|

市场调查报告书

商品编码

1635513

南美洲城市瓦斯发行:市场占有率分析、产业趋势、成长预测(2025-2030)South America City Gas Distribution - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

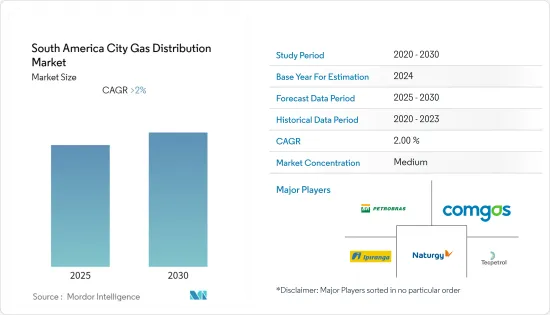

预计南美城市燃气发行市场在预测期内复合年增长率将超过 2%。

从中期来看,对天然气作为替代燃料的需求不断增长,以及城市燃气比煤炭和石油排放更低碳颗粒的能力,预计将推动研究市场的成长。另一方面,运输业越来越多地采用可再生燃料预计将在预测期内抑制市场成长。

CNG动力来源计划可能为城市燃气发行参与企业提供广泛的市场。此外,该地区的快速都市化预计将在未来几年为南美城市燃气供应市场创造重大机会。

巴西在市场上占据主导地位,预计在预测期内仍将保持最高的复合年增长率。这一增长主要是由于该国各行业对天然气的需求不断增加。

南美洲城市瓦斯供应市场趋势

电力产业主导市场

燃气发电厂又称燃气发电厂或天然气发电厂,是一种燃烧天然气发电的火力发电厂。天然气发电厂比其他发电厂建造成本更低、速度更快,而且动态效率也很高。与煤炭和石油相比,天然气燃烧产生的氮氧化物、硫氧化物和颗粒物等污染物较少。

复合迴圈发电厂效率更高,因为它们利用热废气,否则这些废气将被从系统中丢弃。这些高温废气被用来使水沸腾并产生蒸气,然后转动蒸气并产生更多的电力,热效率高达60%。

2021年,南美洲各发电设施发电量约1,364.8太瓦时。其中约 20.6% 是使用天然气产生的。 2021年天然气发电量为281.1TWh,较2020年成长21.2%。预计在预测期内,燃气发电厂的需求将会增加。

根据国际能源总署(IEA)的数据,天然气(55%)和石油(33%)占阿根廷初级能源结构的大部分,其中生质能源占5%,核能和水力发电各占3%。阿根廷即将推出的燃气发电工程预计将推动所研究市场的成长。

2022 年 10 月,Invenergy 位于萨尔瓦多阿卡胡特拉港的 Energia del Pacifico (EDP) 液化天然气发电计划开始运作。该计划包括一座380兆瓦(MW)天然气发电厂、一座浮体式储存和再气化装置(FSRU)、一条连接发电厂和浮体式储存和再气化装置的1.8公里长的海底管线以及一座230千瓦的电力系统。

这些因素正在推动南美国家天然气发电厂的发展,预计将在预测期内主导市场。

巴西主导市场

- 近年来,已证实巴西天然气需求大幅增加。 2021年,全国天然气消费量总量达到404亿立方公尺(BCM),比2020年成长约29%,比2019年成长约13%。未来几年,城市燃气发行的需求将会增加,因为需求的增加是由于终端用途燃料天然气消耗量的增加,而城市燃气发行网路对于城市中天然气的高效运输至关重要预计会增加。

- 根据ABEGAS(巴西管道燃气分销商协会)统计,2021年巴西天然气消费量成长28.82%,超过疫情前水准。 2021年巴西天然气消费量中热电领域占44.7%,其次是工业领域(38.66%)、汽车领域(7.80%)、住宅领域(1.88%)、商业领域(1.03%)和其他部门我也是。

- 此外,该国正在对天然气热电计划进行大量投资,预计这将为天然气发行网路带来商机。例如,2022年2月,巴西政府宣布了一项11.4亿美元的公共和私人投资计划,包括建设该国最大的天然气工厂GNA II,以及在里约热内卢州建设一座新的天然气处理设施。根据矿业和能源部介绍,GNA II工厂是天然气Acu(GNA)计划的一部分,该计画是Prumo Logistica、BP、西门子和SPIC Brasil的合资企业,装置容量为1,673MW。 GNA II 工厂预计将于 2025 年投入运作,成为巴西最大、最高效的天然气工厂。

