|

市场调查报告书

商品编码

1635418

拉丁美洲订阅和收费管理 -市场占有率分析、行业趋势和统计、成长预测(2025-2030)Latin America Subscription and Billing Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

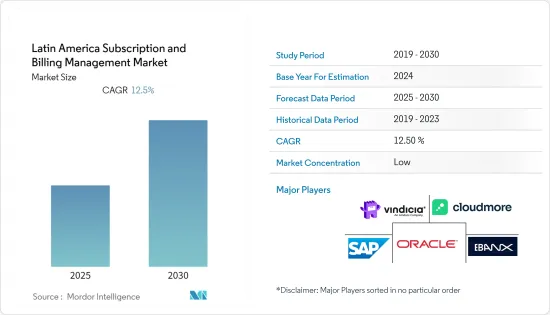

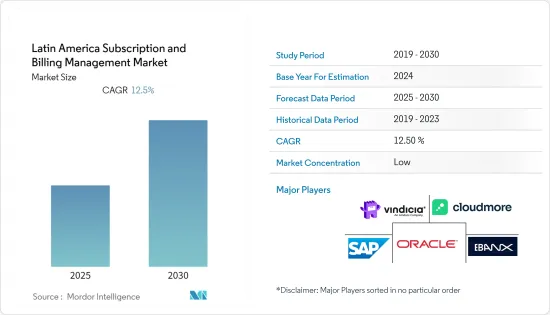

拉丁美洲订阅和收费管理市场预计在预测期内复合年增长率为 12.5%

主要亮点

- 基本客群的显着成长需要自动化和标准化您的订阅申请流程。除此之外,组织越来越注重透过改善客户体验来最大限度地客户维繫。因此,订阅申请管理解决方案的工业利用率预计在预测期内将会上升。

- 订阅收费解决方案通常包括追踪功能,使企业能够更好地了解客户行为,从而提高参与度、客户满意度和客户维繫。当公司能够存取大量消费者资料时,他们可以根据客户的偏好对客户进行细分,并决定如何最好地吸引每个群体。这一特性预计将推动订阅和收费管理市场的成长。

- 根据 2021 年 9 月数位电视研究的数据,到 2026 年,拉丁美洲的 SVOD 订阅人数将达到 1.31 亿。这比 2021年终拉丁美洲预计的 7,600 万例病例大幅增加。

- 此外,Netflix将保持其在SVOD营运商中的主导地位。儘管迪士尼起步相对缓慢,但我们相信未来几年它将在市场上取得重大进展。到 2026 年,Netflix 在拉丁美洲将拥有 4,840 万会员,迪士尼+以 3,250 万位居第二。

- COVID-19 对市场成长产生了正面影响。各种规模的公司都在重新考虑 2021 年及以后的业务策略。这些公司正在部署具有跨通路可见性的订阅管理工具,以推动常态化并调整指标,让事情变得更容易。

拉丁美洲订阅和收费管理市场趋势

预计将在媒体和娱乐产业广泛采用

- 媒体和娱乐产业是快速数位转型的典型例子,不断创新和开发新方法来生产和提供基于订阅的数位产品。广告商、出版商、广播公司和其他机构正在采用基于订阅的经营模式来满足不断增长的需求。

- 随着 Netflix、Amazon Prime、Eros Now、Hulu 和 Hotstar 等媒体提供商的扩张,订阅视讯点播 (SVOD) 串流场景正在迅速扩大。此外,Disney+、Apple TV+、Claro Video 和 HBO Max 等新进者正在支持市场扩张。

- 因此,广播平台、媒体公司和广告公司正在迅速采用收费管理解决方案,将其收益流程统一为简化的、以客户为中心的体验。

- 智慧型手机的普及、资料通讯费用的降低以及对原创内容和区域数位内容的投资是推动统一费率收费管理行业的有利因素。

- Sherlock Communications 于 2021 年 9 月在巴西进行了一项研究,要求受访者选择他们喜欢的订阅随选视讯 (SVOD) 平台。大约三分之二 (63%) 的受访者选择了 Netflix。排名第二的是 Amazon Prime,有 16% 的受访者选择。大约 6% 的受访者选择了 Globoplay 和 HBO Max。

互联网的普及将大大扩大市场。

- 由于世界上智慧型手机数量的不断增加以及世界上大多数国家都存在高速行动电话网络,电子商务行业正在不断增长。随着电子商务产业的成长,行动交易预计也将快速成长,并显着提振订阅市场。

