|

市场调查报告书

商品编码

1636122

中东和非洲压缩天然气加气机:市场占有率分析、产业趋势和成长预测(2025-2030)MEA Compressed Natural Gas Dispenser - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

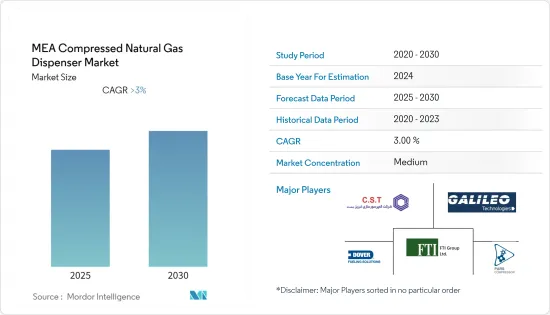

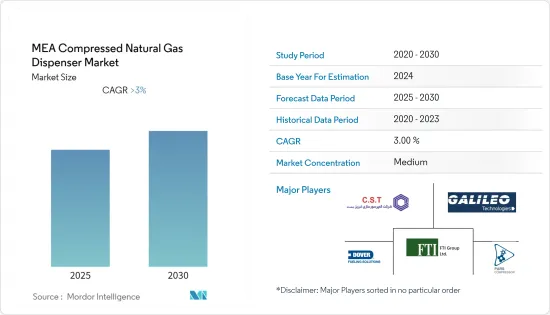

中东和非洲压缩天然气 (CNG) 加气机市场预计在预测期内复合年增长率将超过 3%。

2020 年市场受到 COVID-19 的负面影响。目前市场处于大流行前的水平。

主要亮点

- 从中期来看,由于压缩天然气汽车的经济和环境效益以及从传统引擎到压缩天然气汽车的转换率不断提高,中东和非洲的压缩天然气加气机市场预计将扩大成长。

- 另一方面,该地区电动车的日益普及预计将阻碍压缩天然气汽车及相关基础设施的市场成长。

- 目前,该地区对 CNG 加气站不断增长的需求低于 CNG 车辆所需的数量,这为 CNG 加气机市场创造了机会。

- 由于政府倡议普及汽车,CNG汽车市场成长,预计伊朗将显着成长。

中东和非洲压缩天然气加气机市场趋势

CNG汽车需求的成长预计将推动市场发展

- 在中东和非洲,从传统引擎到压缩天然气汽车的转换率正在稳步提高。这是由于人们越来越认识到压缩天然气汽车的经济和环境效益。由于天然气蕴藏量的高成长率,该地区天然气的供应量很高。

- 阿联酋、伊朗、土耳其、埃及等国家在CNG汽车市场大放异彩。埃及天然气产量在过去十年呈现持续成长,2021年天然气产量达约678亿立方公尺。除了天然气的高可用性之外,该国CNG汽车市场的另一个驱动因素是政府推动市场持续成长的努力。

- 例如,埃及石油和矿产资源部于 2021 年 12 月投资约 1,130 万欧元(1,180 万美元),资助一项将汽车改装为 CNG 车辆的国家计画。作为该计划的一部分,埃及各地的新 CNG 站将配备必要的设备。 GASTEC 将安装 271 个分配器和 100 个压缩机包装,而 NGVC 将安装 229 个分配器和 100 个压缩机包装。

- 此外,在其他国家,高压缩天然气转换率对压缩天然气加气机市场产生了积极影响。例如,在阿拉伯联合大公国,阿联酋运输公司于 2022 年 3 月报告称,该公司在 2021 年改装了约 900 辆 CNG 车辆。自2010年转型以来,全国CNG汽车保有量已达1.1万辆。

- 预计此类发展将在未来几年推动该地区的 CNG 加气机市场。

伊朗实现显着成长

- 伊朗在开发使用压缩天然气的运输方式方面取得了显着进展。根据国际天然气汽车协会(IANGV)的数据,2022年伊朗CNG汽车保有量位居世界第三,仅次于巴基斯坦和阿根廷。这得归功于天然气的高可用性以及汽车公司和政府当局的努力。

- 2021年,中国天然气产量持续成长,增加至2,567亿立方公尺。 CNG汽车也有望扩大部署场景。这得归功于伊朗政府为推动CNG汽车生产所做的努力。

- 例如,2022年12月,石油部指示伊朗国家石油产品分销公司(NIOPDC)计划在该国生产45,000辆CNG汽车。当局与伊朗领先的汽车製造商之一伊朗霍德罗公司签署了一项协议。他们打算将所有汽油公共、计程车、货车、皮卡车和客车转换为压缩天然气汽车。

- 伊朗国家石油炼製和分销公司 (NIORDC) 宣布,约 165,000 辆公共交通车辆已改装为燃油车辆(汽油或 CNG)。所有这一切都是在迄今为止实施的压缩天然气项目的支持下成为可能的。

- 随着此类新兴市场的发展,伊朗预计很快就会占据CNG加气机市场的较大份额。

中东和非洲压缩天然气加气机产业概况

中东和非洲压缩天然气加气机市场适度细分。主要参与企业(排名不分先后)包括 FTI Group Ltd.、Galileo Technologies SA、Pars 压缩机、压缩机 Sazi Tabriz 和 Dover Fueling Stations。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 地区

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 埃及

- 坦尚尼亚

- 其他中东/非洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- FTI Group Ltd.