- 2021年11月,瓦锡兰与巴西矿业和能源部签署协议,为巴西提供三座总合发电量为150兆瓦的燃气引擎发电厂。该计划将以EPC(设计、采购和施工)方式交付给位于巴西东南部圣埃斯皮里图州的现有电厂UTE Luiz Oscar Rodrigues de Melo和UTE Viana 1以及新电厂UTE Povoacao 1。

- 据巴西国家交通秘书处(Senatran)称,2022年第一季改装为天然气汽车(NGV)的车辆数量较2020年同期增加了74%。从绝对数量来看,2022 年改装了 67,487 辆汽车,而 2020 年改装了 38,747 辆汽车。 2021年,燃油价格高位元年,涨幅高达86.65%。根据 Senatran 2022 年 6 月的资料,巴西有超过 260 万辆汽车配备了 NGV。

- 由于这些因素,天然气发电厂的不断发展和天然气汽车数量的增加预计将在预测期内扩大市场。

南美洲城市瓦斯供应产业概况

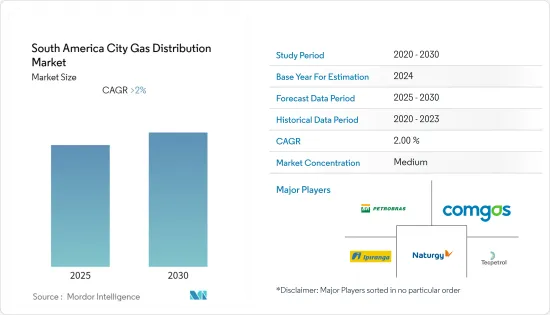

南美城市燃气供应市场已部分整合。主要参与企业(排名不分先后)包括 Petroleo Brasileiro SA、Companhia de Gas de Sao Paulo (Comgas)、Ipiranga、Naturgy Energy Group SA 和 Tecpetrol。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2027年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 类型

- 压缩天然气 (CNG)

- 管道天然气(PNG)

- 最终用户

- 工业的

- 电力部门

- 住宅/商业

- 运输

- 地区

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Petroleo Brasileiro SA

- Companhia de Gas de Sao Paulo(Comgas)

- Ipiranga

- Naturgy Energy Group SA

- Tecpetrol

- GNL Quintero SA

- Metrogas SA

- Enel SpA

- Empresas Gasco SA

- Potiguar Gas Company(Potigas)

第七章 市场机会及未来趋势

The South America City Gas Distribution Market is expected to register a CAGR of greater than 2% during the forecast period.

Over the medium term, the growing demand for natural gas as an alternative fuel and the ability of city gas to emit low carbon particles compared to coal and oil are factors expected to drive the growth of the market studied. On the other hand, the increasing adoption of renewable fuels in the transportation sector is expected to restrain the growth of the market studied during the forecast period.

Nevertheless, projects using CNG to power will likely provide a vast market for the city gas distribution players. Additionally, the rapid urbanization in the region is expected to create considerable opportunities for the South American city gas distribution market in the coming years.

Brazil dominates the market and is also predicted to witness the highest CAGR during the forecast period. The growth is mainly driven by the increased demand for natural gas from the various sectors in the country.

South America City Gas Distribution Market Trends

Power Sector to Dominate the Market

A gas-fired power plant also called a gas-fired power station or natural gas power station, is a thermal power plant that generates electricity by burning natural gas. Natural gas power plants are low-cost and quick to build and have very high thermodynamic efficiencies compared to other power plants. The burning of natural gas churns out fewer pollutants, such as NOx, SOx, and particulate matter than coal and oil.

Combined cycle plants are more efficient because they utilize hot exhaust gases that would otherwise be discarded from the system. These are then used to boil water into steam, which can then spin another turbine and generate more electricity, resulting in up to 60% thermal efficiency.

In 2021, about 1,364.8 TWh of electricity was generated at various electricity generation facilities in South America. About 20.6% of this electricity generation was from natural gas. In 2021, electricity generated from natural gas was 281.1 TWh, with an increase of 21.2% from 2020. The demand for gas-fired power plants is expected to increase during the forecast period.

