|

市场调查报告书

商品编码

1636121

南美洲石油和天然气软管和接头:市场占有率分析、行业趋势、统计、成长趋势预测(2025-2030)South America Oil And Gas Hoses And Coupling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

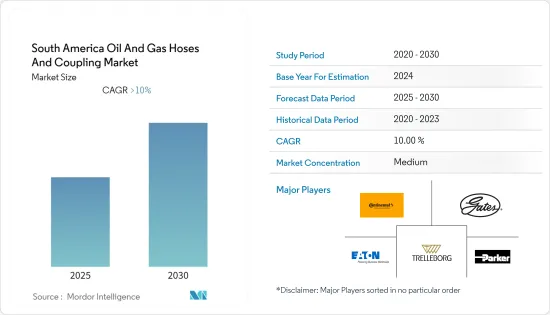

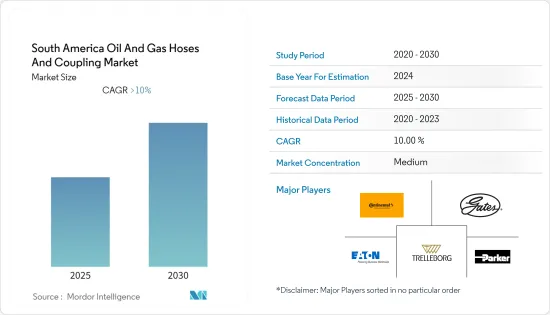

南美石油和天然气软管和接头市场预计在预测期内复合年增长率将超过 10%。

COVID-19 对市场产生了负面影响。目前市场处于大流行前的水平。

主要亮点

- 从中期来看,石油和天然气投资的增加以及各种应用对高压软管的需求等因素正在推动市场成长。

- 另一方面,安装石油和天然气软管组件需要技术和科学知识,以适应不同的地点。软管组装不当可能会导致严重伤害和财产损失。对熟悉石油和天然气软管的熟练工人的需求是市场成长的主要限制因素。

- 一些製造商正在增加对产品开发的投资,为海上和陆上上游应用提供更高品质和改进的软管和组件。预计这将为在市场上运营的主要企业创造利润丰厚的机会。

- 巴西在市场上占据主导地位,并且可能在预测期内实现最高的复合年增长率。这一增长归因于该国石油和天然气产量的增加。

南美洲油气软管及接头市场趋势

中游板块有望成为重要板块

- 中游部门运输和储存提取的石油和天然气。这包括原油和天然气管道、天然气加工厂、天然气液化厂以及液化气和再气化储存等基础设施。

- 浮体式油气软管通常用于安全且有效率地向浮式油气生产、储存和货运设施船、公路和铁路油轮以及浮式生产储油船(FPSO)供应燃料。它的设计不仅可以向炼油厂供应原油,向加油站供应成品油,还可以作为从加油站到汽车的燃油供应软管。

- 世界传统上依赖石油来满足初级能源需求。然而,由于对排放气体的担忧日益增加,近年来天然气消耗量增加。因此,天然气加工厂的投资活性化。根据英国石油公司《世界能源统计年鑑》显示,2021年南美洲天然气消费量为1,633亿立方公尺。

- 根据阿根廷投资和国际贸易署的《阿根廷石油和天然气投资报告》(2020年4月),阿根廷在其短期计划计划(2024-2025年)中纳入了价值约30亿美元的5 MTPA液化天然气出口设施。中期计划计画(2026-2027)还包括价值约15亿美元的2MTPA液化天然气出口设施。

- 2022年9月,YPF和马来西亚国家石油公司签署协议,就综合液化天然气计划和清洁能源解决方案进行合作。本研究调查了阿根廷综合液化天然气出口计划的可行性。

- 2022年6月,哥伦比亚政府重新启动7亿美元建设液化天然气进口码头竞标。据哥伦比亚矿业和能源规划部门(UPME)称,该国正在寻找承包商在太平洋港口城市布埃纳文图拉建造、拥有和运营液化天然气再气化设施。

- 这些因素正在推动该地区国家中游产业的持续投资和市场发展,预计在预测期内将占据主导地位。

巴西主导市场

- 截至 2021 年,巴西是南美洲石油和天然气支出领先的国家。该国海上盐层下油田产量约占石油总产量的50%,至2020年终,这一比例将增加至75%左右。产量的增加和对海上天然气田的依赖增加,是由于钻井技术的改进、海上石油产业专业知识的增加以及基础设施的扩大,生产成本稳定下降。

- 截至 2022 年 6 月,约有 7 座钻机在海上作业,3 座钻机在陆上运作。截至2021年,浮式海上油气生产货运设施(FPSO)、钻井船、浮体式潜船、浮体式海上油气储货运设施(FSO)等浮体式海上油气生产设备占全国运作海上平台的80%以上。这反映了海浮体式资产在巴西上游油气产业的优势。

