|

市场调查报告书

商品编码

1635456

义大利容器玻璃:市场占有率分析、产业趋势与成长预测(2025-2030)Italy Container Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

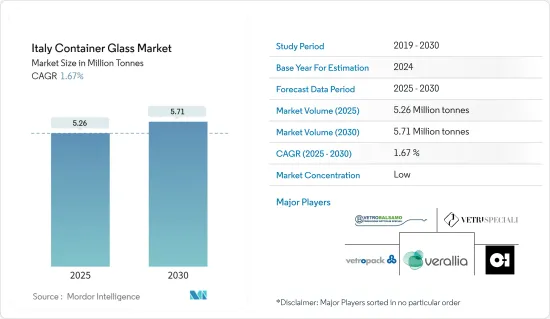

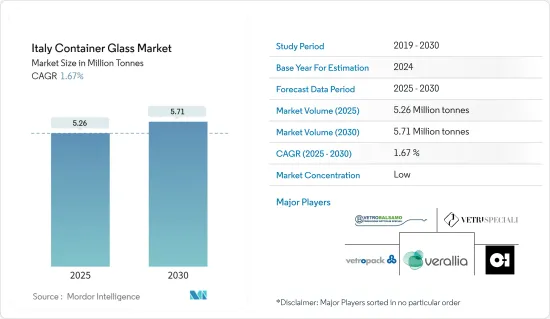

义大利容器玻璃市场规模预估2025年为526万吨,预估2030年将达571万吨,预测期内(2025-2030年)复合年增长率为1.67%。

主要亮点

- 玻璃由天然和永续材料製成,是注重健康的消费者的首选包装。义大利的人口老化正在促进药品包装市场的成长。义大利玻璃包装产业致力于永续生产,与客户合作开发创新、环保的包装解决方案。这些努力包括减少製造过程中的能源消耗、增加回收玻璃的使用以及在不牺牲强度或品质的情况下开发更轻的玻璃容器。

- 义大利不断增长的啤酒市场正在推动玻璃瓶设计的创新,包括更轻、更环保的选择和使品牌脱颖而出的独特形状。这一趋势鼓励製造商实现产品系列多元化,为玻璃容器产业创造成长机会。啤酒製造商越来越多地与玻璃製造商合作,打造自订的瓶子设计,以反映其品牌形象并迎合消费者的美学偏好。

主要亮点

- 据啤酒和麦芽製造商协会 (ASSOBIRRA) 称,义大利的啤酒消费量将从 2020 年的 1,890 万升增至 2023 年的 2,120 万公升。消费量的成长增加了对玻璃瓶的需求,特别是对于精酿啤酒和特殊啤酒,玻璃包装通常是维持产品品质和提升品牌形象的首选。

- 玻璃是一种永久性材料,可以回收製成无穷无尽的新包装。随着更多的玻璃废弃物被分类和收集,回收玻璃的品质和数量将会提高。在义大利,随着许多城市引入了有效的收集系统,并且消费者已经意识到正确处理玻璃的重要性,玻璃回收率正在稳步提高。

- 根据国际贸易中心统计,2023年义大利是第三大容器玻璃出口国。义大利容器玻璃(HS编码-701090)的出口总额为1,314,600美元,高于2022年的1,246,900美元。作为主要出口国,义大利正在加强与其他国家的贸易关係,并为容器玻璃开闢新市场。这将增强义大利进入新兴市场的能力,进一步扩大出口机会,并促进容器玻璃产业生产、创新和投资的长期成长。

- 营运成本上升以及塑胶和锡等替代产品的使用增加可能会限制市场成长。塑胶包装因其重量轻、可成型性和厚度可控而日益普及,可能会影响玻璃包装市场的发展。然而,玻璃产业正在透过投资降低生产成本和改善玻璃製造环境足迹的技术来回应,以保持在包装市场的竞争力。

义大利容器玻璃市场趋势

酒精细分市场占据主要市场占有率

- 在义大利容器玻璃市场,酒精饮料产业约占80%的市场占有率,在推动市场成长方面发挥重要作用。

- 义大利以其丰富的葡萄酒和烈酒生产传统而闻名,义大利葡萄酒、普罗塞克和格拉巴酒等产品在国内外备受推崇。这些饮料的文化重要性确保了对玻璃容器的稳定和强劲的需求。玻璃通常因其能够保留酒精的风味和完整性而受到青睐,尤其是对于优质和陈年饮料。

