|

市场调查报告书

商品编码

1635483

欧洲冷却系统 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Europe Cooling Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

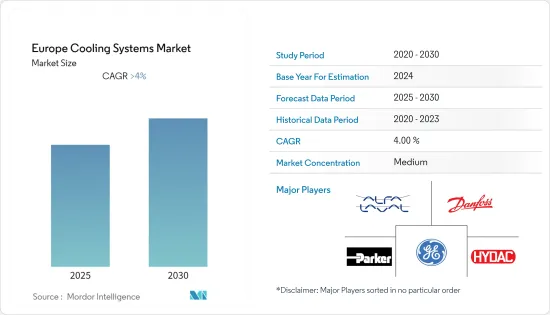

预计欧洲冷却系统市场在预测期间内将维持4%以上的复合年增长率。

2020 年市场受到 COVID-19 的负面影响。目前,市场已达到疫情前水准。

主要亮点

- 从中期来看,石油和天然气下游产业投资的增加预计将推动市场成长。

- 同时,可再生能源在电力行业的份额正在增加,预计将在预测期内阻碍欧洲冷却系统市场的成长。

- 冷却系统技术的不断进步以实现可持续的工业成长可能会在预测期内为欧洲冷却系统市场创造有利的成长机会。

- 德国在市场上占据主导地位,并且可能在预测期内实现最高的复合年增长率。这一增长归因于能源部门(石油和天然气、电力等)以及化学和石化行业的投资增加。

欧洲冷却系统市场趋势

热交换器显着成长

- 热交换器是在两种或多种介质之间传递热量的系统或设备。这些介质通常是流体、气体或气体和液体的组合。热交换器分为三种类型。翅片管式热交换器:空气或气体到流体,壳管式热交换器:流体到流体或流体到气体,板式热交换器:流体到流体或流体到蒸气。

- 热交换器用于许多工程应用,包括暖气和空调系统 (HVAC)、冷冻、发电厂、废热回收装置、食品加工系统、汽车散热器和化学加工系统。

- 2021年,欧洲发电量为4,032.5兆瓦时。这与前一年同期比较增长了近4%。

- 液压系统也是热交换器的主要最终用户之一。热交换器用于保持液压油的恆定温度。假设液压油或液体的温度低于所需温度。在这种情况下,液压油的黏度会增加,导致故障和压力损失过大。

- 2021 年 3 月,HRS 热交换器收到了来自辉瑞、Moderna 和 Oxford Astra Zeneca 分包商的各种製药热交换器订单。该热交换器的订单可能会在英国和欧洲使用。

- 同样,如果液压油或液压油的温度高于其工作温度,则过高的温度会加热液压油并开始分解液压油,从而在系统部件的表面形成清漆并可能劣化系统密封性。过多的热量迟早会给您的液压系统带来麻烦。过多的热量会分解油,损坏密封件和轴承,并增加泵浦和其他部件的磨损。

- 因此,由于上述因素,预计热交换器领域将在预测期内主导欧洲冷却系统市场。

德国主导市场

- 德国是欧洲工业化程度最高、人口最多的国家,以技术进步闻名。该国是世界领先的汽车、汽车零件、药品、飞机、直升机、太空船、精製石油和天然气、引擎零件、功能机械、医疗设备以及人类和动物血液生产国之一。

- 过去二十年,能源、化工、石化工业显着扩张。此外,该国拥有发达的冷却系统製造。

- 2021年,德国发电量为584.5兆瓦时,较上年增加近2%。研究期间减少了 1.9兆瓦时,并于 2017 年达到高峰超过 651兆瓦时。

- 由于石化产品需求的增加,国家对石化产业的投资也大幅增加。新的石化厂以及需要液压系统製程冷却的炼油厂正在兴建中。例如,2022年4月,INEOS Nitriles宣布有意在德国科隆投资建造世界规模的乙腈生产设施,预计在预测期内推动冷却系统的需求。

- 2022 年 10 月,德国经济事务和气候行动部呼吁提出研究和先导计画提案,以加速向热泵和其他气候中性供暖和製冷形式的过渡。预计这些重大发展将对冷却系统产生巨大需求。

- 因此,各个最终用户产业对冷却系统的需求不断增加预计将在未来几年推动该领域的发展。

欧洲冷却系统产业概况

欧洲冷却系统市场适度细分。市场上的主要企业包括(排名不分先后)Alfa Laval AB、Danfoss AS、General Electric Company、Parker Hannifin Corp. 和 Hydac International GmbH。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2027年市场规模及需求预测(单位:百万美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

第六章 冷却系统

- 热交换器

- 风扇和鼓风机

- 其他冷却装置(翅片)

第 7 章 最终用户

- 能源领域(石油/天然气、电力等)

- 化工/石化

- 农业/建筑

- 其他的

第八章 应用

- 液压系统

- 引擎

第9章 区域

- 法国

- 挪威

- 义大利

- 德国

- 欧洲其他地区

第10章竞争格局

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Alfa Laval AB

- Thermax Limited

- Danfoss AS

- API Heat Transfer

- Xylem Inc.

- HRS Heat Exchangers

- General Electric Company

- SPX Flow Inc.

- EJ Bowman

- Parker Hannifin Corp.

- WW Grainger Inc.

- Hydac International GmbH

第十一章 市场机会及未来趋势

简介目录

Product Code: 92841

The Europe Cooling Systems Market is expected to register a CAGR of greater than 4% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently, the market now reached pre-pandemic levels.

