominent player in Software Defined Trust (SDT) announced the availability of i-Accept, a complete software-based replacement for acceptance terminals in Brazil.

Latin America POS Terminal Industry Overview

The Latin America POS Terminal Market is moderately competitive, with a considerable number of regional and global players. Key players include Samsung Electronics Co. Ltd, Ingenico Group, Cisco Systems Inc. among others

- October 2021 - Hash, a fintech company focused on payment infrastructure raised USD 40 million in a Series C fundraising round that was jointly managed by QED Investors and Kaszek. Hash provides end-to-end payment infrastructure, ranging from point-of-sale (POS) software and mobile applications to dashboards and payments, for non-financial B2B enterprises wishing to offer banking services.

- August 2021 - As a result of an exclusive agreement between Caixa Cartes, a division of Caixa Economia Federal, and Fiserv, Inc, a provider in payments and financial services technology, businesses across Brazil now have access to purchasing services through Caixa-branded point-of-sale (POS) terminals. All 4,300 Caixa branches have Caixa-branded terminals. Businesses can use the terminals to take payments made with debit, credit, or gift cards and proximity payments made with a card or QR code, such as those made with the Caixa Tem app.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Value Chain Analysis

- 4.4 Assesment of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Low Total Cost of Ownership Compared to Other Channels of Payments

- 5.1.2 Significant Rise in the Demand for Contactless and Mobile POS Terminals

- 5.2 Market Restrains

- 5.2.1 Security Concerns due to the Usage of Critical Information

- 5.3 Market Opportunities

- 5.3.1 Increase in Number of Cashlesss Transactions

- 5.4 Key Regulations and Complaince Standards of PoS Terminals

- 5.5 Commentary on the rising use of contactless payment and its impact on the industry

- 5.6 Analysis of Major Case Studies

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Fixed Point-of-sale Systems

- 6.1.2 Mobile/Portable Point-of-sale Systems

- 6.2 By Country

- 6.2.1 Mexico

- 6.2.2 Brazil

- 6.2.3 Argentina

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 PAX Technology

- 7.1.2 BBPOS

- 7.1.3 VeriFone System Inc.

- 7.1.4 DSpread

- 7.1.5 Castles

- 7.1.6 YourTransactor

- 7.1.7 Ingenico SA

- 7.1.8 SZZT

- 7.1.9 Spectra

- 7.1.10 WizarPOS

8 INVESTMNET ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219