|

市场调查报告书

商品编码

1636120

欧洲压缩天然气加气机:市场占有率分析、产业趋势、成长预测(2025-2030)Europe Compressed Natural Gas Dispenser - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

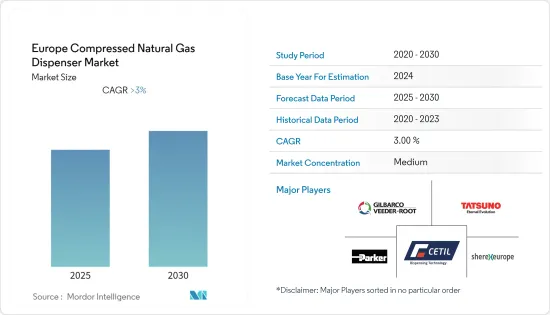

欧洲压缩天然气加气机市场预计在预测期内复合年增长率将超过 3%。

2020 年市场受到 COVID-19 的负面影响。目前市场处于大流行前的水平。

主要亮点

- 中期来看,CNG汽车的数量将主要在欧洲增加,各种政府措施都集中在增加CNG加气站的数量。压缩机天然气加气机市场受到车辆二氧化碳排放稳定和减少的推动。

- 另一方面,对充足天然气基础设施的需求,例如管道到达某些地区的困难以及电池等替代燃料来源的增加,将成为预测期内市场成长的限制因素。

- 到2030年,欧洲CNG汽车数量预计将增加20%。因此,政府支持天然气利用的倡议以及全部区域汽车保有量的增加等因素预计将在未来几年为 CNG 加气机市场提供重大机会。

- 义大利拥有最多的 CNG 加气站和 CNG 车辆,在 CNG 加气机市场占据主导地位。

欧洲压缩天然气加气机市场趋势

快速灌装领域占市场主导地位

- 大多数快速加油站适用于车辆随机到达且必须快速加油的零售情况。所有公共CNG 加气站均提供快速加气服务。

- 快速加註站从当地公用事业公司接收低压燃料,并使用现场压缩机将其压缩至高压。压缩的 CNG 储存在一系列储存容器中,并且可以轻鬆重新填充。 CNG 还可以与汽油和其他燃油加油机一起加油。

- 快速加气站的 CNG 通常存放在具有高工作压力 (4,300 psi) 的容器中,以便加气机可以快速将其输送到车辆上。加油机使用感测器并考虑温度来确定压力和输送到油箱的汽油加仑当量 (GGE) 的数量。

- 到 2021 年,天然气汽车将越来越受欢迎,预计将有超过 200 万欧洲人使用 CNG 汽车。适合所有类型的交通工具,包括私家车和公共运输。

- CNG汽车的温室气体排放远低于未来环境标准的要求,是迈向能源永续性和向绿色燃料过渡的重要一步。例如,在德国,对城市环境的环境保护有严格的规定,车辆可以自由进入都市区交通受到限制的区域。因此,欧洲越来越多的公司和公共工程正在采用 CNG 汽车。

- 2013年至2020年间,匈牙利註册的压缩天然气(CNG)汽车数量增加了约2,000辆。截至2021年,全国註册CNG汽车2,277辆。

- 2021 年 11 月,英国政府宣布到 2040 年禁止新销售柴油和汽油重型货车 (HGV),以实现交通运输业脱碳。根据政府的计划,许多公司都选择使用 CNG 汽车。例如,2022 年 2 月,爱马仕英国公司安装了 70 辆依维柯 S-way CNG 车辆,作为其到 2035 年实现直接和间接碳排放净零的计画的一部分。此次增加使 Hermes 的压缩天然气 (CNG)持有达到 160 辆,约占其核心拖拉机持有的一半。每台依维柯 S-way 装置的二氧化碳排放量比欧盟 6 柴油引擎少 80%。

- 在研究期间,上述因素预计将推动压缩天然气加气机市场对快速填充细分市场的需求。

义大利主导市场

- 义大利的天然气加气站数量多年来一直在增加。 CNG 网路的维修和发展始于 20 世纪 90 年代初。当时设立了150个站,主要分布在北部和中部地区。现在所有地区都有天然气汽车(NGV)加气站。

