|

市场调查报告书

商品编码

1635501

南美洲太阳能逆变器:市场占有率分析、产业趋势、成长预测(2025-2030)South America Solar PV Inverters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

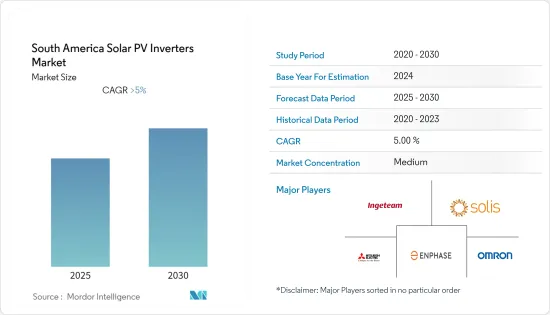

南美洲太阳能逆变器市场预计在预测期内维持5%以上的复合年增长率

2020 年市场受到 COVID-19 的负面影响。目前已达到疫情前水准。

主要亮点

- 从长远来看,太阳能发电需求的增加预计将刺激太阳能逆变器市场的成长。此外,不断增加的投资和雄心勃勃的太阳能目标预计将推动所研究市场的成长。

- 另一方面,组串式逆变器的技术缺陷预计将阻碍太阳能逆变器在预测期内的成长。

- 太阳能逆变器的产品创新和最新技术的采用可能会创造利润丰厚的成长机会。

- 预计巴西将主导市场并在预测期内实现最高的复合年增长率。这一增长是由国家投资增加和政府支持措施推动的。

南美洲太阳能逆变器市场趋势

公用事业规模领域主导市场

- 随着南美洲公用事业规模计划的迅速增加,选择合适的逆变器对于太阳能发电工程高效产生大量能源变得越来越重要。常用的公用事业规模逆变器包括集中式逆变器和电网规模逆变器。

- 此外,几十年来,公用事业规模的太阳能一直以稳定的燃料价格生产可靠、绿能。发展公用事业规模的太阳能是减少碳排放最快的方法之一,也是大规模太阳能发电装置和逆变器的关键驱动力之一。

- 根据IRENA预测,南美洲太阳能发电装置容量将从2020年的1,275万千瓦增加到2021年的154万千瓦。

- 智利是该地区最大的太阳能市场之一。巨大的太阳能潜力、容易获得的土地、强有力的政府奖励和监管以及稳定的政治和经济商业环境确保了资产和投资的安全,许多外国公司已经进入该国的太阳能产业。

- 2022 年 6 月,希腊工业集团 Mytilineos SA 与智利电力公司 Enel Generacion Chile SA 签署了一份为期 10 年的购电协议。该公司通过位于阿里卡和帕里纳科塔(109兆瓦)、安託法加斯塔(228兆瓦)、阿塔卡马(165兆瓦)和科金博(86兆瓦)的四家太阳能发电厂(累积容量为588兆瓦)发电,并提供Enel Generacion每年提供高达1.1TWh的太阳能。一个计划已开始建设,另外三个项目正处于开发后期阶段。

- 在其他南美国家中,阿根廷拥有最大的太阳能市场。在官民合作关係(PPP)立法等政府措施以及监管和鼓励私人投资该国经济关键领域的努力的推动下,该国太阳能产业正在温和成长。预计将有30多个太阳能发电工程以PPP模式实施,主要涉及能源、交通等重大基础设施和社会领域计划。

- 因此,预计该国太阳能市场将由大型公用事业规模发电工程主导,从而在预测期内推动对大型中央逆变器解决方案的需求。 2021年12月,阿根廷电力生产商Genneia SA开始建造80MW Sierras de Ullum太阳能发电厂,价值6,000万美元。

- 这些发展凸显了南美洲对公用事业规模太阳能光电解决方案的需求正在迅速增长,预计在预测期内对公用事业规模发电工程的大型中央逆变器的需求也将增长。

巴西主导市场

- 巴西是南美洲最大的太阳能发电市场,也是最大的太阳能逆变器市场之一。据IRENA称,巴西太阳能发电容量将从2020年的787万千瓦增加到2021年的1305万千瓦,几乎翻倍。 2021年,巴西45%的电力将由再生能源生产,而太阳能发电仅占总发电量的1.7%。

