|

市场调查报告书

商品编码

1635455

日本容器玻璃:市场占有率分析、产业趋势、成长预测(2025-2030)Japan Container Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

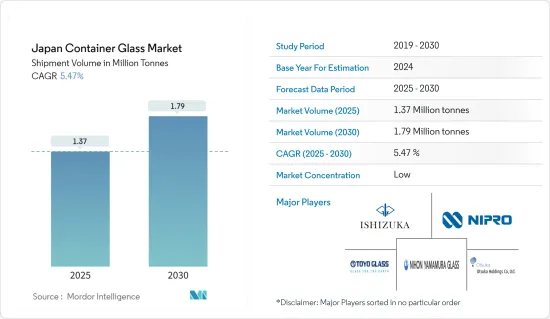

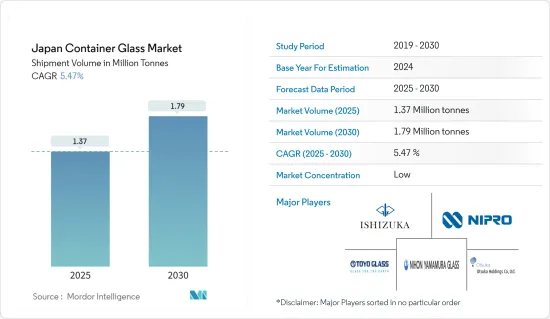

日本容器玻璃市场规模(以出货量为准)预计将从2025年的137万吨扩大到2030年的179万吨,预测期间(2025-2030年)复合年增长率为5.47%。

主要亮点

- 由于玻璃容器无限的再生性使用性、可回收性、可再填充性以及各行业日益接受的推动,对玻璃容器的需求正在上升。这些优势对于市场拓展发挥着重要的推动作用。

- 在日本,对更健康、更安全包装的推动正在推动容器玻璃产业的成长。独特的形状、改进的美观性和压花等创新使包装对消费者更具吸引力。此外,蓬勃发展的食品和饮料市场以及对生物分解性和环保产品不断增长的需求进一步支持了玻璃包装的成长。

- 在日本,玻璃瓶在饮料产业占据主导地位。该行业拥有高效的瓶子回收系统。随着对废弃物和全球暖化的担忧增加,对玻璃容器的需求持续增加。

- 根据美国农业部(USDA)统计,日本非酒精饮料市场价值约400亿美元,其中进口额约10亿美元。美国是日本非酒精饮料的主要供应国,主要出口矿泉水、胡萝卜汁和葡萄汁。这种涌入使得日本本土製造商有可能推出新的口味和类型,尤其是玻璃瓶装的口味和类型,以应对不断变化的消费者偏好,并保持与进口产品的竞争力,从而促进多元化。

- 日本两个地球 (J2E) 研究着眼于透过人工智慧分类带来的玻璃回收革命。这种人工智慧驱动的分类会随着时间的推移而适应,透过准确分类玻璃颜色和类型来解决劳动力短缺问题并提高玻璃回收率。Ricoh集团旗下领先的扫描器製造商 PFU Corporation 推出了尖端的人工智慧工具。该工具采用影像识别技术,引导机械臂能够区分棕色和不透明玻璃等颜色,每分钟可分类 70 个瓶子。像弘前市的 Seinan Co., Ltd. 这样的公司已经试行了这个人工智慧系统,以部分自动化玻璃瓶分类。

- 然而,玻璃生产是能源密集型的,并且在熔化过程中会从原材料中排放二氧化碳。回收商务用玻璃容器面临挑战。日本玻璃产业正在积极采取措施减少玻璃对环境的影响,但这可能是抑制市场成长的因素。

日本容器玻璃市场的动向

医药产业大幅成长

- 日本是继美国和中国之后的世界第三大医药市场。鑑于人口老化,日本政府正在加快创新药物的核准流程并简化生命科学法规。该策略旨在增强国内外製药公司的实力,同时吸引新参与企业进入日本市场。世界经济论坛强调了日本独特的人口结构,指出日本超过10%的人口年龄超过80岁,使其成为世界上人口老化程度最高的国家。

- 据Adagos Pharma称,截至2024年5月,日本市场的高估值证实了其巨大的潜力和医疗保健消费者的深度信任。美国着名製药巨头已在日本建立了强大的影响力,这证实了只要符合日本严格的品质标准,该市场就向外国公司开放。在政府的大力支持和充满活力的研发环境下,生技药品和专利药物有望显着成长。

