|

市场调查报告书

商品编码

1636191

印度的 EPCM(工程、采购和施工管理):市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)India Engineering, Procurement, And Construction Management (EPCM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

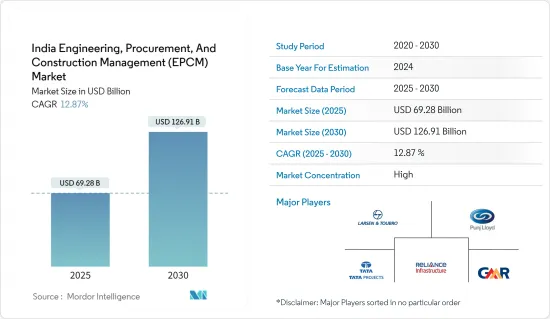

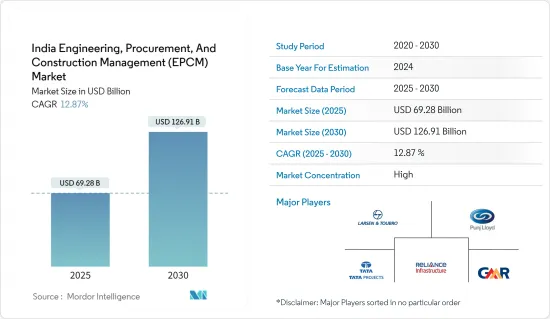

印度EPCM(工程、采购和施工管理)市场规模预计到2025年为692.8亿美元,预测期内(2025-2030年)复合年增长率为12.87%,到2030年将达到1269.1亿美元。

主要亮点

- 印度的工程、采购和施工(EPC)市场在该国基础设施发展中发挥着至关重要的作用。这个市场呈现出不同产业的趋势、挑战和机会。在雄心勃勃的基础设施蓝图和工业进步的推动下,印度的 EPC 市场正在稳步成长。在政府支持和私人投资的支持下,市场的复合年增长率预计将保持势头。大量投资正投入道路建设、铁路网现代化和智慧城市使命等巴拉特马拉计划等措施。此外,太阳能、风能等可再生能源计划也迅速增加。

- 此外,火力发电厂、水电厂、核能发电厂的开发和扩建以及输电加固也在取得进展。智慧城市使命、AMRUT 和 Bharatmala 等关键倡议凸显了印度对基础设施发展的承诺。此外,快速的工业化和都市化也增加了对基础设施发展的需求。最后,外商直接投资政策的自由化正在吸引国际EPC参与者,他们也正在采用尖端的施工技术和计划管理工具。

印度EPCM(工程、采购和施工管理)市场趋势

基础建设发展带动EPC服务需求

印度政府已着手实施雄心勃勃的基础设施项目,包括智慧城市使命、Bharatmala Pariyojana 高速公路项目和 Sagarmala计划等。智慧城市使命旨在透过加强核心基础设施、提高生活品质、创造清洁和永续的环境以及引入「智慧」解决方案来改善城市。该任务以永续和包容性增长为重点,重点关注紧凑地区,旨在创建可复製的模式来指南其他城市。这项倡议不仅改变了各个城市,也促进了全国各地迈向智慧城市中心的运动。

这些倡议凸显了印度对基础建设发展的承诺,也为 EPCM 服务带来了巨大机会。随着都市化的加快,从地铁到机场和智慧城市计划等城市基础设施亟待升级。同时,旨在加强製造业的「印度製造」宣传活动刺激了新工厂和工业设施的建设,进一步拉动了对EPCM服务的需求。

「印度製造」计画的全球推出标誌着印度重新关注製造业。该倡议的主要目标是将印度定位为全球製造业的顶级竞争者。自成立以来,印度政府迎来了多项改革,以加强製造、设计、创新和新兴企业。在全球经济低迷的背景下,印度以7.5%的成长速度成为成长最快的经济体,且成长速度持续加快。 「印度製造」、「数位印度」、「100 个智慧城市」和「印度技能」等倡议在推动这一成长方面发挥关键作用。

「印度製造」的具体目标是将印度融入全球供应链,并强调印度企业在全球舞台上发挥作用的必要性。印度大幅开放经济,向外国直接投资(FDI)开放国防、铁路、建筑、保险、退休基金和医疗设备等产业。此举使印度成为世界上最开放的经济体之一。为进一步改善营商环境,印度政府优先考虑改善营商便利度。重点在于简化法规并创造更容易营商的环境。利用技术,政府已将 14 项服务整合到 eBiz 入口网站中,以简化各个政府机构的审批流程。 「印度製造」的影响已经显现。

