|

市场调查报告书

商品编码

1636204

北美废弃物管理:市场占有率分析、产业趋势和成长预测(2025-2030)North America Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

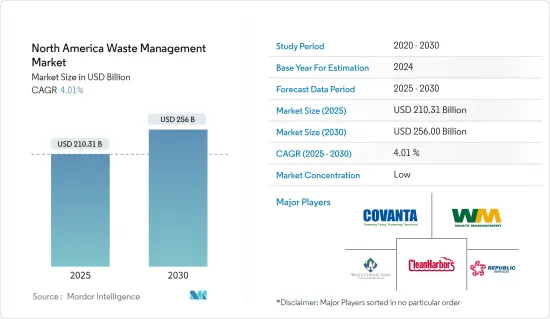

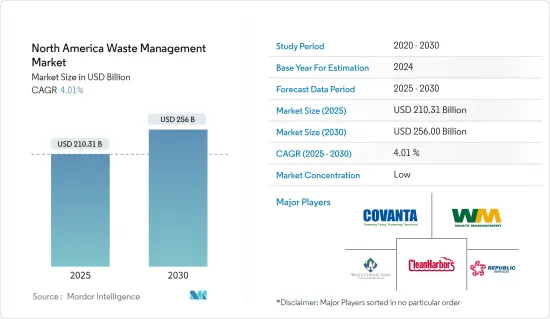

北美废弃物管理市场规模预计到 2025 年为 2,103.1 亿美元,预计到 2030 年将达到 2,560 亿美元,预测期内(2025-2030 年)复合年增长率为 4.01%。

根据 2024 年 7 月宣布的新联邦塑胶污染策略,到 2035 年,一次性塑胶将逐步从美国政府的所有业务中淘汰。该政策列举了塑胶造成的海洋污染和空气污染的严峻情况。

预计逐步淘汰将增加对先进回收技术和设施的需求,这些技术和设施可以处理替代材料和管理残留塑胶。废弃物管理公司可能需要开发新的系统和基础设施来满足这些不断变化的需求。

随着废弃物技术的发展和废弃物方法的改进,这个市场的发展也不断进步,反映出向绿色和循环经济原则的转变。此类技术的例子包括等离子弧气化、热解和迴转窑。

2024年3月,美国能源局生质能源技术办公室(BETO)和国家可再生能源实验室(NREL)启动了下一阶段的废弃物技术援助。该计划扩大到州政府,也包括废弃物资源。

该计划将透过扩大州政府的参与资格并进一步扩大其范围以纳入废弃物资源,从而推动北美废弃物管理市场的发展。这项措施将促进垃圾焚化发电技术的传播,并有望扩大废弃物管理市场。

北美废弃物管理市场趋势

由于塑胶废弃物问题日益严重,废弃物管理市场激增

- 根据美国人口普查局统计,2023年美国废弃塑胶出口量约9.2亿磅,与前一年同期比较减少4.6%,比2015年减少近80%。加拿大和墨西哥是主要出口目的地,占美国塑胶废料出口的一半以上。

- 这种下降表明塑胶废料加工对国际市场的依赖减少,并表明越来越需要加强国内回收和废弃物管理解决方案。随着出口机会的减少,美国越来越需要在国内开发更强大的回收基础设施和废弃物管理系统。

- 在加拿大,2022 年各种排放的废弃物处理量增加了 50 万吨(+1.91%),达到 2,662 万吨。这一增长对应于观察期间废弃物处置的最高值。这一成长凸显了需要有效管理的废弃物量的增加,以及对改善废弃物管理策略、加强回收计画和全面废弃物减少措施的需求。

塑造北美废弃物管理的国家策略

- 2024 年 6 月,美国农业部 (USDA)、美国环保署 (EPA)、美国食品药物管理局(FDA) 和白宫推出。

- 该倡议旨在到 2030 年将粮食损失和浪费减少 50%,同时增加有机回收。该策略支持应对气候变迁、改善粮食安全和促进环境正义等更广泛的目标。

- 为了实现这些目标,美国农业部、环保署和食品药物管理局(FDA) 正在资助新的研究、进行宣传宣传活动,并专注于建立社区范围的回收基础设施。我们也与热衷于减少废弃物的行业领导者建立伙伴关係。

