|

市场调查报告书

商品编码

1636164

西班牙电子商务物流:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030)Spain E-commerce Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

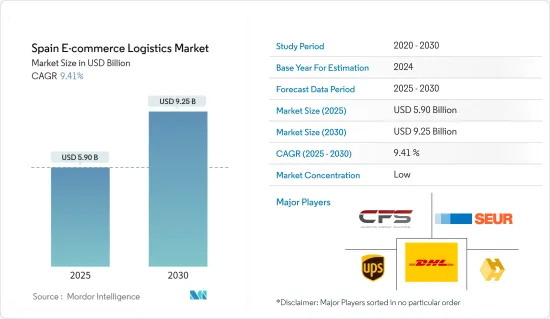

西班牙电商物流市场规模预估至2025年为59亿美元,预估至2030年将达92.5亿美元,预测期间(2025-2030年)复合年增长率为9.41%。

根据产业专家预测,2022年,大约有550万年龄在35岁至44岁之间的人在西班牙电子商务市场上在线购买商品和服务,其次是545万年龄在45岁至54岁之间的人。

25% 的 Statista 调查受访者表示,舒适度将成为 2022 年西班牙消费者在网路上而非实体店购买某些产品的主要原因之一。此外,14% 的受访者表示,他们在网路上购物是因为价格、折扣和优惠更优惠。然而,只有 5% 的样本将处理便利性视为网路购物的驱动力。

根据产业专家2023年7月进行的调查,西班牙的电子商务支出在其他参与国中排名第五。疫情期间电子商务的采用率激增,但在封锁限制解除、实体店重新开业后不久就放缓了。

西班牙电商物流市场趋势

网路购物用户增加

根据西班牙国家统计局预测,2022年将有31.7%的企业涉足电子商务,业务量较2021年成长20.3%。许多公司正在进行数位转型,以应对不断变化的消费者偏好和市场动态。

根据欧盟统计局2023年发布的报告,网路用户购买电子商务商品和服务的比例已从2020年的67%跃升至2023年的76%。随着西班牙网路普及率的提高,更多的人将能够访问网路购物平台。

根据业界专家同年编製的报告,西班牙公民的网路接取率从2018年的87%上升到2023年的95%。正如 2020 年 1 月发布的《欧盟安全 5G 部署通讯》中所述,西班牙一直是 5G 及其发展背后的驱动力,并将继续支持欧盟。

仓库租金上涨

2022年,马德里物流市场规模将达126万平方米,较2012年成长5%。物流空间的需求强劲,成交量为 92 笔,而 2021 年为 86 笔。

到2022年终,巴伦西亚物流市场收购面积将约为39万平方米,比前一年的记录(37.7万平方米)增加3%。

根据行业报告,到 2022 年,马德里超过 5,000 平方米的仓库租金自 2020 年以来一直稳定在每平方米 75 欧元(80.48 美元)。同时,巴伦西亚的仓库租金从 2021 年的 54 欧元(57.95 美元)增加到 2022 年的 66 欧元。巴塞隆纳的每平方公尺租金也从 2021 年的 87 欧元(93.36 美元)上涨至 2022 年的 90 欧元(96.58 美元)。

2022 年,巴塞隆纳的加泰隆尼亚物流市场依然强劲。消息人士透露,收购的仓库面积将超过821,000平方米,并将分布在巴塞隆纳的60个交易中。

西班牙电商物流业概况

由于各种公司的存在,西班牙电子商务物流市场竞争非常激烈。西班牙电商物流市场分散,市场参与者竞争激烈。竞争格局是动态的,不断的发展和竞争促使企业适应新趋势、技术进步和不断变化的消费者偏好。 UPS 等全球物流巨头实力雄厚,提供从快递到供应链管理的广泛服务。然而,西班牙电商物流行业的进入门槛较低至中等,允许新公司进入市场。 DHL International Gmbh、Celeritas 和 Seur 是该市场最重要的参与者。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 目前的市场状况

- 科技趋势

- 产业价值链分析

- 政府法规和倡议

- 电子商务洞察

- 价值链/供应链分析

- 供需分析

第五章市场动态

- 促进因素

- B2C 电子商务成长

- 都市化和人口密度

- 抑制因素

- 基础设施挑战

- 最后一哩交付的复杂性

- 机会

- 拓展跨境电商

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者/买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第六章 市场细分

- 按服务

- 运输

- 仓库/库存管理

- 附加价值服务(标籤和包装)

- 按业务

- B2B

- B2C

- 目的地

- 国内的

- 国际/跨境

- 副产品

- 时尚/服饰

- 家电

- 家具

- 美容及个人保健产品

- 其他(玩具、食品等)

第七章 竞争格局

- 公司简介

- FedEx Corporation

- UPS

- DHL

- Amphora Logistics

- CTT Express

- Celeritas

- Correos Express

- Citibox

- SEUR

- Nacex*

- 其他公司

第八章 市场机会及未来趋势

第九章 附录

The Spain E-commerce Logistics Market size is estimated at USD 5.90 billion in 2025, and is expected to reach USD 9.25 billion by 2030, at a CAGR of 9.41% during the forecast period (2025-2030).