总体而言,印度正在见证「印度製造」倡议的实际成效,包括经济指标上升、外国投资增加和製造业扩张。在智慧城市使命、Bharatmala Pariyojana、Sagarmala Project和Make in India的共同努力下,印度的基础设施正在重建。这项雄心勃勃的议程将加强城市和工业的能力,为工程、采购和施工管理服务打开大门。随着印度深化融入全球供应链并改善商业环境,印度正在成为重要的製造业和基础设施中心,为我正在努力的持续经济成长和发展奠定了基础。

由于投资和倡议增加,印度能源和公共产业行业需求激增

印度仍然受到电网不可靠的困扰,很大一部分人口没有连网,每天都面临停电的情况。印度电力产业因其多样化的能源来源而在全球脱颖而出。除煤炭、天然气、石油、核能等传统能源来源外,我们还利用风能、太阳能、水力发电、都市垃圾、生质能等新能源来源。在向清洁能源转型的推动下,印度政府正在对该产业进行重大改革。这包括升级基础设施和投资绿色能源,包括风能和太阳能。

印度政府认识到私人投资的重要作用,并推出了多项奖励计划来加强该行业。印度的雄心勃勃的目标是在 10 年内将二氧化碳排放减少 45%,到 2030 年 50% 的电力来自可再生能源,并最终在 2070 年实现碳中和。这些目标和印度强劲稳定的经济成长为能源公司提供了良好的前景。

印度的2030年愿景包括5亿千瓦的清洁能源产能,其中2.8亿度将来自太阳能。截至2023年2月,印度总发电量为412.21GW,其中约100GW来自清洁能源。值得注意的是,印度风电装置容量位居亚洲第二,仅次于中国。它也是世界上成长第五快的太阳能市场和最具成本效益的太阳能生产国。

在全球范围内,印度在可再生能源发电方面排名第四。政府已在未来五年内投入 420 亿美元的累计,用于促进创新和扩大能源产业。印度在世界银行 2019 年营商便利度-获得电力研究中取得了 89.4 分的骄人成绩。此分数评估与电网连接的便利性、供应的可靠性、电价的透明度和电价。顺便说一下,丹麦的得分稍高一些,为90.2。

展望未来,印度製定了雄心勃勃的离岸风力发电计划,目标是到2022年建立5GW计划,到2030年建立30GW项目。併网太阳能屋顶计画的目标是到2022年实现40GW的屋顶太阳能发电(RTS)计划容量。主要重点是研究、开发和示范(RD&D),以加强新能源和可再生能源的引进。新能源和可再生能源部(MNRE)积极推动研究和开发,以提高能源技术、材料和当地生产能力。

整体而言,印度电力产业正在经历重大变革时期,能源结构多元化,并明显专注于清洁能源。这种转变正在刺激基础设施的重大加强并吸引大量投资。印度有着减少碳排放、增加可再生能源产能并最终实现碳中和的明确目标,已成为对能源公司有吸引力的后起之秀。积极的政府措施进一步增强了这种吸引力,包括促进创新和促进行业成长的慷慨资金和支持政策。随着印度加强其能源格局并采用更多的再生能源,它正在巩固其作为永续能源全球领跑者的地位。这承诺为其公民提供更可靠的电力供应,并强调印度对全球环境目标的承诺。

印度EPCM(工程、采购和施工管理)产业概况

印度的工程、采购和施工管理 (EPCM) 市场分散,参与者众多。虽然主要企业,但市场分散,不少中小企业积极进入市场,特别是专业领域和区域市场。该领域的一些知名公司包括 Larsen &Toubro (L&T)、Tata Projects Limited、Punj Lloyd Group、Reliance Infrastructure Limited 和 GMR Group。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 可再生能源计划

- 政府倡议

- 市场限制因素

- 监管和官僚障碍

- 建筑材料成本上涨

- 市场机会

- 采用智慧基础设施技术

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- PESTLE分析

- 洞察市场创新

第五章市场区隔

- 按服务

- 设计

- 采购

- 建造

- 其他服务

- 按行业分类

- 住宅、基础设施(交通)、能源和公共产业

- 产业

- 基础设施(交通)

- 能源/公共产业

第六章 竞争状况

- Market Concetration Overview

- 公司简介

- Larsen & Toubro(L&T)

- Tata Projects Limited

- Punj Lloyd Group

- Reliance Infrastructure Limited

- GMR Group

- Afcons Infrastructure Limited

- Hindustan Construction Company(HCC)

- NCC Limited(Nagarjuna Construction Company)

- IVRCL Limited

- KEC International

- Gammon India Limited

- Simplex Infrastructures Limited

- Rays Power Infra Limited

- Megha Engineering & Infrastructures Ltd

- Salasar Techno Engineering Ltd(STEL)

第7章 未来趋势

The India Engineering, Procurement, And Construction Management Market size is estimated at USD 69.28 billion in 2025, and is expected to reach USD 126.91 billion by 2030, at a CAGR of 12.87% during the forecast period (2025-2030).