- 在接下来的十年中,皮埃蒙特、伦巴第和特伦蒂诺-上阿迪杰等重要地区促进了天然气汽车的普及。天然气汽车的环境效益受到更多关注,鼓励燃料业者在各自地区建造CNG加气站网路。

- 2021年,该国将安装1,571座CNG加气站,占整个欧洲的37.4%。

- 国内CNG汽车数量不断增加。截至2021年,全国註册CNG汽车27,346辆。

- 2022年6月,Consip(义大利公共行政中央采购部门)签署了向中央和地方政府以及公共交通公司供应天然气公车的框架协议。作为该计划的一部分,将提供 1,000 多辆车辆(包括公车),其中包括 800 辆 CNG 公车和 200 辆 LNG 公车。利用国家恢復和復原计划 (PNRR) 下的补充国家计划 (PNC) 基金提供的资源,政府机构可以透过「交钥匙」合约快速购买各种类型和规模的公车。竞标将分为八个标段,拨款额为 4.73 亿美元。

- 因此,由于上述因素,预计义大利将在预测期内占据压缩天然气市场的重要份额。

欧洲压缩天然气加气机产业概况

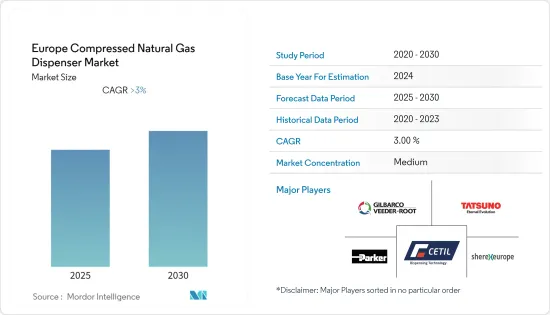

欧洲压缩天然气加气机市场适度细分。市场上的主要企业包括(排名不分先后)Gilbarco Inc.、Tatsuno Europe AS、Parker Hannifin Corp.、Cetil Dispensing Technology、SL 和 Sherex Europe ApS。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 分配器类型

- 快速填充

- 时间填充

- 地区

- 义大利

- 德国

- 西班牙

- 法国

- 欧洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Gilbarco Inc.

- Tatsuno Europe AS

- Parker Hannifin Corp

- Cetil Dispensing Technology, SL

- Sherex Europe ApS

- FTI Group Ltd

- Wayne Fueling Systems LLC.

- Dover Corporation

- ANGI Energy Systems, Inc.

- GRASYS JSC

第七章 市场机会及未来趋势

简介目录

Product Code: 5000104

The Europe Compressed Natural Gas Dispenser Market is expected to register a CAGR of greater than 3% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market now reached the pre-pandemic levels.

Key Highlights

- Over the medium term, an increasing number of CNG vehicles around Europe and various government policies are focused on including more CNG stations. It is to stabilize and reduce the carbon footprint of vehicles to drive the compressor natural gas dispenser market.

- On the other hand, the need for proper natural gas infrastructures, such as pipeline inaccessibility to certain areas and rising alternate fuel sources such as batteries, is expected to act as restraints for the market to grow during the forecasting period.

- Nevertheless, the CNG vehicle count in Europe is expected to increase by 20% by 2030. As a result, factors such as government initiatives to support natural gas applications and an increasing population of vehicles across the region are expected to create a significant opportunity for the market for CNG dispensers in the coming years.

- Italy is dominating the CNG dispenser market with the highest number of CNG fuel stations and CNG vehicle presence.

Europe Compressed Natural Gas Dispenser Market Trends

Fast-Fill Segment to Dominate the Market

- Most fast-fill stations are suitable for retail situations where vehicles arrive randomly and must be filled up quickly. All public CNG stations provide fast-fill services.

- A fast-fill station receives fuel from a local utility line at a low pressure and compresses it to a high pressure using a compressor on-site. The compressed CNG is then stored in a series of storage vessels to be easily refilled. CNG can also be delivered in dispensers with gasoline or other fuel dispensers.

