|

市场调查报告书

商品编码

1635504

德国叶轮:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Germany Rotor Blade - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

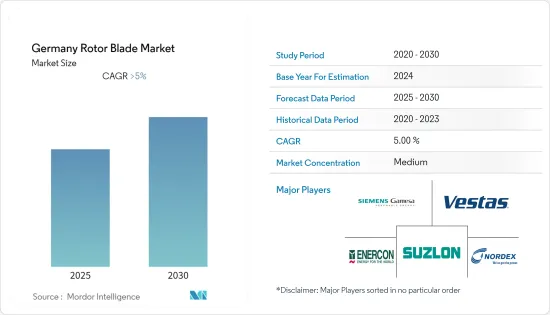

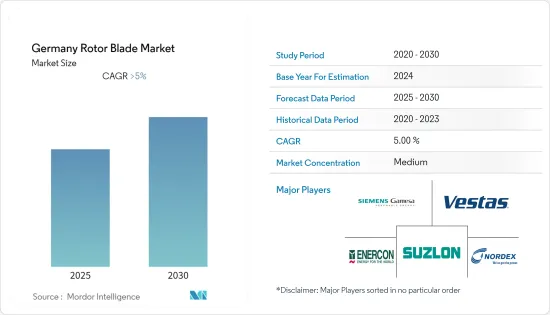

德国叶轮市场预计在预测期内复合年增长率将超过 5%。

2020 年市场受到 COVID-19 的中等程度影响。目前,市场已达到疫情前水准。

主要亮点

- 从中期来看,德国增加的投资和即将推出的计划将推动市场。

- 另一方面,高昂的相关运输成本以及来自太阳能和水力发电等替代清洁能源的市场竞争有可能阻碍市场成长。

- 产品创新和最新叶轮技术的采用可能会在预测期内为德国叶轮市场创造有利的成长机会。

德国叶轮市场趋势

田径运动主导市场

- 在过去五年中,陆上风电技术不断发展,以最大限度地提高每兆瓦装置容量的发电量,并覆盖更多风速较低的地区。除此之外,近年来风力发电机轮毂高度增加,直径增大,风力发电机叶片变得更大。

- 根据德国风力发电协会统计,截至2021年,德国风电装置容量约5,805万千瓦,为欧洲第一。根据弗劳恩霍夫实验室的数据,截至 2021 年,德国约有 28,320 台陆上涡轮机和 484 台海上涡轮机正在运作。到2050年,预计将达到2.6亿千瓦,以满足气候变迁承诺和可再生能源发电能力目标。

- 到 2021 年,德国将拥有 28,230 台陆上风力涡轮机,高于 2020 年的 29,608 台。陆域风力发电机在2021年德国电力结构中的可再生能源中贡献最大,陆上风机略有下降。

- 此外,根据WindEurope称,陆上风电将引领欧洲市场需求,到2030年将实现净零碳排放。根据GWEC统计,陆域风电装置容量约占风力发电的90%。减少碳排放和逐步淘汰传统电力系统的严格法规预计将推动市场发展。

- 2022年6月,德国议会通过了新的陆域风电法案(WindLandG),旨在从2025年起将大规模陆上风力发电量每年扩大10吉瓦。这是一项名为「復活节包装」的措施的一部分,该措施规定了扩大再生能源是首要公共利益问题这一原则。

- WindLandG 是对德国陆上风力发电的扩张路线和竞标时间表的审查。 WindLandG的目标是到2025年将陆上风力发电年容量提高到12GW以上。 2025年起,德国计划每年新增10GW陆上风电装置容量。该法案还包括对陆上风电授权的改进,以确保有足够的计划储备。

- 因此,对风力发电的需求不断增长以及政府增加陆上风力发电的措施预计将在未来几年推动这一领域的发展。

投资增加和即将推出的计划推动市场

- 风发电工程投资的增加极大地促进了风电行业的成长,并增加了全球风力发电机叶片市场的需求。

- 德国风电装置容量自2008年以来大幅成长,2021年达到高峰63,760兆瓦。与前一年同期比较,这一数字增长了近 2.5%。陆域风电占装置容量的大部分。 2021年,陆域风电场总合容量达56,013兆瓦。

- 2021年5月,莱茵集团和BASF计画投资49亿美元离岸风力发电计划。作为该计划的一部分,RWE 计划在 2030 年之前建造 2GW 的离岸风力发电。该计划旨在为BASF维希港化工厂提供能源。

- 此外,2021年11月,Google签署了一份50MW风力发电合同,由丹麦能源巨头Orsted从德国北海建造的离岸风力发电电场提供。为期 12 年的商业购电协议 (CPPA) 有助于 Google 承诺在 2030 年使用无碳能源运作所有资料中心。

- 2021 年 11 月,莱茵集团宣布计画在 2030 年投资 500 亿欧元(570 亿美元)。该投资旨在将绿色能源发电量翻一番,达到 50 吉瓦 (GW)。预计这将在预测期内为德国叶轮市场创造重大商机。

- 因此,预计在预测期内,不断增加的投资和即将开展的计划将推动德国叶轮市场的发展。

德国叶轮产业概况

德国叶轮市场因其性质而适度细分。市场主要企业包括(排名不分先后)Nordex SE、Siemens Gamesa Renewable Energy, SA、Vestas Wind Systems A/S、Suzlon Energy Limited 和 Enercon GmbH。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2027年之前的市场规模与需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- PESTLE分析

第五章市场区隔

- 部署地点

- 陆上

- 离岸

- 刀片材质

- 碳纤维

- 玻璃纤维

- 其他刀片材料

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Nordex SE

- Siemens Gamesa Renewable Energy SA

- Vestas Wind Systems A/S

- Suzlon Energy Limited

- Enercon GmbH

- LM Wind Power(a GE Renewable Energy business)

- Aerodyn Energiesysteme GmbH

- Acciona SA

- TPI Composites Inc.