- 义大利玻璃瓶产业与葡萄酒产业和义大利美食中的丰盛食品有着广泛的联繫。玻璃包装是一种流行的选择,大多数义大利葡萄酒、食品和调味品行业最终都将产品包装在玻璃瓶中。

- 由于玻璃是一种惰性材料,这些行业严重依赖玻璃瓶来满足其包装需求。这使其成为储存人类消费产品的安全选择。玻璃瓶不含化学物质,不会与产品或环境反应。

- 近几十年来,义大利葡萄酒供应链在国内和国际市场的盈利和成功方面表现良好。儘管其产品、价格、消费格局,尤其是其组织的分散性,阻碍了其充分利用规模经济,但情况仍然如此。

- 义大利各地葡萄酒消费量的不断增长正在推动市场对容器玻璃杯的需求。葡萄酒是义大利农业最传统的产品之一,也是义大利饮食的恆久元素之一。古往今来,葡萄酒一直是一种廉价的能源来源,是水不安全时期的必备饮料,也是社交庆典的象征元素。

- 啤酒通常用玻璃瓶包装,尤其是高级啤酒和精酿啤酒越来越受欢迎。随着啤酒消费量的增加,对用于包装啤酒的玻璃容器的需求也增加。

- 据啤酒和麦芽製造商协会(AssoBirra)称,义大利年人均啤酒消费量将从2020年的31.7公升增加到2023年的36.1公升。

- 啤酒消费量的增加通常与啤酒种类的增加有关,包括优质啤酒和精酿啤酒,而玻璃包装通常因其美观和保留风味的能力而受到青睐。这一趋势推动了对高品质、具有视觉吸引力的玻璃容器的需求。

医药领域显着扩大。

- 由于玻璃适用于多种配方,因此它仍然是药品的主要包装材料。玻璃广泛应用于工业,具有确保产品安全性和稳定性的特性,使其成为许多应用的首选。玻璃容器广泛应用于製药领域,提供可靠的屏障,抵御外部污染物并保持封装药品的完整性。

- 由于製药公司的大量投资,义大利製药市场正在扩大。这种扩张正在推动对药用玻璃包装的需求,因为玻璃仍然是许多药品的主要包装材料。义大利药品产量的不断增加以及对高品质玻璃包装解决方案的相应需求,在製药和玻璃产业之间建立了共生关係。

- 药品生产投资的增加可能会增加国内生产设施的数量。随着製药公司扩大业务,他们需要稳定供应高品质的包装,特别是玻璃容器,以满足其生产需求。这一趋势将为国内容器玻璃製造商带来进一步的商机。

- 据製药业协会Farmindustria称,义大利药品生产投资从2017年的14.6亿美元增加到2023年的17.3亿美元。这项投资的大幅增加凸显了义大利製药业的成长,并凸显了包括玻璃包装在内的相关产业持续扩张的潜力。

- 药品生产投资的增加可能会增加国内生产设施的数量。随着製药公司扩大业务,他们需要稳定供应高品质的包装,特别是玻璃容器,以满足其生产需求。这一趋势将为国内容器玻璃製造商带来进一步的商机。

- 严格的包装法规适用于药品,特别是那些用于国际出口的药品。由于玻璃的耐化学性、抗渗透性和稳定性,这些法规通常优先考虑玻璃的使用。这种法规环境预计将进一步推动对高品质义大利容器玻璃製造商的需求。

- 强调遵守药品包装国际标准强化了玻璃作为首选材料的重要性,製药公司和玻璃製造商之间合作开发满足或超过监管要求的包装解决方案可以带来更牢固的关係。

- 根据Farmindustria的报告,义大利药品出口额将从2018年的280.5亿美元增加到2023年的531.6亿美元。出口量的显着增长不仅体现了义大利製药业的实力,也反映出对可靠、高品质包装解决方案以支援这些产品的国际分销的需求不断增长。