- 巴西的太阳能产业受到其他再生能源竞争的限制。生质能源、水力发电和风电等替代可再生能源的成长预计将在预测期内严重限制太阳能和光伏逆变器的需求。

- 儘管如此,巴西的最新计画PDEE(Plano Decenal de Expansao de Energia)2027预计到2027年将非水力可再生能源占发电量的比例提高到28%。此外,由于公用事业发电工程和分散式太阳能发电工程预计将在各种竞标中开发,因此在预测期内,对大型中央逆变器的需求预计将保持在较高水准。

- 2022年4月,阳光电源宣布与Comerc Energia集团成员Mercury Renew签署500MWac光伏逆变器解决方案供应协议。根据该合同,阳光电源将为米纳斯吉拉斯州650兆瓦Helio Vargas光伏电站的建设提供500兆瓦容量的SG3125HV-30中央逆变器解决方案。

- 太阳能产业也得到了净计量等政府措施的支持,该措施允许将多余的电力卖回电网并从您的帐单中扣除。因此,住宅领域正在快速成长,预计在预测期内,小型太阳能逆变器(包括离网太阳能逆变器)的需求将会很大。预计2020年逆变器出货量将超过480万千瓦,大幅超过2019年终的装置容量(约350万千瓦)。这主要是由小型分散式发电的成长所推动的。预计这将导致该国住宅领域的需求激增,从而带动对小型微型逆变器和组串逆变器的需求。

- 巴西也有国内公司参与製造逆变器等太阳能设备。随着该国建立自己的供应链,预计价格将进一步下降,需求将成长。预计国内太阳能製造业的发展将在预测期内及以后为市场提供重大成长机会。

南美洲太阳能逆变器产业概况

南美洲太阳能逆变器市场是细分的。该市场的主要企业包括(排名不分先后)Ingeteam、Ginlong (Solis) Technologies、三菱电机公司、Enphase Energy Inc.和欧姆龙。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2027年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 市场驱动因素

- 市场限制因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 按逆变器类型

- 中央逆变器

- 组串式逆变器

- 微型逆变器

- 按用途

- 住宅

- 商业和工业

- 实用规模

- 按地区

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Ingeteam

- Ginlong(Solis)Technologies

- Mitsubishi Electric Corporation

- Enphase Energy Inc.

- Omron Corporation

- Sungrow Power Supply Co. Ltd

- SMA Solar Technology AG

- SolarEdge Technologies Inc.

- Growatt New Energy Co. Ltd

- Siemens AG

第七章市场机会与未来趋势

简介目录

Product Code: 92907

The South America Solar PV Inverters Market is expected to register a CAGR of greater than 5% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. It has now reached pre-pandemic levels.

Key Highlights

- Over the long term, the growing demand for solar power is expected to stimulate the growth of the solar PV inverters market. Furthermore, increasing investments and ambitious solar energy targets are expected to drive the growth of the market studied.

- On the other hand, technical drawbacks of string inverters are expected to hamper the growth of solar PV inverters during the forecast period.

- Nevertheless, product innovation and adaptation of the latest technologies in solar PV inverters are likely to create lucrative growth opportunities.

- Brazil is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period. This growth is attributed to the increasing investments, coupled with supportive government policies in the country.

South America Solar PV Inverters Market Trends

Utility-scale Segment to Dominate the Market

- The number of utility-scale projects across South America is increasing rapidly, and choosing the best inverter is increasingly important to generate a massive amount of energy efficiently for the solar PV project. Some of the commonly used utility-scale inverters are central inverters and grid-scale inverters.

- Furthermore, utility-scale solar has been generating reliable, clean electricity with a stable fuel price for decades. Developing utility-scale solar power is one of the fastest ways to reduce carbon emissions, which is one of the significant drivers for large-scale PV installation and inverters.

- According to IRENA, South America's solar PV capacity increased from 12.75 GW in 2020 to 1.54 GW in 2021.

- Chile is one of the largest solar Energy markets in the region. Due to its high solar photovoltaic potential, easy land availability coupled with extremely supportive government incentives and regulations, and a politically and economically stable business environment allowing asset and investment security has attracted many foreign companies to the country's solar energy sector.

