|

市场调查报告书

商品编码

1683537

北美铅酸电池:市场占有率分析、行业趋势和成长预测(2025-2030 年)North America Lead Acid Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

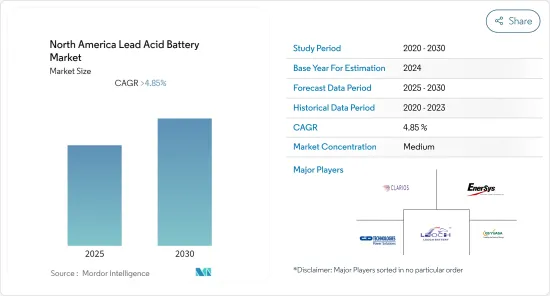

预测期内,北美铅酸电池市场预计将以超过 4.85% 的复合年增长率成长

主要亮点

- 预计预测期内,SLI 电池领域将成为北美电池市场成长最快的领域。由于全国持有车辆数量众多,SLI(启动、照明和点火)意味着铅酸电池销售量庞大。

- 铅酸电池技术的进步有望为市场参与者创造巨大的商机,因为与最先进的电池技术相比,铅酸电池技术的进步可以提高储存密度、延长使用寿命、改善寒冷天气性能,而且成本相对较低。

- 由于强大的工业基础设施、基于电池的储能计划的能源储存以及不断扩大的再生能源基础设施,美国是全球工业电池的主要热点之一。此外,美国对可再生能源和住宅分散式能源系统部署的优惠政策可能会在未来几年推动电池市场的发展。

北美铅酸电池市场趋势

汽车电池(SLI 电池)领域将占据市场主导地位

- 过去几年来,几乎所有汽车都安装了启动、照明和点火 (SLI) 电池。一般来说,SLI 电池用于短时间供电,例如运行轻电负载或启动汽车引擎。此外,当车辆的电气负载超过充电系统的供应量时,这些电池还会提供额外的电力,并充当电压安定器,平衡电气系统中的电压尖峰,从而防止电气系统中其他组件的损坏。

- SLI 电池市场成长的主要驱动力是对这些电池的需求不断增长,以使用高性能、长寿命和具有成本效益的铅酸电池为马达、灯和其他内燃机提供动力。

- 铅酸电池是北美等世界各地传统内燃机车辆(例如汽车和卡车)中所有 SLI 电池应用的首选技术。铅酸电池由于其出色的冷启动性能、可靠性和低成本,成为经典汽车 SLI 应用(包括启动停止和基本微混合系统)最经济可行的量产技术。超过 90% 的汽车 SLI 电池都是铅酸电池,超过 90%(基于储存容量)的工业固定和马达应用都是铅酸电池。

- 北美是世界上最大的汽车市场之一。这使得该地区成为汽车生产的全球领导者,并成为全球最大的 SLI 电池市场之一。

- 截至 2021 年,美国是世界第二大汽车生产国,约占该地区汽车总产量的 69%。中国也是福特、通用汽车和特斯拉等一些全球最大汽车製造商的所在地,因此中国是 SLI 电池的主要消费国。

- 鑑于上述情况,预计汽车电池(SLI 电池)领域将在预测期内见证显着的市场成长。

美国:预计市场将大幅成长

- 美国是世界上最大的汽车市场之一。它也是领先的机动车製造商之一,包括轻型商用车。近年来,该国汽车产业经历了显着成长,但 2020 年因新冠疫情爆发而出现下滑迹象。

- 由于该国汽车市场的规模,也占据了铅酸电池市场的很大份额。铅酸电池由于在SLI的应用,在汽车领域仍占有很大的份额。

- 此外,铅酸电池可能在锂离子电池目前占主导地位的电动车市场提供巨大的机会。铅酸电池的回收率极高,约96%,这是经过数十年的研究和开发才实现的。这使得它们比锂离子电池更具优势,因为锂离子电池的回收过程非常复杂且昂贵,而且成功率极低。

- 美国是全球工业电池主要热点地区之一,得益于其强大的能源储存计划、基于电池的储能项目的激增以及不断增长的再生能源基础设施。此外,美国对采用可再生能源和住宅分散式能源系统的优惠政策可能会在未来几年推动电池市场的发展。

- 此外,美国政府宣布2021年预算将大幅增加军事开支。根据预算,美国政府将在2022财政年度拨款7,700亿美元用于军事开支,而美国参议院已决议2021财政年度拨款7,050亿美元用于军事开支。

- 预计国家军事投资的增加将支持军队中电池供电的通讯和其他电子设备的日益广泛使用,这反过来有望在预测期内推动对铅酸电池的需求。

- 因此,鑑于上述情况,预计美国电池市场在预测期内将出现显着的成长。

北美铅酸电池产业概况。

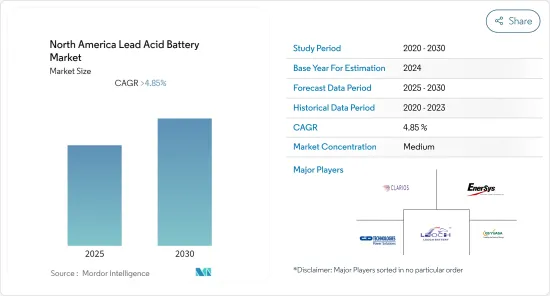

北美铅酸电池市场中等分散。该市场的主要企业包括 Clarios(Brookfield Business Partners 的子公司)、EnerSys、C&D Technologies Inc、Leoch International Technology Limited 和 GS Yuasa Corporation。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2027 年市场规模与需求预测

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 应用

- SLI(启动、照明和点火)电池

- 固定电池(电讯、UPS、能源储存系统(ESS)等)

- 可携式电池(用于家用电器等)

- 其他用途

- 原产地

- 美国

- 加拿大

- 北美其他地区

第六章 竞争格局

- 合併、收购、合作及合资

- 主要企业策略

- 公司简介

- Clarios(a subsidiary of Brookfield Business Partners)

- EnerSys

- C&D Technologies Inc.