- 预计巴西将在海上石油和天然气产业从动盪的2021年復苏中发挥关键作用,特别是在浮体式生产市场。预计到 2025 年,该国将部署约 18 艘 FPSO。

- 2022年5月,新加坡吉宝船厂在巴西国家石油公司为巴西Buzios油田计画建造的两艘FPSO的工程、采购和建造(EPC)合约竞标中提交了最高竞标。吉宝分别以 29.8 亿美元收购 A 地块和 B 地块,胜科海事的提案为 36.6 亿美元和 37.3 亿美元。其他四家竞标拒绝了提案。目标FPSO是P-80和P-82,计画于2026年在桑托斯盆地盐层下开始运作。

- 巴西国家石油公司计划在 2022 年至 2026 年间投资约 680 亿美元。在总投资中,84%将分配给石油和天然气勘探和生产(E&P)。 E&P总资本投资(570亿美元)的约67%将投资于盐层下。这显示石油和天然气上游产业,特别是巴西的海上石油和天然气资产,预计在预测期内将出现大量投资。

- 因此,海上油气田(尤其是盐层下盆地)的开发计画等因素预计将在预测期内推动巴西上游油气软管和接头市场的发展。

- 除了巴西上游产业的需求外,由于该国即将推出的管道和液化天然气计划,中游产业预计将在预测期内进一步推动市场。截至2020年,巴西75%以上的管道基础设施位于陆上,其余管道基础设施连接巴西运作的浮体式再气化终端和海上油气平台。

- 截至2021年,巴西拥有17家炼油厂,巴西国家石油天然气公司营运该国总炼油能力的98%。大多数炼油厂位于巴西海岸的需求中心附近。作为其战略计划(2021-2025)的一部分,巴西国家石油公司宣布将在 2022 年之前出售其 12 家现有炼油厂中的 8 家,以及中游和燃料分销部门的剩余股权。此举由巴西矿业和能源部主导,旨在有效促进下游产业向开放、无竞争的产业转型。

- 根据BP世界能源统计显示,2021年巴西石油产量为1.568亿吨,较2011年的1.14亿吨增加37.54%。

- 预计上述因素将在调查期间推动油气软管和接头的需求。

南美洲油气软管及接头产业概况

南美石油和天然气软管和接头市场适度细分。市场的主要企业包括(排名不分先后)大陆集团、盖兹公司、伊顿公司、特瑞堡公司和派克汉尼汾公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 目的

- 川上

- 在河里

- 下游

- 地区

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Continental AG

- Gates Corporation

- Eaton Corporation Plc

- Trelleborg AB

- ParkerHannifin Corporation

- Bosch Rexroth AG

- Manuli Hydraulics

- Kuriyama Holdings Corporation

- WW Grainger, Inc.

- Jason Industrial Inc.

第七章 市场机会及未来趋势

简介目录

Product Code: 5000105

The South America Oil And Gas Hoses And Coupling Market is expected to register a CAGR of greater than 10% during the forecast period.

COVID-19 negatively impacted the market. Presently the market now reached the pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as a rise in oil and gas investments and a need for high-pressure hoses in various applications are driving the market growth.

- On the other hand, installing oil and gas hose assemblies requires technological and scientific knowledge to fit various locations. Improperly assembled hoses can result in serious injuries or property damage. The need for more skilled workers with expertise in oil and gas hoses is the major constraint to market growth.

- Nevertheless, several manufacturers are investing more in product development to offer better quality and improved hoses and assemblies for offshore and onshore upstream applications. It is expected to create lucrative opportunities for key players operating in the market.

- Brazil dominates the market and will likely witness the highest CAGR during the forecast period. This growth is attributed to the country's increasing oil and gas production.

South America Oil And Gas Hoses And Coupling Market Trends

Midstream is Expected to Become a Significant Segment

- The midstream sector involves transporting and storing crude oil and natural gas extracted. It includes infrastructure such as crude oil and natural gas pipelines, gas treatment plants, natural gas liquefaction plants, and liquefied gas and regasification storage.

- It is common for mid-stream oil and gas hoses to be used for safe and effective fuel delivery on floating production storage and offloading vessels, road and rail tankers, and FPSOs. In addition to handling crude oil delivered to refineries and finished oil delivered to petrol service stations, they are also designed to serve as dispensing hoses to transfer fuel from garage forecourt dispensers to vehicles.

- The world traditionally depended on oil for its primary energy needs. However, the growing concern over emissions increased natural gas consumption in the past few years. It resulted in heavy investment in natural gas processing plants. According to the bp Statistical Review of World Energy, South America's natural gas consumption in 2021 is 163.3 billion cubic meters.

- According to the Argentine Investment and International Trade Agency's - Investing in Argentina Oil & Gas Report (April 2020), the country include around USD 3 billion worth of 5 MTPA LNG export facility under its short-term project plan (2024-2025). It also includes around USD 1.5 billion worth of 2 MTPA LNG export facilities under its medium-term project plan (2026-2027).