Key Highlights

- India's engineering, procurement, and construction (EPC) market is pivotal in the nation's infrastructure landscape. This market presents a spectrum of trends, challenges, and opportunities spanning diverse industries. India's EPC market has grown robustly and is fueled by ambitious infrastructure blueprints and industrial advancements. Bolstered by governmental impetus and private investments, the market's compound annual growth rate (CAGR) is poised to maintain its vigor in the coming years. Noteworthy investments are channeled into the Bharatmala project for road construction, the modernization of the railway network, and initiatives like the Smart Cities Mission. In addition, there is a notable surge in renewable energy projects, spanning solar, wind, and other avenues.

- The nation is also witnessing the development and expansion of thermal, hydroelectric, and nuclear power plants alongside a bolstered power transmission network. Key initiatives such as the Smart Cities Mission, AMRUT, and Bharatmala underscore India's commitment to infrastructure growth. Furthermore, the nation's rapid industrialization and urbanization fuel an escalating demand for enhanced infrastructure. Lastly, the liberalization of FDI policies is drawing in international EPC players, who are also embracing cutting-edge construction technologies and project management tools.

India Engineering, Procurement, And Construction Management (EPCM) Market Trends

Infrastructure Development Driving Demand For EPC Services

The Indian government has embarked on ambitious infrastructure programs, notably the Smart Cities Mission, Bharatmala Pariyojana for highways, and the Sagarmala Project for ports. The Smart Cities Mission aims to elevate cities by enhancing core infrastructure, ensuring a high quality of life, fostering a clean and sustainable environment, and implementing 'Smart' Solutions. Emphasizing sustainable and inclusive growth, the mission focuses on compact areas, aiming to create a replicable model to guide other cities. This initiative is not just about transforming individual cities but about catalyzing a nationwide movement toward smarter urban centers.

These initiatives underscore India's commitment to infrastructure development, presenting significant opportunities for EPCM services. With urbanization surging, there is a critical need for upgraded urban infrastructure, from metro rail systems to airports and smart city projects. In tandem, the "Make in India" campaign, aimed at bolstering manufacturing, is spurring the construction of new plants and industrial facilities, further driving the demand for EPCM services.

The global launch of the "Make in India" initiative marked India's renewed focus on manufacturing. The primary goal of this initiative is to position India as the top choice for global manufacturing. Since its inception, the Indian government has spearheaded numerous reforms to bolster manufacturing, design, innovation, and startups. Amidst a globally subdued economic landscape, India has emerged as the fastest-growing economy, boasting a growth rate of 7.5% that continues to accelerate. Initiatives like "Make in India," "Digital India," "100 Smart Cities," and "Skill India" have played a pivotal role in driving this growth.

"Make in India" specifically targets integrating India into the global supply chain, emphasizing the need for Indian companies to excel on a global stage. India has significantly liberalized its economy, opening sectors like defense, railways, construction, insurance, pension funds, and medical devices to foreign direct investment (FDI). This move has positioned India as one of the most open economies worldwide. To further enhance the business environment, the Indian government has prioritized improving the ease of doing business. The focus is on simplifying regulations to foster a conducive environment for businesses. Leveraging technology, the government has integrated 14 services into the eBiz portal, streamlining clearances from various government agencies. The impact of "Make in India" is already evident.

Overall, India is witnessing tangible outcomes from its "Make in India" initiative, with economic indicators on the rise, foreign investments increasing, and the manufacturing sector expanding. The concerted efforts of the Smart Cities Mission, Bharatmala Pariyojana, Sagarmala Project, and Make in India are reshaping India's infrastructure. This ambitious agenda bolsters urban and industrial capabilities and opens up significant avenues for engineering, procurement, and construction management services. With India's deepening integration into global supply chains and ongoing efforts to improve its business environment, the nation is on track to emerge as a pivotal manufacturing and infrastructure hub, setting the stage for sustained economic growth and development.

India's Energy And Utilities Segment Experiencing Surge in Demand, Driven by Increased Investments and Initiatives

India still grapples with an unreliable power grid, leaving a significant portion of its populace unconnected and facing daily power outages. The country's power sector stands out globally for its diverse energy sources. India harnesses traditional avenues like coal, natural gas, oil, and nuclear power alongside newer options such as wind, solar, hydropower, municipal waste, and biomass. Driven by a commitment to transition to clean energy, the Indian government is spearheading a substantial industry overhaul. This includes revamping infrastructure and channeling investments into green energy, notably wind and solar power.