According to the International Energy Agency (IEA), in Argentina, natural gas (55%) and oil (33%) constitute the majority of the country's primary energy mix, while bioenergy contributes 5% and nuclear and hydropower each contribute 3%. The upcoming gas-fired power projects in Argentina are expected to drive the growth of the market studied.

In October 2022, Invenergy commissioned operations at the Energia del Pacifico (EDP) LNG-to-power project located at the Port of Acajutla in El Salvador. A natural gas-fired power plant of 380 megawatts (MW) is included in the project, along with a floating storage regasification unit (FSRU), a 1.8-kilometer subsea pipelines connecting the power plant with the floating storage regasification unit, and two 230-kV transmission lines, one of which connects to the Central American Electrical Interconnection System.

Due to these factors, the ongoing developments in power plants based on natural gas in various South American countries are expected to dominate the market during the forecast period.

Brazil to Dominate the Market

- Recently, It has been observed that the demand for natural gas in Brazil has increased significantly in recent years. In 2021, the country's total natural gas consumption reached 40.4 billion cubic meters (BCM), representing an increase of about 29% over 2020 and 13% over 2019. The increase in demand is the result of an increase in the consumption of natural gas as a fuel in end-use applications, which, in turn, is expected to increase the demand for city gas distribution in the coming years, since city gas distribution networks are critical for the efficient transportation of natural gas in cities.

- According to ABEGAS (Brazilian Association of Piped Gas Distributors), Brazil's Natural Gas consumption grew by 28.82% in 2021, exceeding the pre-pandemic level. The thermoelectric sector consumed 44.7% of Brazil's natural gas in 2021, followed by the industrial sector (38.66%), vehicular (7.80%), residential (1.88%), commercial (1.03%), and other sectors.

- Further, the country is witnessing considerable investment in natural gas-based thermoelectric projects, which are expected to create opportunities for gas distribution networks. For instance, in February 2022, The government of Brazil announced a package of USD 1.14 billion in public and private investments, which include the construction of the country's largest gas plant, GNA II, and a new natural gas processing facility in Rio de Janeiro state. Acoording to the mines and energy ministry, the GNA II plant is part of the Gas Natural Acu (GNA) project, a joint venture between Prumo Logistica, BP, Siemens and SPIC Brasil, with a 1,673 MW in installed capacity. The GNA II plant is expected to become Brazil's largest and most efficient natural gas plant upon its inauguration in 2025.

- In November 2021, Wartsila signed a contract with the Brazilian Ministry of Mines and Energy to supply three gas engine power plants with a combined output of 150 MW in Brazil. The projects are going to be delivered on Engineering, Procurement, and Construction (EPC) basis to existing power plant sites UTE Luiz Oscar Rodrigues de Melo and UTE Viana 1, as well as a new power plant UTE Povoacao1, all located in EspiritoSanto, a state in Southeast Region of Brazil.

- According to the National Traffic Secretariat (Senatran) of Brazil, the number of conversions of cars into natural gas vehicles (NGVs) increased by 74% in the first semester of 2022 as compared to the same period in 2020. In absolute numbers, 67,487 vehicles were modified in 2022, as opposed to 38,747 in 2020. In 2021, the first year of high fuel prices, the increase had been 86.65%. According to Senatran data for June 2022, more than 2.6 million units in Brazil are equipped with NGV equipment.

- Because of these factors, the ongoing developments in power plants based on natural gas and increasing natural gas vehicles are expected to propel the market during the forecast period.

South America City Gas Distribution Industry Overview

The South American city gas distribution market is partially consolidated. Some of the major players (in no particular order) are Petroleo Brasileiro SA, Companhia de Gas de Sao Paulo (Comgas), Ipiranga, Naturgy Energy Group SA, and Tecpetrol.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Compressed Natural Gas (CNG)

- 5.1.2 Pipeline Natural Gas (PNG)

- 5.2 End-user

- 5.2.1 Industrial

- 5.2.2 Power Sector

- 5.2.3 Residential and Commercial

- 5.2.4 Transportation

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Chile

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Petroleo Brasileiro SA

- 6.3.2 Companhia de Gas de Sao Paulo (Comgas)

- 6.3.3 Ipiranga

- 6.3.4 Naturgy Energy Group SA

- 6.3.5 Tecpetrol

- 6.3.6 GNL Quintero SA

- 6.3.7 Metrogas SA

- 6.3.8 Enel SpA

- 6.3.9 Empresas Gasco SA

- 6.3.10 Potiguar Gas Company (Potigas)