- In September 2022, YPF and Petronas signed an agreement to collaborate on an integrated LNG project and clean energy solutions. It is to study the potential for an integrated liquefied natural gas export project in Argentina.

- In June 2022, The Colombian government relaunched a USD 700 million tender for constructing a proposed liquefied natural gas import terminal after failing to attract offers last year due to a lack of interest. According to the country's Mining & Energy Planning Unit (UPME), Colombia is looking for a contractor to build, own and operate an LNG regasification facility in the Pacific seaport city of Buenaventura.

- Because of these factors, the ongoing investments and developments in the midstream sector among the different countries in the region are expected to dominate the market during the forecast period.

Brazil to Dominate the Market

- As of 2021, Brazil is the major country in South America regarding oil & gas spending. The country's offshore pre-salt oil fields pumped around 50% of the total oil output, and this share increased to approximately 75% by the end of 2020. The increasing production and dependency on offshore oil & gas fields can be attributed to steadily decreasing production expenses due to improved drilling technology, growing expertise in the offshore oil & gas industry, and increased infrastructure.

- As of June 2022, around seven active rigs are operating in the offshore areas and three active rigs in the onshore regions of the country. As of 2021, floating assets such as Floating Production Storage and Offloading (FPSO), Drillships, semi-submersibles, and Floating Storage and Offloading (FSO) accounted for more than 80% of the active offshore platforms in the country. It, in turn, indicates the dominance of offshore floating assets in Brazil's upstream oil & gas industry.

- Brazil is expected to play a significant role in the offshore oil and gas industry's recovery from a tumultuous 2021, especially in the floating production market. The country is expected to deploy around 18 FPSOs by 2025.

- In May 2022, Singapore's Keppel Shipyard submitted the best bids in a Petrobras tender for the engineering, procurement, and construction (EPC) contracts for two FPSOs planned for Brazil's Buzios field. Keppel offered USD 2.98 billion each in lot A and lot B, beating the proposals of Sembcorp Marine, which offered USD 3.66 billion and USD 3.73 billion. Four other prospective bidders declined to submit proposals. Moreover, the FPSOs involved are P-80 and P-82, scheduled to begin operations in 2026 in the Santos basin pre-salt asset.

- Petrobras plans to invest around USD 68 billion from 2022 to 2026. Of this total investment, 84% is allocated to oil and natural gas exploration and production (E&P). Of the total E&P CAPEX (USD 57 billion), around 67% will be given to pre-salt assets. It indicates that the upstream oil & gas sector, especially Brazil's offshore oil & gas assets, is expected to witness significant investment during the forecast period.

- Therefore, factors such as plans to develop offshore oil and gas blocks, particularly in the pre-salt basins, are expected to drive the oil and gas hoses and couplings market in the upstream segment of Brazil during the forecast period.

- In addition to the demand from the country's upstream segment, the midstream in Brazil is expected to drive the market further during the forecast period owing to the upcoming pipeline and LNG projects in the country. As of 2020, more than 75% of the pipeline infrastructure in the country is located onshore, and the remaining pipeline infrastructure connects the floating regasification terminals and offshore oil & gas platforms operating in Brazil.

- As of 2021, Brazil contains 17 refineries, of which the state-owned oil & gas company operates 98% of the country's total refining capacity - Petrobras. Most of the refineries are located near demand centres on the country's coast. As part of its Strategic Plan (2021-2025), Petrobras announced to divest 8 of its 12 existing refineries and sell its remaining stakes in the midstream and fuels distribution sectors by 2022. This move, initiated by Brazil's Mines & Energy Ministry, aims to effectively facilitate the sector's ability to transition to an open and competitive downstream sector.

- According to a bp statistical review of world energy, the oil production in Brazil was 156.8 million tonnes in 2021, an increase of 37.54% over 114.0 million tonnes in 2011.

- The abovementioned factors are expected to drive the demand for oil and gas hoses and couplings over the study period.

South America Oil And Gas Hoses And Coupling Industry Overview

The South America Oil and Gas Hoses and Couplings market is moderately fragmented. Some of the major players in the market (in no particular order) include Continental AG, Gates Corporation, Eaton Corporation Plc, Trelleborg AB, and Parker Hannifin Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Upstream

- 5.1.2 Midstream

- 5.1.3 Downstream

- 5.2 Geography

- 5.2.1 Brazil

- 5.2.2 Argentina

- 5.2.3 Colombia

- 5.2.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Continental AG

- 6.3.2 Gates Corporation

- 6.3.3 Eaton Corporation Plc

- 6.3.4 Trelleborg AB

- 6.3.5 ParkerHannifin Corporation

- 6.3.6 Bosch Rexroth AG

- 6.3.7 Manuli Hydraulics

- 6.3.8 Kuriyama Holdings Corporation

- 6.3.9 W. W. Grainger, Inc.

- 6.3.10 Jason Industrial Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219