Key Highlights

- Over the medium term, increasing investment in the oil and gas downstream sector is expected to drive the market's growth.

- On the other hand, the increased share of renewables in the power sector is expected to hamper the Europe cooling systems market growth during the forecast period.

- Nevertheless, increasing advancements in the cooling system technology to achieve sustainable industrial growth are likely to create lucrative growth opportunities for the Europe cooling systems market in the forecast period.

- Germany dominates the market and will likely witness the highest CAGR during the forecast period. This growth is attributed to the increasing investments in the energy sector (oil and gas, power, etc.) and chemical and petrochemical industries.

Europe Cooling Systems Market Trends

Heat Exchangers to Witness Significant Growth

- A heat exchanger is a system or equipment that transfers heat between two or more mediums. These media are typically fluid, gas, or a combination of gas and liquid. Heat exchangers are classified into three types. Finned Tube heat exchangers: air or gas to fluid, Shell and tube heat exchangers: Fluid to fluid or Fluid to gas, Plate heat exchangers: Fluid to fluid or Fluid to Vapor.

- Heat exchangers are used in many engineering applications, such as heating and air-conditioning systems (HVAC), refrigeration, power plants, waste heat recovery units, food processing systems, automobile radiators, and chemical processing systems.

- In 2021, electricity production in Europe stood at 4,032.5 terawatt-hours. This represented an increase of nearly 4% compared to the previous year.

- Hydraulic systems are also one of the major end users of heat exchangers. They're used to maintain the desired temperature of the hydraulic fluid. Suppose the hydraulic oil or fluid temperature is less than the desired temperature. In that case, the fluid's viscosity increases, resulting in sluggish operation and excessive pressure drop.

- In March 2021, HRS Heat Exchangers received various orders for pharmaceutical heat exchangers placed by Pfizer, Moderna, and Oxford Astra Zeneca subcontractors. The order for heat exchangers would likely be used in the United Kingdom and Europe.

- On similar lines, if the temperature of hydraulic fluid or oil is higher than the operable temperature, the excess temperature can heat the oil, start oil decomposition, form varnish on system component surfaces, and begin to deteriorate system seals. Excess heat sooner or later spells trouble for any hydraulic system. Too much heat breaks down oil, damages seals and bearings, and increases wear on pumps and other components.

- Therefore, based on the factors mentioned above, the heat exchangers segment is expected to dominate the Europe cooling systems market during the forecast period.

Germany to Dominate the Market

- Germany is Europe's most industrialized and populous country, famed for its technological advancement. The country is one of the leading global producers of cars, vehicle parts, pharmaceuticals, aircraft, helicopters and spacecraft, refined petroleum, petroleum gas, engine parts, machinery having individual functions, medical instruments, human or animal blood, etc.

- The country witnessed a considerable expansion in the energy, chemical, and petrochemical industries in the last two decades. Moreover, the country has a well-developed manufacturing of cooling systems.

- In 2021, Germany generated 584.5 terawatt hours of electricity, an increase of nearly 2% from the previous year. Nevertheless, during the period in consideration, figures decreased by 1.9 terawatt hours and peaked at over 651 terawatt hours in 2017.

- Due to the rising demand for petrochemicals, the country also witnessed significant investments in the petrochemical sector. Similar to refineries which require process cooling for hydraulic systems, the construction of new petrochemical plants. For instance, in April 2022, INEOS Nitriles announced its intention to invest in a world-scale Acetonitrile production facility in Koln, Germany, which is expected to push the demand for cooling systems during the forecast period.

- In October 2022, Germany's Ministry for Economic Affairs and Climate Action issued a call for proposals for research and pilot projects to accelerate the transition to heat pumps and other climate-neutral forms of heating and cooling. Such key developments are expected to create significant demand for cooling systems.

- Therefore, the growing demand for cooling systems from various end-user industries is expected to drive the segment in the coming years.

Europe Cooling Systems Industry Overview

Europe's cooling systems market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Alfa Laval AB, Danfoss AS, General Electric Company, Parker Hannifin Corp., and Hydac International GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, until 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

6 Cooling Equipment

- 6.1 Heat Exchangers

- 6.2 Fans and Blowers

- 6.3 Other Cooling Equipment (fins)

7 End-user

- 7.1 Energy Sector (Oil & Gas, Power, etc.)

- 7.2 Chemical and Petrochemicals

- 7.3 Agriculture and Construction

- 7.4 Other End-Users

8 Application

- 8.1 Hydraulic Systems

- 8.2 Engine

9 Geography

- 9.1 France

- 9.2 Norway

- 9.3 Italy

- 9.4 Germany

- 9.5 Rest of Europe

10 COMPETITIVE LANDSCAPE

- 10.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 10.2 Strategies Adopted by Leading Players

- 10.3 Company Profiles

- 10.3.1 Alfa Laval AB

- 10.3.2 Thermax Limited

- 10.3.3 Danfoss AS

- 10.3.4 API Heat Transfer

- 10.3.5 Xylem Inc.

- 10.3.6 HRS Heat Exchangers

- 10.3.7 General Electric Company

- 10.3.8 SPX Flow Inc.

- 10.3.9 EJ Bowman

- 10.3.10 Parker Hannifin Corp.

- 10.3.11 W.W. Grainger Inc.

- 10.3.12 Hydac International GmbH

11 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219