- B2C 和 B2B 业务的经常性订阅收入都在成长。客户喜欢租用软体而不是购买软体。因此,SaaS(订阅即服务)越来越受到企业的欢迎。

- 拉丁美洲拥有6.57亿人口,经济规模达10.5兆美元,是一片充满机会和成长潜力的大陆,预计2021年将实现3.7%的正成长。具有移动意识的中阶正在蓬勃发展,知识渊博的工人正在采用技术解决方案来推动他们的社区发展。

- 此外,根据 GSMA Intelligence 的数据,拉丁美洲行动互联网渗透率将从 2018 年的 53% 上升至 2025 年的 64%。

- 组织正在寻求实施更好的收费策略,以创建灵活的业务运作并节省资本支出。无纸化收费可协助企业节省纸张、列印和运输成本。透过采用申请和订阅软体以及网路门户,客户可以更好地协调付款时间表和预算,并避免过多的逾期罚款。

拉丁美洲订阅和收费管理产业概述

订阅收费管理市场已被细分,因为该地区的多个市场参与企业正在为基于订阅的业务提供创新的收费和申请解决方案。此外,新参与企业和现有企业越来越多地寻求资金筹措来加强和改进其产品,以最大限度地提高市场吸引力。

- 2022 年 2 月 - Amdocs Media 旗下部门 Vindicia 宣布扩大与 Vimeo 的长期伙伴关係。作为此次合作的一部分,Vimeo 将继续使用 Vindicia 的订阅管理和保留解决方案服务。

- 2021 年 10 月—建立网路经济基础设施的全球科技公司 Stripe 宣布,已同意收购主要企业的网路业务付款验证软体公司 Recko。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 订阅经营模式的快速采用

- 更新旧有系统的需求日益增加

- 市场问题

- 资料同步的复杂性

- 评估 COVID-19 对拉丁美洲订阅和收费管理市场的影响

- 产业生态系分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 依发展(趋势、2020年至2027年销售量、市场前景)

- 云

- 本地

- 依组织规模(趋势、2020年至2027年的销售额、市场前景)

- 小型企业

- 大公司

- 依最终用户产业(趋势、2020年至2027年的销售额、市场前景)

- BFSI

- 零售/电子商务

- 资讯科技/通讯

- 公共部门和公共产业

- 媒体娱乐

- 其他的

- 按地区(趋势、2020年至2027年销售额、市场前景)

- 巴西

- 墨西哥

- 其他拉丁美洲

第六章 竞争状况

- 公司简介

- EBANX

- Cloudmore

- Oracle

- SAP

- Vindicia

- Stripe

- Kushki

- Magnaquest Technologies

- Chargebee

- OneBill

- Billcentrix

第七章 投资分析

第八章 市场未来展望

简介目录

Product Code: 91739

The Latin America Subscription and Billing Management Market is expected to register a CAGR of 12.5% during the forecast period.

Key Highlights

- Automation and standardization of the subscription billing process are becoming necessary due to the substantial growth of the customer base. This is in addition to organizations' growing emphasis on maximizing client retention through improved customer experience. As a result, industry usage of subscription billing management solutions is likely to rise during the projection period.

- Subscription billing solutions typically include tracking capabilities that allow businesses to understand the behavior of customers better and, as a result, boost engagement, customer happiness, and retention. When companies have access to a large amount of consumer data, they may segment clients based on their preferences and decide the best ways to engage each group. This characteristic is expected to drive the growth of the Subscription and Billing Management Market.

- According to Digital TV Research, in September 2021, it is stated that, by 2026, the Latin America region will have 131 million SVOD subscriptions. This represents a huge increase over the 76 million expected for Latin America region by the end of 2021.

- Furthermore, Netflix will remain the dominant SVOD operator; Disney, despite a relatively late start, will make great strides in the market in the following years. By 2026, Netflix will have 48.4 million members in Latin America, with Disney+ coming in second with 32.5 million.

- COVID-19 has had a favorable impact on market growth. Companies of all sizes are rethinking their business strategies for 2021 and beyond. These businesses are implementing subscription management tools with cross-channel visibility to drive normality and make things easier by matching their metrics.

Latin America Subscription & Billing Management Market Trends

Significant Adoption Is Expected in the Media and Entertainment Industry

- The media and entertainment sector is a prime example of rapid digital transformation, constantly innovating technology and developing new ways to generate and distribute subscription-based digital products. Advertisers, publishers, broadcasters, and others are adopting the subscription-based business model to keep up with the continually expanding demand.

- The subscription video-on-demand (SVOD) streaming scene is fast expanding due to the expansion of media providers like Netflix, Amazon Prime, Eros Now, Hulu, Hotstar, and others. In addition, new entrants like Disney+ and Apple TV+, as well as Claro Video and HBO Max, fuel market expansion.