- Galileo Technologies SA

- Pars Compressor Company

- Dover Fuelling Solutions

- Compressor Sazi Tabriz

- Gilbarco Inc.

- Censtar Science & Technolgy Corp. Ltd.

- Parker Hannifin Corporation

第七章 市场机会及未来趋势

简介目录

Product Code: 5000106

The MEA Compressed Natural Gas Dispenser Market is expected to register a CAGR of greater than 3% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market now reached the pre-pandemic levels.

Key Highlights

- Over the medium term, the Middle East and Africa compressed natural gas dispenser market is expected to include augmented growth due to CNG vehicles' economic and environmental benefits and the growing conversion rate of conventional engines to CNG vehicles.

- On the other hand, the growing occupancy of electric vehicles in the region is expected to impede the market growth for CNG vehicles and associated infrastructure.

- Nevertheless, the growing demand for CNG fuelling stations, which is currently less than the requirement for CNG vehicle units in the region, places an opportunity on the CNG dispensers market.

- Iran is expected to witness significant growth due to the growing CNG vehicles market because of the government's initiatives to promote vehicles.

MEA Compressed Natural Gas Dispenser Market Trends

Growing Demand of CNG vehicles Expected to Drive the Market

- The Middle East and Africa region is envisaging a steady growth in the conversion rate of conventional engines into CNG vehicles. It is due to the growing awareness of CNG vehicles' economic and environmental benefits. The region is blessed with high availability of natural gas due to the high growth rate in huge natural gas reserves.

- The countries like UAE, Iran, Turkey, and Egypt are glowing in the CNG vehicles market. Egypt's natural gas production witnessed consistent growth in the last decade, reaching around 67.8 billion cubic meters of natural gas production in the year 2021. Apart from high natural gas availability, the other propelling factor for the CNG vehicles market in the country is the government's initiatives to see consecutive growth in the market.

- For example, in December 2021, the Egyptian Ministry of Petroleum and Mineral Resources invested around EUR 11.3 million (USD 11.8 million) to finance the national program to convert cars to CNG vehicles. The required equipment will be installed in new CNG stations throughout Egypt as part of the program. GASTEC will install 271 dispensers and 100 compressor packages, while NGVC will install 229 dispensers and 100 compressor packages.

- Furthermore, in other countries, the high CNG conversion rate is positively influencing the CNG dispenser market. For example, in UAE, in March 2022, the Emirates Transport Company reported converting around 900 CNG vehicles in 2021. The total number of CNG vehicles in the country reached 11,000 vehicles since the conversion started in 2010.

- Such developments are expected to propel the CNG dispensers market in the region in the coming years.

Iran to Witness Significant Growth

- Iran made remarkable progress in the development of CNG-based transportation. According to the International Association of Natural Gas Vehicles (IANGV), Iran ranked third for the number of CNG vehicles in the world after Pakistan and Argentina in 2022. It is due to the high availability of natural gas and initiatives taken by automotive companies and government authorities.

- Natural gas production in the country rose to 256.7 billion cubic meters in 2021 after witnessing consistent growth. The CNG vehicles are expected to increase the unfolding scene, too. It is due to the efforts made by the Iranian government to boost CNG vehicle production.

- For example, in December 2022, the Ministry of Petroleum instructed the National Iranian Oil Products Distribution Company (NIOPDC) launched a plan to manufacture 45000 CNG vehicles in the country. The authority signed an agreement with Iran Khodro, one of the country's leading automakers. They intend to convert all gasoline-powered public vehicles, taxis, vans, pickup trucks, and passenger cars to CNG vehicles.

- The National Iranian Oil Refining and Distribution Company (NIORDC) announced that around 165,000 public transport vehicles had been converted into duel-fuel cars (gasoline or CNG). All this was made possible with the help of the CNG programs implemented so far.

- Such developments are expected to make Iran include a significant share in the CNG dispensers market shortly.

MEA Compressed Natural Gas Dispenser Industry Overview

The Middle East and Africa CNG dispenser market is moderately fragmented. Some key players (in no particular order) include FTI Group Ltd., Galileo Technologies SA, Pars Compressor, Compressor Sazi Tabriz, and Dover Fuelling Stations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Geography

- 5.1.1 United Arab Emirates

- 5.1.2 Saudi Arabia

- 5.1.3 Egypt

- 5.1.4 Tanzania

- 5.1.5 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 FTI Group Ltd.

- 6.3.2 Galileo Technologies SA

- 6.3.3 Pars Compressor Company

- 6.3.4 Dover Fuelling Solutions

- 6.3.5 Compressor Sazi Tabriz

- 6.3.6 Gilbarco Inc.

- 6.3.7 Censtar Science & Technolgy Corp. Ltd.

- 6.3.8 Parker Hannifin Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219