- Leoch International Technology Limited

- GS Yuasa Corporation

- East Penn Manufacturing Company

- Exide Technologies

- Power-Sonic Corporation

- Johnson Controls International PLC

- Panasonic Holdings Corp

第七章 市场机会与未来趋势

简介目录

Product Code: 92071

The North America Lead Acid Battery Market is expected to register a CAGR of greater than 4.85% during the forecast period.

Key Highlights

- SLI Battery segment is the fastest growing segment in the North American battery market during the forecast period. SLI (Starting, Lighting, and Ignition), owing to the large vehicle fleet of the country translates into large volumes of lead-acid battery sales.

- Advances in lead-acid battery technology to increase storage density, extend usable service life, and improve cold-weather performance at a comparatively lower cost than modern battery technologies are expected to provide a significant opportunity to the market players.

- The United States is one of the major hotspots for industrial batteries across the world on account of robust industrial infrastructure, surging deployment of battery-based energy storage projects, and expansion in renewable power infrastructure. Moreover, the favorable policy toward the deployment of renewable energy and residential distributed energy systems in the United States is likely to drive the battery market in the coming years.

North America Lead acid battery Market Trends

Automotive Batteries (SLI Batteries) Segment to Dominate the Market

- Starting, lighting, and ignition (SLI) batteries have been in almost every car for the past several years. Generally, SLI batteries are used for short power bursts, such as running light electrical loads or starting a car engine. Moreover, these batteries supply extra power when the vehicle's electrical load exceeds the supply from the charging system & act as a voltage stabilizer in the electrical even out voltage spikes, thereby preventing them from damaging other components in the electrical system.

- The primary factor attributing to the growth of the SLI battery market is the increasing demand for these batteries to power motors, lights, or other internal combustion engines with high performance, long life, and cost-efficient lead-acid.

- The lead-acid battery is the technology of choice for all SLI battery applications in conventional combustion engine vehicles, such as cars and trucks across the globe, including North America. Lead-acid batteries are the most economically viable mass-market technology for SLI applications in classic cars, including those with start-stop and basic micro-hybrid systems, owing to their excellent cold cranking performance, reliability, and low cost. More than 90% of automotive SLI batteries are lead-acid based, and over 90% (by storage capacity) of industrial stationary and motive applications.

- North America is one of the biggest markets for automobiles globally. Due to this, the region is also a global leader in the production of automobiles, making it one of the largest markets for SLI batteries globally.

- As of 2021, the United States is the 2nd-largest producer of motor vehicles globally, accounting for approximately 69% of the region's total automobiles 2021. The country is also home to some of the world's largest automobile manufacturers, such as Ford, General Motors and Tesla, which are the primary consumers of SLI batteries.

- Hence, owing to the above points, the Automotive Batteries (SLI Batteries) segment will likely see significant market growth during the forecast period.

United States Expected to see Significant the Market Growth

- The United States is one of the largest automobile markets in the world. The country is also one of the major manufacturers of automobiles, including light and commercial vehicles. In recent years the automobile sector in the country has witnessed significant growth, only showing signs of decline in 2020 due to the outbreak of COVID-19.

- Due to the large size of the country's automobile market, the country holds a major share in the region's lead-acid battery market. Lead-acid battery still holds the major share in the automobile sector due to their SLI applications.

- Additionally, lead-acid batteries might also provide a significant opportunity in the electric vehicle market, where currently lithium-ion batteries hold the major share. Lead-acid batteries have a very high rate of recyclability of around 96%, which has been possible due to decades of research and development; this provides them an upper hand against lithium-ion batteries, which have a very complex and expensive process of recyclability with very low success rate.

- The United States is one of the major hotspots for industrial batteries across the world on account of robust industrial infrastructure, surging deployment of battery-based energy storage projects, and expansion in renewable power infrastructure. Moreover, the favorable policy toward the deployment of renewable energy and residential distributed energy systems in the United States is likely to drive the battery market in the coming years.

- Additionally, the United States government announced a substantial increase in military spending in its 2021 Budget. According to the budget, the US government allocated USD 770 billion in FY 2022 to the military and the US Senate voted to give the military USD 705 billion for FY 2021.

- The increasing investment in the country's military is expected to support the growing usage of battery-powered communication and other electronic equipment used in the army, in turn, driving the demand for lead-acid batteries during the forecast period.

- Hence, owing to the above points, the United States is expected to see significant market growth in Battery market during the forecast period.

North America Lead acid battery Industry Overview

The North American lead acid battery market is moderately fragmented. Some of the key players in this market are Clarios (a subsidiary of Brookfield BusinessPartners) , EnerSys, C&D Technologies Inc, Leoch International Technology Limited, and GS Yuasa Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 SLI (Starting, Lighting, and Ignition) Batteries

- 5.1.2 Stationary Batteries (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.1.3 Portable Batteries (Consumer Electronics, etc.)

- 5.1.4 Other Applications

- 5.2 Countries

- 5.2.1 United States

- 5.2.2 Canada

- 5.2.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Clarios (a subsidiary of Brookfield Business Partners)

- 6.3.2 EnerSys

- 6.3.3 C&D Technologies Inc.

- 6.3.4 Leoch International Technology Limited

- 6.3.5 GS Yuasa Corporation

- 6.3.6 East Penn Manufacturing Company

- 6.3.7 Exide Technologies

- 6.3.8 Power-Sonic Corporation

- 6.3.9 Johnson Controls International PLC

- 6.3.10 Panasonic Holdings Corp

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219