- CNG at fast-fill stations is often stored in vessels at high service pressure (4,300 psi) so the dispenser can quickly deliver it to a vehicle. The dispenser uses sensors to determine the pressure and the number of gasoline gallon equivalents (GGEs) delivered to the tank, taking temperature into account.

- By 2021, natural gas-powered vehicles will become increasingly popular, with over two million Europeans using CNG-powered vehicles. These are suitable for all types of transport, including private vehicles and public transportation.

- CNG cars now emit far fewer greenhouse gases than future environmental standards requirement, which is an important step towards energy sustainability and the transition to a more environmentally friendly fuel. For example, in Germany, where there are strict rules for the environmental protection of the urban environment, they are free to enter areas with limited urban mobility. It is why more and more companies and utilities in Europe are also adopting CNG fleets.

- Between 2013 and 2020, the number of compressed natural gas (CNG) vehicles registered in Hungary grew by almost 2000 units. As of 2021, there were 2,277 registered CNG vehicles in the country.

- In November 2021, the United Kingdom government announced to ban the sale of new diesel and petrol heavy goods vehicles (HGVs) by 2040 to decarbonize the transport sector. As per government plans, many companies are opting for CNG vehicles. For instance, in February 2022, Hermes UK launched Iveco's 70 S-way CNG vehicles to its fleet as a part of its plans to reach net-zero direct and indirect carbon emissions by 2035. The additions bring Hermes' total compressed natural gas (CNG) fleet to 160 - roughly half of its core tractor fleet. Each Iveco S-way unit emits 80% less carbon dioxide than a Euro 6 diesel.

- The factors mentioned above are expected to drive the demand for the fast-fill segment in the compressed natural gas dispenser market over the study period.

Italy to Dominate the Market

- An increase in natural gas refuelling stations in Italy is observed for several years. CNG network renovation and development began in the early 1990s. At that time, 150 stations were installed, mainly in the northern and central regions. Now, all regions include natural gas vehicles (NGVs) refuelling stations.

- During the next decade, some critical regions, including Piemonte, Lombardia, and Trentino-Alto Adige, contributed to the growth of NGVs. Greater attention was paid to the environmental benefits of these vehicles, and fuel operators were encouraged to create a network of CNG stations in their areas.

- By 2021, there were 1,571 CNG refuelling in the country, contributing a significant share of 37.4% in the entire European region.

- The number of CNG vehicles is increasing in the country. As of 2021, there were 27,346 registered CNG vehicles in the country.

- In June 2022, A framework agreement was awarded for the supply of natural gas buses to central/local governments and public transport companies by Consip (the central purchasing department of the Italian public administration). As part of this initiative, more than 1,000 vehicles (including 800 CNG buses and 200 LNG buses) will be made available (including the buses). Using the resources provided by the Complementary National Plan (PNC) fund, under the National Recovery and Resilience Plan (PNRR), public administrations will be able to purchase buses of different types and sizes quickly through a "ready to use" contract. This tender is divided into eight lots, and USD 473 million is allocated.

- Therefore, based on the above factors, Italy is expected to include a significant share of the compressed natural gas market during the forecast period.

Europe Compressed Natural Gas Dispenser Industry Overview

The Europe compressed natural gas dispenser market is moderately fragmented. Some of the key players in the market (in no particular order) include Gilbarco Inc., Tatsuno Europe AS, Parker Hannifin Corp, Cetil Dispensing Technology, S.L., and Sherex Europe ApS.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Dispenser Type

- 5.1.1 Fast-fill

- 5.1.2 Time-fill

- 5.2 Geography

- 5.2.1 Italy

- 5.2.2 Germany

- 5.2.3 Spain

- 5.2.4 France

- 5.2.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Gilbarco Inc.

- 6.3.2 Tatsuno Europe AS

- 6.3.3 Parker Hannifin Corp

- 6.3.4 Cetil Dispensing Technology, S.L

- 6.3.5 Sherex Europe ApS

- 6.3.6 FTI Group Ltd

- 6.3.7 Wayne Fueling Systems LLC.

- 6.3.8 Dover Corporation

- 6.3.9 ANGI Energy Systems, Inc.

- 6.3.10 GRASYS JSC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219