As indicated by industry experts, in 2022, about 5.50 million people between 35 and 44 years of age bought products or services online in the Spanish e-commerce market, followed by 5.45 million users aged between 45 and 54 years.

According to 25% of Statista survey respondents, comfort was among the main reasons Spanish consumers bought certain products online rather than from bricks and mortar shops in 2022. In addition, 14% of respondents said that they had purchased online due to better prices, discounts, or offers. However, only 5% of the sample mentioned the easy process as the driving factor for online shopping.

As per a study conducted in July 2023 by industry experts, Spain ranked fifth in terms of e-commerce expenditure among other participating countries. E-commerce penetration surged during the pandemic, though moderated shortly after the ending of lockdown restrictions and the re-opening of physical retail stores.

Spain E-commerce Logistics Market Trends

The Rise in the Number of Online Shoppers

According to the National Statistics Institute of Spain, in 2022, 31.7% of businesses were involved in e-commerce, increasing the volume of business by 20.3% compared to 2021. In order to cope with changing consumer preferences and market dynamics, a number of businesses have undertaken digital transformation initiatives.

A Eurostat report published in 2023 stated that the percentage of internet users who bought e-commerce goods and services leaped from 67% in 2020 to 76% in 2023. More people will be able to access online shopping platforms due to an increase in the overall internet penetration rate in Spain.

The Spanish population's access to the Internet increased from 87% in 2018 to 95% by 2023, according to a report compiled by industry experts for that year. Spain has been a driving force for 5G and its development and continues to support the Union, as outlined in the Communication Secure 5G Deployment in the European Union, published in January 2020.

Warehouse Rent on the Rise

In 2022, Madrid's logistics market reached a take-up volume of 1.26 million sq. m, a 5% increase from 2012. There was a strong demand for logistics space, with 92 transactions recorded compared to 86 in 2021.

By the end of 2022, the Valencia logistics market had almost 390,000 sq. m of take-up, exceeding the previous year's record by 3% (377,000 sq. m).

In 2022, Madrid's rent for warehouses sized over 5,000 sq. m remained steady at EUR 75 (USD 80.48) per square meter since 2020, according to industry reports. Meanwhile, rent for warehouses in Valencia shot from EUR 54 (USD 57.95) in 2021 to EUR 66 in 2022. Barcelona also recorded an increase in rent from EUR 87 (USD 93.36) in 2021 to EUR 90 (USD 96.58) in 2022 per sq. m.

The Catalan logistics market in Barcelona continued its positive trend in 2022. As per sources, warehouse take-up exceeded 821,000 sq. m, distributed across 60 transactions in Barcelona.

Spain E-commerce Logistics Industry Overview

The market for e-commerce logistics in Spain is competitive, owing to the presence of various companies. The e-commerce logistics market in Spain is fragmented and depicts intense competition among the market players. The competitive landscape is dynamic, with ongoing developments and competition driving companies to adapt to emerging trends, technological progress, and changing consumer preferences. Global logistics giants such as UPS have a strong presence, providing a range of services from express delivery to supply chain management. However, the e-commerce logistics industry in Spain has low to moderate barriers to entry, allowing new companies to enter the market. DHL International Gmbh, Celeritas, and Seur are among the most important players in this market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Industry Value Chain Analysis

- 4.4 Government Regulations and Initiatives

- 4.5 Insights into the E-commerce

- 4.6 Value Chain / Supply Chain Analysis

- 4.7 Demand and Supply Analysis

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Growth of B2C E-commerce

- 5.1.2 Urbanization and Population Density

- 5.2 Restraints

- 5.2.1 Infrastructure Challenges

- 5.2.2 Last-mile Delivery Complexities

- 5.3 Opportunities

- 5.3.1 Cross-border E-commerce Expansion

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers / Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Transportation

- 6.1.2 Warehousing and Inventory Management

- 6.1.3 Value-added Services (Labeling and Packaging )

- 6.2 By Business

- 6.2.1 B2B

- 6.2.2 B2C

- 6.3 By Destination

- 6.3.1 Domestic

- 6.3.2 International/Cross-border

- 6.4 By Product

- 6.4.1 Fashion and Apparel

- 6.4.2 Consumer Electronics and Home Appliances

- 6.4.3 Furniture

- 6.4.4 Beauty and Personal Care Products

- 6.4.5 Other Products (Toys, Food Products, etc.)

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 FedEx Corporation

- 7.2.2 UPS

- 7.2.3 DHL

- 7.2.4 Amphora Logistics

- 7.2.5 CTT Express

- 7.2.6 Celeritas

- 7.2.7 Correos Express

- 7.2.8 Citibox

- 7.2.9 SEUR

- 7.2.10 Nacex*

- 7.3 Other Companies