|

市场调查报告书

商品编码

1636179

插电式混合动力汽车电池:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Plug-in Hybrid Electric Vehicle Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

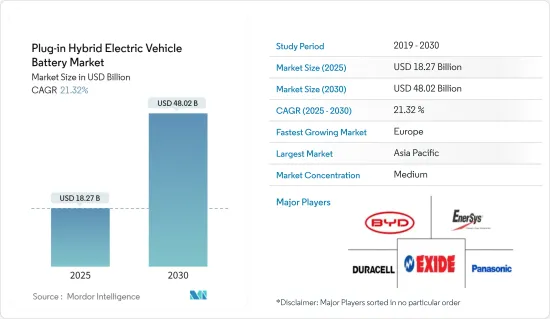

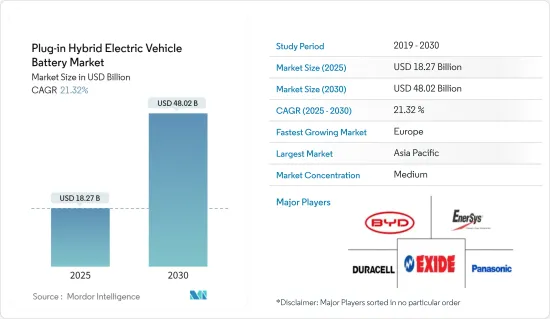

插电式混合动力汽车电池的市场规模预计到2025年为182.7亿美元,到2030年达到480.2亿美元,预测期内(2025-2030年)复合年增长率为21.32%。

主要亮点

- 从中期来看,电动车(EV)普及率的提高和锂离子电池价格的下降预计将在预测期内推动插电式混合动力汽车电池的需求。

- 另一方面,蕴藏量的短缺可能会显着抑制插电式混合动力汽车电池市场的成长。

- 电池材料的技术进步,如提高能量密度、缩短充电时间、提高安全性和延长使用寿命,预计将在不久的将来为插电式混合动力电动车电池市场的参与企业提供巨大的商机。

- 由于电动车的采用不断增加,欧洲是预测期内全球插电式混合动力汽车电池市场成长最快的地区。

插电式混合动力汽车电池市场趋势

锂离子电池类型主导市场

- 全球锂离子电动车电池市场呈现出充满机会与挑战的迷人景象。由于其良好的容量重量比,锂离子二次电池比其他电池技术更受欢迎。促使锂离子二次电池广泛采用的因素包括性能提高(例如更长的使用寿命和更低的维护要求)、更长的保质期和更低的价格。锂离子电池的价格通常高于其他电池。然而,市场上的主要企业正在进行投资以获得规模经济和研发活动,以提高性能、加剧竞争并导致锂离子电池的价格下降。

- 随着电动车(EV)和电池能源储存系统(BESS)的平均电池组价格上涨,电池价格将在2023年降至139美元/kWh,降幅超过13%。随着技术创新和製造水准的提高,电池组价格预计将进一步下降,2025年达到113美元/kWh,2030年达到80美元/kWh。

- 此外,由于对环境问题的日益关注,世界各国政府都在大力推广电动车。政府重点关注净零碳排放目标。全球对电动车的需求庞大,各公司都在大力投资以满足不断增长的电动车需求。

- 例如,现代汽车在2024年3月宣布,到2026年可能在韩国投资超过500亿美元。该公司的目标是到2030年将电动车产量增加到360万辆以上。诸如此类的倡议可能会在未来几年增加全国范围内对电动车后来者的需求,并且在预测期内对锂离子电池的需求可能会增加。

- 此外,世界各国政府也采取了各种措施和奖励来推广电动车。这些措施对锂离子电池的需求产生了正面影响。政府宣布了多项在全部区域推广电动车的倡议。

- 例如,截至 2023 年,中国政府将为购买电动车提供大量补贴,每辆车最高可达 10 万元人民币(15,000 美元)。另一个好处是电动车购买者将免征车辆购置税,这对中国消费者来说是一个节省成本的重大机会。此类倡议可能会在未来几年加速中国电动车的生产和需求,从而推动预测期内对锂离子电池的需求。

- 此类计划和投资可能会增加全部区域的电动车产量,从而在预测期内推动对锂离子电池的需求。

欧洲正在经历显着的成长

- 由于监管支援、技术进步以及消费者对永续交通解决方案日益增长的需求,欧洲插电式混合动力汽车(PHEV) 电池市场正在迅速扩大。成长的推动因素包括政府提高电池产量的努力、蓬勃发展的电动车产业以及该地区大量电池製造商的存在。

- 欧洲,包括德国、英国和瑞典等国家,插电式混合动力汽车电池市场正经历显着成长。这是由于对环保汽车的需求不断增长以及政府对减少碳排放的大力支持所推动的。

- 该全部区域对插电式混合动力电动车 (PHEV) 的需求正在显着增加。德国是该地区插电式混合动力车的主要生产国。例如,根据国际能源总署 (IEA) 的数据,德国到 2023 年将销售 18 万辆插电式混合动力车,其次是英国和日本,销售 14 万辆。随着欧洲各地建立众多电动车生产工厂以及插电式混合动力汽车(PHEV)电池需求的增加,未来几年电动车销量将会增加。