- 强调遵守药品包装国际标准强化了玻璃作为首选材料的重要性,製药公司和玻璃製造商之间合作开发满足或超过监管要求的包装解决方案可以带来更牢固的关係。

- 随着生技药品和疫苗等药物配方变得更加复杂,对能够承受恶劣条件(例如温度和压力变化)的特殊玻璃的需求不断增加。义大利玻璃产业有机会透过生产创新的玻璃包装解决方案来利用这一需求。满足这些复杂药品的独特需求的先进包装和製造技术的开发可以使义大利玻璃製造商成为全球药品包装市场的领导者。

义大利容器玻璃产业概况

义大利容器玻璃市场较为分散,有许多地区和全球参与者。市场参与者正在采取各种策略来巩固自己的地位并促进成长。其中包括专注于轻量化和环保设计的产品创新、与供应商和最终用户的合作、加强市场占有率的合併以及扩大产品系列和地理覆盖范围的收购。

此外,公司正在投资研发,使玻璃产品更加可回收,符合永续性趋势和法规要求。这些共同努力正在增加各个市场占有率,并支持义大利容器玻璃市场的整体成长和发展。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 容器玻璃进出口资料

- PESTEL分析-义大利容器玻璃产业

- 包装玻璃行业标准及法规

- 包装玻璃的原料分析及材质考虑

- 容器和包装玻璃的永续性趋势

- 义大利货柜玻璃熔炉的生产能力和位置

第五章市场动态

- 市场驱动因素

- 葡萄酒产量增加对义大利容器玻璃市场成长的影响

- 製药业更采用玻璃容器和包装

- 市场挑战

- 替代品的可用性可能会阻碍市场成长

- 欧洲容器玻璃市场义大利现况分析

- 贸易概况:义大利容器玻璃产业进出口模式的历史与现况分析

第六章 市场细分

- 按最终用户产业

- 饮料

- 酒精饮料(计划提供定性分析)

- 啤酒和苹果酒

- 葡萄酒/烈酒

- 非酒精饮料(计划提供定性分析)

- 碳酸饮料

- 果汁

- 水

- 乳类饮料

- 调味饮料

- 食物

- 化妆品

- 药品

- 其他最终用户产业

- 饮料

第七章 竞争格局

- 公司简介

- Verallia Group

- Vetropack Holding Ltd

- Vetri Speciali SpA

- Vetrobalsamo SpA

- OI Glass, Inc.

- Bormioli Luigi SpA

- Ardagh Group SA

- Zignago Vetro SpA

- Vetreria Etrusca SpA

第八章补充资料:义大利主要容器玻璃厂主要窑炉供应商分析

第九章 市场未来展望

The Italy Container Glass Market size is estimated at 5.26 million tonnes in 2025, and is expected to reach 5.71 million tonnes by 2030, at a CAGR of 1.67% during the forecast period (2025-2030).

Key Highlights

- Glass, made from natural and sustainable raw materials, is the preferred packaging for health-conscious consumers. Italy's aging population contributes to the growth of the pharmaceutical packaging market. The Italian glass packaging industry is committed to sustainable production and collaborates with customers to develop innovative, environmentally friendly packaging solutions. This commitment includes reducing energy consumption in manufacturing processes, increasing the use of recycled glass, and developing lighter-weight glass containers without compromising strength or quality.

- The expanding beer market in Italy is driving innovation in glass bottle designs, including lightweight, eco-friendly options and unique shapes to differentiate brands. This trend encourages manufacturers to diversify their product range, creating growth opportunities for the container glass industry. Breweries are increasingly partnering with glass manufacturers to create custom bottle designs that reflect their brand identity and appeal to consumers' aesthetic preferences.

- According to ASSOBIRRA, the Association of Brewers and Maltsters, Italians consumed 21.2 million hectoliters of beer in 2023, an increase from 18.9 million hectoliters in 2020. This growth in consumption has led to increased demand for glass bottles, particularly for craft and specialty beers that often prefer glass packaging to maintain product quality and enhance brand image.

- Glass is a permanent material that can be infinitely recycled into new packaging. The quality and quantity of recycled glass production improve with increased selective collection of glass waste. In Italy, glass recycling rates have been steadily increasing, with many municipalities implementing effective collection systems and consumers becoming more aware of the importance of proper glass disposal.