- In June 2022, Greek industrial conglomerate Mytilineos SA signed a 10-year PPA with Chilean utility Enel Generacion Chile SA. The company will generate the power through four of its solar farms located in Arica y Parinacota (109 MW), Antofagasta (228 MW), Atacama (165 MW), and Coquimbo (86 MW), with a cumulative capacity of 588 MWp, and will supply Enel Generacion with up to 1.1 TWh of solar per year. One project has started construction, while the other three are in the advanced stages of development.

- Among the other South American nations, Argentina has the largest solar market. The country's solar sector has been growing at a moderate pace, bolstered by government policies such as the Public-Private Partnership (PPP) law and efforts to regulate and encourage private investments in the critical sectors of the country's economy. More than 30 solar projects, primarily across major infrastructure and social sectors, including energy and transport projects, are expected to be implemented under the PPP model.

- Due to this, the country's solar market is expected to be dominated by larger, utility-scale solar projects, boosting the demand for large central inverter solutions during the forecast period. In December 2021, Argentine power producer Genneia SA started the construction of the 80 MW Sierras de Ullum solar farm worth USD 60 million.

- Such developments highlight the fact that the demand for utility-scale solar PV solutions is growing rapidly in South America, which is expected to be complemented by a similar growth in the demand for larger central inverters for utility-scale solar PV projects during the forecast period.

Brazil to Dominate the Market

- Brazil is the largest solar energy market in the South American region and is also one of the largest solar PV inverter markets. According to IRENA, Brazil's solar PV capacity nearly doubled from 7.87 GW in 2020 to 13.05 GW in 2021. Though 45% of Brazil's electricity was produced from renewables in 2021, solar PV only accounted for 1.7% of the total production.

- The solar sector in the country has been restrained by competition from other renewables. The growth of alternate renewable energy sources such as bioenergy, hydro, and wind is expected to significantly restrain the demand for solar energy and solar PV inverters during the forecast period.

- Despite this, under its latest plan, Plano Decenal de Expansao de Energia (PDEE) 2027, Brazil is expected to increase its non-hydro renewable energy to 28% of its electricity generation mix by 2027. Moreover, utility-scale solar projects and distributed solar generation projects are expected to be rolled out under various auctions, and the demand for large central inverters is expected to remain high during the forecast period.

- In April 2022, Sungrow announced that it had secured a 500 MWac PV inverter solution supply contract with Mercury Renew, part of the Comerc Energia Group. Under the contract, Sungrow is expected to supply 500 MWac capacity SG3125HV-30 central inverter solutions for the construction of the 650 MW Helio Valgas PV plant in Minas Gerais.

- The solar sector has also been bolstered by government initiatives, like net metering, to allow customers to get credits on the bills by selling excess electricity produced to the grid. Due to this, the residential segment has grown rapidly, and smaller solar inverters, including off-grid solar inverters, are expected to see significant demand during the forecast period. It is estimated that inverter shipments in 2020 crossed ~4.8 GW, which is significantly higher than the installed capacity at the end of 2019 (~3.5 GW). This has been primarily driven by the growth in smaller, decentralized power generation. Due to this, the country is expected to see a rapid rise in demand from the residential sector, which is expected to be translated into demand for smaller micro and string inverters.

- Brazil also has domestic companies involved in the manufacture of solar equipment, such as inverters. As the country builds its own supply chain, the price is expected to fall further, and demand is expected to grow. The development of an indigenous solar PV manufacturing industry is expected to be a significant growth opportunity for the market beyond the forecast period.

South America Solar PV Inverters Industry Overview

The South American solar PV inverters market is fragmented. Some of the major players in the market (in no particular order) include Ingeteam, Ginlong (Solis) Technologies, Mitsubishi Electric Corporation, Enphase Energy Inc., and Omron Corporation, among others

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Market Drivers

- 4.5.2 Market Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Inverter Type

- 5.1.1 Central Inverters

- 5.1.2 String Inverters

- 5.1.3 Micro Inverters

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial

- 5.2.3 Utility-Scale

- 5.3 By Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Chile

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Ingeteam

- 6.3.2 Ginlong (Solis) Technologies

- 6.3.3 Mitsubishi Electric Corporation

- 6.3.4 Enphase Energy Inc.

- 6.3.5 Omron Corporation

- 6.3.6 Sungrow Power Supply Co. Ltd

- 6.3.7 SMA Solar Technology AG

- 6.3.8 SolarEdge Technologies Inc.

- 6.3.9 Growatt New Energy Co. Ltd

- 6.3.10 Siemens AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219