|

市场调查报告书

商品编码

1689840

印度城市燃气发行(CGD)-市场占有率分析、产业趋势与统计、成长预测(2025-2030)India City Gas Distribution (CGD) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

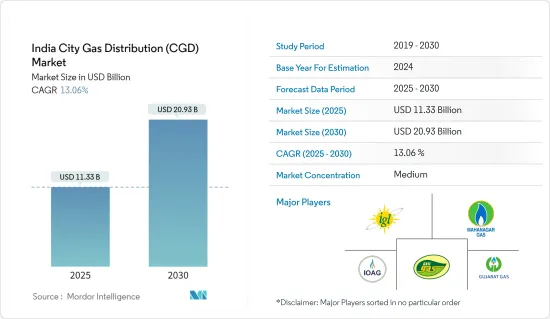

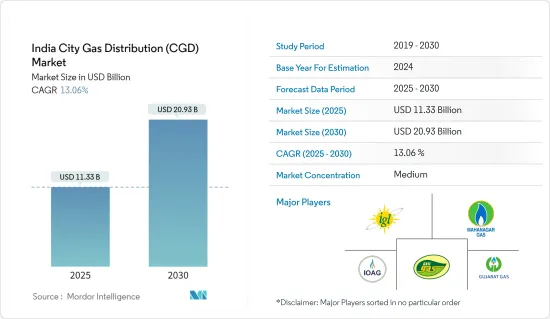

印度城市燃气发行市场规模预计在 2025 年为 113.3 亿美元,预计到 2030 年将达到 209.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 13.06%。

关键亮点

- 从中期来看,预计市场将受到政府加大住宅和运输领域的脱碳力度推动,这将增加对 CNG 汽车的需求。

- 另一方面,电动车需求的增加预计将阻碍市场成长。

- 在政府将印度转变为以天然气为基础的经济体的雄心推动下,天然气在能源结构中的份额预计将从2019年的6%增加到2030年的15%。预计这将在印度城市燃气发行(CGD)市场创造巨大的机会。

印度城市燃气发行市场趋势

工业领域主导市场

- 工业部门包括各种需要天然气暖气的製造业。例如,钢铁业使用天然气将生铁熔化成钢。同样,天然气也用于砖块行业,以提高强度和硬度等机械性能。

- 除住宅和商业部门外,PNG Connection 也向工业部门供应天然气。多年来,印度工业部门不断发展。印度中央公共部门银行提供的各种中小型产业措施和便利的资金筹措选择预计将在未来几年推动进一步成长。

- 与住宅和商业部门相比,工业部门是天然气的最大主要消费者。工业领域需要大量天然气。例如,钢铁业每小时需要近18,000立方公尺天然气。然而,这个数字可能会根据行业产能而有所不同。同样,茶叶产业也需要大量的天然气来大量干燥茶叶。

- 截至 2023 年 3 月,该产业拥有约 16,563 个 PNG 连线。与住宅和商业设施相比,这个连接数量似乎很少。但它的使用率相当高。根据 PPAC 的数据,从 2022 年 4 月到 2022 年 9 月,工业消耗的天然气约为 12.1 MMSCMD,与住宅领域的 2.5 MMSCMD 和商业领域的 0.67 MMSCMD 相比相对较高。

- 截至 2023 年 2 月,根据印度中小型企业部的资料,中小微型企业 (MSME) 占据印度市场主导地位,占有超过 96.6% 的份额。其次为小型中小型企业,占3.12%,中型中小微型企业占0.28%。如此大的市场占有率证实了中小微型企业在印度经济中发挥的重要作用,提供了就业机会并促进了 GDP 成长。

- 由于中小型工业的兴起,预计未来几年工业领域的天然气消费量将进一步增加。根据印度中小微型企业部的数据,截至 2023 年 2 月,印度约有 14,392,652 家中小型微型企业。其中,微企业1,380万户,小型企业44.698万户,中型企业4.04万户。

- 因此,由于上述因素,工业部门预计将在预测期内占据最大的市场占有率。

巴布亚新几内亚的连通性和不断增加的 CNG 加气站预计将推动市场

- 印度城市天然气供应市场由PNG和CNG部分组成。 PNG 连接可供各种最终用户使用,包括住宅、工业和商用。同时,CNG 站(也称为零售店)正在各地建立,以便人们使用天然气进行运输。