- 该策略预计将透过增加对先进解决方案的需求对废弃物管理市场产生重大影响。随着有机废弃物数量的增加,企业必须扩大服务范围并加强回收流程。需求的增加预计将推动该行业的成长。此外,该策略将鼓励加强合作和更有效的资源分配,并改善北美的整体废弃物管理实践。

北美废弃物管理产业概述

北美废弃物管理市场的特点是竞争激烈,多家主要企业提供各种解决方案。废弃物管理公司(Waste Management Inc.)和共和服务公司(Republic Services Inc.)是该地区广泛的收集、回收和处置网路的主要领导者。 Waste Connections Inc. 也占有重要地位,提供全面的废弃物和回收服务,特别是在中小型市场。

永续性、创新和合规性是这个市场的关键驱动力。例如,废弃物管理公司正在大力投资垃圾垃圾掩埋沼气发电工程,从垃圾掩埋场捕获甲烷来生产可再生能源,减少温室气体排放并永续性。同样,共和服务公司也制定了先进的回收计划和零废弃物倡议,以转移废弃物垃圾掩埋场的废弃物并促进循环经济。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

- 分析方法

- 调查阶段

第三章执行摘要

第四章市场洞察

- 目前的市场状况

- 科技趋势

- 洞察供应链/价值链分析

- 产业监管洞察

- 洞察产业技术进步

第五章市场动态

- 市场驱动因素

- 环保意识不断增强

- 废弃物管理技术的创新

- 市场限制因素

- 资本和营运成本高

- 市场机会

- 增加回收和堆肥计划

- 新的废弃物发电解决方案

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第六章 市场细分

- 依废弃物类型

- 工业废弃物

- 都市固态废弃物

- 电子废弃物

- 塑胶废弃物

- 生物医药+其他(含建筑废弃物)

- 依加工方法分

- 掩埋

- 焚化

- 回收

- 按国家/地区

- 美国

- 加拿大

- 墨西哥

第七章 竞争格局

- 市场集中度概览

- 公司简介

- Waste Management, Inc.

- Republic Services, Inc.

- Waste Connections, Inc.

- Clean Harbors, Inc.

- Covanta Holding Corporation

- Veolia North America

- Rumpke Waste & Recycling

- Heritage Environmental Services

- Waste Pro USA

- EnviroServe*

- 其他公司

第八章 市场机会及未来趋势

第九章 附录

The North America Waste Management Market size is estimated at USD 210.31 billion in 2025, and is expected to reach USD 256.00 billion by 2030, at a CAGR of 4.01% during the forecast period (2025-2030).

Single-use plastic will be phased out of all US government operations by 2035 under a new federal plastic pollution strategy unveiled in July 2024. The policy cites a crisis of littered oceans and poisoned air due to plastics.

The phase-out is expected to boost the need for advanced recycling technologies and facilities capable of processing alternative materials and managing residual plastics. Waste management companies will need to develop new systems and infrastructure to handle these evolving requirements.

The market studied is also witnessing growth in the development of waste-to-energy technologies and improved waste processing methods, reflecting a shift toward more eco-friendly and circular economy principles. Examples of these technologies are plasma arc gasification, pyrolysis, and rotary kilns.

In March 2024, the US Department of Energy's Bioenergy Technologies Office (BETO) and the National Renewable Energy Laboratory (NREL) launched the next phase of Waste-to-Energy Technical Assistance. The program eligibility has been expanded to include state governments, and the scope now includes additional waste resources.

The program promotes the North American waste management market by broadening state governments' eligibility and expanding the scope to include additional waste resources. This initiative encourages more widespread adoption of waste-to-energy technologies, which can drive growth in the waste management market.

