|

市场调查报告书

商品编码

1635459

欧洲铅酸电池:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Europe Lead-acid Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

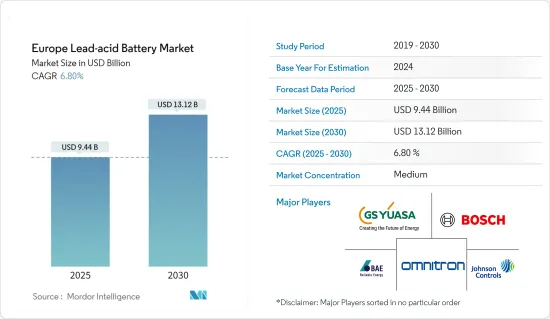

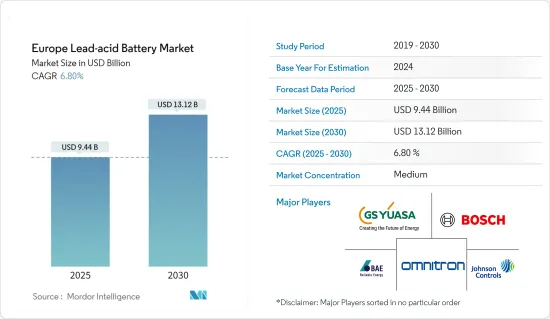

欧洲铅酸电池市场规模预计到2025年为94.4亿美元,预计2030年将达到131.2亿美元,预测期内(2025-2030年)复合年增长率为6.8%。

主要亮点

- 从中期来看,汽车产业的成长和电池能源储存系统(BESS)的采用等因素预计将在预测期内推动欧洲铅酸电池市场的发展。

- 另一方面,锂离子电池的日益普及和电动车销量的成长可能会限制未来几年铅酸电池市场的成长。

- 然而,离网太阳能发电设备投资的增加预计将为欧洲铅酸电池市场创造重大商机。

- 由于汽车製造商数量众多,德国可能主导欧洲铅酸电池市场。

欧洲铅酸蓄电池市场趋势

SLI 电池领域占据市场主导地位

- 过去 100 年来,几乎每辆汽车都安装了启动、照明和点火 (SLI) 电池。通常,SLI 电池用于短期供电,例如启动汽车引擎或运行轻负载。

- 由于 SLI 电池专为汽车用途而设计,因此它们始终随车辆的充电系统一起安装,这意味着每当车辆使用时,电池都会进行连续的充电和放电循环。 12 伏特电池已最常使用 50 多年,但其平均电压接近 14 伏特。

- 此外,电讯业主要依赖由行动电话讯号塔和现场设备组成的复杂网路来传输电话和网路服务。为了高效运行,这些塔和现场设施需要持续可靠的电源。通常,对于有线网络,来自电网的电力被转换为-48伏特的直流电(DC),对于无线网络,来自电网的电力被转换为+24伏特的直流电(DC)。电讯业使用的电池包括 VRLA、NiCd 和锂离子电池。

- 近年来,由于欧洲地区汽车行业的OEM和售后市场的需求不断增长,SLI电池的需求量很大。这些电池主要用于为启动马达、照明、点火系统和其他内燃机提供动力,确保高性能、长寿命和成本效益。

- 此外,到2022年,德国、法国和英国将成为乘用车销售的领先国家。德国乘用车销量约265万辆,法国约160万辆,英国约160万辆。

- 此外,2022年欧盟新销量约930万辆,较上年下降4.6%。然而,旧车中旧 SLI 电池的更换预计将推动市场发展。

- 综上所述,SLI电池产业预计将在预测期内主导欧洲铅酸电池市场。

德国主导市场

- 德国是世界上最大的乘用车和商用车製造商之一。几十年来,汽车工业一直是德国经济的主要部门。

- 此外,德国是全球公认的汽车产业创新中心,所有主要汽车製造商都在这里设有业务。到2022年,德国将成为欧洲第一大汽车市场,约占乘用车製造量的26%,约占新车註册量的20%。