- 该地区各国政府正在实施各种措施和奖励,以鼓励插电式混合动力汽车汽车和电动车的普及。这包括补贴、税收减免和更严格的排放法规,以鼓励製造商生产更多插电式混合动力车。

- 例如,挪威政府宣布,从2023年开始,对用作公司用车的电动和插电式混合动力汽车的课税进行调整。 2023 年至 2026 年间,向员工提供电动车的雇主可以从课税中扣除 15,000 丹麦克朗(2,150 美元)。这项扣除额适用于所有零排放车辆,并支持全部区域电动车的采用。此类倡议可能会在未来几年加速电动车的生产和需求,并在预测期内推动对插电式混合动力车电池的需求。

- 此外,整个欧洲充电基础设施的扩张使插电式混合动力车成为消费者更可行的选择。这种基础设施的发展,加上电池技术的进步和政府的支持,使欧洲市场成为全球转型为永续和电气化交通的关键参与企业。政府已推出多项倡议,以在未来几年内增加全国公共充电站的数量。

- 例如,2023年10月,法国政府宣布将投资2亿欧元(2.16亿美元)用于电动车充电站。政府设定的目标是到2030年安装40万个公共充电终端。 2亿欧元的一揽子计画旨在支持公共和商业建筑中快速充电站和设备的开发。这些措施和目标预计将增加全部区域公共充电点的数量,并在预测期内大幅增加对 PHEV 电池的需求。

- 此类计划的开发证明了插电式混合动力电池解决方案对于电动车电池能源储存系统的可行性和重要性,并可能在未来一年增加全国范围内对插电式混合动力电池的需求。

插电式混合动力汽车电池产业概况

插电式混合动力汽车电池市场处于半瓜分状态。主要参与企业(排名不分先后)包括比亚迪有限公司、金霸王公司、Exide Industries Ltd.、EnerSys 和松下控股公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车 (EV) 产量增加

- 锂离子电池价格下降

- 抑制因素

- 原料蕴藏量不足

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 电池类型

- 锂离子电池

- 铅酸电池

- 钠离子电池

- 其他电池类型

- 车型

- 客车

- 商用车

- 2029 年之前的市场规模和需求预测(按地区)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 北欧的

- 俄罗斯

- 土耳其

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 澳洲

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 卡达

- 南非

- 其他中东/非洲

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略及SWOT分析

- 公司简介

- BYD Company Ltd

- Duracell Inc.

- EnerSys

- Panasonic Holdings Corporation

- Energizer

- Exide Industries Ltd

- Saft Groupe SA

- AMTE Power

- Amperex Technology Co. Limited

- Gotion High tech Co. Ltd

- 其他知名公司名单

- 市场排名/份额分析

第七章 市场机会及未来趋势

- 电池材料技术进步

简介目录

Product Code: 50002588

The Plug-in Hybrid Electric Vehicle Battery Market size is estimated at USD 18.27 billion in 2025, and is expected to reach USD 48.02 billion by 2030, at a CAGR of 21.32% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising adoption of electric vehicles (EV) and declining lithium-ion battery prices are expected to drive the demand for plug-in hybrid electric vehicle batteries during the forecast period.

- On the other hand, the lack of raw material reserves can significantly restrain the growth of the plug-in hybrid electric vehicle battery market.

- Nevertheless, technological advancements in battery materials like higher energy density, faster charging times, improved safety, and longer lifespan are expected to create significant opportunities for plug-in hybrid electric vehicle battery market players in the near future.

- Europe is the fastest-growing region in the global plug-in hybrid electric vehicle battery market during the forecast period due to the rising adoption of electric vehicles.

Plug-in Hybrid Electric Vehicle Battery Market Trends

Lithium-Ion Battery Type Dominate the Market

- The lithium-ion electric vehicle battery market worldwide presents a fascinating landscape of opportunities and challenges. Due to their favorable capacity-to-weight ratio, lithium-ion rechargeable batteries are gaining more popularity than other battery technologies. Factors contributing to their increased adoption include enhanced performance (such as longer lifespan and lower maintenance requirements), extended shelf life, and decreasing prices. The price of lithium-ion batteries is usually higher than that of other batteries. However, major players across the market have been investing to gain economies of scale and R&D activities to enhance their performance, increasing the competition and, in turn, resulting in declining prices of lithium-ion batteries.

- Owing to the increasing average battery pack prices of electric vehicles (EV) and battery energy storage systems (BESS), the battery prices declined in 2023 to USD 139 /kWh, a decrease of over 13%. The trajectory of technological innovation and manufacturing enhancements is anticipated to decrease the battery pack prices further, projecting the price to reach USD 113/kWh in 2025 and USD 80/kWh in 2030.

- Furthermore, governments worldwide are significantly promoting electric vehicles due to rising environmental concerns. The government is significantly focused on net zero carbon emission targets. The demand for electric vehicles is significant across the globe, and companies are investing heavily to fulfill the rising demand for EVs.