- 日本製药业实施严格的目视检查、特殊包装和细緻的标籤。材料和包装技术的选择不仅要符合当地法规,还要回应消费者的偏好。尤其是在人口老化的日本,易于使用、专为老年人设计的设计受到青睐。因此,以耐高温且缺乏化学反应性而闻名的玻璃在日本的需求量很大。

- 透过消除全球投资障碍,日本政府正在刺激医药市场的扩张。随着需求的增加,日本对玻璃容器的依赖预计将会增加。日本药品批发商协会(JPWA)的资料显示,日本伦理药品市场中学名药的销售份额发生显着变化,从 2020 年的 78.3% 上升至 2023 年的 80.2%。

- 各行业玻璃容器出货量的激增进一步支持了市场扩张。玻璃容器优选用于包装各种产品,包括易腐烂和不易腐烂的产品,以及液体药品和化学品。此外,日本政府正在透过放鬆监管和鼓励外国投资来促进这一成长。

饮料销售推动市场成长

- 玻璃是包装酒精饮料(尤其是烈酒)的首选材料。这种偏好是由该产品保持香气和风味的独特能力所驱动的。彩色玻璃瓶在葡萄酒包装中尤其引人注目,在保护葡萄酒免受阳光照射方面发挥重要作用。随着葡萄酒消费量持续增加,日本对玻璃容器和包装的需求预计在预测期内也会增加。

- 日本酒精饮料部门在日本饮料製造领域占有重要地位。据财务省称,国内酒精饮料出口额将从2020年的710.3亿日圆(6.7亿美元)跃升至2023年的1,344.1亿日圆(12.7亿美元)。酒精饮料出口的激增将加强对国内玻璃容器的需求。

- 日本可口可乐公司在环保方面处于领先地位,取消了饮料上的塑胶标籤,并减少了自动贩卖机的能源消费量。此举符合可口可乐最近的全球承诺,到 2030 年使其 25% 的包装可回收。可口可乐的策略重点是可重复使用的包装,特别是可回收的玻璃瓶,这将加强玻璃容器的区域市场。

- 日本的一些城市支持玻璃瓶的回收和再利用,作为永续性倡议的一部分。例如,Circular Yokohama 是一个旨在振兴横滨市经济的线上平台。横滨可重复使用垃圾箱计划由横滨市资源回收商业合作社主导,专注于生产可重复使用的玻璃瓶。这项措施强调地产地销,使环境和当地社区受益。

- 随着消费者越来越重视便利性和随身携带的选择,包装偏好也不断改变。传统上,由于玻璃瓶的重量和易碎性,玻璃瓶被认为不如塑胶和纸盒替代品方便,但现在它们越来越受欢迎。这种变化很大程度上归功于轻质设计和防碎涂层等先进的包装技术,使玻璃瓶对现代消费者更具吸引力。因此,饮料业预计玻璃瓶包装将获得更广泛的接受,从而推动市场成长。

日本容器玻璃产业概况

日本容器玻璃市场较为分散,主要企业包括:东洋精工集团控股有限公司、日本山村硝子、日本精工硝子、石冢硝子等公司拥有重要的市场份额,并专注于透过合作和合併进行创新和业务扩张。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 容器玻璃进出口贸易资料

- 包装用容器玻璃产业标准与法规

- 容器和包装的永续性趋势

- 日本容器用玻璃熔炉的容量和位置

第五章市场动态

- 市场驱动因素

- 对环保和可重复使用产品的需求不断增长

- 食品和饮料市场的需求不断增加

- 市场限制

- 玻璃生产火热且能源密集

- 日本在亚洲容器玻璃市场现况分析

- 贸易情景-日本容器玻璃产业进出口包装的历史与现状分析

第六章 市场细分

- 按最终用户产业

- 饮料

- 酒精饮料

- 葡萄酒和烈酒

- 啤酒/苹果酒

- 其他酒精饮料

- 非酒精饮料

- 碳酸饮料

- 果汁

- 水

- 乳类饮料

- 调味饮料

- 其他非酒精饮料

- 食物

- 化妆品

- 药品

- 其他最终用户产业

- 饮料

第七章 竞争格局

- 公司简介

- Toyo Seikan Group Holdings, Inc.

- Nihon Yamamura Glass Co. Ltd

- Japan Seiko Glass

- Otsuka Pharmaceutical Co., Ltd.

- KOA Glass Co., LTD

- Ishizuka Glass Co., Ltd.