- Xinjiang Goldwind Science & Technology Co. Ltd

第七章 市场机会及未来趋势

简介目录

Product Code: 92914

The Germany Rotor Blade Market is expected to register a CAGR of greater than 5% during the forecast period.

The market was moderately impacted by COVID-19 in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the major driving factors of the market are increasing investments and upcoming projects to drive the market in Germany.

- On the flip side, the associated high cost of transportation and cost competitiveness of alternate clean power sources, like solar power, hydropower, etc., have the potential to hinder the market's growth.

- Nevertheless, product innovation and adaptation of the latest rotor blade technologies will likely create lucrative growth opportunities for the German rotor blade market in the forecast period.

Germany Rotor Blade Market Trends

Onshore to Dominate the Market

- Over the last five years, onshore wind power generation technology evolved to maximize electricity produced per megawatt capacity installed and to cover more sites with lower wind speeds. Besides this, in recent years, wind turbines have become more extensive with taller hub heights, broader diameters, and larger wind turbine blades.

- According to the German Wind Energy Association, as of 2021, Germany had the most considerable wind power installed capacity in Europe, around 58.05 GW. According to Fraunhofer Institute, in Germany, approximately 28,320 onshore and 484 offshore turbines were in operation as of 2021. By 2050, it is estimated to reach 260 GW to fulfill its climate commitments and renewable power capacity goals.

- Germany's onshore wind energy turbines registered 28,230 units in 2021, from 29,608 units in 2020. Even though there was a slight decrease in onshore wind turbines, onshore wind power made the most significant contribution of renewable sources to the German power mix in 2021.

- Further, according to WindEurope, onshore wind energy will lead the market demand in the European region to achieve net-zero carbon emissions by 2030. According to GWEC, onshore wind energy capacity takes around 90% of wind energy. The strict regulations to reduce carbon emissions and phase out conventional power systems are expected to drive the market.

- In June 2022, the German Parliament adopted a new Onshore Wind Law (WindLandG), which aims to expand onshore wind by a massive 10 GW a year from 2025. It's part of an "Easter Package" of measures that also enshrines the principle that the expansion of renewables is a matter of overriding public interest.

- The WindLandG revises the expansion path and auction schedules for onshore wind in Germany. It aims to gradually increase annual onshore wind additions to more than 12 GW by 2025. After 2025 Germany plans to build 10 GW of new onshore wind each year. The law includes improvements to onshore wind permitting to allow for a sufficiently big pipeline of projects.

- Therefore, the growing demand for wind energy and the government's policies to increase onshore wind energy are expected to drive the segment in the coming years.

Increasing Investments and Upcoming Projects to Drive The Market

- The increasing investments in wind power projects have been providing a significant boost to the growth of the wind power sector, thus, increasing the demand for the wind turbine blade market globally.

- Wind power capacity in Germany has increased significantly since 2008, reaching a peak of 63,760 megawatts in 2021. This was an increase of almost 2.5% compared to the previous year. Onshore wind energy accounted for the majority of installations. In 2021, the combined capacity of wind farms on land reached 56,013 megawatts.

- In May 2021, RWE and BASF planned to invest USD 4.9 billion in offshore wind power projects. As part of the project, RWE intends to build a 2 GW offshore wind park by 2030. The project aims to supply energy to BASF's Ludwigshafen chemical complex.

- Also, in November 2021, Google signed up for 50 MW of wind power to be delivered from an offshore wind farm built by Danish energy giant Orsted in the German North Sea. The 12-year corporate power purchase agreement (CPPA) will contribute to Google's commitment to operating all data centers with carbon-free energy by 2030.

- In November 2021, RWE announced plans to invest EUR 50 billion (USD 57 billion) by 2030. The investment aims to double its green energy to 50 gigawatts (GW). This is expected to create significant opportunities for the German rotor blade market during the forecast period.

- Therefore, increasing investments and upcoming projects are expected to drive the German rotor blade market during the forecast period.

Germany Rotor Blade Industry Overview

The German rotor blade market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Nordex SE, Siemens Gamesa Renewable Energy, SA, Vestas Wind Systems A/S, Suzlon Energy Limited, and Enercon GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Blade Material

- 5.2.1 Carbon Fiber

- 5.2.2 Glass Fiber

- 5.2.3 Other Blade Materials

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Nordex SE

- 6.3.2 Siemens Gamesa Renewable Energy SA

- 6.3.3 Vestas Wind Systems A/S

- 6.3.4 Suzlon Energy Limited

- 6.3.5 Enercon GmbH

- 6.3.6 LM Wind Power (a GE Renewable Energy business)

- 6.3.7 Aerodyn Energiesysteme GmbH

- 6.3.8 Acciona SA

- 6.3.9 TPI Composites Inc.

- 6.3.10 Xinjiang Goldwind Science & Technology Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219