North America Waste Management Market Trends

Waste Management Market Surges in Response to Escalating Plastic Waste Concerns

- In 2023, the United States exported approximately 920 million pounds of scrap plastic, marking a 4.6% decrease from the previous year and a nearly 80% drop from 2015, according to the US Census Bureau. Canada and Mexico were the leading destinations for these exports, accounting for over half of the US plastic scrap exports.

- This decline suggests a reduced reliance on international markets for plastic scrap disposal, signaling a growing need for enhanced domestic recycling and waste management solutions. As export opportunities contract, there is an increasing imperative for the United States to develop a more robust recycling infrastructure and waste management systems within its borders.

- In Canada, waste disposal from all sources increased by 0.5 million tonnes (+1.91%) in 2022, reaching 26.62 million tonnes. This rise represents the highest waste disposal level in the observed period. The increase underscores a growing volume of waste that needs effective management, highlighting the demand for improved waste management strategies, enhanced recycling programs, and comprehensive waste reduction measures.

National Strategy Shaping North American Waste Management

- In June 2024, the US Department of Agriculture (USDA), US Environmental Protection Agency (EPA), US Food and Drug Administration (FDA), and the White House launched the National Strategy for Reducing Food Loss and Waste and Recycling Organics.

- This initiative aims to reduce food loss and waste by 50% by 2030 while enhancing the recycling of organic materials. The strategy supports broader objectives of combating climate change, improving food security, and promoting environmental justice.

- The USDA, EPA, and FDA will fund new research, launch awareness campaigns, and focus on building community-scale recycling infrastructure to achieve these goals. They will also foster partnerships with industry leaders dedicated to waste reduction.

- This strategy is expected to significantly impact the waste management market by increasing the demand for advanced solutions. As the volume of organic waste rises, companies must expand their services and enhance recycling processes. This increased demand is anticipated to drive growth in the sector. Moreover, the strategy encourages greater collaboration and more efficient resource allocation, improving overall waste management practices in North America.

North America Waste Management Industry Overview

The North American waste management market is characterized by a competitive landscape with several key players offering various solutions. Waste Management Inc. and Republic Services Inc. are significant leaders, dominating the region's extensive collection, recycling, and disposal networks. Waste Connections Inc. also holds a significant position, providing comprehensive waste and recycling services, especially in smaller and mid-sized markets.

Sustainability, technological innovation, and regulatory compliance are major drivers in this market. For instance, Waste Management Inc. has invested heavily in landfill gas-to-energy projects, capturing methane from landfills to produce renewable energy, which helps reduce greenhouse gas emissions and supports energy sustainability. Similarly, Republic Services Inc. has implemented advanced recycling programs and zero-waste initiatives to divert waste from landfills and promote a circular economy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Insights on Supply Chain/Value Chain Analysis

- 4.4 Insights into Governement Regualtions in the Industry

- 4.5 Insights into Technological Advancements in the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Environmental Awareness

- 5.1.2 Innovations In Waste Management Technologies

- 5.2 Market Restraints

- 5.2.1 High Capital and Operational Costs

- 5.3 Market Opportunities

- 5.3.1 Growth in Recycling and Composting Programs

- 5.3.2 Emerging Waste-to-Energy Solutions

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Waste type

- 6.1.1 Industrial waste

- 6.1.2 Municipal solid waste

- 6.1.3 E-waste

- 6.1.4 Plastic waste

- 6.1.5 Biomedical + Others (Including Construction Waste)

- 6.2 By Disposal methods

- 6.2.1 Landfill

- 6.2.2 Incineration

- 6.2.3 Recycling

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

- 6.3.3 Mexico

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Waste Management, Inc.

- 7.2.2 Republic Services, Inc.

- 7.2.3 Waste Connections, Inc.

- 7.2.4 Clean Harbors, Inc.

- 7.2.5 Covanta Holding Corporation

- 7.2.6 Veolia North America

- 7.2.7 Rumpke Waste & Recycling

- 7.2.8 Heritage Environmental Services

- 7.2.9 Waste Pro USA

- 7.2.10 EnviroServe*

- 7.3 Other Companies