Recognizing the pivotal role of private investment, the Indian government has rolled out several incentive schemes to bolster the sector. Setting ambitious targets, India aims to slash carbon emissions by 45% by the end of the decade, source 50% of its electricity from renewables by 2030, and ultimately achieve carbon neutrality by 2070. These targets and India's robust and consistent economic growth present lucrative prospects for energy companies.

India's vision for 2030 includes a 500 GW clean energy capacity, with a significant 280 GW from solar power. As of February 2023, India's total generation capacity stood at 412.21 GW, with approximately 100 GW attributed to clean sources. Notably, India boasts the second-highest wind power capacity in Asia, trailing only China. It also holds the title of the world's fifth-fastest-growing solar energy market and the most cost-efficient producer of solar power.

On the global stage, India ranks fourth in renewable energy generation. The government has earmarked a substantial USD 42 billion over the next five years to foster innovation and scale up the energy sector. India's commitment to enhancing its energy landscape is underscored by its impressive score of 89.4 in the World Bank's 2019 Ease of Doing Business - Getting Electricity survey. This score evaluates the ease of connecting to the grid, supply reliability, tariff transparency, and electricity pricing. For context, Denmark secured a slightly higher score of 90.2.

Looking ahead, India has laid out ambitious plans for offshore wind energy, aiming to establish 5 GW of projects by 2022 and a substantial 30 GW by 2030. The "Grid Connected Solar Rooftop Program" is set on achieving a 40 GW capacity for rooftop solar (RTS) projects by 2022. The key focus is on research, development, and demonstration (RD&D) to bolster the adoption of new and renewable energy. The Ministry of New and Renewable Energy (MNRE) actively promotes R&D to advance energy technologies, materials, and local production capabilities.

Overall, India's power sector is undergoing a significant transformation, a diverse energy mix, and a notable focus on clean energy. This shift is spurring substantial infrastructure enhancements and drawing in considerable investments. With clear targets to slash carbon emissions, ramp up renewable energy capacity, and ultimately achieve carbon neutrality, India emerges as an attractive prospect for energy firms. The government's proactive steps bolstered this appeal, such as generous funding and supportive policies, which nurture innovation and foster sectoral growth. As India fortifies its energy landscape and embraces more renewables, the country is on track to cement its position as a global frontrunner in sustainable energy. This promises a more dependable power supply for its citizens and underscores India's commitment to worldwide environmental objectives.

India Engineering, Procurement, And Construction Management (EPCM) Industry Overview

The Indian engineering, procurement, and construction management (EPCM) market features a fragmented landscape, hosting numerous players. Although dominant players exist, the market is fragmented, with many small to mid-sized companies actively participating, especially in specialized sectors or regional markets. Prominent entities in this sector include Larsen & Toubro (L&T), Tata Projects Limited, Punj Lloyd Group, Reliance Infrastructure Limited, and GMR Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Renewable Energy Projects

- 4.2.2 Government Initiatives

- 4.3 Market Restraints

- 4.3.1 Regulatory and Bureaucratic Hurdles

- 4.3.2 Increase in Cost of Construction Material

- 4.4 Market Opportunities

- 4.4.1 Adoption of Smart Infrastructure Technologies

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 PESTLE Analysis

- 4.8 Insights into Technology Innovation in the Market

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Engineering

- 5.1.2 Procurement

- 5.1.3 Construction

- 5.1.4 Other Services

- 5.2 By Sectors

- 5.2.1 Residential Industrial, Infrastructure (Transportation), and Energy and Utilities

- 5.2.2 Industrial

- 5.2.3 Infrastructure (Transportation)

- 5.2.4 Energy and Utilities

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 Larsen & Toubro (L&T)

- 6.2.2 Tata Projects Limited

- 6.2.3 Punj Lloyd Group

- 6.2.4 Reliance Infrastructure Limited

- 6.2.5 GMR Group

- 6.2.6 Afcons Infrastructure Limited

- 6.2.7 Hindustan Construction Company (HCC)

- 6.2.8 NCC Limited (Nagarjuna Construction Company)

- 6.2.9 IVRCL Limited

- 6.2.10 KEC International

- 6.2.11 Gammon India Limited

- 6.2.12 Simplex Infrastructures Limited

- 6.2.13 Rays Power Infra Limited

- 6.2.14 Megha Engineering & Infrastructures Ltd

- 6.2.15 Salasar Techno Engineering Ltd (STEL)