- According to the International Trade Centre, Italy was the third-largest exporter of container glass in 2023. Italy's total exports of container glass (HS Code-701090) reached USD 1,314.6 thousand, an increase from USD 1,246.9 thousand in 2022. By being a leading exporter, Italy strengthens trade relationships with other countries, opening up new markets for its container glass. This increases the country's ability to penetrate emerging markets and further boosts export opportunities, driving long-term growth in production, innovation, and investments in the container glass sector.

- Rising operational costs and increased use of substitute products, such as plastics and tin, may limit market growth. The growing popularity of plastic packaging, due to its lightweight nature, moldability, and controllable thickness, could impact the development of the glass packaging market. However, the glass industry is responding by investing in technologies to reduce production costs and improve the environmental footprint of glass manufacturing, aiming to maintain its competitive edge in the packaging market.

Key Highlights

Italy Container Glass Market Trends

Alcoholic Segment to Hold Significant Market Share

- The alcoholic segment dominates under beverage, accounting for approximately 80% of the market share in the Italy container glass market, and plays a pivotal role in driving the market's growth.

- Italy is known for its rich wine and spirits production tradition, with products like Italian wine, prosecco, and grappa being highly regarded domestically and internationally. The cultural importance of these beverages ensures a steady and robust demand for glass containers, as glass is often the preferred choice due to its ability to preserve the flavor and integrity of alcohol, especially for premium and aged beverages.

- The Glass bottle manufacturing industry in Italy is widely associated with the wine industry and hearty foods that belong to Italian cuisine. Glass packaging is a popular choice, and most of Italy's wine, food, and condiment industries end up packaging their products in glass bottles.

- These industries heavily rely on glass bottles for their packaging needs because glass is an inert material. This makes it a safe option for storing products made for human consumption. Glass bottles are chemical-free and do not react with the products or the environment.

- The Italian wine supply chain has performed well in recent decades in terms of profitability and success in the domestic and international markets. This is despite its fragmentation in terms of products, prices, and consumption context, particularly its organization, which hinders the full exploitation of economies of scale.

- The growing consumption of wine across the country has boosted the demand for container glasses in the market. Wine is one of Italian agriculture's most traditional products and one of the most characterizing and constant elements of the Italian population's diet. Throughout time, wine has been a cheap source of energy, an essential beverage when water was unsafe to drink, and a symbolic element of social celebrations.

- Beer is often packaged in glass bottles, particularly premium and craft beers, which are becoming increasingly popular. As beer consumption rises, the demand for glass containers used in packaging beer also increases.

- According to AssoBirra, the Association of Brewers and Maltsters, the annual volume of beer consumed per capita in italy accounts to 36.1 liters in 2023 which was 31.7 liters in 2020.

- The rise in beer consumption often correlates with an increase in the variety of beers available, including premium and craft beers, which typically favor glass packaging for its aesthetic appeal and ability to preserve flavor. This trend enhances the demand for high-quality, visually appealing glass containers.

Pharmaceutical Segment to Expand Significantly

- Glass remains a primary packaging material for pharmaceutical products due to its suitability for various formulations. Its widespread use in the industry makes it the preferred choice for many applications, offering properties that ensure product safety and stability. Glass containers are extensively used in the pharmaceutical sector, providing a reliable barrier against external contaminants and maintaining the integrity of the enclosed medications.

- Significant investments from pharmaceutical companies are growing the pharmaceutical market in Italy. This expansion drives the demand for pharmaceutical glass packaging, as glass remains the primary packaging material for many drugs. The increasing production of pharmaceuticals in Italy has led to a corresponding rise in the need for high-quality glass packaging solutions, creating a symbiotic relationship between the pharmaceutical and glass industries.

- Higher investments in pharmaceutical production are likely to increase domestic manufacturing facilities. As pharmaceutical companies expand operations, they will require a consistent supply of high-quality packaging, particularly glass containers, to meet production needs. This trend creates more business opportunities for local container glass manufacturers.