- Nipro Corporation

- DAI-ICHI GLASS CO.,LTD

第八章补充通报-区域内主要容器玻璃厂主要窑炉供应商分析

第九章 市场未来展望

简介目录

Product Code: 91871

The Japan Container Glass Market size in terms of shipment volume is expected to grow from 1.37 million tonnes in 2025 to 1.79 million tonnes by 2030, at a CAGR of 5.47% during the forecast period (2025-2030).

Key Highlights

- Demand for glass containers is on the rise, driven by their endless reusability, recyclability, refillability, and growing acceptance across various industries. These benefits play a crucial role in fueling market expansion.

- In Japan, the push for healthier and safer packaging is driving the growth of the container glass industry. Innovations such as unique shapes, aesthetic enhancements, and embossing make packaging more attractive to consumers. Additionally, the booming food and beverage market, along with a rising demand for biodegradable and eco-friendly products, is further propelling the growth of glass packaging.

- In Japan, glass bottles dominate the beverage sector. The industry boasts efficient bottle recycling systems. As concerns about waste and global warming grow, the demand for glass containers continues to rise.

- As per the United States Department of Agriculture (USDA), Japan's non-alcoholic beverage market is valued at around USD 40 billion, with imports making up about USD 1 billion. The U.S. stands as the leading supplier of non-alcoholic beverages to Japan, with top exports being mineral water, carrot juice, and grape juice. This influx might encourage local Japanese producers to diversify their offerings, potentially introducing new flavors or types, especially those in glass bottles, to cater to changing consumer preferences and stay competitive against imports.

- Research by Japan 2 Earth (J2E) highlights a revolution in glass recycling through AI-powered sorting. This AI-driven sorting, which adapts over time, tackles labor shortages and enhances glass recycling rates by accurately categorizing glass by color and type. PFU Limited, a leading scanner manufacturer under the Ricoh Group, has introduced a cutting-edge AI tool. Leveraging image recognition technology, this tool guides robotic arms capable of sorting 70 bottles per minute, adept at distinguishing colors like brown or opaque glass. Companies like Hirosaki City's Seinan Corporation have piloted this AI system for partial automation of their glass bottle sorting.

- Nonetheless, glass production is energy-intensive, releasing CO2 from raw materials during melting. Recycling commercial glass containers poses challenges. The Japanese glass industry is actively working on initiatives to mitigate glass's environmental impact, a factor that could impede market growth.

Japan Container Glass Market Trends

Pharmaceutical Industry to Witness Significant Growth

- Japan ranks as the world's third-largest pharmaceutical market, following the United States and China. In light of its aging population, the Japanese government is expediting the approval process for innovative drugs and streamlining life science regulations. This strategy aims to strengthen both domestic and foreign pharmaceutical companies while attracting newcomers to Japan's market. The World Economic Forum highlights Japan's unique demographic, noting that over 10% of its population is aged 80 or older, making it home to the world's oldest populace.

- Adragos Pharma reports that as of May 2024, the market's lofty valuation underscores its immense potential and the deep trust it commands from healthcare consumers. Prominent U.S. pharmaceutical giants have cemented their presence in Japan, underscoring the market's openness to foreign entities, provided they meet Japan's rigorous quality benchmarks. With robust government support and a dynamic R&D landscape, biologics and patented drugs are set for substantial growth.

- Japan's pharmaceutical sector enforces rigorous visual inspections, specialized packaging, and meticulous labeling. The selection of materials and packaging technologies must not only comply with local regulations but also cater to consumer preferences. This is particularly crucial given the aging demographic in Japan, which favors user-friendly and senior-centric designs. As a result, glass, known for its ability to withstand high temperatures and chemical non-reactivity, sees heightened demand in the nation.

- By removing barriers to global investment, the Japanese government is fueling the expansion of its pharmaceutical market. With rising demand, Japan foresees an increased reliance on glass containers. Data from The Federation of Japan Pharmaceutical Wholesalers Association (JPWA) reveals a notable shift: the volume share of generics in Japan's prescription drug market climbed from 78.3% in 2020 to 80.2% in 2023.

- The market's expansion is further supported by a surge in glass container shipments across diverse sectors. Glass containers are preferred for packaging not only liquid pharmaceuticals and chemicals but also a wide array of perishable and non-perishable goods. Moreover, the Japanese government is nurturing this growth by relaxing regulations and promoting foreign investments.