- For instance, in March 2024, Hyundai announced it is likely to invest more than USD 50 billion in South Korea by 2026, with a considerable investment dedicated to boosting the development and production of electric vehicles across the country. The company aims to boost electric car production to more than 3.6 million units by 2030. Such initiatives are likely to raise the demand for late EVs across the country in the coming years and increase the demand for lithium-ion batteries during the forecast period.

- Additionally, the government worldwide has implemented various policies and incentives to promote electric vehicles. These policies have positively impacted the demand for lithium-ion batteries. The government announced numerous initiatives to promote EVs across the region.

- For instance, as of 2023, the Chinese government offers substantial subsidies for EV purchases, sometimes up to RMB 100,000 (USD 15,000) per vehicle. Additionally, EV buyers benefit from exemptions from the vehicle purchase tax, which can be a significant cost-saving opportunity for Chinese consumers. Such initiatives are likely to accelerate the production and demand of EVs across the country in the coming years and are likely to raise the demand for lithium-ion batteries in the forecast period.

- Such types of projects and investments are likely to increase EV production across the region, and there will be a rising demand for lithium-ion batteries during the forecast period.

Europe to Witness Significant Growth

- The Plug-in Hybrid Electric Vehicle (PHEV) battery market in Europe is expanding rapidly, driven by a combination of regulatory support, technological advancements, and increasing consumer demand for sustainable transportation solutions. The growth is fueled by government initiatives promoting battery production, the thriving EV industry, and the presence of numerous battery manufacturers in the region.

- The European region, including countries like Germany, the United Kingdom, and Sweden, is experiencing significant growth in the PHEV battery market. This is due to rising demand for eco-friendly vehicles and a robust governmental push toward reducing carbon emissions.

- The demand for plug-in hybrid electric vehicles (PHEV) is rising significantly across the region. Germany is the region's leading producer of PHEV. For instance, according to the International Energy Agency (IEA), in 2023, the sale of Plug-in Hybrid Electric Vehicles in Germany was 0.18 million units, followed by the United Kingdom and Japan with 0.14 million units. EV Sales are rising in the coming years as numerous EV production plants are set up across the European region, and the demand for plug-in hybrid electric vehicle (PHEV) batteries is increasing.

- Governments in the region are implementing various policies and incentives to promote the adoption of plug-in hybrid and electric vehicles. These include subsidies, tax benefits, and stringent emission norms which encourage manufacturers to produce more PHEVs.

- For instance, as of 2023, the government of Norway announced the adjustment of taxation for electric cars and plug-in hybrid cars used as company vehicles. Employers who provide employees with electric cars can deduct DKK 15,000 (USD 2,150) from the tax base from 2023 to 2026. This deduction applies to all zero-emission cars, supporting the uptake of EVs across the region. Such initiatives are likely to accelerate the production and demand of EVs across the country in the coming years and are likely to raise the demand for PHEV batteries during the forecast period.

- Moreover, the expansion of charging infrastructure across Europe makes PHEVs a more viable option for consumers. This infrastructure development, combined with advancements in battery technology and governmental support, positions the European market as a pivotal player in the global shift toward sustainable and electrified transportation. The government launched several initiatives to raise public charging points across the country in the coming years.

- For instance, in October 2023, the French government announced that it is likely to pour EUR 200 million (USD 216 million) into charging stations for electric cars. The government set a target of 400,000 public charging terminals by 2030. The 200 million euro package is intended to support the development of fast-charging stations and installations in public and commercial premises. Such initiatives and targets are likely to raise public charging points and surge the demand for PHEV batteries during the forecast period across the region.

- Such project developments showcase the feasibility and importance of PHEV battery solutions for battery energy storage systems in EVs and are likely to raise the demand for PHEV batteries across the country in the coming year.

Plug-in Hybrid Electric Vehicle Battery Industry Overview

The plug-in hybrid electric vehicle battery market is semi-fragmented. Some key players (not in particular order) are BYD Company Ltd, Duracell Inc., Exide Industries Ltd, EnerSys, and Panasonic Holdings Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Electric Vehicle (EV) Production

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Sodium-ion Battery

- 5.1.4 Other Battery Types

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Geography [Market Size and Demand Forecast till 2029 (for regions only)]

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 NORDIC

- 5.3.2.7 Russia

- 5.3.2.8 Turkey

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 South Korea

- 5.3.3.6 Malaysia

- 5.3.3.7 Thailand

- 5.3.3.8 Indonesia

- 5.3.3.9 Vietnam

- 5.3.3.10 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 Nigeria

- 5.3.4.4 Egypt

- 5.3.4.5 Qatar

- 5.3.4.6 South Africa

- 5.3.4.7 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Colombia

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 Duracell Inc.

- 6.3.3 EnerSys

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Energizer

- 6.3.6 Exide Industries Ltd

- 6.3.7 Saft Groupe SA

- 6.3.8 AMTE Power

- 6.3.9 Amperex Technology Co. Limited

- 6.3.10 Gotion High tech Co. Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Battery Materials

02-2729-4219

+886-2-2729-4219