- According to Farmindustria, Association of Pharmaceutical Companies, investments in Italian pharmaceutical production grew from USD 1.46 billion in 2017 to USD 1.73 billion in 2023. This significant increase in investment highlights the growth of the pharmaceutical sector in Italy and underscores the potential for continued expansion in related industries, including glass packaging.

- Pharmaceutical products, especially those for international export, are subject to stringent packaging regulations. These regulations often prioritize glass use due to its chemical resistance, impermeability, and stability. This regulatory environment is expected to drive further demand for high-quality container glass manufacturers in Italy.

- The emphasis on compliance with international standards for pharmaceutical packaging reinforces the importance of glass as a preferred material, potentially leading to increased collaboration between pharmaceutical companies and glass manufacturers to develop packaging solutions that meet or exceed regulatory requirements.

- Farmindustria reports that the export value of pharmaceutical products in Italy increased from USD 28.05 billion in 2018 to USD 53.16 billion in 2023. This substantial growth in exports not only demonstrates the strength of Italy's pharmaceutical industry but also indicates a growing need for reliable and high-quality packaging solutions to support the international distribution of these products.

- As pharmaceutical formulations become more advanced, such as biologics and vaccines, the need for specialized glass that can withstand extreme conditions (e.g., temperature fluctuations, pressure changes) is increasing. Italy's glass industry has the opportunity to capitalize on this demand by producing innovative glass packaging solutions. The development of advanced glass formulations and manufacturing techniques to meet the specific requirements of these complex pharmaceuticals could position Italian glass manufacturers as leaders in the global pharmaceutical packaging market.

Italy Container Glass Industry Overview

The Italy Container Glass Market is fragmented, with many regional and global players. Market players employ various strategies to strengthen their position and drive growth. These include product innovation, focusing on lightweight and eco-friendly designs, partnerships with suppliers and end-users, mergers to consolidate market share, and acquisitions to expand product portfolios or geographical reach.

Additionally, companies are investing in research and development to enhance the recyclability of glass products, aligning with sustainability trends and regulatory requirements. These collective efforts are expanding individual market shares and propelling the overall growth and evolution of the Italian container glass market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Export-Import Data of Container Glass

- 4.3 PESTEL ANALYSIS - Container Glass Industry in Italy

- 4.4 Industry Standard and Regulation for Container Glass Use for Packaging

- 4.5 Raw Material Analysis and Material Consideration for Packaging

- 4.6 Sustainability Trends for Glass Packaging

- 4.7 Container Glass Furnace Capacity and Location in Italy

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Impact of Growing Wine Production on Italy's Container Glass Market Growth

- 5.1.2 Increasing Adoption of Glass Container Packaging in Pharmaceutical Industry

- 5.2 Market Challenges

- 5.2.1 Availablity of the Substitute can Hinder the Growth of the Market

- 5.3 Analysis of the Current Positioning of Italy in the European Container Glass Market

- 5.4 Trade Scenerio - Analysis of the Historical and Current Export Import Paradigm for Container Glass Industry in Italy

6 MARKET SEGMENTATION

- 6.1 By End-user Vertical

- 6.1.1 Beverages*

- 6.1.1.1 Alcoholic Beverages (Qualitative Analysis to be Provided)

- 6.1.1.1.1 Beer and Cider

- 6.1.1.1.2 Wine and Spirits

- 6.1.1.2 Non-Alcoholic Beverages (Qualitative Analysis to be Provided)

- 6.1.1.2.1 Carbonated Soft Drinks

- 6.1.1.2.2 Juices

- 6.1.1.2.3 Water

- 6.1.1.2.4 Dairy Based Drinks

- 6.1.1.2.5 Flavored Drinks

- 6.1.2 Food

- 6.1.3 Cosmetics

- 6.1.4 Pharmaceutical

- 6.1.5 Other End-user Verticals

- 6.1.1 Beverages*

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Verallia Group

- 7.1.2 Vetropack Holding Ltd

- 7.1.3 Vetri Speciali SpA

- 7.1.4 Vetrobalsamo S.p.A.

- 7.1.5 O-I Glass, Inc.

- 7.1.6 Bormioli Luigi S.p.A.

- 7.1.7 Ardagh Group S.A.

- 7.1.8 Zignago Vetro S.p.A.

- 7.1.9 Vetreria Etrusca S.p.A.