- 此外,2022 年 6 月,德国公开反对欧盟到 2035 年禁止在该地区销售新型内燃机汽车的禁令。内燃机汽车占大众、宝马和梅赛德斯等德国主要公司生产的汽车库存的很大一部分。此外,2022年德国乘用车销量达约265万辆。

- 德国被认为是世界上最发达的市场之一,也是欧盟(EU)的金融强国。因此,资料中心很多,截至2023年终,日本运作的资料中心超过522个。而且,由于自动化和5G网路的发展,资料中心的需求在德国。

- 在德国,由于汽车、资料中心和通讯产业投资增加,对铅酸电池的需求不断增加。存在锂离子电池等替代品,但所有这些行业对铅酸电池的需求仍然很高。铅酸电池寿命长、安全性高、长期性能良好,是资料中心、汽车、通讯业的首选。

- 因此,德国汽车和资料中心产业的所有这些发展都可能在预测期内推动铅酸电池市场的发展。

欧洲铅酸蓄电池产业概况

欧洲铅酸电池市场呈现半分散状态。市场主要企业包括(排名不分先后)BAE Batterien GmbH、Exide Technologies Inc.、GS Yuasa Corporation、Johnson Controls International PLC 和 Omnitron Griese GmbH。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 汽车销量增加

- 扩大电池能源储存系统(BESS)的采用

- 抑制因素

- 锂离子电池日益受到重视

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按用途

- SLI 电瓶(启动、照明、点火)

- 固定电池(电讯、UPS、能源储存系统(ESS)等)

- 可携式电池(家用电器等)

- 其他用途

- 依技术

- 浸没式

- VRLA(阀控铅酸电池)

- 按地区

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 北欧的

- 土耳其

- 俄罗斯

- 其他欧洲国家

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Johnson Controls International PLC

- Exide Technologies Inc.

- GS Yuasa Corporation

- Robert Bosch GmbH

- Omnitron Griese GmbH

- BAE Batterien GmbH

- Amara Raja Batteries Ltd

- Leoch International Technology Limited

- Panasonic Corporation

- Market Ranking/Share Analysis

第七章 市场机会及未来趋势

- 增加离网太阳能安装投资

简介目录

Product Code: 91997

The Europe Lead-acid Battery Market size is estimated at USD 9.44 billion in 2025, and is expected to reach USD 13.12 billion by 2030, at a CAGR of 6.8% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the growing automotive sector and adoption of battery energy storage systems (BESS) are expected to drive the lead-acid battery market in Europe during the forecast period.

- On the other note, rising adoption of lithium-ion batteries and increasing electric vehicle sales are likely to restrain the growth of the lead-acid battery market over the coming years.

- Nevertheless, increased off-grid solar installation investment is estimated to provide a significant opportunity for the lead acid market in Europe.

- Germany is likely to dominate the lead acid battery market in Europe due to the higher presence of automobile manufacturers in the country.

Europe Lead-acid Battery Market Trends

SLI Battery Segment to Dominate the Market

- Starting, lighting, and ignition (SLI) batteries have been in almost every car for the past 100 years. Generally, SLI batteries are used for short power bursts, such as starting a car engine or running light electrical loads.

- SLI batteries are designed for automobiles and, therefore, are always installed with the vehicle's charging system, which means that there is a continuous cycle of charge and discharge in the battery whenever the vehicle is in use. The 12-volt batteries have been the most commonly used for more than 50 years; however, their average voltage is close to 14-volt.

- Also, the telecom industry is primarily dependent on an elaborate network of mobile phone towers and field facilities for the transmission of phone calls and internet services. For their efficient operations, these towers and field facilities require a constant and highly reliable supply of electric power, usually from the electrical grid converted to direct current (DC) power at -48 volts for wired networks and +24 volts for wireless networks. The batteries used in the telecom industry include VRLA, NiCd, and Li-ion, among others.