- Hence, the broadcast platforms, media corporations, and advertising companies are rapidly deploying subscription billing management solutions with an aim to integrate revenue processes into one streamlined customer-focused experience, which is expected to provide unprecedented insight into the entire Quote-to-Cash process.

- Smartphone adoption, low data tariffs, and investments in original and regional digital content are some favorable aspects driving the subscription and billing management industry.

- In September 2021, Respondents were asked to select their favorite subscription video-on-demand (SVOD) platform in a survey conducted by Sherlock Communications in Brazil. Almost two-thirds (63%) of those polled chose Netflix. Amazon Prime came in second place, with 16% of respondents choosing it. Globoplay and HBO Max were selected by around 6% of the subjects.

Internet Penetration holds Significant growth in the Market

- With the increasing number of smartphones worldwide and high-speed cellular networks present in most countries worldwide, the e-commerce industry is growing. With an increase in the E-commerce industry, mobile transactions are also expected to grow rapidly, providing a significant boost to the Subscription market.

- Both B2C and B2B businesses are seeing an increase in recurring revenue from subscriptions. Customers prefer to rent software rather than buy it. Therefore subscription as a service (SAAS) is becoming increasingly popular among enterprises.

- Latin America is a continent brimming with growth chances and potential, with a population of 657 million and a USD 10.5 trillion economy forecast to return to positive growth of 3.7 percent in 2021. It is home to a booming mobile-minded middle class and a knowledge-hungry workforce willing to embrace technological solutions to progress their communities.

- Moreover, According to GSMA Intelligence, mobile internet penetration in Latin America will rise from 53% in 2018 to 64% by 2025.

- For instance, prominent technology companies such as Uber, Spotify, Apple Inc., and Google LLC have transformed their business models to adapt to changing customer demand and are transitioning from a static & linear product offering to a subscription-based model to encourage predictable, recurring, and stable revenue.

- Organizations are considering introducing better billing strategies to build flexible business operations and save capital investment. Paperless billing methods help organizations save money on paper, printing, and shipping. Customers can better arrange their payment schedules and budgets and prevent excessive late penalties by employing software and internet portals for billing and subscriptions.

Latin America Subscription & Billing Management Industry Overview

The Subscription Billing Management Market is fragmented due to several market players in this region offering innovative billing and invoicing solutions for subscription-based businesses. Also, the new and emerging and existing companies are increasingly raising funds to enhance and improvise their offerings to gain maximum market traction.

- February 2022 - Vindicia, a division of Amdocs Media Division, announced an expansion of its long-standing partnership with Vimeo. Vimeo continues using Vindicia's services for subscription management and retention solutions as part of this arrangement.

- October 2021 - Stripe, a worldwide technology company that builds internet economic infrastructure, said it has agreed to purchase Recko, a leading provider of payments reconciliation software for internet businesses.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions? and Market Definition

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Adoption of Subscription business models

- 4.2.2 Increasing need for Updating Legacy Systems

- 4.3 Market Challenges

- 4.3.1 Complexities related to Data Synchronization

- 4.4 Assessment of the Impact of COVID-19 on the Latin America subscription and Billing Management Market

- 4.5 Industry Ecosystem Analysis

- 4.6 Industry Attractiveness-Porter's Five Force Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Deployment (Trends, Revenue for the period of 2020-2027 & Market Outlook)

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 By Organization Size(Trends, Revenue for the period of 2020-2027 & Market Outlook)

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 By End-user Industry (Trends, Revenue for the period of 2020-2027 & Market Outlook)

- 5.3.1 BFSI

- 5.3.2 Retail and E-Commerce

- 5.3.3 IT and Telecommunication

- 5.3.4 Public Sector and Utilities

- 5.3.5 Media and Entertainment

- 5.3.6 Other End-user Industries

- 5.4 By Region (Trends, Revenue for the period of 2020-2027 & Market Outlook)

- 5.4.1 Brazil

- 5.4.2 Mexico

- 5.4.3 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 EBANX

- 6.1.2 Cloudmore

- 6.1.3 Oracle

- 6.1.4 SAP

- 6.1.5 Vindicia

- 6.1.6 Stripe

- 6.1.7 Kushki

- 6.1.8 Magnaquest Technologies

- 6.1.9 Chargebee

- 6.1.10 OneBill

- 6.1.11 Billcentrix

7 Investment Analysis

8 Future Outlook of the Market

02-2729-4219

+886-2-2729-4219