Beverage Sales to Drive the Market Growth

- Glass stands out as the preferred material for packaging alcoholic beverages, especially spirits. Its distinct capability to maintain product aromas and flavors drives this preference. Tinted glass bottles, especially prominent in wine packaging, play a crucial role in shielding wine from sunlight. As wine consumption continues to rise, so too will the demand for glass packaging in the country during the forecast period.

- Japan's alcoholic beverage sector holds a significant position in the nation's beverage manufacturing arena. According to the Ministry of Finance Japan, exports of domestic alcoholic beverages jumped from JPY 71.03 billion (USD 670 million) in 2020 to JPY 134.41 billion (USD 1.27 billion) in 2023. This surge in alcoholic drink exports is poised to bolster the demand for glass containers domestically.

- Coca-Cola Japan is leading the charge in eco-friendliness, removing plastic labels from its beverages and cutting down energy consumption in its vending machines. This move is in line with Coca-Cola's recent global commitment to make 25% of its packaging recyclable by 2030. Their strategy emphasizes reusable packaging, especially returnable glass bottles, which is set to enhance the regional market for glass containers.

- Several cities in Japan are championing the recycling and reuse of glass bottles as part of their sustainability initiatives. For example, Circular Yokohama is an online platform aimed at boosting Yokohama city's economy. The Yokohama reuse bin project, spearheaded by the Yokohama City Resource Recycling Business Cooperative, focuses on creating reusable glass bottles. This initiative emphasizes local production and consumption, benefiting both the environment and the community.

- As consumers increasingly prioritize convenience and on-the-go options, packaging preferences are evolving. While glass bottles have traditionally been viewed as less convenient due to their weight and fragility compared to plastic or carton alternatives, they are now gaining popularity. This shift is largely due to advancements in packaging technology, such as lightweight designs and shatter-resistant coatings, making glass bottles more appealing to modern consumers. Consequently, the beverage sector is expected to embrace glass bottle packaging more widely, driving market growth.

Japan Container Glass Industry Overview

The Japan Glass Container Market is moderately fragmented, with key players such as Toyo Seikan Group Holdings, Inc., Nihon Yamamura Glass Co. Ltd, Japan Seiko Glass, Ishizuka Glass Co., Ltd., and more. These players have a significant market share and are focused on innovations and business expansion through collaboration and mergers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Import Export Trade Data of Container Glass

- 4.3 Industry Standards and Regulations for Container Glass Use for Packaging

- 4.4 Sustainability Trends for Packaging

- 4.5 Container Glass Furnace Capacity and Location in Japan

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Environmentally Friendly and Reusable Products

- 5.1.2 Increased Demand in the Food and Beverage Market

- 5.2 Market Restrain

- 5.2.1 Glass Production is Energy Intensive with High Temperatures for Manufacturing

- 5.3 Analysis of the Current Positioning of Japan in the Asian Container Glass Market

- 5.4 Trade Scenario - Analysis of the Historical and Current Export-Import Packaging for Container Glass Industry in Japan

6 MARKET SEGMENTATION

- 6.1 End-User Industry

- 6.1.1 Beverages

- 6.1.1.1 Alcoholic Beverages

- 6.1.1.1.1 Wines and Spirits

- 6.1.1.1.2 Beer and Cider

- 6.1.1.1.3 Other Alcoholic-Beverages

- 6.1.1.2 Non-Alcoholic Beverages

- 6.1.1.2.1 Carbonated Drinks

- 6.1.1.2.2 Juices

- 6.1.1.2.3 Water

- 6.1.1.2.4 Dairy-Based

- 6.1.1.2.5 Flavored Drinks

- 6.1.1.2.6 Other Non-Alcoholic Beverages

- 6.1.2 Food

- 6.1.3 Cosmetics

- 6.1.4 Pharmaceuticals

- 6.1.5 Other End-user Industries

- 6.1.1 Beverages

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Toyo Seikan Group Holdings, Inc.

- 7.1.2 Nihon Yamamura Glass Co. Ltd

- 7.1.3 Japan Seiko Glass

- 7.1.4 Otsuka Pharmaceutical Co., Ltd.

- 7.1.5 KOA Glass Co., LTD

- 7.1.6 Ishizuka Glass Co., Ltd.

- 7.1.7 Nipro Corporation

- 7.1.8 DAI-ICHI GLASS CO.,LTD

8 SUPPLEMENTARY COVERAGE - ANALYSIS OF MAJOR FURNACE SUPPLIERS TO MAJOR CONTAINER GLASS PLANTS IN THE REGION**

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219