- In the last couple of years, the SLI batteries witnessed significant demand due to the growing demand from OEMs and aftermarkets from the automotive sector in the European region. These batteries primarily mostly utilized power start motors, lights, ignition systems, or other internal combustion engines while ensuring high performance, long life, and cost-efficiency.

- Moreover, in 2022, Germany, France and United kingdom are the leading countries in terms of sales of passengers cars. Germany's passenger car sales amounted to around 2.65 million units. in fracne it was around 1.6 million and United kingdom is was around 1.6 million.

- Also, around 9.3 million new passenger cars were sold across the European Union in 2022, which is 4.6% less than the previous year. However, the replacement of the old SLI batteries in old vehicles is anticipated to drive the the market.

- Owing to the above points, SLI Battery Segement is expected to dominate Europe lead-acid battery market during the forecast period.

Germany to Dominate the Market

- Germany is one of the world's largest manufacturing countries for passenger and commercial vehicles. For several decades the automobile industry has been a key sector in the German economy.

- Moreover, Germany has been recognized worldwide as an Innovation hub for the automotive industry, as all major automobile manufacturers have a presence in the country. In 2022, Germany is Europe's number one automotive market, accounting for around 26% of all passenger cars manufactured and approximately 20% of all new car registrations.

- Also, In June 2022, Germany, raised its voice against the EU ban on new ICE vehicles in the region by 2035. The ICE vehicles form a considerable part of the vehicle stock manufactured by major players in Germany like Volkswagen, BMW, and Mercedes. Moreover, Germany's passenger car sales amounted to around 2.65 million units in 2022.

- Germany is considered a highly developed market in the world, and it is the financial powerhouse of the European Union. This, resulting a higher number of data centres, and as of the end of 2023, there were more than 522 active data centres in the country. Furthermore, due to automation and development meant of the 5G network, the demand for the data centre is in Germany.

- The demand for lead acid batteries is rising in Germany due to increased investment in the automobile, data centre and telecommunication industry. Though there is the presence of substitutes, such as lithium-ion batteries, there is still more demand for lead acid batteries from all these industries. The lead acid battery has a long life, safety and good performance in the long run, which makes them the first choices in the data centre, automobile and telecommunication industry.

- Thus all these development in Germany in the automobile and data centre industry is likely to drive the lead acid market during the forecast period.

Europe Lead-acid Battery Industry Overview

The Europe lead-acid battery market is semi fragmented. Some of the key players (in no particular order) in the market include BAE Batterien GmbH, Exide Technologies Inc., GS Yuasa Corporation, Johnson Controls International PLC, Omnitron Griese GmbH, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Sales of Automobiles

- 4.5.1.2 Growing Adoption of Battery Energy Storage Systems (BESS)

- 4.5.2 Restraints

- 4.5.2.1 Rising Emphasis on Lithium-Ion Batteries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 SLI (Starting, Lighting, Ignition) Batteries

- 5.1.2 Stationary Batteries (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.1.3 Portable Batteries (Consumer Electronics, etc.)

- 5.1.4 Other Applications

- 5.2 Technology

- 5.2.1 Flooded

- 5.2.2 VRLA (Valve Regulated Lead-acid)

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Spain

- 5.3.5 Italy

- 5.3.6 NORDIC

- 5.3.7 Turkey

- 5.3.8 Russia

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Johnson Controls International PLC

- 6.3.2 Exide Technologies Inc.

- 6.3.3 GS Yuasa Corporation

- 6.3.4 Robert Bosch GmbH

- 6.3.5 Omnitron Griese GmbH

- 6.3.6 BAE Batterien GmbH

- 6.3.7 Amara Raja Batteries Ltd

- 6.3.8 Leoch International Technology Limited

- 6.3.9 Panasonic Corporation

- 6.4 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increased Off-Grid Solar Installation Investment

02-2729-4219

+886-2-2729-4219