- 2023年10月,全国完成了12轮竞标后,政府宣布已覆盖98%的人口,而上次招标的比例为96%。预计此次覆盖范围的扩大将增加全国范围内的 PNG 和 CNG 连接数量。

- 根据印度的“2030年天然气基础设施愿景”,印度石油和天然气管理委员会宣布计划将天然气在能源结构中的份额从2010年的11%提高到2025年的20%,这可能会导致该国巴布亚新几内亚连接和CNG站数量的增加。

- 石油和天然气监管委员会负责向从事天然气发行网路(CGD 网路)安装、建造、营运和扩建的营运商颁发许可证,并将邀请营运商进行竞争性竞标,以安装、建造、营运和扩建 CGD 网路。该许可证授予了 25 年的物理垄断权,以铺设、建造、运营和扩展包括 CNG 和 PNG 在内的 CGD 网路。

- 截至 2023 年 3 月,印度石油和天然气监管委员会 (PNGRB) 辖下共有 5,665 个 CNG 站,其中家庭管道天然气 (PNG) 连接数为 11,029,228 个,商用管道天然气 (PNG) 连接数为 37,772 个,工业管道连接数为 1653 NG。

- 据巴布亚纽几内亚资源委员会称,预计到 2025 年,约有 230 个城市将建造天然气基础设施。随着新地区扩张的加速,到 2025 年,管道基础设施将增加近四倍,压缩天然气站将增加两倍。

- 预计在预测期内,此类发展将推动巴布亚纽几内亚在国内市场的采用以及全国 CNG 站的扩张。

印度城市燃气供应产业概况

印度的城市天然气分销(CGD)市场处于半分散状态。市场的主要企业(不分先后顺序)包括 Indraprastha Gas Limited、Mahanagar Gas Ltd、GAIL Gas Limited、Gujarat Gas Ltd、IndianOil-Adani Gas Pvt。有限公司等

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 至2029年的市场规模及需求预测(单位:美元)

- 截至 2024 年 7 月,印度各地区巴布亚纽几内亚连接点及 CNG 加气站数量

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- CNG车辆需求不断成长

- 加强政府努力,实现住宅和交通部门脱碳

- 限制因素

- 电动车需求不断成长

- 驱动程式

- 供应链分析

- PESTLE分析

第五章市场区隔

- 类型

- 管道天然气(PNG)连接

- 压缩天然气(CNG)连接

- 最终用户

- 车

- 住宅

- 商用

- 工业的

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Indraprastha Gas Limited

- Mahanagar Gas Ltd

- GAIL Gas Limited

- Gujarat Gas Ltd

- Maharashtra Natural Gas Ltd

- Haryana City Gas Distribution Network Ltd

- Aavantika Gas Ltd

- Sabarmati Gas Ltd

- Assam Gas Company Ltd

- Adani Total Gas Ltd.

- Torrent Group

第七章 市场机会与未来趋势

- 氢能交通运输发展

简介目录

Product Code: 68834

The India City Gas Distribution Market size is estimated at USD 11.33 billion in 2025, and is expected to reach USD 20.93 billion by 2030, at a CAGR of 13.06% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, increased government efforts to decarbonize the residential and transport sectors and rising demand for CNG vehicles are expected to drive the market.

- On the other hand, the rising demand for electric vehicles is expected to hinder the market's growth.

- Nevertheless, the government's intention of converting India into a gas-based economy is expected to increase the natural gas share in its energy mix from 6% in 2019 to 15% by 2030. This is expected to create enormous opportunities for the India City Gas Distribution (CGD) Market.

India City Gas Distribution Market Trends

Industrial Sector to Dominate the Market

- The industrial segment includes various manufacturing industries requiring natural gas for heating. For example, natural gas is used in the steel industry to melt pig iron into steel. Similarly, natural gas is used in the brick industry to increase mechanical properties like strength and hardness.

- Like the residential and commercial sectors, PNG connections supply industries with natural gas. Over the years, the Indian industrial sector has grown. It is expected to grow further in the upcoming years due to various medium- and small-scale industry policies and convenient financing methods from India's central public sector banks.

- The industrial sector is the major segment that consumes the highest volume of natural gas compared to the residential and commercial sectors. Natural gas is required in large volumes in industries. For instance, the steel manufacturing industry needs nearly 18000 cubic meters of natural gas per hour. However, this number may change based on the industry's capacity. Similarly, the tea industry requires a large volume of natural gas to dry the tea leaves in bulk.

