|

市场调查报告书

商品编码

1635491

南美洲叶轮:市场占有率分析、产业趋势、成长预测(2025-2030)South America Rotor Blade - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

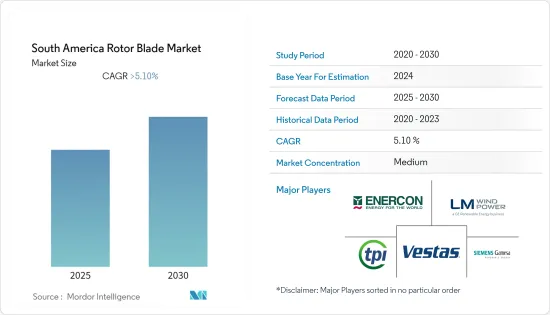

南美洲叶轮市场预计在预测期内将维持超过5.1%的复合年增长率。

2020 年市场受到 COVID-19 的中等程度影响。目前已达到疫情前水准。

主要亮点

- 从长远来看,该全部区域海上和陆上风力发电装置数量的增加预计将成为市场的主要驱动力。

- 另一方面,高昂的运输成本以及来自太阳能和水力发电等替代清洁能源的市场竞争可能会阻碍市场成长。

- 风电产业需要具有成本效益的解决方案,而高效的产品有可能改变产业的动态。在某些情况下,旧涡轮机被更换,不是因为损坏,而是因为市场上出现了更有效率的叶片。因此,技术发展对于南美洲叶轮市场来说是一个机会。

- 随着全国风力发电装置的增加,巴西预计将主导叶轮市场。

南美洲叶轮市场趋势

土地领域主导市场

- 陆域风电技术在过去五年中不断发展,以最大限度地提高每兆瓦装置容量的发电量,并覆盖更多风速较低的地区。除此之外,近年来风力发电机变得越来越大,轮毂高度更高,直径更宽,风力发电机叶片也更大。

- 截至2021年11月,风力发电装置容量已超过20GW。巴西有750个风力发电场,拥有10,000多风力发电机。巴西电力监管机构(ANEEL)已核准350多个新风发电工程,总容量超过12吉瓦,其中计划正在建设中。

- 根据《2022年全球风能报告》,巴西陆上风电装置容量为21.5GW,排名全球第六。此外,根据巴西风力发电协会(ABEEolica)的数据,到2024年,巴西将拥有至少3,000万千瓦的风电装置容量。这推动了全部区域风电场叶轮的普及。

- 智利陆域风电装置容量超过1吉瓦,位居南美洲第二位。智利制定了雄心勃勃的可再生能源计划,预计将推动该地区陆上市场的发展。

- 此外,发电成本的下降和投资的增加,特别是在巴西、智利和阿根廷,预计将推动陆上风力发电机的安装,进而预计在预测期内推动该地区的风力叶轮市场。

- 由于这些因素,预计土地领域将在预测期内主导市场。

巴西可望主导市场

- 风力发电是巴西第二大发电来源,其重要性逐年增加。 2021年该国风力发电产量创历史新高,装置容量超过20GW,风力发电量约72.286Gwh。

- 此外,大型风力发电机有助于降低风力发电成本,事实证明,与石化燃料替代品相比,风能在经济上具有竞争力。截至2022年6月,未来五年规划65个陆域风发电工程,总投资230亿美元。巴伊亚州(70 亿美元)、北里奥格兰德州(60 亿美元)、南里奥格兰德州(30 亿美元)和皮奥伊州(20 亿美元)是陆上风发电工程。你正在投资。

- 2022年4月,丹麦风电巨头维斯塔斯与叶片製造商LM Wind Power签署了一份多年供应协议,重点关注具有出口弹性的巴西陆上市场。根据协议,LM Wind Power 将从其位于伯南布哥州伊波茹卡的工厂交付维斯塔斯的 V150-4.2MW 涡轮机叶片。

- 2021年12月,中国製造商中材科技宣布计划扩大在巴西的业务,投资2,880万美元建造一座工厂来製造风力发电机叶片。中材股份将与中材科技母公司中国建材集团(CNBMG)旗下承包商中材海外成立合资公司,在萨尔瓦多兴建工厂。新工厂计划每年生产260套转子叶片。

- 鑑于上述情况,预计巴西将在预测期内主导市场。

南美洲叶轮产业概况

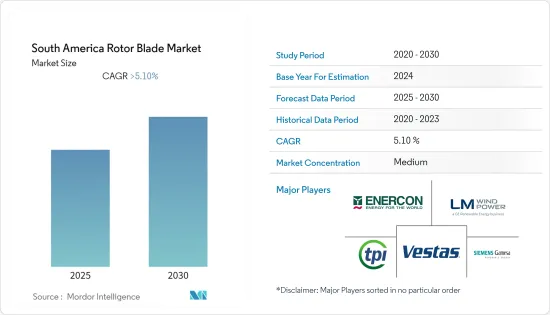

南美洲叶轮市场较为分散。市场上的主要企业包括(排名不分先后)TPI Composites SA、LM Wind Power(GE 再生能源业务)、Siemens Gamesa Renewable Energy SA、Vestas Wind Systems A/S 和 Enercon GmbH。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2027年之前的市场规模与需求预测(单位:十亿美元)

- 风力发电机叶轮价格分析

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 市场驱动因素

- 市场限制因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 按地点

- 陆上

- 离岸

- 按刀片材质分

- 碳纤维

- 玻璃纤维

- 其他刀片材料

- 按地区

- 巴西

- 阿根廷

- 哥伦比亚

- 秘鲁

- 智利

- 南美洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- TPI Composites Inc.

- Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd

- LM Wind Power(a GE Renewable Energy business)

- Nordex SE

- Siemens Gamesa Renewable Energy SA

- Vestas Wind Systems A/S

- MFG Wind

- Sinoma wind power blade Co. Ltd

- Aeris Energy

- Suzlon Energy Limited

- Enercon GmbH

第七章 市场机会及未来趋势

简介目录

Product Code: 92864

The South America Rotor Blade Market is expected to register a CAGR of greater than 5.1% during the forecast period.

The market was moderately impacted by COVID-19 in 2020. It has now reached pre-pandemic levels.

Key Highlights

- Over the long term, the major driving factors of the market are expected to be the growing number of offshore and onshore wind energy installations across the region.

- On the flip side, the associated high cost of transportation and cost competitiveness of alternate clean power sources, like solar power, hydropower, etc., have the potential to hinder market growth.

- The wind power industry has been in demand for cost-effective solutions, and a highly efficient product can change the industry's dynamics. There were instances where old turbines were replaced, not because of the damage but due to the availability of more efficient blades in the market. Hence, technological developments are opportunities for the South American rotor blade market.

- Brazil is expected to dominate the rotor blade market, with growing wind power installations across the country.

South America Rotor Blade Market Trends

Onshore Segment to Dominate the Market

- Onshore wind energy power generation technology has evolved over the last five years to maximize electricity produced per megawatt capacity installed and to cover more sites with lower wind speeds. Besides this, in recent years, wind turbines have become larger with taller hub heights, broader diameters, and larger wind turbine blades.

- As of November 2021, the installed wind power capacity surpassed 20 GW. The nation has over 10,000 wind turbines installed across 750 operational wind parks. The Brazilian Electricity Regulatory Agency (ANEEL) has approved more than 350 new wind power projects with a total capacity of over 12 GW, out of which 170 projects are under construction.

- According to the Global Wind Energy Report 2022, Brazil is in sixth place in the global ranking, with 21.5 GW of onshore wind installed capacity. Furthermore, according to the Brazilian Association of Wind Energy (ABEEolica), Brazil will have at least 30 GW of installed wind energy capacity by 2024. This, in turn, aids the growth of using rotor blades for wind plants across the region.

- Chile has more than a gigawatt of installed onshore wind capacity, which is the second-highest in South America. Chile has ambitious plans for renewable energy, which, in turn, is expected to drive the onshore market in the region.

- Furthermore, decreasing the cost of power generation and growing investments, particularly in Brazil, Chile, and Argentina, are expected to drive the onshore wind turbine installation, which, in turn, is expected to drive the wind rotor blade market in the region during the forecast period.

- Owing to these factors, the onshore segment is expected to dominate the market during the forecast period.

Brazil is Expected to Dominate the Market

- Wind energy is Brazil's second-largest source of power generation, and its importance grows yearly. Wind energy production in the country hit a record in 2021, exceeding 20 GW of installed capacity, and wind power generation was about 72.286 Gwh.

- In addition, the growing size of wind turbines has assisted in lowering the cost of wind energy, indicating that it is economically competitive with fossil fuel alternatives. As of June 2022, 65 onshore wind projects are planned over the next five years, with a total investment of USD 23 billion. The Bahia (USD 7 billion), Rio Grande do Norte (USD 6 billion), the Rio Grande do Sul (USD 3 billion), and Piaui (USD 2 billion) are the states investing the most in onshore wind energy projects.

- In April 2022, Danish wind giant Vestas finalized a multi-year supply agreement with blade maker LM Wind Power, focused on the onshore Brazilian market with the flexibility for export. Under the deal, LM Wind Power will deliver Vestas's V150-4.2MW turbine blades from its factory in Ipojuca in Pernambuco.

- In December 2021, Chinese manufacturer Sinoma Science and Technology announced its plan to expand business in Brazil by building a USD 28.8 million plant to manufacture wind turbine blades. Sinoma will set up a joint venture with Sinoma Overseas Development, a contractor under Sinoma Science's parent company China National Building Material Group (CNBMG), to build the plant in Salvador. The new plant will produce 260 power blade sets a year.

- Owing to the above points, Brazil is expected to dominate the market during the forecast period.

South America Rotor Blade Industry Overview

The South American rotor blade market is fragmented in nature. Some of the major players in the market (in no particular order) include TPI Composites SA, LM Wind Power (a GE Renewable Energy business), Siemens Gamesa Renewable Energy SA, Vestas Wind Systems A/S, and Enercon GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Wind Turbine Rotor Blades Price Analysis

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Market Drivers

- 4.6.2 Market Restraints

- 4.7 Supply Chain Analysis

- 4.8 Industry Attractiveness - Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 By Blade Material

- 5.2.1 Carbon Fiber

- 5.2.2 Glass Fiber

- 5.2.3 Other Blade Materials

- 5.3 By Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Colombia

- 5.3.4 Peru

- 5.3.5 Chile

- 5.3.6 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 TPI Composites Inc.

- 6.3.2 Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd

- 6.3.3 LM Wind Power (a GE Renewable Energy business)

- 6.3.4 Nordex SE

- 6.3.5 Siemens Gamesa Renewable Energy SA

- 6.3.6 Vestas Wind Systems A/S

- 6.3.7 MFG Wind

- 6.3.8 Sinoma wind power blade Co. Ltd

- 6.3.9 Aeris Energy

- 6.3.10 Suzlon Energy Limited

- 6.3.11 Enercon GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219