- As of March 2023, industries have around 16,563 PNG connections. The connection number seems low as compared to residential and commercial. However, its uses are significantly high. As per PPAC, in the period April 2022-September 2022, industries consumed nearly 12.1 MMSCMD of natural gas, which is relatively high as compared to 2.5 MMSCMD in the residential and 0.67 MMSCMD in the commercial sector.

- As of February 2023, data from the Ministry of Micro, Small & Medium Enterprises reveals that Micro MSMEs dominated the Indian market, holding a share of over 96.6 percent. They were trailed by Small MSMEs at 3.12 percent and Mid MSMEs at 0.28 percent. This significant market share underscores the critical role Micro MSMEs play in the Indian economy, providing employment opportunities and contributing to GDP growth.

- During the upcoming years, natural gas consumption in the industrial sector is expected to grow further due to an increase in the numbers of small and medium-scale industries. As per the Ministry of Micro, Small, and Medium Enterprises, as of February 2023, there are nearly 14,392,652 MSMEs in India. Among all, 13.8 million are micro-enterprises, 446,980 are small, and 40,400 are midsize enterprises.

- Therefore, based on the above-mentioned factors, industrial sector is expected to have the largest market share during the forecast period.

Increasing PNG Connections and CNG Stations are Expected to Drive the Market

- The city gas distribution market in India includes PNG and CNG segments. PNG connections are provided to various end-users, such as domestic, industrial, and commercial. At the same time, CNG stations, also known as retail outlets, are installed at various places so that people can have access to natural gas for transport.

- After the completion of the 12 bidding rounds in the country in October 2023, the government announced that it had covered 98% of the population compared to 96% in the previous round. This increase in the coverage area is expected to increase the number of PNG and CNG connections across the country.

- The Petroleum & Natural Gas Regulatory Board in India, under the Natural Gas Infrastructure in India "Vision 2030," has announced plans to increase the share of natural gas in the energy mix by 20% in 2025 as compared to 11% in 2010, which may increase the number of PNG connections and CNG stations in the country.

- The Petroleum and Natural Gas Regulatory Board is mandated to authorize entities to lay, build, operate, or expand the local natural gas distribution network (CGD Network) for which it calls for competitive bids from entities for laying, building, operating, or expansion of CGD networks. The authorization to the entity gives the physical exclusivity to lay, build, operate, and expand the CGD Network, which includes CNG & PNG, for a period of 25 years.

- As of March 2023, under Petroleum & Natural Gas Regulatory Board (PNGRB), there are 5,665 CNG stations, with 1,10,29,228 domestic, 37,772 commercial, and 16,563 industrial piped natural gas (PNG) connections across India

- According to PNGRB, by 2025, around 230 cities are likely to have gas infrastructure. Pipeline infrastructure is set to grow nearly four times, and compressed natural gas stations are to increase three times through 2025 as expansion in new geographies picks up pace.

- Such developments are expected to drive the adoption of PNG in the household sector and expanstion of CNG stations across the country during the forecast period.

India City Gas Distribution Industry Overview

The India city gas distribution (CGD) market is semi-fragmented. The key players in the market (in no particular order) include Indraprastha Gas Limited, Mahanagar Gas Ltd, GAIL Gas Limited, Gujarat Gas Ltd, and IndianOil-Adani Gas Pvt. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Number of PNG Connections and CNG Stations, By Location, India, as of July 2024

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Rising Demand for CNG Vehicles

- 4.6.1.2 Increased Government Efforts To Decarbonize The Residential And Transport Sector

- 4.6.2 Restraints

- 4.6.2.1 Rising Demand for Electric Vehicles

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Pipeline Natural Gas (PNG) Connections

- 5.1.2 Compressed Natural Gas (CNG) Connections

- 5.2 End User

- 5.2.1 Automotive

- 5.2.2 Residential

- 5.2.3 Commercial

- 5.2.4 Industrial

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Indraprastha Gas Limited

- 6.3.2 Mahanagar Gas Ltd

- 6.3.3 GAIL Gas Limited

- 6.3.4 Gujarat Gas Ltd

- 6.3.5 Maharashtra Natural Gas Ltd

- 6.3.6 Haryana City Gas Distribution Network Ltd

- 6.3.7 Aavantika Gas Ltd

- 6.3.8 Sabarmati Gas Ltd

- 6.3.9 Assam Gas Company Ltd

- 6.3.10 Adani Total Gas Ltd.

- 6.3.11 Torrent Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Hydrogen Transportation

02-2729-4219

+886-2-2729-4219